The miners on my list are on shaky ground, especially MUX. The day started out pretty good, most were green, gold was up nearly $50 as it moved above the $4,000 level and silver rose nearly $1.00, but it all went down hill from there. MUX opened sharply higher, bounced off of the upper pivot at $19.80 to the penny, then, fell apart quickly.

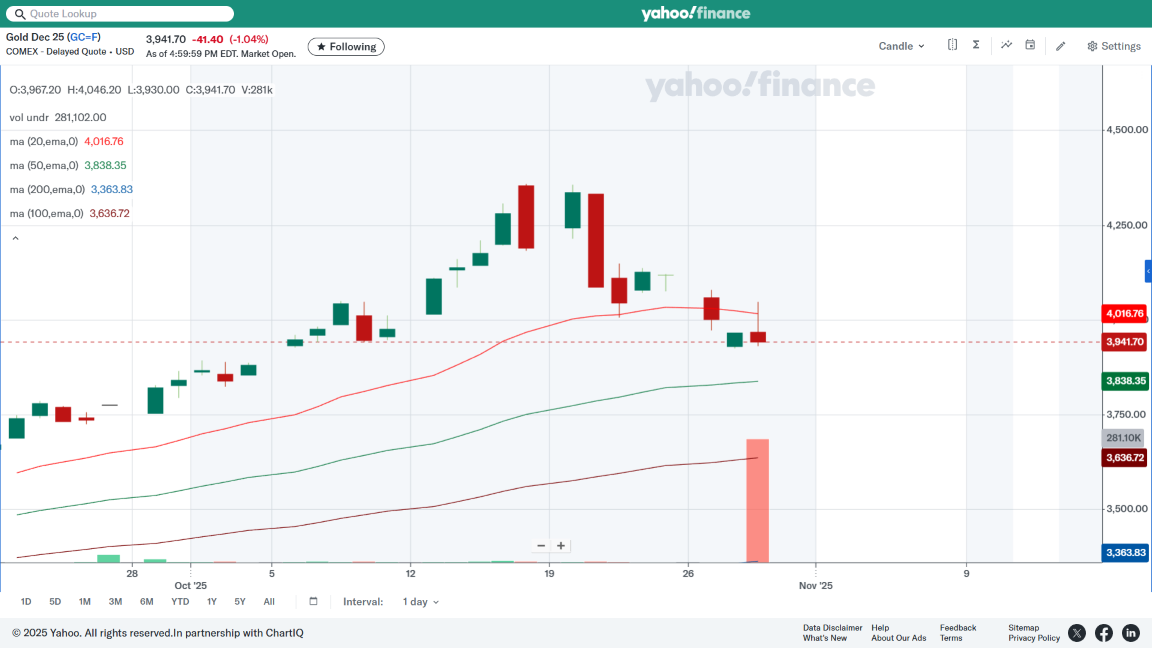

Both gold and silver failed to close above their 20-day-ema's. Gold, silver, and the miners gave it a run early on but began to falter as afternoon approached, and then,... the fed's dropped a 1/4% point on the interest rate turning everything red, silver managed a 10¢ gain at the close.

MUX eventually gave up its 20-day late in the afternoon after making a higher high, but also a lower low, this is really the first day it closed decisively below its 20-day. It bounced around under and over its 20-day several times through out mid day and by late afternoon, it dropped sharply, ...forming a bearish engulfment on yesterday's bar (which is very meaningful).

If we don't get a stop at $18.05 then I'm guessing the 50-day could be its next attempt, with a stall around a $17.28 pivot. The message here is this, ...it tried to break above the $19.80 but failed, so now we try to take it below the $18.05. One would have to guess the short players are back in control, or, large players are taking profit while other players are trying to get back in at lower levels. Sorry to see a possible move to lower levels, but we should see a clearer picture by late Friday. One more thing, I see they are due to report Q3 earnings either on the 3rd or 4th of November, which could also be a reason we are seeing weakness in MUX, and of course it leaks out to the street, and we are always the last to know.

|