Goldman Sachs And The Blockchain

Oct. 5, 2017 2:39 PM ET

Gary Alexander

Summary

Goldman Sachs has announced the possibility of setting up a trading operation for bitcoin and other cryptocurrencies, though CEO Lloyd Blankfein is still “uncertain”.

Opening up Goldman’s trading platform to cryptocurrencies could be seen as big-bank validation for bitcoin, which is something J.P. Morgan’s Jamie Dimon has repeatedly denounced.

Large institutional Goldman clients could be prompted to dabble in cryptocurrencies for the first time, hastening capital flow into bitcoin and ethereum.

Both Bitcoin and Ethereum have seen flat price action in the past two months, after a 2x and 10x rise year to date, respectively.

Goldman Sachs (NYSE: GS) made huge waves this week when news broke that it was considering setting up a bitcoin trading operation, the first of its kind among the big banks. Goldman, arguably the most highly venerated Wall Street firm, would lend massive credibility to cryptocurrencies and possibly induce institutional investors to trade crypto for the first time.

Goldman has also published a lengthy blockchain 101 article on its website, extolling the technology’s virtues, dubbing it “the new technology of trust." This move indicates Goldman's desire to be seen as a thought leader in the space.

Figure 1. Goldman Sachs blockchain primer - screenshot of cover page  Lloyd Blankfein, Goldman’s CEO, tweeted that he was still uncertain on whether Goldman would take the leap into the crypto world. Lloyd Blankfein, Goldman’s CEO, tweeted that he was still uncertain on whether Goldman would take the leap into the crypto world.

Note that Blankfein’s comments offer sharp contrast from those of J.P. Morgan’s (NYSE: JPM) Jamie Dimon, who has denounced bitcoin as a fraud and compared it to tulip bulbs.

Note that neither bank has denounced the blockchain itself, which is the underlying distributed transaction technology that underpins bitcoin and other virtual currencies. J.P. Morgan has poured enormous resources into blockchain research and partnered with Digital Asset Holdings, a highflying startup founded by Blythe Masters, a former J.P. Morgan trading executive who is now considered an industry pioneer in blockchain.

It’s bitcoin alone that has garnered controversy from the banks, particularly J.P. Morgan, though Goldman’s newly minted open-minded attitude about bitcoin trading could open the door to mass capital flows into the crypto markets. This article will offer some brief thoughts on what a Goldman entry into the market might imply.

dg> GS has never considered themselves a Bank, In fact, I am waiting to hear one day in the future that GS has some investments in the legal side of the Marijuana industry.

Quick take: implications for bitcoin At current, bitcoin sports a $70 billion market capitalization (approximately half of the total crypto market cap of ~$150 billion). Ethereum, the second-largest cryptocurrency which has a broader set of use cases (via “smart contracts”), has a market capitalization of $27 billion.

Institutional funds have been wary of trading highly speculative cryptocurrencies, possibly due to security reasons, and also possibly because their prospectuses and investment mandates have not (yet) expanded to encompass crypto trades. But if Goldman’s rubber stamp and perceived security capabilities could induce some of these investors to buy their first bitcoins. After all, hedge funds trade everything from everyday bonds to livestock and orange juice futures - why not bitcoin?

Some of the institutional investors in Goldman’s rolodex (think of the Bridgewaters and Och-Ziffs of the world) have AUMs approaching or even exceeding $100 billion, encompassing the entire market cap of bitcoin alone, and several multiples of ethereum’s market cap. In a research note this summer, Goldman research analyst Robert Boroujerdi wrote to clients that “it’s getting harder for institutional investors to ignore cryptocurrencies.” Indeed, if Goldman opens up its trading platform to accommodate bitcoin, those institutional investors might not want to ignore it any longer.

How the entry of institutional investors into the bitcoin market may affect price movements remains to be seen. Will prices stabilize as hedge funds and other professionally managed funds take large positions and hold them? Or will volatility increase massively as institutional investors’ trading volumes basically decimate the pricing power of individual investors who only buy single or fractional bitcoins at a time? Whichever it is, the outcome will surely have a profound impact on the crypto markets as they stand today.

Quick take: implications for Goldman Sachs It’s an open secret on Wall Street that trading desk revenues are past their heyday. After a brief spike in November election volatility, trading desks have become sleepy again.

In 2Q17, Goldman reported a 17% y/y decline in trading revenues, hastened by an astonishing 40% drop in FICC (fixed income, commodities, and currency) trading revenues. Trading is by far Goldman’s largest source of revenues (40% of Q2) and twice as large as investment banking.

Goldman leans on its trading operations far more than most of its Wall Street cousins, as rivals J.P. Morgan and Bank of America have steady, boring commercial banking businesses to even out the ebbs and flows of trading revenues. With activity in its current asset class segments slowing down, Goldman could stand to benefit from taking on a new asset to trade - especially since it would be the first among its rivals to offer bitcoin trading capabilities.

GDAX, the exchange owned by Coinbase and one of the most well-known platforms for beginning traders, reports a current 24-hour trading volume of about $60,000,000, more than half of which owes to bitcoin trading (it also supports trading of ethereum and litecoin, at smaller volumes). The largest bitcoin exchange, Bitfinex, reports a 24-hour trading volume over $100,000,000, according to CoinMarketCap.

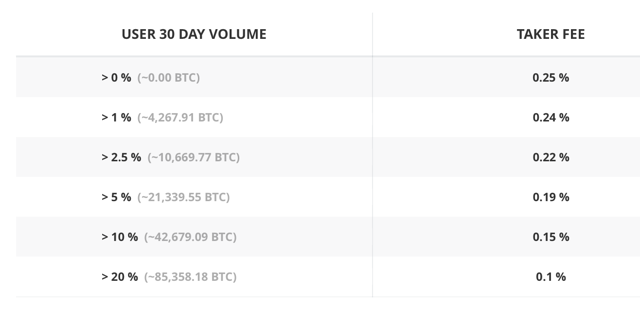

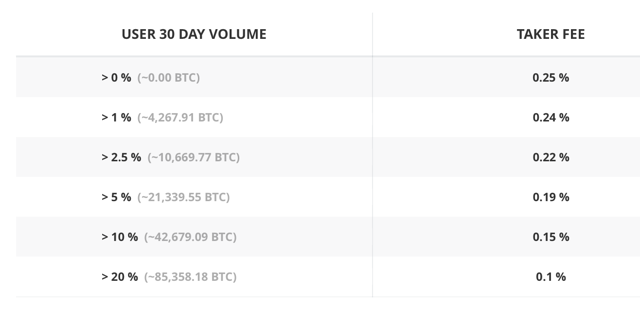

GDAX charges a fee of between 0.10% to 0.25% for each bitcoin trade, with the lower rates available on a tier basis according to volume. Ethereum and litecoin trades carry higher fees, and users who place trades via Coinbase (versus GDAX directly) pay higher fees of ~2-3% per trade.

Figure 2. GDAX fee schedule

For simplicity’s sake, let’s assume Goldman can start off a bitcoin trading operation with $100 million in daily volume (it is, after all, a sophisticated investment bank with infinitely larger trading clients than crypto exchanges that serve retail investors) and makes a 0.25% spread from each trade. This indicates revenue of $250,000 per day (solely for the purpose of calculating an average; of course we note that with trading revenues, spreads and P&L results fluctuate heavily per day as they carry balance sheet risk) or $92 million per year.

Obviously, this figure is peanuts for Goldman, which earned nearly $10 billion of revenues on market making and trading in FY16. Still, the potential to increase revenues by at least $100 million (or 1%) in a business that’s otherwise declining must be attractive, to say the least, to Goldman. And with Goldman’s vast reach and hard-charging sales force, it would have the ability to generate much more than the $100 million in daily volume assumed for this exercise.

Quick take: implications for ICOsYes, ICOs - not IPOs. Would Goldman ever dabble in that as well as bitcoin trading? After all, Goldman originates bonds and stocks as well as trades them - it’s a full-service shop - so why wouldn’t it do the same for cryptocurrencies?

Trading revenues aren’t the only line of business facing a squeeze at Goldman. Investment banking revenues, while holding steady overall due to elevated M&A activity, is down for the equity capital markets (ECM) side of the house, as more and more companies choose to stay private longer (think of the major holdouts like Uber and Airbnb - in the old days, it was rare for super-unicorns to stay private for so long, depriving investment banks of their juicy underwriting fees).

ECM revenues were down an astonishing 43% in FY16 at Goldman Sachs, to a paltry $891 million (down from $1.5 billion in the prior year). That decline has reversed somewhat in the first half of FY17, with ECM revenues of $571 million (up 26% from 1H16) as Goldman co-led major deals like the IPOs of Snap (NYSE: SNAP) and Invitation Homes (NYSE: INVH).

Still, it’s clear that the wellspring for IPO fees (as well as follow-on offerings, which form a major part of equity underwriting revenues) is dryer these years than in the past, and investment banks can’t rely on banner M&A fees to keep carrying the day forever. Data collected by the Financial Times shows that the total ECM fee wallet was down 21% in FY16.

ICOs represent an interesting new opportunity for investment banks, whose equity bankers are chasing deals that keep getting kicked down the road. It’s unclear whether they would ever enter this business in its current stage (given its current reputation for fraud), but the future prospect is just as interesting as Goldman’s potential foray into bitcoin trading.

After all, the messaging app Kik just raised $100 million in an ICO last week. This amount is roughly equivalent to the amount of capital raised in a typical technology IPO. With tokens as a potentially new asset class and non-dilutive way of buffering up the capital structure (selling not debt nor equity, but a promise to a future service), more and more technology companies could turn to ICOs as an avenue for capital as the process becomes more widely embraced. In principle, an ICO is not so different than what Tesla (NASDAQ: TSLA) did with its Model 3 launch, collecting $1000 in deposits for each Model 3 pre-order. An ICO that offers tokens that can be exchanged for a future product or service is conceptually identical.

Currently, ICO hopefuls need lawyers and accountants to help execute their deals (and they generally get paid only small fees), but the space is wide open for investment banking advisors, who could potentially shepherd in much larger deals from their network of large-cap corporate issuers and large-AUM institutional clients.

The Kiks of the world are few today, but the next few years will almost certainly see growth in the number of high-profile ICO deals. And when lots of money changes hands, investment banks are sure to follow their noses to the source.

Final thoughtsEven crypto’s most ardent critics agree that the underlying technology, blockchain, is a revolutionary improvement over the way we transact today. While the prices of bitcoin and ethereum are extremely volatile today and draw cries of scandal and fraud, they will someday see a path to maturity (that is, if governments don’t step in and stop the party) as acceptance and usage becomes more mainstream.

Goldman’s open-minded stance (it has not yet made any clear indication) toward cryptocurrencies is a step in that direction. With a blue-chip investment bank (arguably, the bluest of the blue chips) circling around blockchain trading and its possibilities, the outcomes are sure to be astonishingly large and send shockwaves through the market. |