HDD Shipments Almost Halved in 2022

By Mark Tyson

published about 20 hours ago

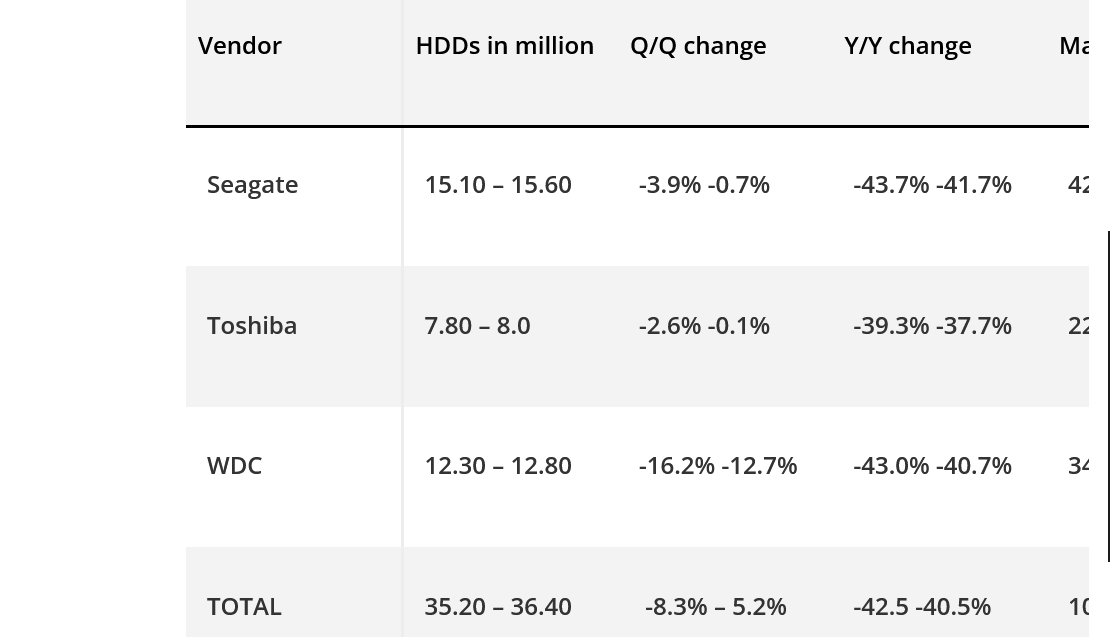

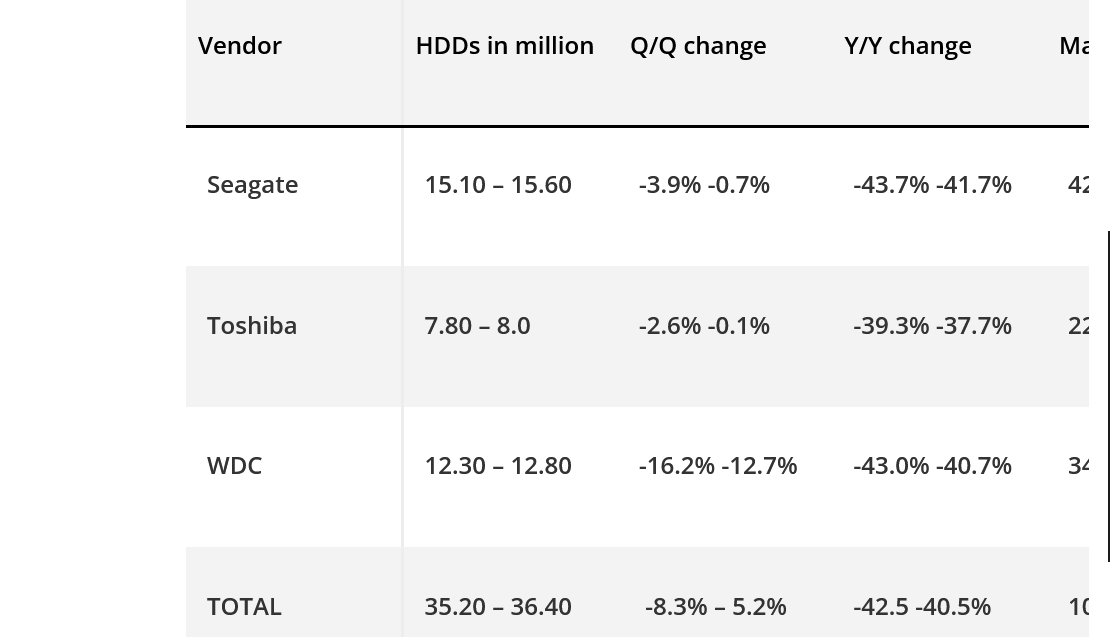

Quarterly and yearly shipment figures for Seagate, Toshiba and WDC are a sea of red.

A new report from Trendfocus shines a light on the carnage in the mechanical storage industry as we start 2023. The Storage Newsletter shared an excerpt from the Trendfocus research work, which spans 2022 and covers the largest HDD storage providers, their shipments, and their market shares. All suffered dramatic declines in shipments over the past year, with Seagate and WDC seeing their shipments almost halve.

According to this data, the worst market performer is the biggest member of the HDD industry triumvirate. Seagate’s HDD shipments dropped as much as 43.7% last year, and WDC was almost as bad, with a 43.0% slide over the same period. However, Toshiba was by no means unscathed by 2022, with the scale of its HDD shipments declining in the same ballpark as its rivals, with shipments falling at as much as 39.3% YoY.

[see source for better formatting]

Table uses Trendfocus report data

Vendor -- HDDs in million -- Q/Q change -- Y/Y change -- Market share

Seagate

| 15.10 – 15.60

| -3.9% -0.7%

| -43.7% -41.7%

| 42.9 – 42.9%

| Toshiba

| 7.80 – 8.0

| -2.6% -0.1%

| -39.3% -37.7%

| 22.2% – 22.0%

| WDC

| 12.30 – 12.80

| -16.2% -12.7%

| -43.0% -40.7%

| 34.9% – 35.2%

| TOTAL

| 35.20 – 36.40

| -8.3% – 5.2%

| -42.5 -40.5%

| 100%

|

Shipments for the industry also fell as much as 42.5% over the year to approximately 35 or 36 million units. Naturally, the industry can’t take a beating like this for too many years before it becomes unsustainable and HDDs are interned in the graveyard of tech. However, this is largely the result of inventory corrections and a cooling economy.

In addition to the overall market trends and consideration of the fortunes of each of the big three HDD makers, the market analysts considered three HDD segments separately. Trendfocus reckons the biggest current woe for HDD storage makers is the fall in enterprise cloud storage business demand. A combination of cloud storage firm mergers and inventory corrections meant that this segment “cut nearline shipments to between 10 and 11 million units in CQ4 2022.”

Moving along to 3.5-inch desktop and consumer HDDs, the single-digit percentage drops observed weren’t awful but showed no green shoots of recovery to be grateful for. The 3.5-inch HDD sellers were hoping for a tick-up in the surveillance market and an end to the consumer confidence slump in Q4 2022 – both of which never materialized.

Lastly, 2.5-inch HDDs showed a glimmer of light with a 15% QoQ rebound into Q4. We question whether or not there is always a Q4 rebound due to the holiday gifting season.

We recently reported on half-terabyte HDDs and SSDs hitting price parity. In that report, TrendForce (not to be confused with Trendfocus) delivered some very gloomy news to the laptop HDD industry, saying that 92% of laptops sold in 2022 had SSDs, with the proportion expected to grow to 96% in 2023.

Mark Tyson is a Freelance News Writer at Tom's Hardware US. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

tomshardware.com |