Suspicion, gold should do okay 2022, because pooped on by Bloomberg, chief suspect and apologist for and on behalf of a lot of interested parties, all suspects

but, yes, remember what Martin Armstrong noted, so, perhaps another year of HODL-ing

bloomberg.com

Unloved and Uninteresting, Gold Heads for Worst Year Since 2015

Eddie Spence

1 January 2022, 03:03 GMT+8

Molten gold pours from a crucible into a mold during the casting of ingots at a foundry in Krasnoyarsk, Russia.

Photographer: Andrey Rudakov/BloombergGold is poised to end 2021 the same way it spent much of the year: little changed and tottering along, somewhere in the vicinity of $1,800 an ounce.

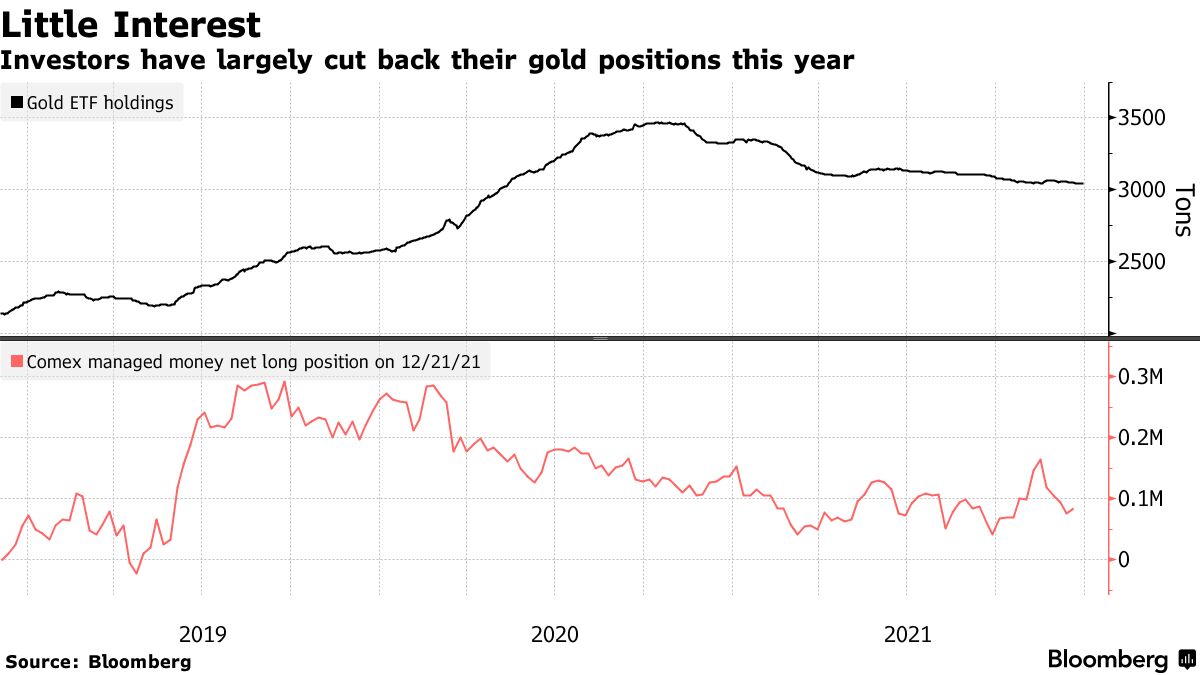

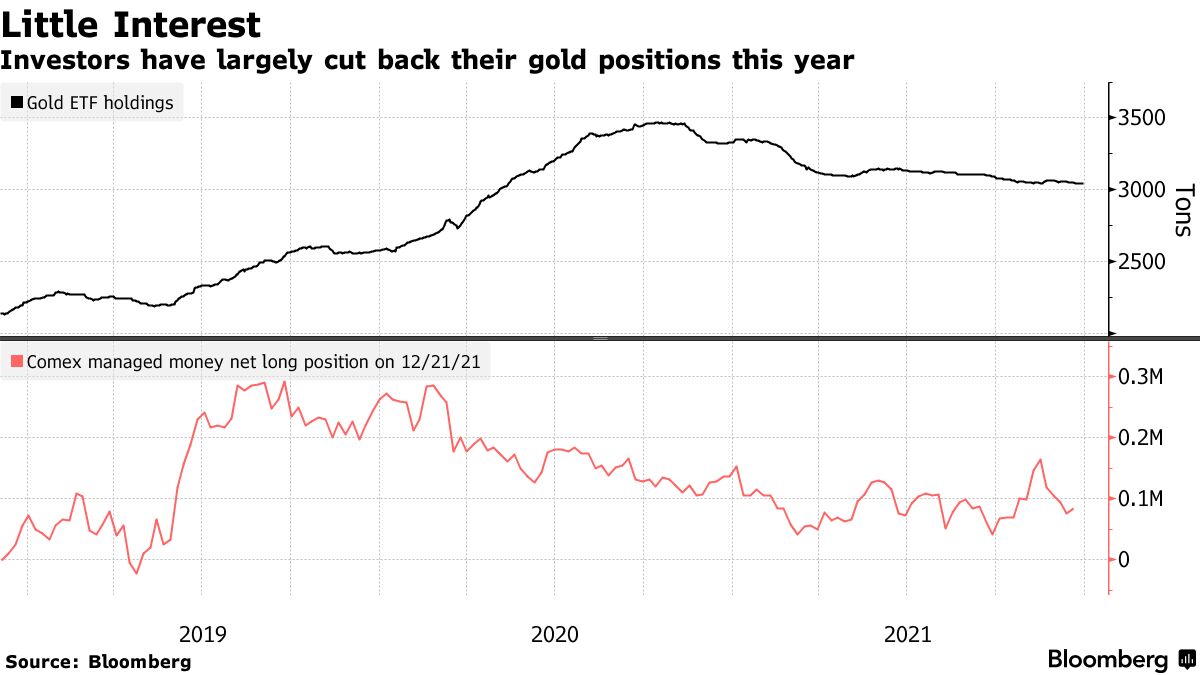

After a tumultuous start to the pandemic that drove gold to record levels in 2020, the metal famously touted as a hedge against rising prices has failed to capitalize on this year’s scorching-hot inflation. Investors appear to have lost interest, leaving gold trading in tight ranges for weeks on end, while exchange-traded fund holdings trickle down.

Spot gold has fallen almost 4% this year, on track for its biggest annual decline since 2015. A stronger U.S. dollar and the threat of a pullback in stimulus by the world’s major central banks have deterred many investors, who saw better opportunities in surging equity markets. The exciting booms and busts of Bitcoin -- often touted as a digital equivalent to bullion -- also captured attention.

Gold started the year under pressure, dropping 10% in the first quarter. Vaccine successes spurred hopes for a quick recovery from the pandemic, while President Joe Biden’s Democrats secured the U.S. Senate opened the door to pro-growth infrastructure programs and more fiscal aid.

Prices later rebounded after the emergence of new virus variants and political gridlock in the U.S. But then bullion got stuck in the doldrums.

One key factor has been a lack of interest from financial investors, who are crucial to driving gold’s rallies. Holdings in exchange-traded funds have dropped almost 9% through the year, while hedge funds trading Comex futures have kept their bullion bets muted.

While the prospect of monetary tightening hurt gold’s appeal, prices were supported by strong demand from Asian jewelry consumers and central bank buying.

The opposing drivers have left bullion hovering almost magnetically around the $1,800-an-ounce mark. While that’s a historically high price, it will be disappointing to those who enjoyed the surge to a record in 2020.

However, the equilibrium between dip buyers and sellers may not hold for long. More gains in the dollar could spell misery. On the other hand, signs of persistent, runaway inflation could finally provide the spark needed for a sustainable gold rally.

BlackRock Inc.’s Evy Hambro said earlier this month that gold could climb in 2022, driven by a combination of real interest rates, U.S. dollar performance and demand for haven assets. However, analysts at JPMorgan Chase & Co. see gold coming under more pressure as the global economic recovery continues, forecasting an average price of $1,631 an ounce for next year.

On the last day of 2021, gold edged up 0.7% to $1,827.10 an ounce by 1:38 p.m. in New York. Bullion for February delivery fell 0.8% to settle at $1,828.60 on the Comex. Silver and platinum also gained, while palladium declined. The Bloomberg Dollar Spot Index fell 0.4%.

— With assistance by Yvonne Yue Li

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |