Am certain of very few things, so the few certainties are precious to me, and they are ...

1. Bitcoin moves faster than gold, in whichever direction and all directions, just faster, and may not be powered by same motivations but might be, at times

2. Gold will not go to zero. Bitcoin might.

3. Gold might not reach 250k or 500k. Bitcoin might.

4. Indubitably true that whenever Bitcoin going up, we do not have enough. Whenever moving down, we have too much. Same for gold and everything else.

In the meantime, BuGd (Bitcoin Up, Gold Down)

bloomberg.com

Crypto Market Value Tops $1 Trillion as Bitcoin Breaches $37,000

Olga Kharif

7 January 2021, 10:46 GMT+8

The milestone comes amid a broad rally by digital coins

The total market value of cryptocurrencies surpassed $1 trillion for the first time Thursday amid a frenzied and volatile rally in Bitcoin to yet another record.

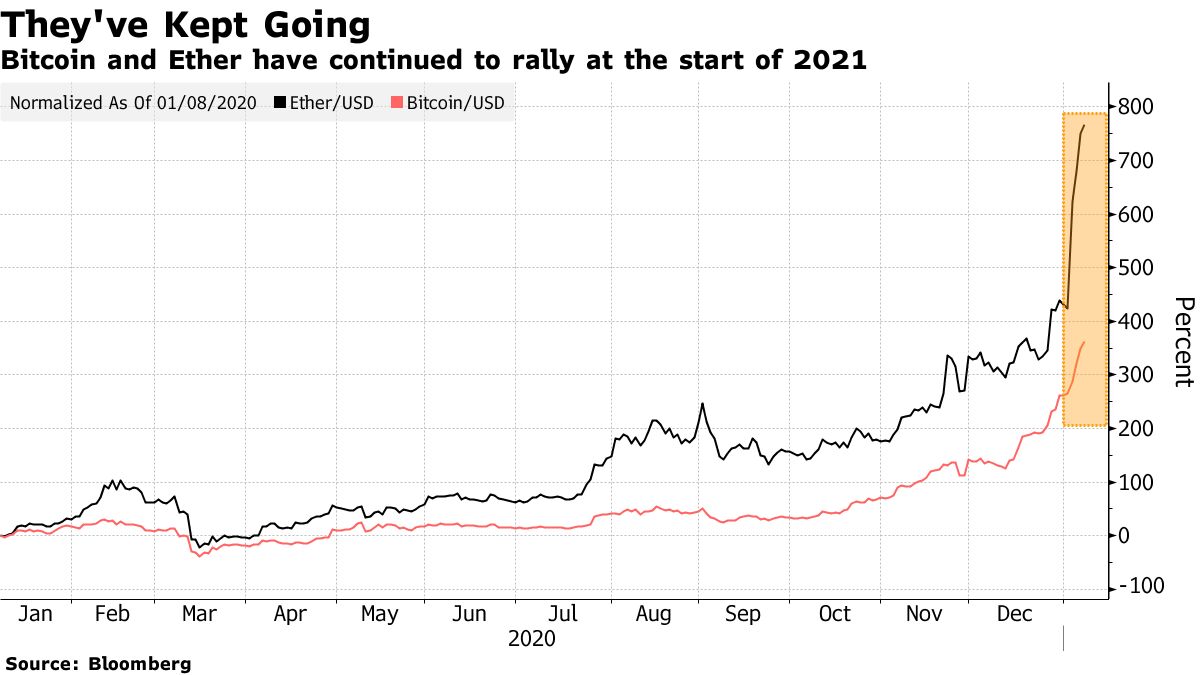

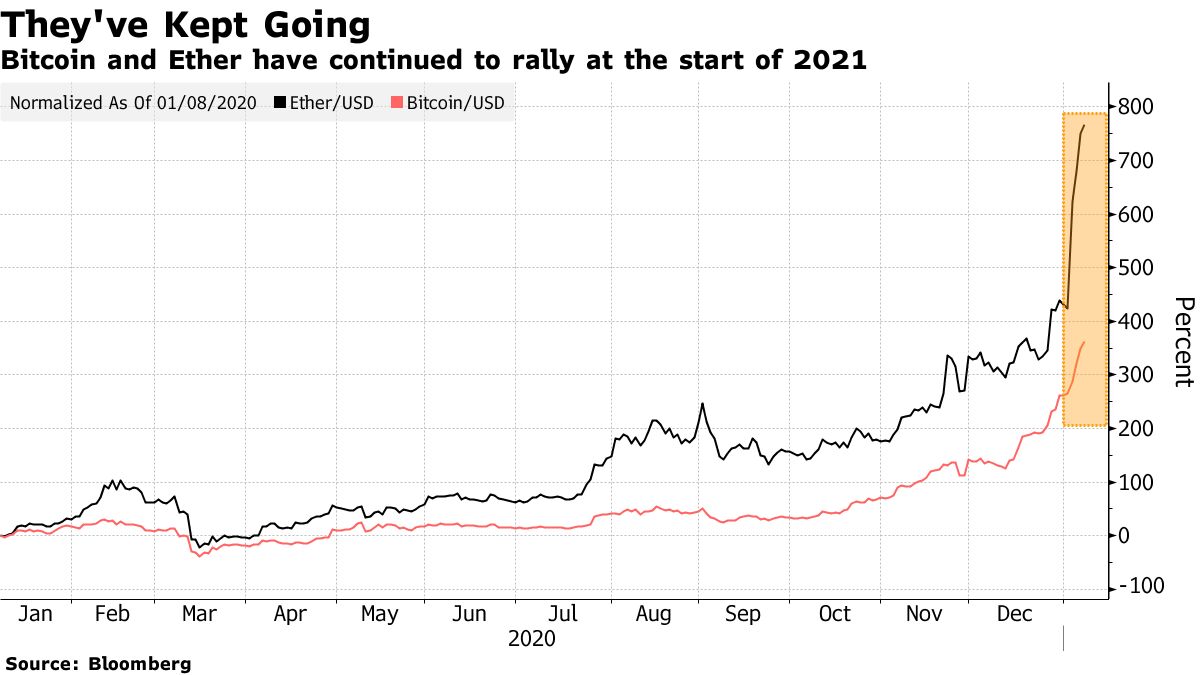

Cryptocurrencies hit the milestone after a fivefold climb in market value in the past year, data from tracker CoinGecko shows. Strategists have cited demand from speculative retail traders, trend-following quant funds, the rich and even institutional investors as among the reasons for the surge.

Bitcoin rose as much as 4% on Thursday to top $37,000 and has more than quadrupled in the past year, according to a composite of prices compiled by Bloomberg. It accounts for about two-thirds of cryptocurrency market value, followed by Ether on about 14%. Ether is up 62% so far this year.

Digital coins are jumping in a world awash with fiscal and monetary stimulus, even as some commentators fear an inevitable bust and others question the basic integrity of crypto markets. Proponents of Bitcoin argue it offers a hedge against dollar weakness and the risk of faster inflation, a bit like gold, while critics decry the intellectual soundness of comparing the two assets.

Active Bitcoin accounts are nearing their all-time high levels of late 2017, according to researcher Flipside Crypto -- possibly a sign that some holders are planning to sell. Fewer than 2% of accounts hold 95% of Bitcoin supply, so a few big trades can impact prices. The last big Bitcoin boom began imploding in late 2017.

Some traders pointed to JPMorgan Chase & Co.’s long-term Bitcoin price forecast of $146,000 as possibly fueling the rally. Others said sentiment was boosted by a U.S. regulatory update that allows a class of less volatile coins to be used by banks for payments.

Read More

— With assistance by Lynn Thomasson |