Re: Betty Davis....................

Her voice, too, speaks as though she's a two pack a day girl, smoking only unfiltered Camels!!

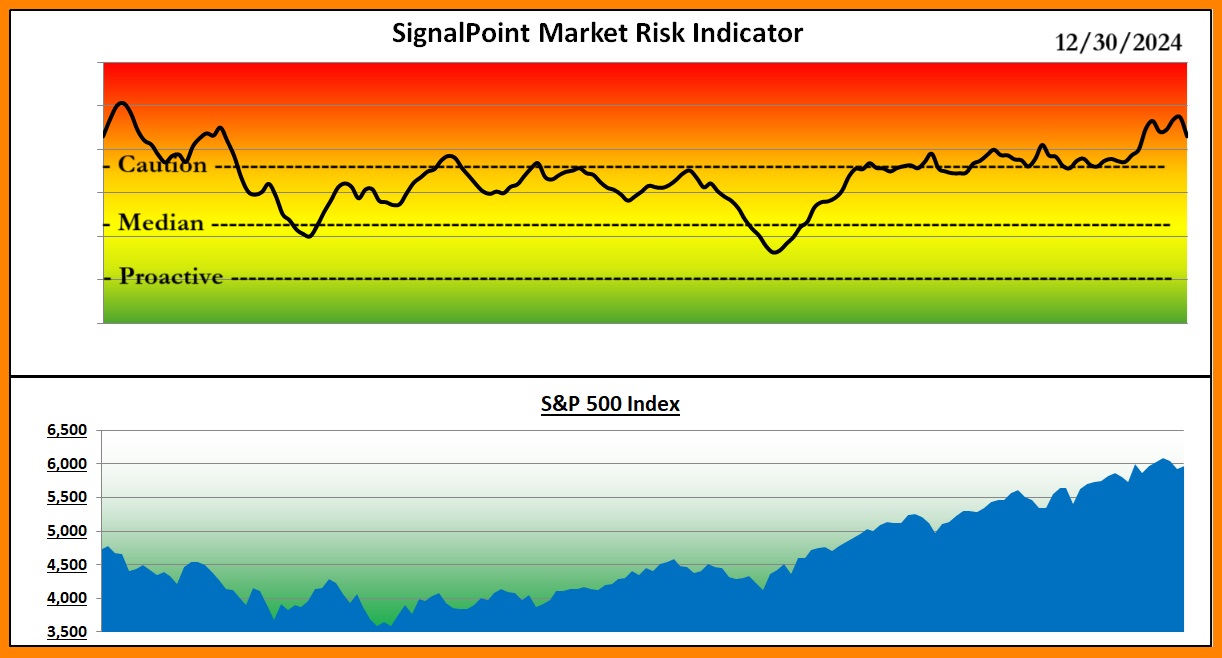

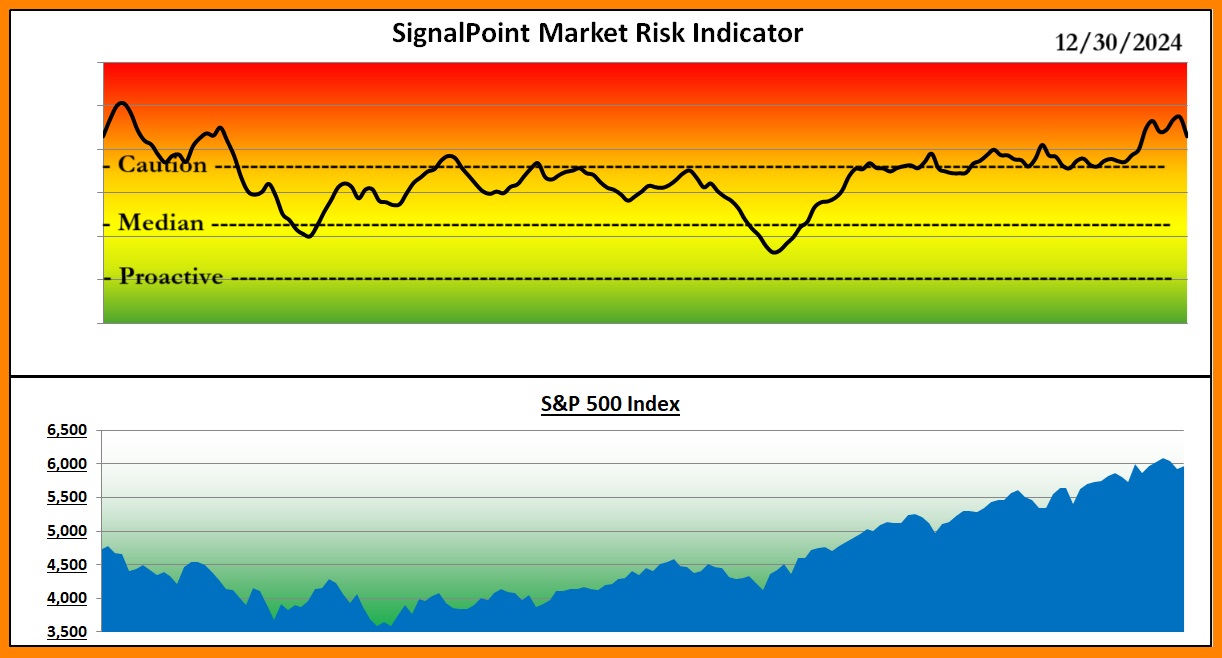

The small setback we've seen in the indexes in the last week or so were enough to soften the high levels of market risk a bit, but not enough to create any broad buying opportunities as of yet.

Both risk indicators are still suggesting 33% to 36% cash liquidity right now as we head into the New Year. While my own portfolios aren't quite as liquid, they've done a remarkable job of building cash during 2024.

We're still a very long way from bargain basement deals. Our Market Weight Lifter is gonna have to rest a while.

I was talking with a friend recently and we were discussing whether CASH is an Anglo-Saxon Four Letter Word! During 2024 it seems that sidelining cash was missing an opportunity. However, that's only if we consider Cash's value vs turning it into risk.

I suggested that for any portfolio, cash can be an inexpensive insurance policy. While not a magic bullet, it does offer some cushioning during short term downturns. If nasty bear markets come along it offers its true value as portfolio insurance. It can be used to build out a portfolio during the times that markets offer better value.

We buy cars and houses and don't think twice about having insurance on those items. It's just a cost added to the ownership. Does Car Insurance prevent us from getting into accidents? Does home insurance prevent flooding, fire or other damage to the structure? As I said, insurance isn't a magic bullet. It's only there to help recover from unexpected damages.

During much of the first two decades of the New Millennium truly cash had very little value when sitting on the side. However, with the joys of Inflation came better yield on cash. Now the cash segment of our portfolios is at least pulling some of its own weight. It's earning at better than 2x the average yield on stocks right now. So, holding a portfolio of high priced stocks is yielding less than cash if that portfolio has stalled or has actually started to decline. I guess we can ask at those times, "How much would our total portfolio go down without the cash buffer?" I noted that since the end of November, my U.S. Business Sector ETFs portfolio has dropped 4.64% including its cash reserve. Without the cash, it dropped 5.59% on the "invested" side. So, the cash has provided its first benefit - acting as a buffer. It even went up in value ever so slightly.

Should the ETFs continue to lose value, eventually my AIM program will shift into Purchasing Mode. It takes between 15% and 20% decline from a previous share inventory reduction (incremental sales) before the program gets interested in spending any cash. Once that has happened, the second benefit of holding cash becomes apparent. Now I can rebuild share inventories in a proportional fashion as prices decline. That can continue as long as the cash holds out.

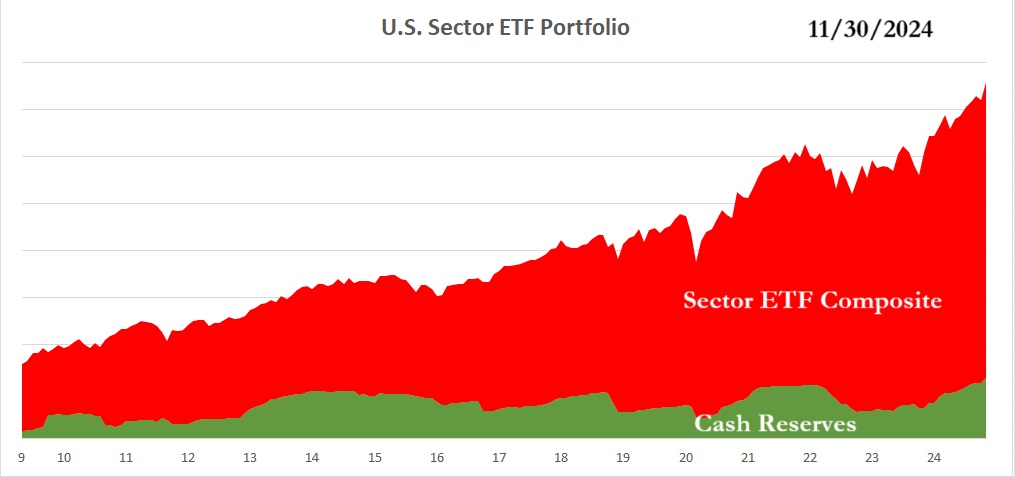

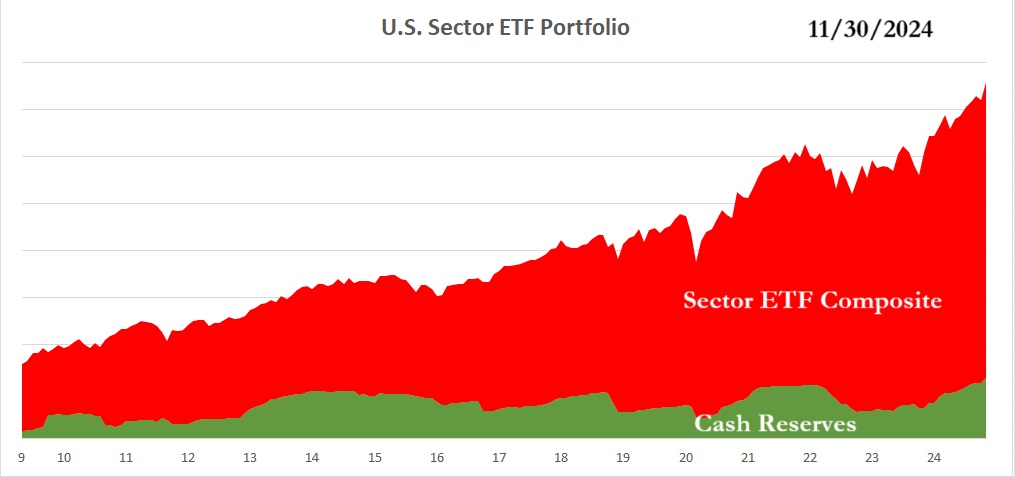

Where mutual funds and individual investors tend to hold the least amount of cash at or near market tops (see Norman Fosback's writings along with AAII) they also hold the greatest amount of cash at or near market lows. My M.O. has that inverted. I tend to hold the greatest percentage in cash nearer market tops and, on occasion, run cash to zero near market lows. In the recent 2022-2023 decline my Sector ETF portfolio drew down the cash by roughly half while buying up lots of shares. My smile would have been greater had the decline been larger and the drawdown complete to zero cash. Still, those new shares provided extra profit for the portfolio during 2024. Here's how that portfolio looks as of the end of November:

So, I'm again ready should the markets get funky. BTW, I use the Invesco "Equal Weight" sector ETFs for this portfolio.

I'm glad you've enjoyed my musings on market risk.

Best wishes for the New Year,

OAG Tom |