Day-1 above the lower pivot-line at $20.21, it hovered around it pretty much all of mid-day into the close on the 5 minute chart, and I'm a little spectacle, the volume could of been better, and running up to $20.66 before pulling back when gold was up well over +$75 was disappointing. I'm cautious, a dreaded head fake is not uncommon with MUX, its Friday you know, ...but, we've had some good Fridays lately too...we'll see.

We need at least a few days above the $20.21 pivot line to confirm a trend reversal. Like a few others here, I'd like to see some sideways action without so many gaps, a platform to work off of, or to land on if things get even nastier. So we're not out of the woods just yet. We closed at $20.25, 4¢ above the pivot since last Friday's down gap and its almost Friday again, ... My how the weeks go by!!

I added arrows on the bars that are meaningful regarding pivots. I removed the upper pivot at $23.69 for now, seems we have more work to do down here. If MUX continues to move higher, the $21.99 from Monday's action is its next hurdle. To the downside, the $19.52 is Wednesday's lower pivot, we will soon see which one comes first. I also added a weekly chart and my watch list below this one.

We had a bearish weekly engulfing, that's when a large bar engulfs a smaller bar of the opposite color

The $20.74 is its weekly pivot.

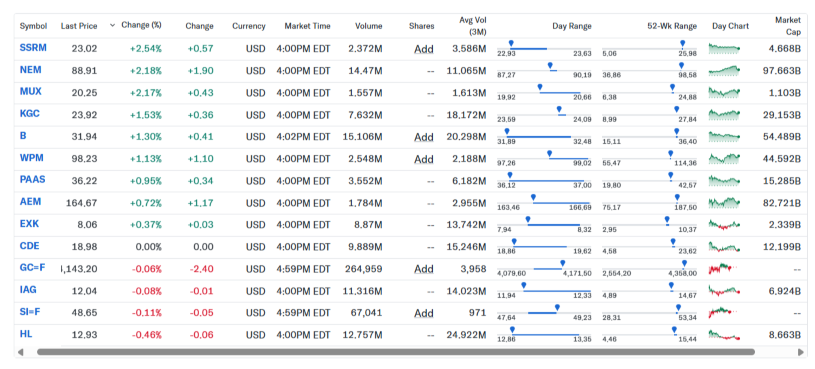

MUX came in 3rd place in the Change% category.

|