Don't try to fast buck trade every hiccup. Wanna win big? Look for good entry windows for LT positions.

<The Fragile Global Oil Trade: How Ukraine's War and LNG Strikes Could Spell Disaster

BY CAPITALIST EXPLOITS

TUESDAY, AUG 29, 2023 - 11:00

THE FRAGILITY OF THE GLOBAL OIL TRADE

We don’t want to see an escalation in the Ukraine war (or any war for that matter). That being said, it probably wouldn’t do our portfolio any harm if the guns started blazing in the Black Sea.

From the article:

Russia exports around 500,000-550,000 barrels a day of crude and 450,000 barrels of refined products, mostly fuel and diesel, from Novorossiysk. The port also loads about 250,000 barrels a day of crude from Kazakhstan that gets delivered to the port via pipelines and from there is shipped to Romania for refining, Kpler data show.

Nearby, the port, the Caspian Pipeline Consortium, or CPC, alone loads tankers with about 1.3 million barrels of crude per day and is the main route for exporting oil from Kazakhstan to Europe.

“Some 2.5 million barrels a day of crude and product flows are endangered by the flareup,” Katona said, adding that a potential halt of the CPC would do much more damage to Western interests.

Russia is also the world’s top wheat exporter, and the bulk of its grain is delivered from Novorossiysk and the Kavkaz anchorage in the Kerch Strait. The country is in the midst of a second bumper harvest, making this a crucial time for getting grain to global markets.

Speaking of energy security and the fragility of the global energy markets…

This is what happened:

Prices on the Title Transfer Facility, the European benchmark, rose to more than €43 per megawatt hour, up from almost €30 on Tuesday, reaching its highest point since mid-June.

The increase was triggered by reports that workers at important LNG plants in Australia were planning strike action in a fight for higher pay and better job security, with market movements exacerbated by some traders closing out bets that gas prices would fall.

The move highlights that despite gas storage levels rising close to capacity in the EU, the energy crisis that has roiled the continent for almost two years is not yet over, and markets are still nervous about the vulnerability of supplies.

While Australian LNG supplies rarely flow directly to Europe, the EU has become increasingly reliant on global seaborne cargoes of LNG to replace Russian supplies cut since the war in Ukraine.

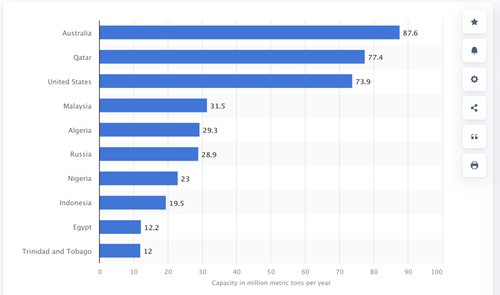

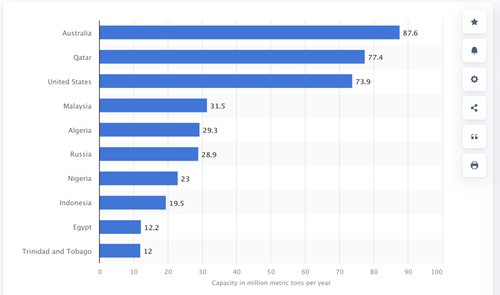

As a matter of interest, the world’s global LNG trade is in the hands of a relative few exporters. Below are the countries with largest liquefied natural gas (LNG) export capacity in operation worldwide as of July 2022 (in million metric tons per year):

The point of all this is that all these “disturbances” are waking many governments up to the fact that they are coming up very short on the energy security front.

Getting back to this European natural gas thing…

The rise we saw last week was a mere blip, prices are still lower than they were at the start of the year. However, it wouldn’t take much for prices to rise materially again as the only thing that has happened is Europe just got lucky with the weather over the last 12 months.

zerohedge.com |