Tight DRAM Supply to Boost DDR5 Contract Prices—Profitability in 2026 Expected to Surpass HBM3e, Says TrendForce

Published Oct.29 2025,16:55 PM (GMT+8)

TrendForce’s latest investigations show that server DRAM contract prices are strengthening in 4Q25, driven by ongoing data center expansion among global CSPs. This momentum is lifting overall DRAM pricing. Although final contract pricing for the quarter is still being negotiated, suppliers are showing a greater willingness to raise quotes as CSPs increase order volumes.

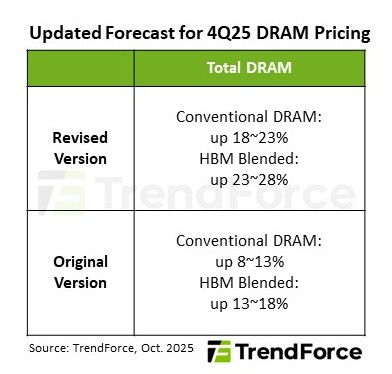

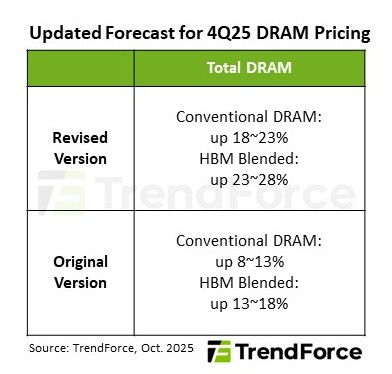

TrendForce has accordingly revised its 4Q25 outlook for conventional DRAM pricing upward, from an earlier forecast of 8–13% growth to 18–23%, with a strong likelihood of further upward revision.

Looking ahead to 2026, global server shipments are expected to grow by around 4% annually. Meanwhile, CSPs are rapidly upgrading to HPC platforms to support massive AI models, driving up memory content per server. This will push overall DRAM bit demand beyond prior expectations and extend the structural supply shortage.

Thanks to server demand remaining strong, DDR5 contract prices are expected to maintain an upward trajectory throughout 2026, especially in the first half of the year. In contrast, given the increasingly competitive landscape among the three major suppliers for HBM3e—and the fact that buyers are holding healthy inventory levels—HBM contract prices are expected to shift into year-over-year decline.

TrendForce observes that as of 2Q25, HBM3e still commanded a price premium more than four times that of DDR5, providing much stronger profitability for suppliers. However, as DDR5 prices continue to rise, the gap between the two will narrow significantly in 2026. DDR5 profitability is projected to surpass that of HBM3e starting in the first quarter of next year.

Since HBM3e and DDR5 compete for the same production capacity, TrendForce expects that once this profitability shift occurs, suppliers may allocate more resources toward server DDR5 to secure earnings. Concurrently, with HBM3e pricing stabilizing and demand still solid, suppliers may also attempt to raise ASPs to maintain balanced profitability across their product portfolios.

Moving forward, the capacity allocation and pricing strategies between DDR5 and HBM among leading suppliers will become key variables shaping the next phase of the memory market.

dramexchange.com

Latest Articles

|