good news I guess, that inflation is down, leaving room for more printing, so to dilute the stock / reservoir, in favour of the flow, GDP / river

By such a a protocol, we must strive to hold on to 'undilutables', and gather sponges of the flow, equities, and so Martin's scenario plays out, the rise of stocks and gold / silver / etc etc

let others quaintly wait for rising interest rate on bonds

zerohedge.com

Core CPI Crashes By Most On Record; Food Costs Soar As Energy & Apparel Collapse

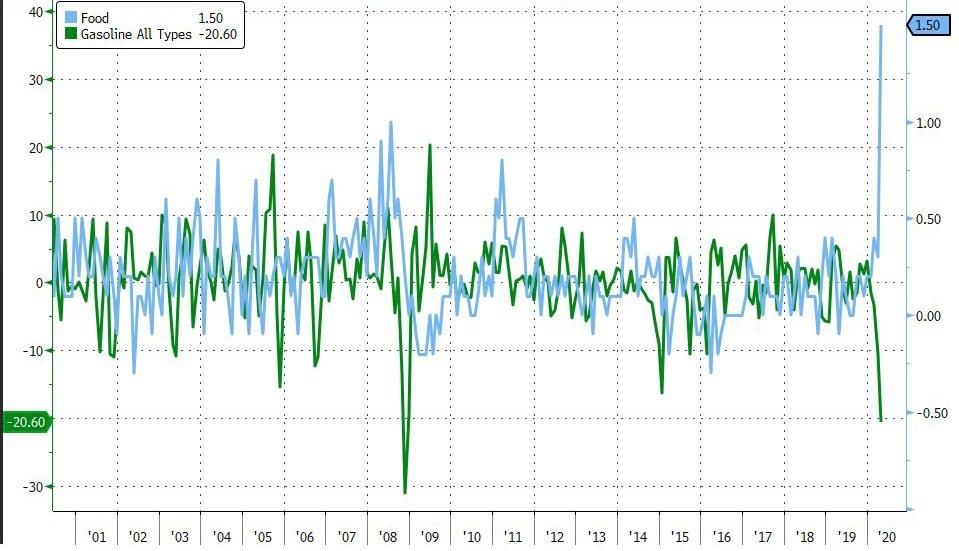

Headline Consumer Prices fell 0.8% MoM - the biggest drop since 2008 - as soaring food inflation was dominated by plunging energy, apparel, and lodging costs...

But it was Core CPI, printing 0.4% MoM that made the headlines. That is the biggest monthly decline since records began in 1961...

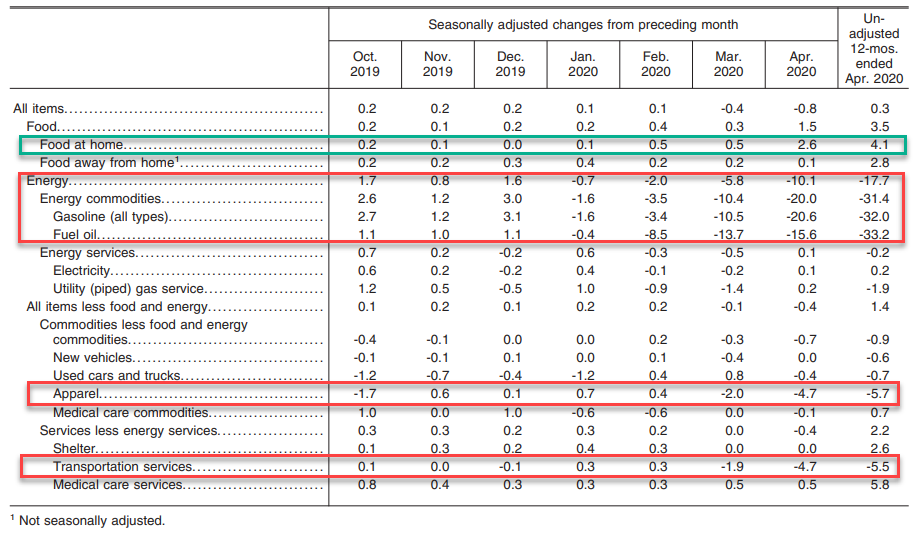

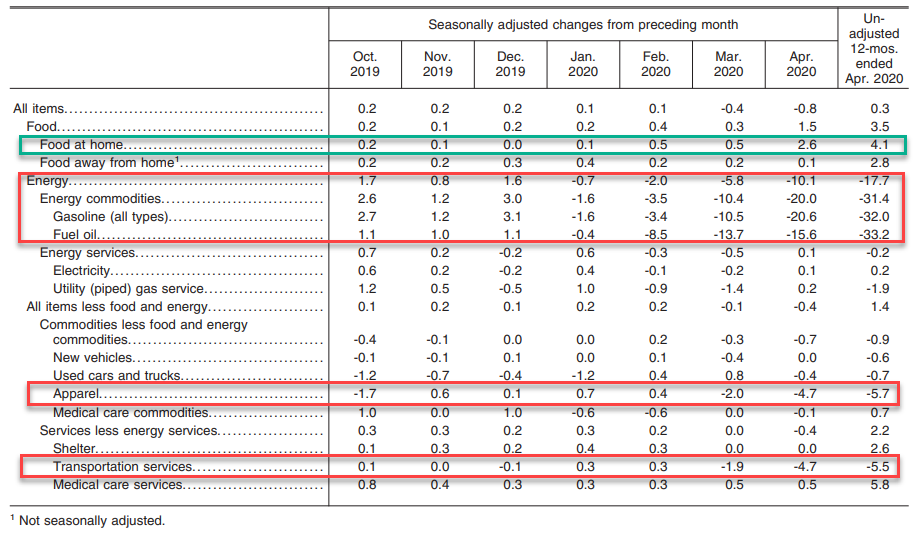

Under the hood, the changes were dramatic to say the least...

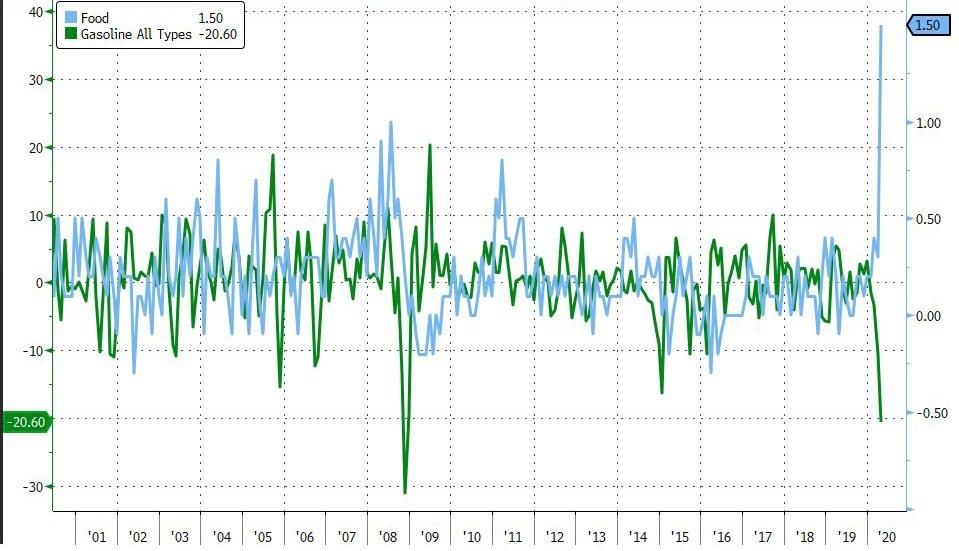

A 20.6-percent decline in the gasoline index was the largest contributor to the monthly decrease in the seasonally adjusted all items index, but the indexes for apparel, motor vehicle insurance, airline fares, and lodging away from home all fell sharply as well.

Goods deflation is accelerating as Services inflation is slumping...

In contrast, food indexes rose in April, with the index for food at home posting its largest monthly increase since February 1974.

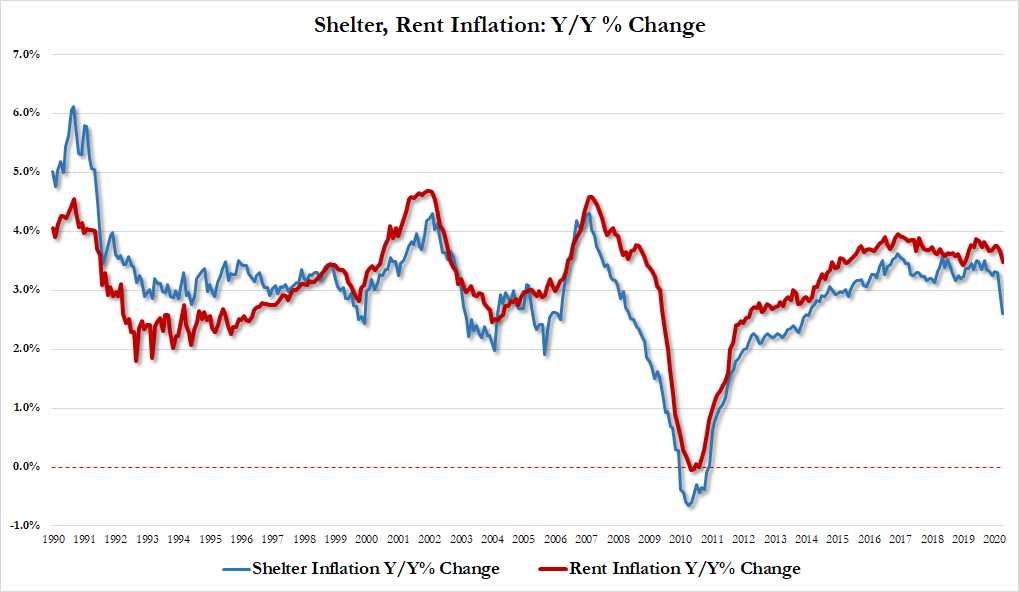

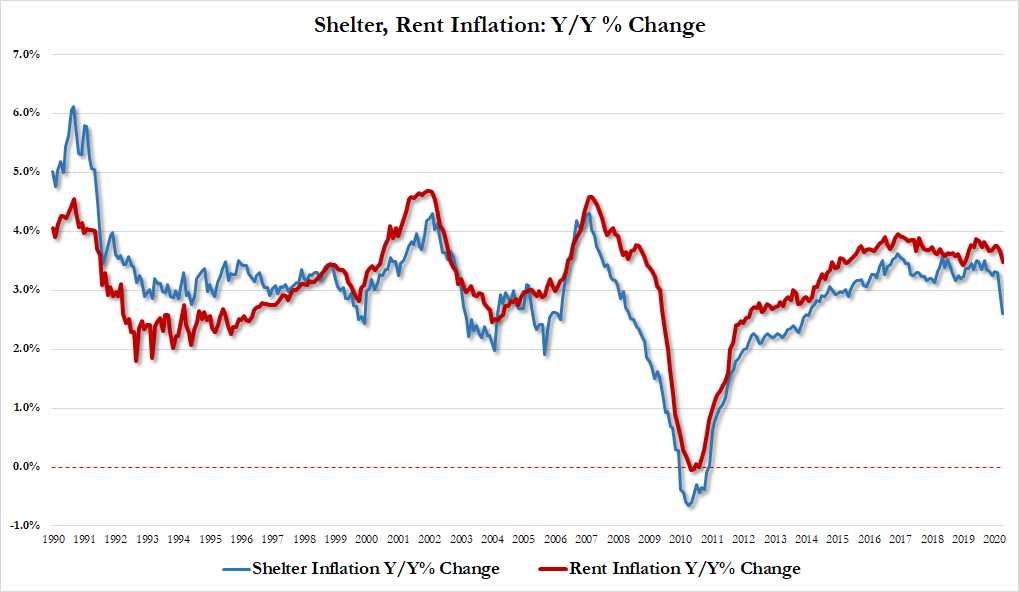

Shelter Inflation up only 2.61%, down from 3.01% in March, and the lowest since Feb 2014. Rent inflation up 3.49%, down from 3.67% in March but lowest only since Jan 2019.

Given the near total lockdown of the US, we do question just how "real" this data is (and the fact that rent strikes, mortgage forbearance, food banks, UBI, PPP, and you name the acronym have distorted all the inputs). |