what a trader friend had to say re the riyadh / beijing initiative

Brilliant idea—-why would a Saudi sell his oil any other way. They always wanted payment in gold for their oil in the past and always converted the US price back into gold anyway.

The world’s top oil importer, China, is preparing to launch a crude oil futures contract denominated in Chinese yuan and convertible into gold, potentially creating the most important Asian oil benchmark and allowing oil exporters to bypass U.S.-dollar denominated benchmarks by trading in yuan, Nikkei Asian Review reports.

zerohedge.com

The Oil Price of Gold

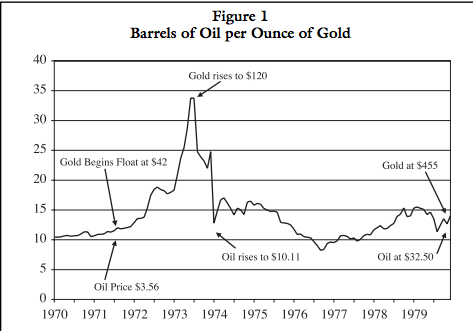

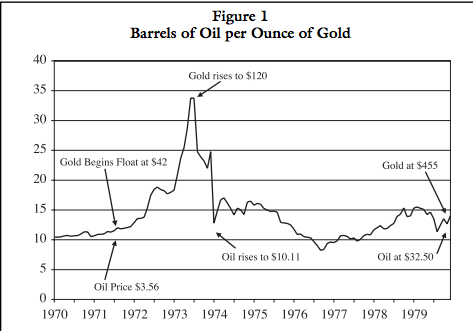

When the price of oil is analyzed in terms of gold, instead of in terms of U.S. dollars, the 1970s look quite different. The U.S. dollar price of oil hardly changed from the end of World War II to the late 1960s: from 1947 to 1967, it rose by less than 2 percent annually on average (from $2.07 to $3.07 per barrel), not even keeping up with U.S. price inflation. Thus, given the Bretton Woods system, the oil/gold price was also nearly fixed. Throughout this entire period, through to the end of Bretton Woods in late 1971, 10–15 barrels of oil would buy an ounce of gold. As figure 1 indicates, the situation changed dramatically in the early 1970s. In 1970, slightly more than 10 barrels of oil would purchase an ounce of gold.8 By the next year, when the Bretton Woods agreement ended, with gold priced at $42 and oil fixed in terms of U.S. dollars at $3.56, oil sellers needed nearly 12 barrels of oil to buy an ounce of gold. This “real” oil price decline, and general worldwide inflation did not go unnoticed in the oil-producing countries. In 1971, OPEC built in a 2.5 percent annual inflation factor by which to adjust the nominal (U.S. dollar) price of oil.9 Yet, by mid-1973, nearly 34 barrels of oil were required to buy an ounce of gold. In little more than two years, the gold price of oil had fallen by more than 70 percent, and the oil price of gold had risen by almost 200 percent |