IBM Raises Its FCF Outlook for 2025 - IBM Stock Could be Undervalued

Mark R. Hake, CFA - Barchart - 1 hour ago Columnist

/International%20Business%20Machines%20Corp_%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

International Business Machines Corp_ logo on phone-by rafapress via Shutterstock

International Business Machines Corp. ( IBM) reported on Oct. 22 its highest adjusted free cash flow (FCF) margin (i.e., FCF/revenue) in its history at 15% for the year-to-date ending Sept. 30. Moreover, IBM raised its full-year outlook for FCF, which could push IBM stock at least 10% higher at $345.00 per share.

IBM stock closed Monday, Oct. 27, at $313.09, up from a recent low of $275.97 on Oct. 16. (i.e., +13.5%).

Improved FCF Outlook Investors are likely pleased that management raised its full-year 2025 adj. FCF outlook to $14 billion, up from its projection of $13.5 billion for 2025 in Q2. Improved FCF Outlook Investors are likely pleased that management raised its full-year 2025 adj. FCF outlook to $14 billion, up from its projection of $13.5 billion for 2025 in Q2.

It makes a significant amount of its full-year FCF in Q4, as its YTD adj. FCF was only $7.181 billion, implying $6.189 billion (i.e., $14b - $7.181b YTD Q3) expected for Q4. Last year's Q4 adj. FCF was $6.163 billion. That implies a slight increase this Q4.

It also implies a full-year 20.9% FCF margin, as analysts are projecting $67.02 billion in revenue for 2025 (i.e., $14.0b / $67.02 billion).

Moreover, based on analysts' forecasts for 2026, its full-year FCF could rise even further.

For example, assuming it makes a 21% adj. FCF margin next year, and using analysts' forecasts of $70 billion in revenue:

0.21 x $70 billion = $14.7 billion FCF for 2026

Target Price for IBM Stock FCF Yield Target Price. That could lead to a higher stock price, based on its historical FCF yield metric.

For example, the trailing 12-month (TTM) adj. FCF has been 4.56% (i.e., $13.344 billion TTM / $292.656 billion market cap).

So, if we assume that in 2026, with the adj. FCF estimate of $14.7 billion and the 4.56% FCF yield, the market cap could rise to $322.4 billion:

$14.7 billion / 0.0456 = $322.4 billion

That is 10.2% higher than today's market cap of $292.656 billion.

In other words, IBM stock could rise over 10% over the next year to $345 per share:

$313.09 x 1.102 = $345.00

Analysts Agree. Yahoo! Finance reports that 20 analysts have an average price target of $313.09. Moreover, AnaChart.com reports that 11 analysts have an average target of $345.69. That is close to my FCF yield-derived target price.

The bottom line is that IBM stock looks cheap based on its strong FCF and analysts' target prices.

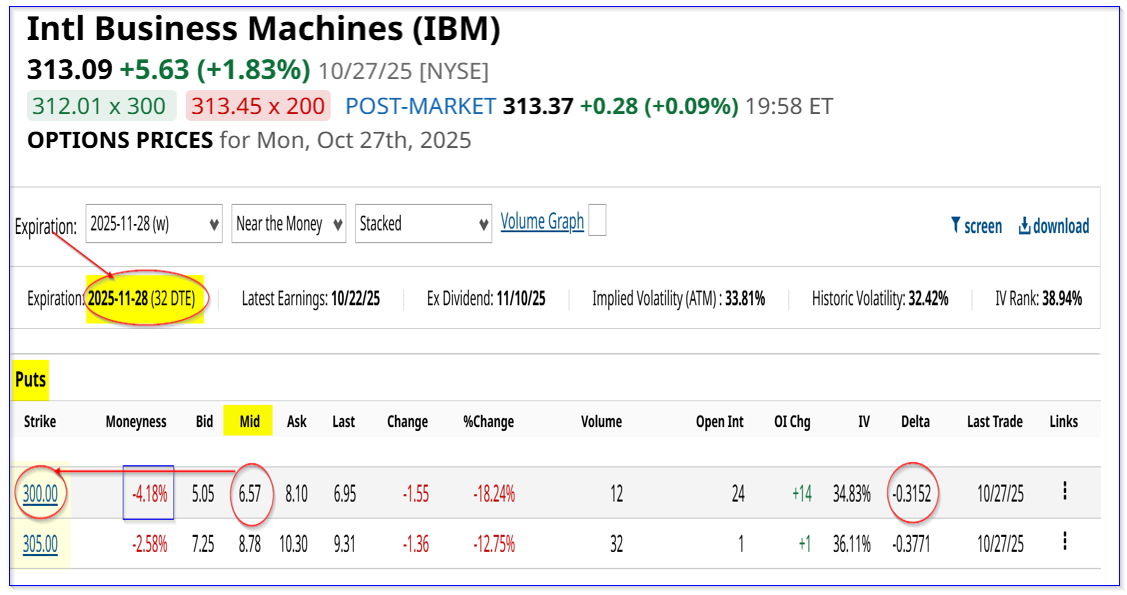

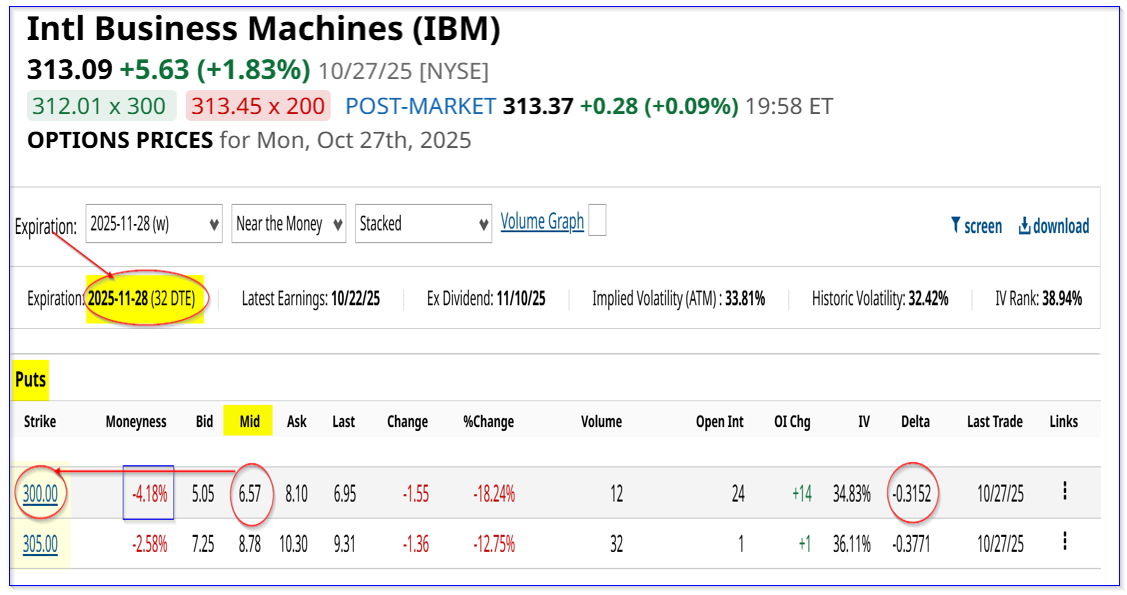

One way to play IBM is to sell short out-of-the-money (OTM) put options for a lower buy-in price and to generate extra income.

Shorting OTM Puts For example, the Nov. 28 options expiration period shows that the $300.00 strike price put option has a midpoint premium of $6.57. That means a short-seller of these puts can make an immediate yield of 2.19%:

$6.57/$300.00 = 0.0219 = 2.19% one-month yield

IBM puts expiring Nov. 28, 2025 - Barchart - As of Oct. 27, 2025 This shows that the strike price is 4% below Monday's price - i.e., it's out-of-the-money. But, even if IBM stock falls 4% to $300.00 and the short-seller's collateral of $30,000 per contract is assigned to buy 100 shares, the breakeven point is still lower: IBM puts expiring Nov. 28, 2025 - Barchart - As of Oct. 27, 2025 This shows that the strike price is 4% below Monday's price - i.e., it's out-of-the-money. But, even if IBM stock falls 4% to $300.00 and the short-seller's collateral of $30,000 per contract is assigned to buy 100 shares, the breakeven point is still lower:

$300.00 - $6.57 = $293.43 breakeven

$293.43 B/E / $313.09 trading price -1 = -6.23% downside protection

The point is that by shorting the $300.00 put option, the investor has a potential buy-in 6.23% lower than the trading price today.

In the meantime, the investor makes a 2.19% yield per month while waiting for this lower potential buy-in point.

Moreover, even if that occurs, the upside is quite good:

$345 target / $293.43 breakeven -1 = 0.1758 = +17.6% upside

The bottom line is that IBM stock appears to be undervalued here, and one way to capitalize on this is to sell out-of-the-money puts.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More News from Barchart

Related Symbols

Symbol Last Chg %Chg | IBM | 313.95 | +0.86 | +0.27% | | Intl Business Machines |

Don’t Miss a Minute of Daily Action Don’t Miss a Minute of Daily Action

Our exclusive midday newsletter highlights top stories, big movers, and breakout charts.

By clicking Sign Up Now to receive this free newsletter, you will also receive free Barchart Partner emails. Opt-out any time. See Terms of Service and Privacy Policy for details.

Most Popular News

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg) 1 1

Dear Tesla Stock Fans, Mark Your Calendars for November 6

2 2

‘We Are at a Critical Inflection Point for Tesla’ According to CEO Elon Musk. Should You Hold on Tight to TSLA Stock or Jump Ship Now?

/PayPal%20Holdings%20Inc%20sign%20on%20building-%20by%20Sundry%20Photography%20via%20Shutterstock.jpg) 3 3

PayPal Reports Q3 Earnings on October 28. Approach PYPL Stock Now with Caution.

4 4

How Much Lower Will Silver Prices Go?

/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg) 5 5

The CoreWeave-Core Scientific Deal Isn’t Likely to Go Through. Analysts Say That Makes CORZ Stock a Buy.

Log Out

Market:

HOME

Stocks

Options

ETFs

Futures

Currencies

Investing

News

Barchart

Markets Today Barchart News Exclusives Contributors Chart of the Day News Feeds

Featured Authors

Andrew Hecht Austin Schroeder Caleb Naysmith Darin Newsom Don Dawson Elizabeth H. Volk Gavin McMaster Jim Van Meerten Josh Enomoto Mark Hake Oleksandr Pylypenko Rich Asplund Rick Orford Sarah Holzmann All Authors

Commodity News

All Commodities Energy Grains Livestock Metals Softs

Financial News

All Financials Crypto Dividends ETFs FX Interest Rates Options Stock Market

Press Releases

All Press Releases ACCESS Newswire Business Wire GlobeNewswire Newsfile PR Newswire

Tools

Learn

Site News 3

B2B SOLUTIONS

Contact Barchart

Site Map

Back to top

Change to Dark mode

Membership Barchart Premier Barchart Plus Barchart for Excel

Resources Site Map Site Education Newsletters Advertise

Barchart App Business Solutions Market Data APIs Real-Time Futures

Stocks: 15 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered by Barchart Solutions. Fundamental data provided by Zacks and Morningstar.

Barchart is committed to ensuring digital accessibility for individuals with disabilities. We encourage users to Contact Us with feedback and accommodation requests.

© 2025 Barchart.com, Inc. All Rights Reserved.

About Barchart | Affiliate Program | Terms of Service | Privacy Policy | Do Not Sell or Share My Personal Information | Cookie Settings

×

Terms of Content Use |

/International%20Business%20Machines%20Corp_%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Improved FCF Outlook Investors are likely pleased that management raised its full-year 2025 adj. FCF outlook to $14 billion, up from its projection of

Improved FCF Outlook Investors are likely pleased that management raised its full-year 2025 adj. FCF outlook to $14 billion, up from its projection of

Don’t Miss a Minute of Daily Action

Don’t Miss a Minute of Daily Action /An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg) 1

1  2

2 /PayPal%20Holdings%20Inc%20sign%20on%20building-%20by%20Sundry%20Photography%20via%20Shutterstock.jpg) 3

3  4

4 /The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg) 5

5