Prices fall sharply in September quarter as renewables surge, batteries displace gas in evening peaks

Waratah Super Battery. Photo: Akaysha Energy.

Giles Parkinson

Oct 30, 2025

Battery

Renewables

Average wholesale electricity prices fell significantly in the September quarter, helped by a surge in renewable energy production, and the rapid growth of battery storage that is displacing both gas and hydro in the critical evening peaks.

The latest Quarterly Energy Dynamics report from the Australian Energy Market Operator reveals that average wholesale electricity prices across the main grid, know as the National Electricity Market, fell to $87/MWh in the September quarter, some 27 per cent below the same quarter last year and 38 per cent below the June quarter.

This is despite record demand levels, particularly in Victoria and NSW, which was only partially offset by an 11 per cent jump in rooftop PV output, also to a new record.

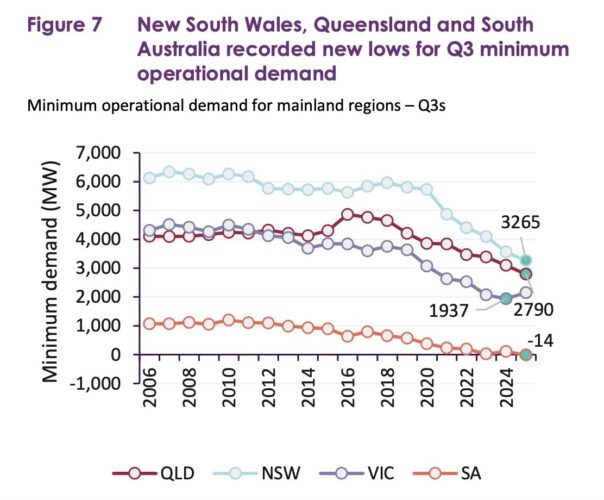

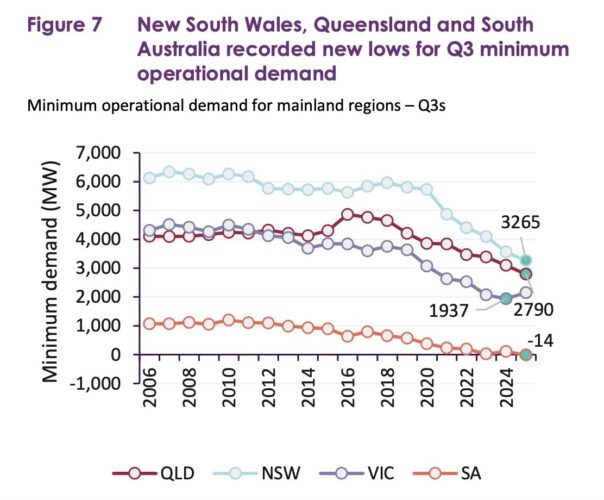

The quarter also witnessed new minimum demand levels – again because of the influence of rooftop solar PV, with new Q3 lows in NSW, Victoria and South Australia, where grid demand fell to minus 14 MW, meaning rooftop PV output was more than state demand.

AEMO says wind generation – driven the commissioning of new projects, including the country’s biggest wind project, the first 736 MW stage of Golden Plains – reached a new all-time high for any quarter, rising 16 per cent to an average 4,676 MW.

Grid sale solar output was also up 16 per cent to a new Q3 high of 1,699 MW (averaged). This more than offset the increase in demand.

“With more energy supplied by wind and solar, the need for higher-cost thermal generation declined, particularly during peak periods,” the report says.

But the big game changer was the surge in battery storage, with 2,936 MW/6,482 megawatt hours (MWh) of new capacity added over the last year, lifting the average output by 150 per cent to 215 MW, but mostly of this was concentrated in the evening peaks.

Screenshot

AEMO says the surge in battery storage – up an average 461 MW in the evening peaks – clearly had an impact on other peaking generation sources, with gas fired generation down 11 per cent, hydro output down 3.5 per cent, and coal fired generation down 0.8 per cent.

“This led to a significant reduction in price volatility,” the report says.

All of these factors also helped the renewable share hit a new Q3 high of 42.7 per cent, nearly 10 per cent higher than the Q3 average of 39.3 per cent last year.

“The electricity demand growth was driven by colder weather, alongside broader trends of increasing electrification of homes, adoption of electric vehicles, and rising data centre consumption,” AEMO head of policy and corporate affairs Violette Mouchaileh said in a statement.

“The impact of increasing renewable energy and storage connecting to the NEM became more evident in September when milder temperatures and less cloudy days led to a new 77.2% renewable contribution record on 22 September – up from 75.6% in Q4 2024,” Mouchaileh said.

The lowest prices came in Queensland, where the average wholesale price fell 28 per cent from a year ago to $72/MWh, and NSW also enjoyed a 31 per cent fall to $90/MWh.

Victoria’s wholesale prices dropped by 26 per cent to an average of $77/MWh.

South Australia had the highest average wholesale spot price in the NEM at $104/MWh, although $18/MWh of this came from a single high priced event in early July, when the main transmission line was constrained, leaving the local grid exposed to a the actions of a few powerful actors in a constrained market.

The other states enjoyed little volatility and no major high priced events, largely because of the influence of battery storage, and the absence of major wind lulls, according to AEMO.

“The surge in low-cost renewable output more than offset a 498 MW rise in operational demand, lifting the renewable share of generation to 42.7%, its highest Q3 level on record. With more energy supplied by wind and solar, the need for higher-cost thermal generation declined, particularly during peak periods.

reneweconomy.com.au |