Re <<Bitcoin>>

Might get more dangerous for a stretch, but let’s see

bloomberg.com

Bitcoin Once Again Is a Risk Asset and No Haven

Vildana Hajric

November 24, 2021, 3:00 AM GMT+8

Speculative stocks on Monday had a rough day, as did Bitcoin and other cryptocurrencies. To some market-watchers, that’s no coincidence.

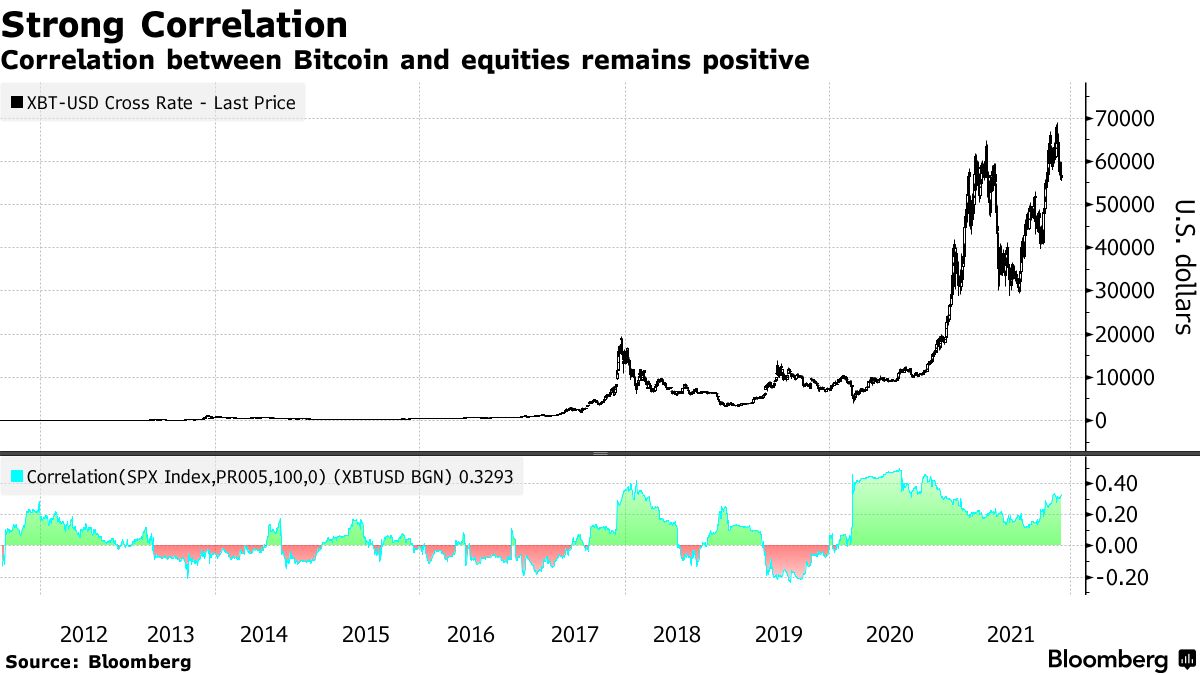

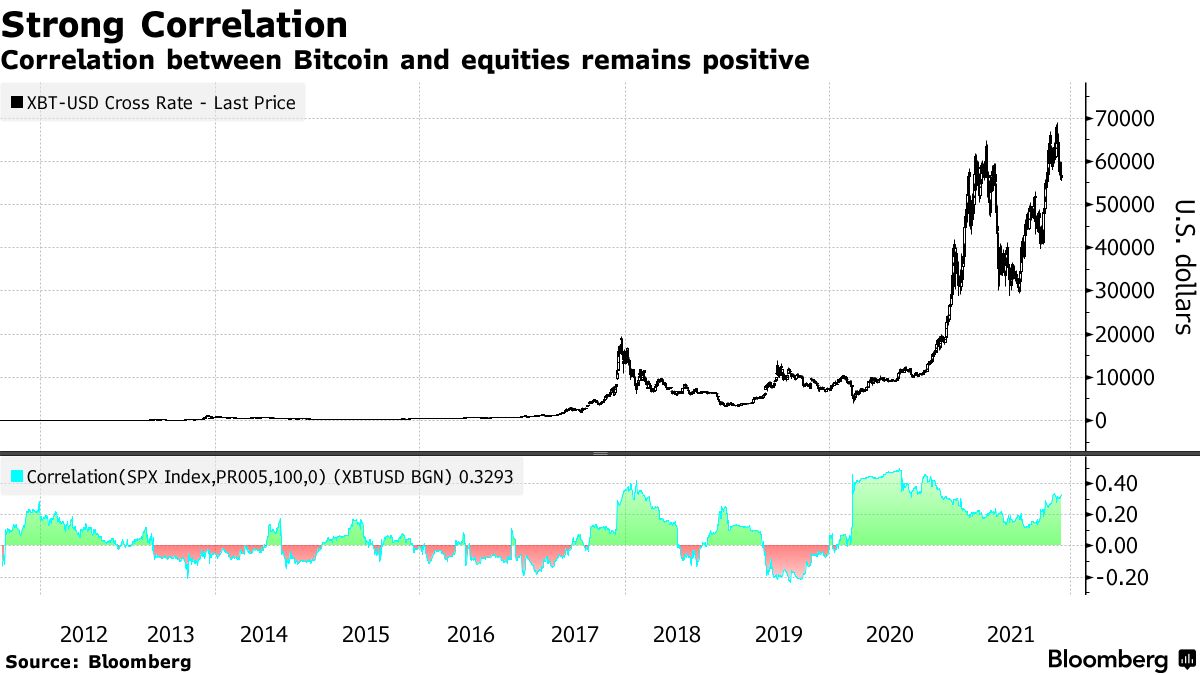

The 100-day correlation coefficient of Bitcoin and the S&P 500 stands at 0.33, among the highest readings of the year. That means that when stocks move up, Bitcoin is likely to do the same, and vice versa. (A coefficient of 1 means the assets are moving in lockstep, while minus-1 would show they’re moving in opposite directions.)

“The recent drawdown in Bitcoin and the rest of the cryptocurrency ecosystem has been tied to the selloff in the more risky growth names,” Art Hogan, chief market strategist at National Securities, said by phone. “So you’re seeing cryptocurrencies come off and you’re seeing the high-flying growth names come down.”

Bloomberg

Crypto proponents have long argued that Bitcoin and other digital assets, on account of their being an idiosyncratic asset class, could act as hedges against wild swings in other areas of the financial market. That proposition is currently being tested as more speculative areas of the market come under pressure amid expectations interest rates could climb higher much sooner than previously expected.

Read more: Selloff in Nosebleed Tech Pressuring Hedge Funds That Piled In

On Monday, losses picked up in very-high-priced technology names, including companies whose expectations for growth have been pushed out further into the future. That’s happening as the bond market has started to price in higher odds of rate hikes next year after President Joe Biden picked Jerome Powell for a second term at the head of the Federal Reserve.

Bitcoin lost as much as 6.5% during Monday’s session. The biggest cryptocurrency is down almost 20% from an all-time high reached Nov. 10. Prices stabilized on Tuesday, with the digital token gaining roughly 2% to $57,420 as of 1:59 p.m. in New York.

“The big-cap tech names have become synonymous with the risk-on/risk-off trade. When the big-cap tech names move in a significant way, other risk assets move in tandem,” said Matt Maley, chief market strategist for Miller Tabak + Co.

Prices for everything from food to commodities to housing have been rising and many notable Wall Street investors and analysts have bought into the idea of using cryptocurrencies as a hedge against that trend. Economists with Bloomberg Economics had estimated that roughly half of Bitcoin’s recent returns can be explained by inflation fears, with the other half coming from market exuberance and momentum trading.

Earlier: Need an Inflation Hedge? Bitcoin Has Delivered 99.996% Deflation

But there are plenty of counter-arguments too, most notably that Bitcoin hasn’t been in existence long enough to burnish its inflation-hedge image. Plus, according to Cam Harvey, a professor at Duke University and a partner at Research Affiliates, it behaves too much like a speculative asset and is prone to periodic crashes.

Marc Chandler, chief market strategist at Bannockburn Global Forex, said he’d like to see a larger sample size than a handful of trading days. That’s because Bitcoin’s movements are, in the short-term, based on any number of different factors and the next hotter-than-expected inflationary print could see it rise too, for instance.

“It’s almost like the whack-a-mole game, where every day people are trying to link it to new things,” Chandler said. “What really determines Bitcoin’s value? I think that just shows the problem we have: what drives it? And if a different thing drives it every day or in the short term -- one day it’s inflation, the next day it’s tech -- how does one get ones hand around it?”

— With assistance by Lu Wang

(Updates price. An earlier updated corrected a spelling error in the last paragraph.)

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |