Energy

Hydropower Jostles for Role in Global Green Recovery Programs

Hydropower association partners with IRENA to make the case for more projects.

Jason Deign February 09, 2021

Hydropower industry groups want green recovery funding to overcome high cost barriers to expanding this carbon-free electricity resource.

The world’s hydropower developers want a seat at the green recovery funding table alongside other key decarbonization technologies such as wind, solar, batteries and green hydrogen.

This month, the International Hydropower Association (IHA) partnered with the International Renewable Energy Agency (IRENA) to secure green recovery program funding for hydro projects.

The agreement “sets out IRENA's and IHA's joint ambition to accelerate the development, financing and deployment of sustainable hydropower,” said the IHA in a press release. “This will involve future policy and market initiatives aimed at better rewarding hydropower for the clean storage and flexibility services it provides to the energy system.”

IRENA’s 2020 Global Renewables Outlook estimates that the world needs an extra 850 gigawatts of hydropower capacity by 2050 in order to meet the climate goals of the Paris Agreement.

That’s equivalent to a 65 percent increase on current global hydropower capacity, according to the IHA’s 2020 Hydropower Status Report.

But so far there is little sign of the necessary funding for this level of development being included in various green recovery programs around the world, said IHA CEO Eddie Rich in a webinar last week.

While “we have never seen momentum like this” in clean energy infrastructure investment, he said, “there is no inevitability about hydropower being part of that journey. The green stimulus packages are heavily focused on wind and solar. Hydropower is rarely listed.”

Hydropower is being ignored by policymakers

Some countries do not even recognize all hydropower as being fully renewable, he said. That’s despite it being a major source of carbon-free energy in many countries, as well as accounting for 96 percent of global energy storage capacity in the form of pumped hydropower projects.

Speaking during the webinar, International Energy Agency executive director Fatih Birol said hydro had become “the forgotten workhorse” of the energy system. “You rarely hear about hydropower,” he said.

Either this was down to bodies such as the International Energy Agency failing to inform the public of the value of hydro, or because industries such as solar and wind were better at lobbying, he said.

“We think hydropower needs to get the attention it deserves in the clean energy transition if we want to be successful.” Getting hydro onto clean energy investment agendas this year will be “critical,” he said.

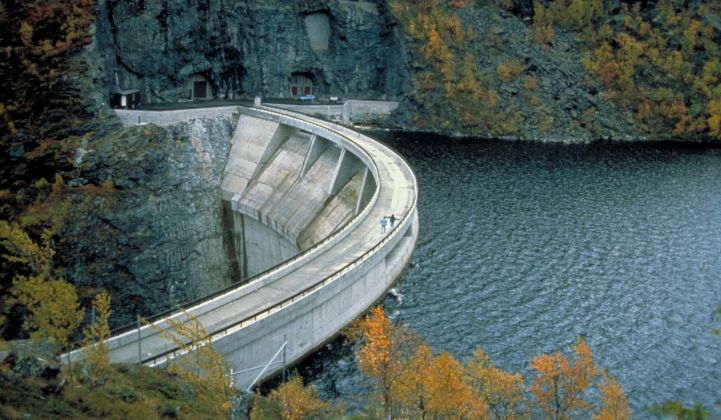

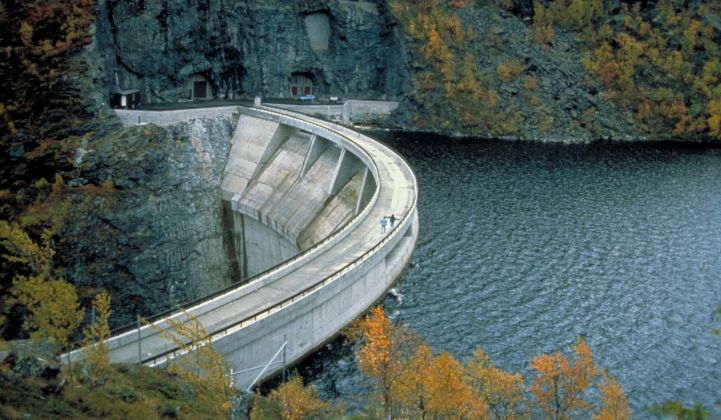

Hydro faces an uphill struggle in attracting investment, though. Compared to wind and solar, hydropower projects are seen as expensive, time-consuming and risky.

A major reason for this is that new dams historically have had major impacts on natural environments and local communities.

With many potential dam sites already occupied by hydropower stations and rising concern over safeguards to natural habitats, upcoming projects are increasingly at risk of failing to pass environmental and community impact hurdles.

Industry moves to demonstrate value

To get around this, in recent years the IHA has developed tools including an environmental, social and corporate governance (ESG) code of practice and in 2010 launched a Hydropower Sustainability Assessment Protocol.

While the moves to improve ESG performance have been lauded, with the geothermal industry looking to adopt a similar framework, the voluntary nature of the code of practice means uptake has been patchy. Only around 30 projects, out of several hundred, have adopted it since 2010.

Besides addressing ESG issues, the hydropower sector is pushing to show how hydro assets can deliver grid flexibility services through a European project called Xflex Hydro. And it has published a guide for identifying, assessing and managing climate risks to projects.

But a lingering problem for the industry is that current market dynamics in many cases fail to provide incentives for the kind of investments needed for hydro development.

“There are other services that hydropower may provide, in terms of increasing resiliency to floods and drought caused by climate change,” said IRENA Director-General Francesco La Camera during the IHA webinar. “Some of these services are not adequately remunerated.”

It is unclear how the IHA and IRENA might be able to compel policymakers to rethink this point before green recovery funds start flowing into the global economy.

Two elephants in the room

The debate over how to stimulate new, sustainable hydropower projects does not fully consider the fact that hydro is highly concentrated in just two countries that have questionable ESG records. More than a third of all worldwide hydro capacity is located in China and Brazil.

The two countries installed more than 9 gigawatts of new hydro in 2019. That’s 58 percent of all the capacity added that year.

China is already running out of new hydropower project locations, although for pumped hydro, “the value proposition is clear,” said Beijing-based BloombergNEF analyst Jonathan Luan Dong in an interview. “Government is really supporting it.”

But even in China, “hydro is mostly invested in by grid companies,” he said. “And these grid companies are currently under pressure to reduce their retail power prices, so they’ve been cutting a lot of fat in their revenue.”

As a result, he said, “the government really needs to come up with new incentives for either the grid companies or somebody else to build pumped hydro storage. Real money needs to be put on the table for the market to respond.”

That sounds like just the kind of message the IHA and IRENA are pushing. Whether it will get through remains to be seen.

greentechmedia.com |