Latest from Agoracom from Macnai

Photonic Integrated Circuit Market Size and Forecast 2025 to 2034

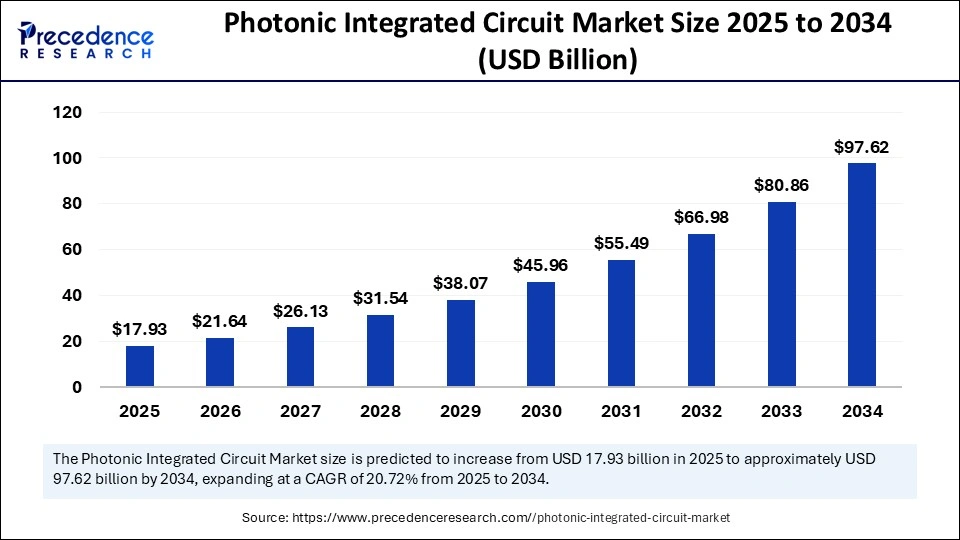

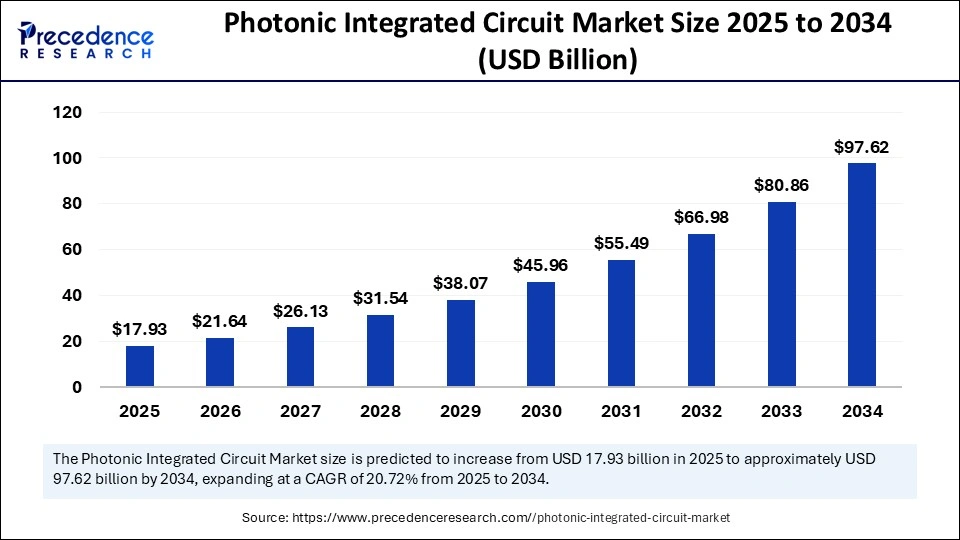

The global photonic integrated circuit market size accounted for USD 14.85 billion in 2024 and is predicted to increase from USD 17.93 billion in 2025 to approximately USD 97.62 billion by 2034, expanding at a CAGR of 20.72% from 2025 to 2034. The rising demand for high-speed data transfer and communication networks is driving the growth of the photonic integrated circuit market.

Photonic Integrated Circuit Market Key Takeaways- In terms of revenue, the photonic integrated circuit market is valued at $17.93 billion in 2025.

- It is projected to reach $97.62 billion by 2034.

- The market is expected to grow at a CAGR of 20.72% from 2025 to 2034.

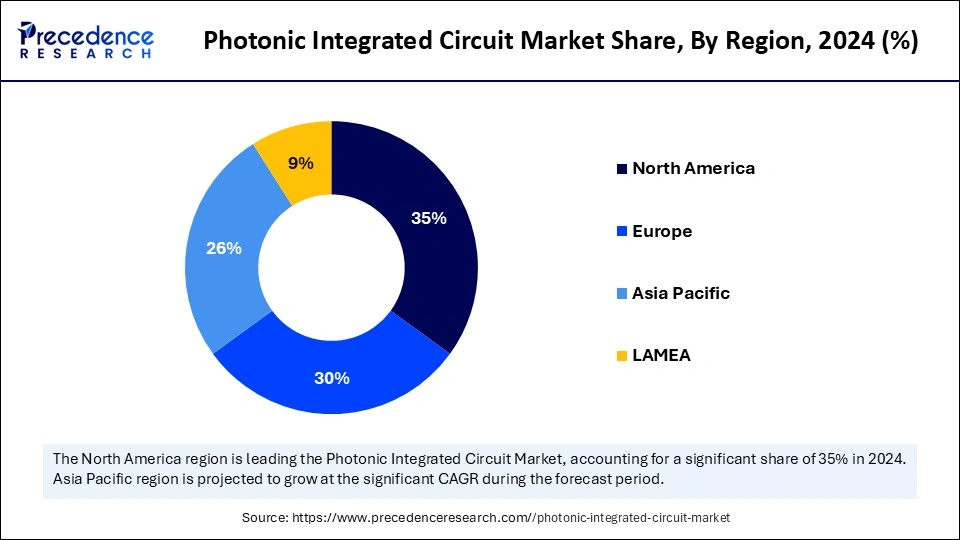

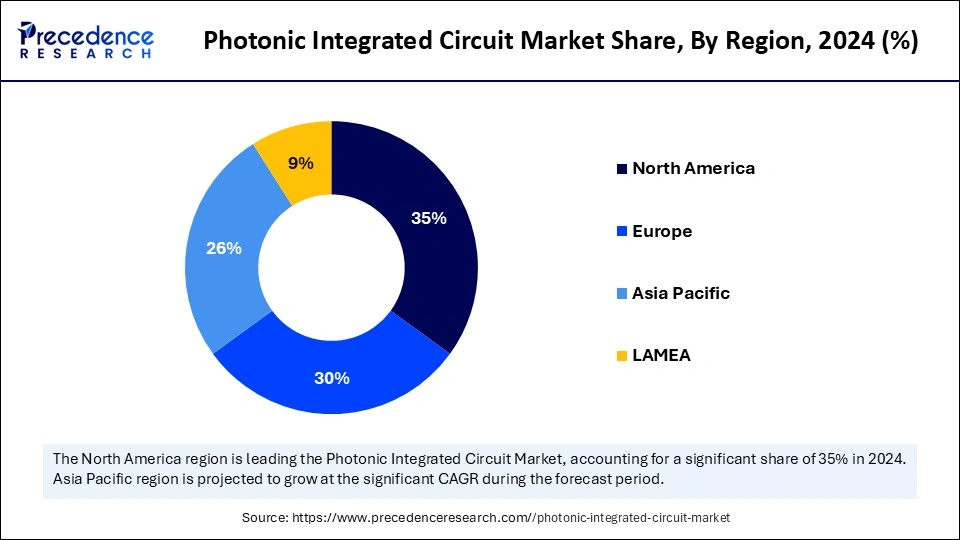

- North America contributed the highest revenue share of 35% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By integration type, the hybrid integration segment dominated the market in 2024.

- By integration type, the monolithic integration segment is expected to grow at the fastest rate in the coming years.

- By component, the modulators segment dominated the market with the largest revenue share in 2024.

- By component, the lasers segment is expected to expand at a significant rate between 2025 and 2034.

- By material, the silicon photonics segment led the market in 2024.

- By material, the indium phosphide (InP) segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the quantum computing segment dominated the market in 2024.

- By application, the optical communication segment is likely to grow at the highest CAGR during the projection period.

- By end use, the data centers segment dominated the market in 2024.

- By end use, the telecommunications segment is expected to grow at a rapid pace during the forecast period.

How AI Integration is Transforming the Photonic Integrated Circuit Market?The integration of Artificial Intelligence in photonic integrated circuits has revolutionized design optimization and application. Through AI simulations, highly precise photonic circuit designs are developed, layouts are generated, and performance prediction matrices are derived. The combination of AI and photonic integrated circuits (PICs) is essential, given the increasing demand for high-speed data transmission in systems like data centers and 5G networks. The use of algorithms in photonic integrated circuit designs has reduced the effort and time previously needed for manual design. Furthermore, AI integration enables PICs to deliver heightened performance while supporting miniaturization to minimize power consumption. AI also automates parameter optimization for improved performance and yield in PIC design and production.

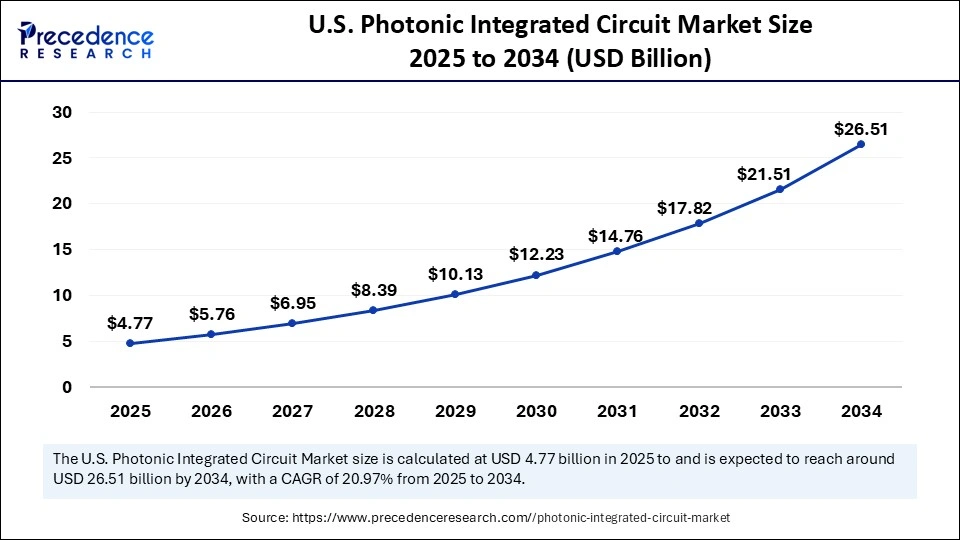

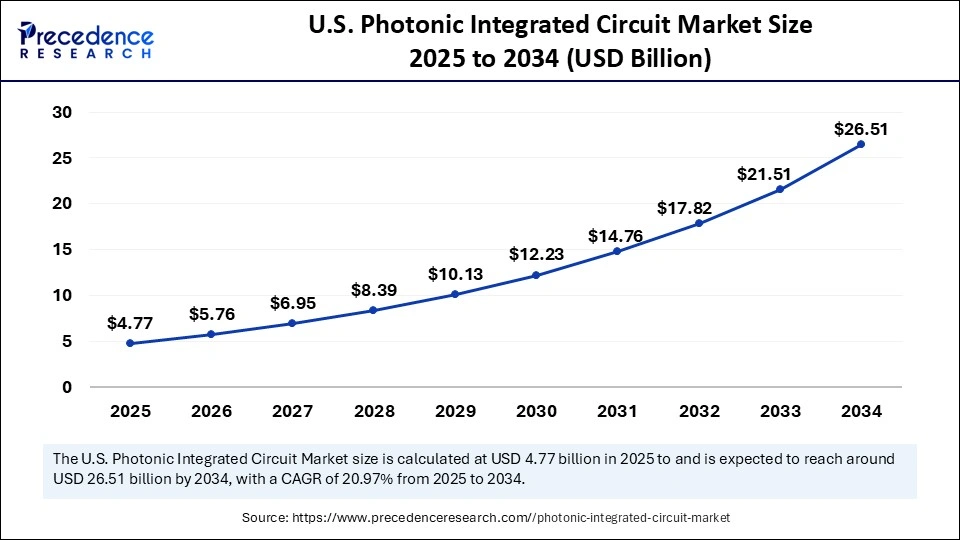

U.S. Photonic Integrated Circuit Market Size and Growth 2025 to 2034The U.S. photonic integrated circuit market size was exhibited at USD 3.95 billion in 2024 and is projected to be worth around USD 26.51 billion by 2034, growing at a CAGR of 20.97% from 2025 to 2034.

North America region dominated the photonic integrated circuit market with the largest share in 2014. This dominance is driven by various factors such as the massive presence of data centres in North America, creating a huge requirement for high-speed data transfer infrastructure at a cost-effective price. This, in turn, drives the demand for photonic integrated circuits. Fibre optic communication is heavily used in the region in wide area networks, which relies on the photonic integrated circuits. The key factor that is fostering the growth of the market in North America is the continuous support from the government to foster research and development of photonic Integrated circuit technology. The region is at the forefront of technological innovation, providing a favorable environment for market players in the region. The increased penetration of 5G technology further bolstered the market.

Asia Pacific is expected to grow at the fastest CAGR in the coming years. This growth is attributed to the expansion of network infrastructure and rising penetration of 5G networks in India, China, Japan, and various other countries. The increasing adoption of cloud computing, IoT, and data centres among businesses further contribute to the growth of the market in the region. The rapid development of digital infrastructure, such as telecommunication networks, is one of the key factors supporting market growth. In addition, the rising demand for high-speed data transfer contributes to regional market growth.

Europe is considered to be a significantly growing area. The growth of the photonic integrated circuit market within Europe is driven by continuous research and development in 5G technology. There is widespread adoption of the Internet of Things (IoT), autonomous cars, and cloud computing, creating the need for robust infrastructure for the reliable data transmission. This. In turn, boosts the demand for photonic Integrated circuits.

Market Overview Photonic integrated circuits utilize light photons instead of electricity for information processing and transmission. The photonic integrated circuit market is driven by the growing need for high-speed network infrastructure, including fiber optic cable networks, data centers, and cloud computing. Market growth is significantly influenced by the increasing demand from data centers and cloud computing, which require high-speed, low-latency communication capable of handling high bandwidth. Advancements in this technology are also fostering market growth.

Photonic Integrated Circuit Market Growth Factors- Growing demand for high-speed data transfer and communication in data centers and cloud computing servers is driving the growth of the photonic integrated circuit market.

- The advent of 5G has created the need for high-tech wireless connectivity and networks. Photonic integrated circuits are highly used in the development of 5G infrastructure, particularly in optical transceivers and communication modules.

- Silicon photonics is crucial for integrating optical and electronic components on a single chip, enhancing performance and efficiency. Continuous innovation in silicon photonics has led to a decline in the cost of photonic integrated circuits over the past few decades, supporting market expansion.

- Governments around the world are making significant investments in photonics technology R&D, recognizing its applications across industries like quantum computing, autonomous vehicles, drones, UAVs, missiles, biomedical imaging, and data and cloud computing servers.

Market Scope

| Report Coverage | Details | | Market Size by 2034 | USD 97.62 Billion | | Market Size in 2025 | USD 17.93 Billion | | Market Size in 2024 | USD 14.85 Billion | | Market Growth Rate from 2025 to 2034 | CAGR of 20.72% | | Dominating Region | North America | | Fastest Growing Region | Asia Pacific | | Base Year | 2024 | | Forecast Period | 2025 to 2034 | | Segments Covered | Integration Type, Component, Material, Application, End Use, and Region | | Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics Drivers Increasing Demand for High-Speed Data Transmission in Telecommunications, Data Centres, Cloud Computing, and Bandwidth-Intensive Applications

The growing cloud computing industry, the rise of artificial intelligence, and the widespread 5G network are key factors driving the demand for high-speed data transmission and bandwidth-intensive applications in daily communications. The use of cloud services is continuously increasing due to their convenience, low cost, and high performance compared to local servers. Cloud computing relies on a robust data center infrastructure to provide seamless connectivity and transmit large data volumes. Technologies like artificial intelligence, autonomous vehicles, augmented reality, and virtual reality, which require high bandwidth and low latency, are driving the demand for photonic integrated circuits due to their critical role in high-speed data transmission within essential networking services.

Restraint High Initial Capital Requirement and High Complexity Involved in the Development Process

The development of photonic integrated circuits requires massive investments. The manufacturing process of integrated photonic integrated circuits is very complex, requiring highly expert individuals and continuous innovation. The development of photonic integrated circuits requires precise alignments and integration of various components. Equipment required in the production process of photonic integrated circuits is very expensive, which is not feasible for all organizations. Continuous focus on upskilling the workforce is essential to achieve manufacturing precision. The design and integration of optical components is a delicate and time-consuming process. Due to the complexity and initial investments, quickly ramping up production to meet increased market demands is challenging.

Opportunity Expanding Scope of Applications

Many industries are shifting to cloud platforms, demanding high bandwidth, low latency, and a strong network. Applications in telecom, data centers, IoT, biomedical, and photonic computing are rapidly increasing, creating the need for high-speed data transfer for optimal communication. Self-driving cars and IoT devices rely on high-performance network connectivity. These factors are creating immense growth opportunities in the photonic integrated circuit market due to its importance in network infrastructure.

Integration Type InsightsWhy did the Hybrid Integration Segment Dominate the Market in 2024?

The hybrid integration segment dominated the photonic integrated circuit market with the largest share in 2024. The growth of the segment is attributed to its ability to combine materials for enhanced performance. This enables the use of high-quality materials for each optical function, offering design flexibility and superior performance in high-speed data transmission and optical processing.

The monolithic integration segment is expected to grow at the fastest rate in the coming years. This dominance is due to cost advantages and high compatibility with current semiconductor processes. Monolithic integration is preferred for its high performance and reliability, especially in data centers and telecommunications. Integrating all photonic components on a single substrate reduces manufacturing complexity and cost. It is highly compatible with CMOS manufacturing, reducing production costs and facilitating upscaling.

Component Insights What Made Modulator the Dominant Segment in 2024?

The modulator segment dominated the photonic indicator circuit market with the major revenue share in 2024. This is due to the rise of high-speed data transmission and the role of modulators in manipulating optical signals. Modulators control the intensity, phase, and polarization of light, making them vital for networking high-bandwidth optical communication systems in data centers, 5G networks, and AI applications.

The laser segment is expected to expand at a significant CAGR during the forecast period because lasers are fundamental light sources in photonic integrated circuits for optical communication in data centers. Rising demand for high-speed data transmission, especially with 5G and data centers, is creating a massive need for efficient and compact lasers. Furthermore, the growth of the segment is driven by technological advancements in laser technology, such as silicon lasers, which simplify systems while enhancing power efficiency and boosting product performance.

Material Insights How does the Silicon Photonics Segment Dominate the Photonics Integrated Circuit Market in 2024?

The silicon photonics segment dominated the market with the highest revenue share in 2024. This dominance is attributed to the wide range of applications of silicon photonics in photonic integrated circuits due to its superior properties. The high popularity of this material is driven by various factors, such as cost-effectiveness, enabling mass production of photonic devices. It's highly compatible with CMOS technology, allowing integration with electronic components on a single chip, providing high power efficiency and seamless signal transfer.

Meanwhile, the indium phosphide segment is expected to grow at the fastest rate due to its ability to integrate with active and passive devices seamlessly. This allows for cost-effective, large-scale production, meeting the demands of high-speed data transmission. 3D sensing features in consumer electronics are enabled by indium phosphide.

Application Insights Why did the Quantum Computing Segment Dominate the Market in 2024?

The quantum computing segment dominated the market with a significant share in 2024 due to its high-speed computing and ability to process many computational tasks efficiently. Quantum computing systems rely on photonic integrated circuits to manipulate photons, leading to advancements. Many companies are heavily investing in photon-based quantum computing to develop more stable and scalable systems, creating the need for photonic integrated circuits.

The optical communication segment is expected to grow at the highest CAGR in the upcoming period. The growth of this segment is driven by the growing need for high-speed data transmission in telecommunication networks and the advent of 5G technology. With the advent of self-driving cars, augmented reality, and internet of things technology, the demand for advanced optical communication solutions is rising. Photonic integrated circuits are essential for efficient data transmission over long distances, making them crucial in modern communication channels, particularly in 5G.

End Use Insights What Made Data Centers the Dominant Segment in 2024?

The data centers segment dominated the photonic integrated circuit market with the largest share in 2024. The dominance of the segment is attributed to the rising data centers in various businesses, driven by the increasing demand for high-speed data transmissions. Advantages offered by photonic integrated circuits in data center applications are contributing to the increasing demand in this particular segment. Enhanced performance, cost effectiveness, energy efficiency, and less heat emission by PICs make them suitable for data centers.

The telecommunication segment is expected to grow at a rapid pace during the forecast period. The growing need for high-speed data transmission in telecommunication networks is the key factor driving the growth of this segment. Rising adoption of 5G technology in various sectors significantly creates the need for high-speed data transmission with wider bandwidth and low latency. 5G networks utilize optical communication solutions to tackle the increasing data traffic and provide real-time data transmission. Photonic integrated circuits play a crucial role in achieving these goals while providing essential infrastructure for seamless operations.

Recent Developments- In May 2025, the startup CCRAFT was launched to commercialize the production of photonic chips, an essential component for next-generation telecom, AI data centers, and quantum technologies. It is the first production-ready company worldwide to sell integrated circuits based on thin-film lithium niobate (TFLN), widely seen as the future platform for high performance photonics.

(Source: electronicspecifier.com

- In March 2025, Keysight Technologies, Inc. announced the launch of Photonic Designer, an innovative photonic design automation (PDA) software solution engineered to provide unparalleled accuracy and compliance-driven design validation. Designed for photonics design engineers, this solution enables streamlined workflows from concept to simulation, emulation, and manufacturing, addressing the challenges of fragmented tools, inconsistent simulation precision, and increasing compliance demands.

(Source: keysight.com

Photonic Integrated Circuit Market Companies

Segments Covered in the Report By Integration Type

- Monolithic Integration

- Hybrid Integration

- Module Integration

By Component

- Lasers

- Modulators

- Photodetectors

- Waveguides

- Multiplexers/Demultiplexers

- Attenuators

- Optical Amplifiers

- Others

By Material

- Indium Phosphide (InP)

- Silicon-on-Insulator (SOI)

- Silicon Photonics

- Gallium Arsenide (GaAs)

- Lithium Niobate

- Others

By Application

- Optical Communication

- Sensing

- Biophotonics

- Optical Signal Processing

- Quantum Computing

- Others (e.g., LiDAR)

By End Use

- Telecommunications

- Data Centers

- Consumer Electronics

- Healthcare & Life Sciences

- Defense & Aerospace

- Industrial

- Automotive

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

|