Who is C3.ai Really?

Another AI software company that has been in the news lately is C3.ai ( AI). Perhaps because they were fortunate enough to acquire the AI ticker symbol, recognizing the potential for a growing megatrend to ensue, the stock is highly volatile and gets traded with heavy volume. Recent trading volume has escalated with over 60M shares trading hands on Thursday 4/6/23. The fact that a letter was sent on April 4 to Deloitte & Touche, C3.ai's audit firm, discussing the short report issued by Kerrisdale Capital a month earlier increased the volatility and the trading volume considerably. Since that time, the company has refuted the allegations of the short seller with a rebuttal posted on the company's website.

So, what sort of company is C3.ai really?

Well according to their own company description, they provide enterprise AI software and services to accelerate digital transformation. Unlike the other chat-based applications from MSFT and GOOG, the software and services provided by C3.ai support the business value chain in an enterprise environment and address a number of high value AI applications including fraud detection, reliability, sensor network health, supply network optimization, energy management, customer engagement, etc.

There are industry solutions for a host of different industries including manufacturing, oil and gas, healthcare, utilities, financial services, government, retail, telecommunications, and transportation. The company claims to have customers with 24 different Fortune 500 companies with more than 120 applications deployed.

Although the company was founded by industry veteran, Tom Siebel, in 2009 it has undergone several transformations since then. Most recently, the company changed its name from C3 IOT to C3.ai in 2019. From the company's press release in January 2023 regarding the newest offering, C3 Generative AI, this description summarizes the products and services currently offered:

C3 AI is the Enterprise AI application software company. C3 AI delivers a family of fully integrated products including the C3 AI Platform, an end-to-end platform for developing, deploying, and operating enterprise AI applications, C3 AI applications, a portfolio of industry-specific SaaS enterprise AI applications that enable the digital transformation of organizations globally, and C3 Generative AI, a suite of large AI transformer models for the enterprise.

In a recent press release it was announced that C3.ai made the Financial Times list of fastest growing companies for the third year in a row, ranking #286 on the 2023 list. In a video interview on Yahoo Finance Live from March of this year, CEO Tom Siebel says that he believes that the AI software market will soon be a $600 billion addressable market.

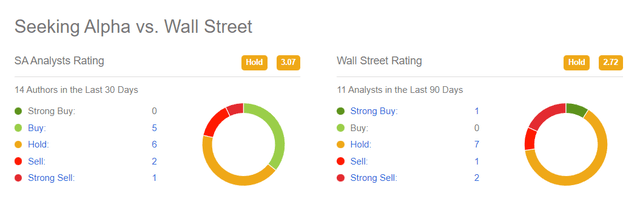

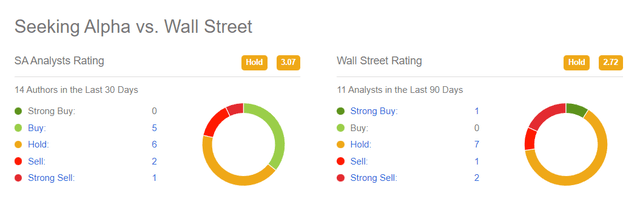

. Analyst ratings are all over the board when it comes to C3.ai stockThere is just 1 Strong Buy from Wall Street and a few Buy ratings from SA analysts, as well as lots of Hold and a few Sell ratings from both SA analysts and Wall Street analysts. Overall, I would rate the stock a Hold, at least until the short selling tapers off and investors can get a clearer picture of what the future earnings growth looks like.

Seeking Alpha Seeking Alpha

Part of the issue with the stock performance is that investors initially got excited about the company's prospects in early 2021. You can see on the stock price chart from the company website how the price action shot up shortly after the company went public in December 2020 and then came crashing down, slowly starting to gain traction again now in 2023.

C3.ai website C3.ai website

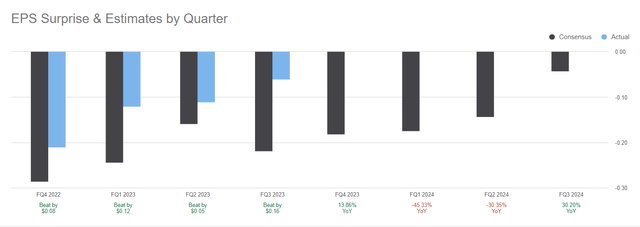

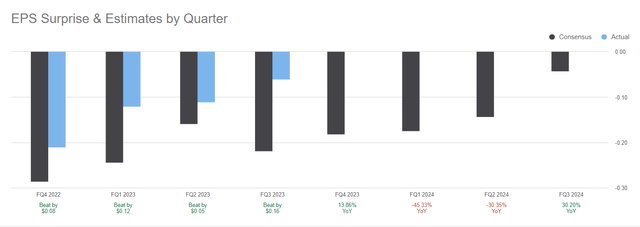

What investors are most interested in is future earnings growth. Recent history does indicate that earnings are improving but will not be positive until at least late 2024 or even 2025. Although revenues have been increasing each quarter for the past 2 years, negative earnings do not warrant a premium share price unless that trend appears to be changing for the better.

Seeking Alpha Seeking Alpha

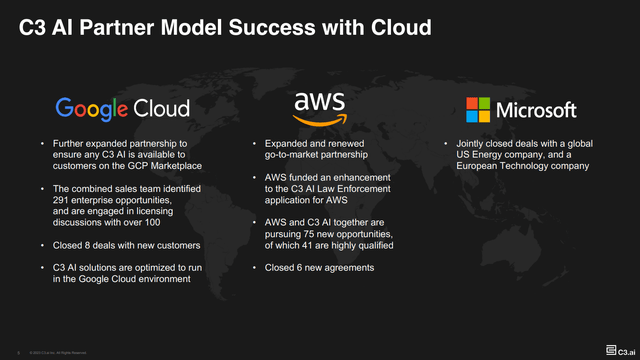

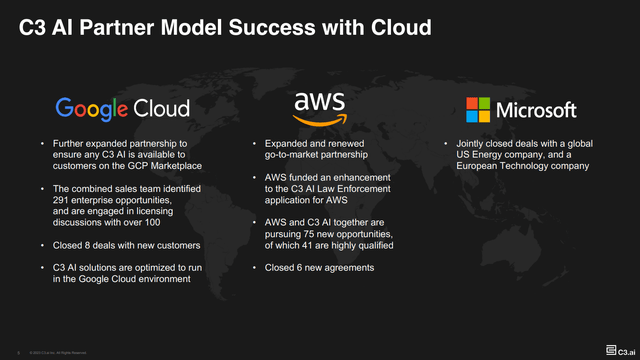

C3.ai partners with all 3 major cloud computing platforms, so that creates a win-win situation for Google, Amazon ( AMZN), and Microsoft as well as for C3.ai. That bodes well for future AI application growth in the cloud environment, which is really the direction things have been heading for the past 7 years or so and looks to continue for the next decade.

C3.ai investor presentation C3.ai investor presentation

In addition, the company partners with global system integrators like Booz, Allen, Hamilton; Ernst & Young; Accenture, and others; as well as industry partners such as Baker Hughes, Shell, Eni, Exxon Mobil, LyondellBasell ( LYB), Petronas, Aramco, and more.

Now if the company can just start making some profits, they may be onto something good. The future looks promising but the leadership at C3.ai needs to start delivering soon. I rate the stock a Hold and own a small, speculative position in my taxable growth stock portfolio.

seekingalpha.com |