Market-Cap $49 Million-- Cash $19 Million or untill end 2020 -- Shares Out 9.1 Million -- Potential FDA approval for their lead drug Anjeso (non-opioid pain reliever ) in Q1 2020 which has HUGE market potential .MASSIVE underpriced Low float stock with significant upside potential here ..My target is $20+ by end of next year .GL

Baudax Bio (BXRX)

Market Cap 49 M

Cash $19 M

Price $5.45

Shares Out 9.1 M

New Presentation (december 2019)

d1io3yog0oux5.cloudfront.net

Janney starts Baudax Bio at buy; fair value estimate $12

biotuesdays.com

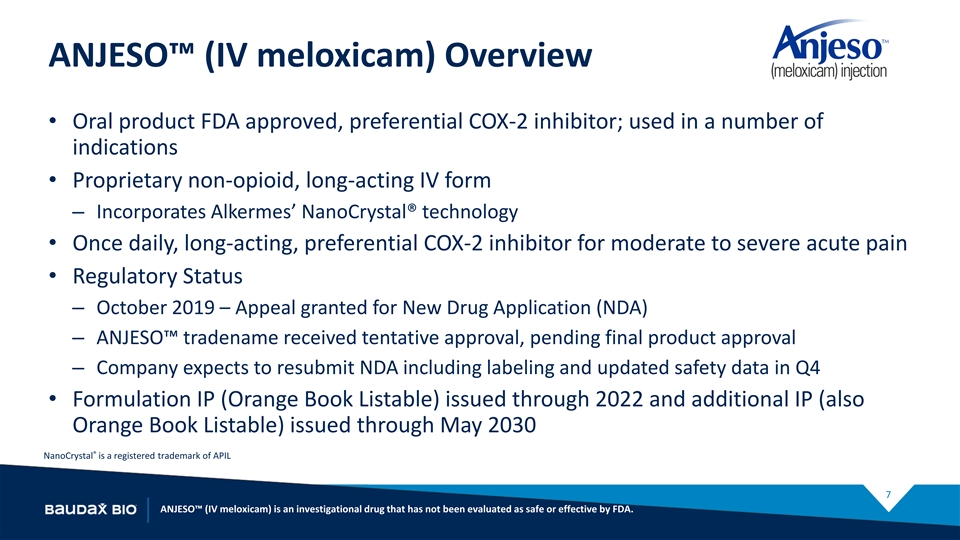

Baudax’s key product is Anjeso, a long-acting intravenous formulation of meloxicam, an established non-opioid pain reliever, available through an oral formulation. “We see a high probability of FDA approval in the first quarter of 2020, which would be a meaningful catalyst to drive the stock towards our fair value,” writes analyst Ester Hong.

She estimates peak U.S. sales of $355-million for Anjeso but sees “upside from increased demand for a potent non-opioid that allows patients to recover and go home faster.”

|