McEwen Mining Starting a New Chapter of Growth

globenewswire.com

June 05, 2025 18:19 ET | Source: McEwen Mining

TORONTO, June 05, 2025 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce a significant development at our Fox Complex’s Stock Mine that will usher in a new chapter of growth. Construction of the ramp system is now underway to provide access to future lower-cost-per-ounce gold production.

Rob McEwen, CEO and Chief Owner of McEwen Mining states:

“As a long-term gold bull, I am always excited to break ground on a new gold mine, especially today, with gold trading at record highs and strong fundamentals for further upside. As we transition production from the Froome Mine to the Stock Mine, the timing is ideal for bringing Stock Mine into production. Moreover, it is important to understand that the Stock Mine will help us increase our near-term gold production and decrease our cost per ounce for three reasons: One, it will eliminate the onerous metal stream from prior owners on the Froome mine, which obligated us to sell 8% of our production at $605 per ounce; Two, the Stock material is softer than that currently processed from Froome, which will enable greater mill throughput and gold output; and Three, with the mill on site, we eliminate the cost of hauling material 35 kilometers from Froome, as you can see further below in Image 1.”

Part of our Fox Complex, the Stock Mine will be the newest gold mine to come online in the prolific Timmins gold mining district, at a time when gold is trading at record highs against fiat currencies. The mine is located along the Destor-Porcupine fault, known as the “Golden Highway”, which hosts many of the richest gold mines in Ontario and Quebec, Canada. This prime location benefits from a robust mining workforce and a regional economy for which mining is an important driver.

McEwen Mining thanks our team and the local communities, First Nations and the provincial government, all of whom helped to make this milestone a reality.

Stock Mine Overview

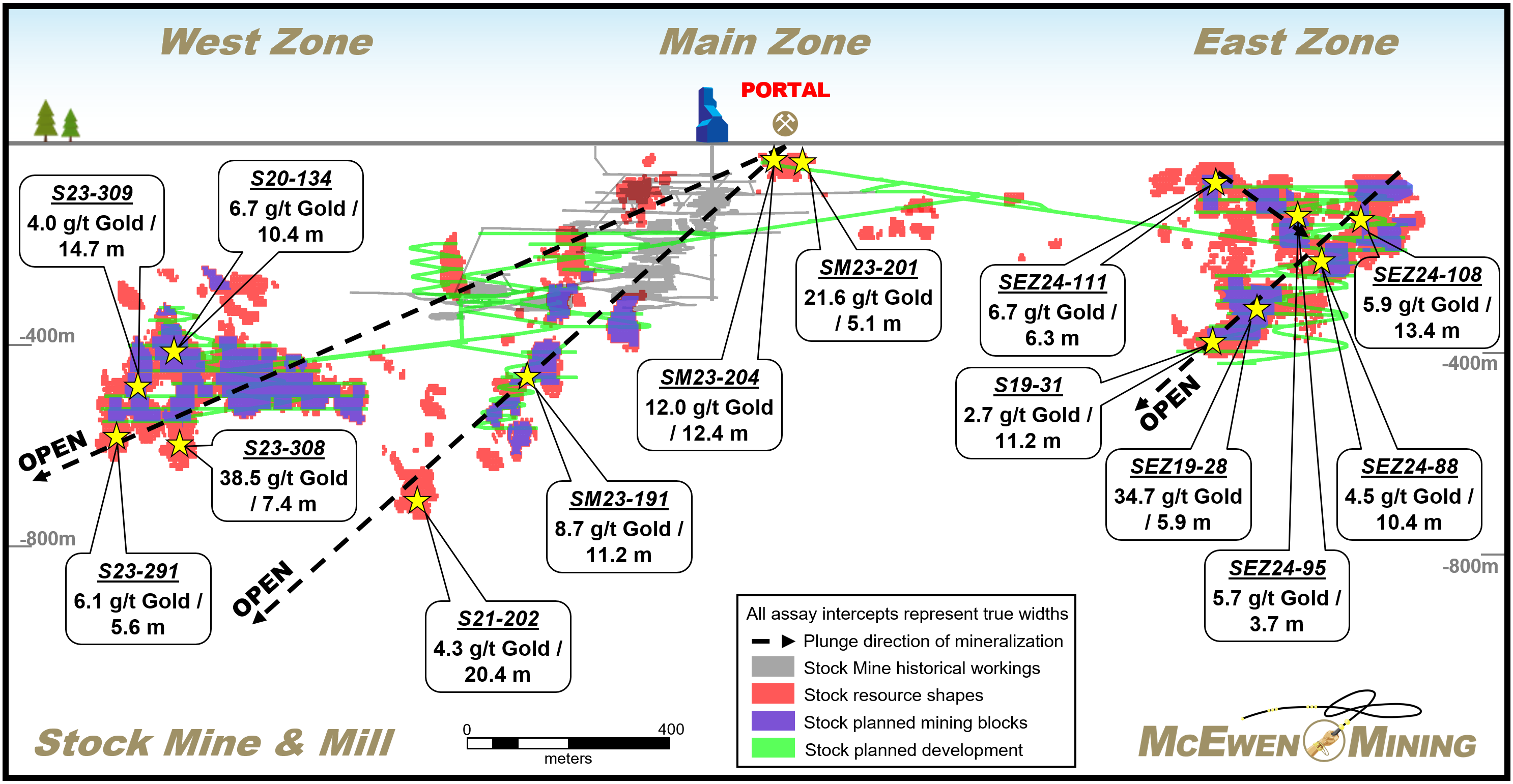

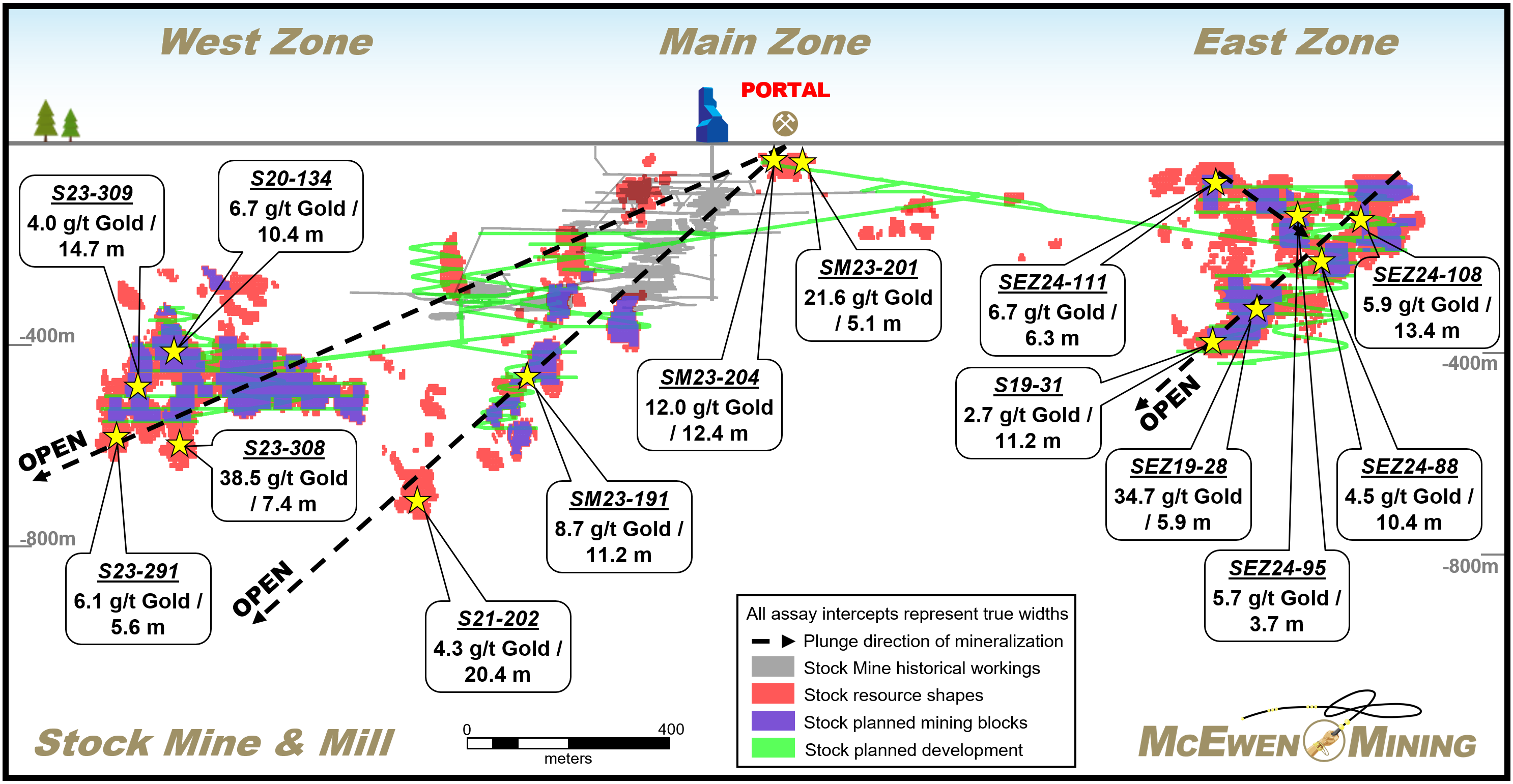

Construction has begun on the Stock Mine portal, pictured below, that will provide both underground access to Stock’s three gold zones, West, Main and East, and a cost-effective platform for underground drilling to test the depth extensions of these zones.

The Stock Property hosts the Stock Mill and the former Stock Mine. It was a small mine that produced 137,000 ounces of gold at a 5.5 g/t average grade from an underground operation between 1989 and 2005.

Extensive drilling has successfully defined three gold deposits at Stock - the West, Main and East zones that are laying the groundwork to confidently begin mining in the second half of 2025. Gold mineralization at the Stock Mine has been delineated on a three-kilometer-long mineralized trend along the prolific Destor-Porcupine Fault, with current gold resources of 281,000 ounces at average grade 3.12 g/t Indicated and 181,000 ounces at average grade 2.87 g/t Inferred.

Figure 1 is a project-wide longitudinal section at Stock, illustrating the proposed ramp development (shown as green straight lines) and mining horizons (shapes in purple) associated with the West, Main and East Zones.

Figure 1. Longitudinal Section at Stock Mine, Showing the West, Main and East Zones with Highlights of Published Drill Results, Together with the Planned Development Works and Mining Blocks

Stock Ramp to Access Gold Production in 2025

The Stock Ramp will connect the West Zone and the East Zone to the existing historical underground workings of the Main Zone.

Stock is expected to provide increased gold production at a lower cost per ounce than our current output from the Froome Mine. The advantages of mining at Stock compared to Froome are significant and can be summarized in three key points:

- Minimal royalty: The bulk of the Stock deposit is royalty-free, whereas Froome is fully subject to an onerous metal stream that obligates us to sell 8% of our production in this area at $605 per ounce - great to see this come to an end;

- Higher mill throughput: The material at Stock has a lower (softer) work index compared to the material currently processed from the Froome Mine. This is expected to result in increased throughput and gold production; and

- Lower haulage costs: The Froome Mine is deeper and located 35 kilometers from the Stock Mill, while the gold mineralization at Stock is at shallower depths and located right next to the mill, significantly reducing transportation costs.

Mining will start in the East Zone, which had a recent increase in the resource (see press release dated June 20, 2024), and will provide early production and cash flow. Our development plan for the Stock Ramp is to drive the ramp to the East Zone concurrently with the ramps to the Main and West zones. This approach will enable simultaneous access to multiple sources of mineralization from the Stock Ramp.

Image 1. The New Stock Mine Portal, with the Nearby Mill in the Background

Image 2. Looking Out of the Stock Portal Toward the Jumbo Drill

Technical Information

The technical content of this news release related to mining and development has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the Company to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, foreign exchange volatility, foreign exchange controls, foreign currency risk, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining Inc. provides its shareholders with exposure to gold, copper and silver in the Americas by way of its three mines located in the United States of America, Canada and Argentina and its large advanced-stage copper development project in Argentina. It also has a gold and silver mine on care and maintenance in Mexico. Its Los Azules copper project aims to be one of the world’s first regenerative copper mines and is committed to achieving carbon neutrality by 2038.

Rob McEwen, Chairman and Chief Owner, has a personal investment in the companies of US$205 million and takes a salary of $1/year. He is a recipient of the Order of Canada and a member of the Canadian Mining Hall of Fame. His objective for MUX is to build its share value and establish a dividend, as he did while building Goldcorp Inc.

McEwen Mining's shares are publicly traded on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the symbol "MUX".

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

Photos accompanying this announcement are available at:

globenewswire.com

globenewswire.com

globenewswire.com |