I'm also suspicious of 'this time it's different,' yet it actually is in the most fundamental sense. World CBs are printing and debasing in a coordinated and high clip, and with negative interest rates in most of the world, they cannot stop.

The end game is almost certainly going to be currency crises, possibly cascading, with some kind of reset at some point.

If it is gold's fate to go to > 10k, and I think it is, then there will be much shaking of the tree on the way.

In 2008 I was buying miners all the way down. Too bad I wasn't smart enough to sell all of them in '12.

Tomorrow will be key, imo... if it is > 1000 points down again, or 2k, then Monday will either be a knockout punch ala 1987, or monetization like the world has never seen, perhaps the $50T day event that Doug Noland wrote about some time ago ('09 or '10).

Wonder what gold would do in that event?

Oil looks like 40 on the horizon, and if the COVID-19 keeps spreading slowly like global warming reclaiming Florida in the next century, then maybe < 15 by the time it turns.

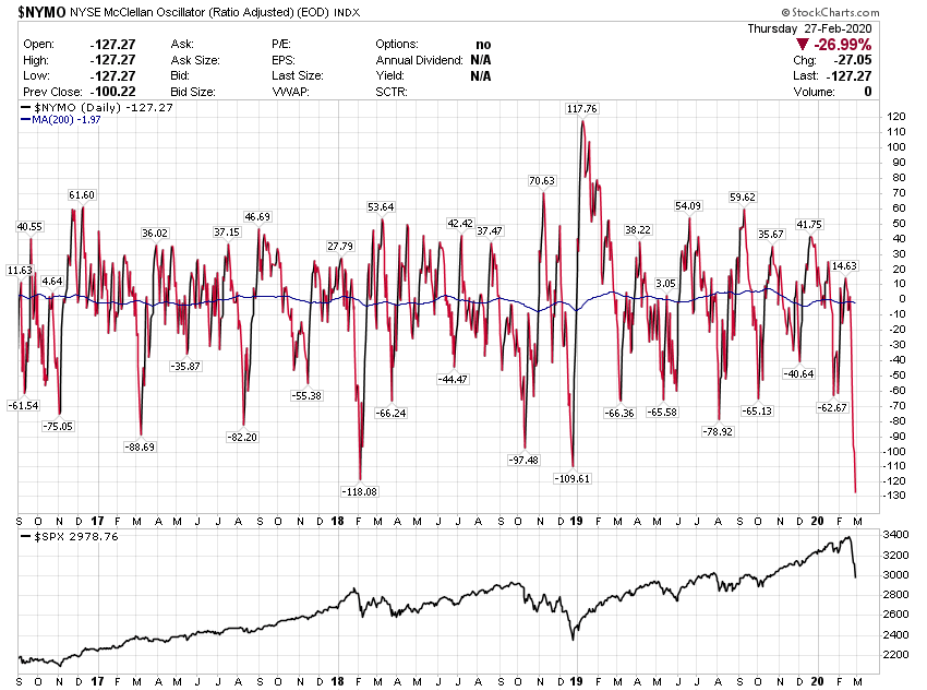

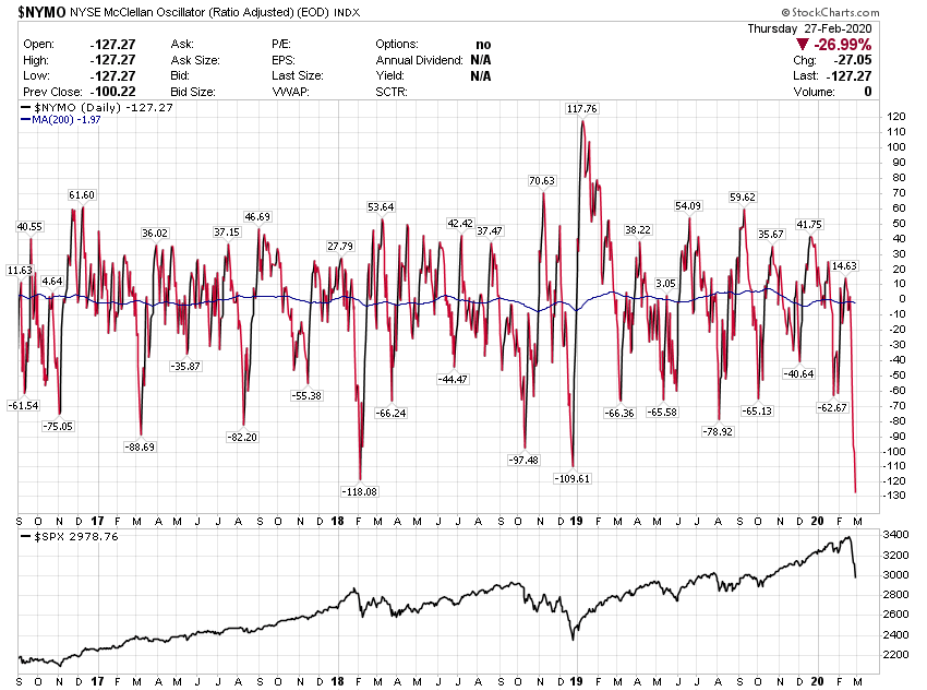

This says bounce tomorrow, or Monday (maybe thousands lower though...).

|