Prospect Ridge Secures High-Potential Camelot Copper-Gold Project in B.C.'s Cariboo Mining District With Drill Program Planned for 2025

"Camelot is a rare, drill-ready porphyry target hiding in plain sight," said Len Brownlie, CEO of Prospect Ridge. "We intend to unlock its discovery potential this year."

accessnewswire.com

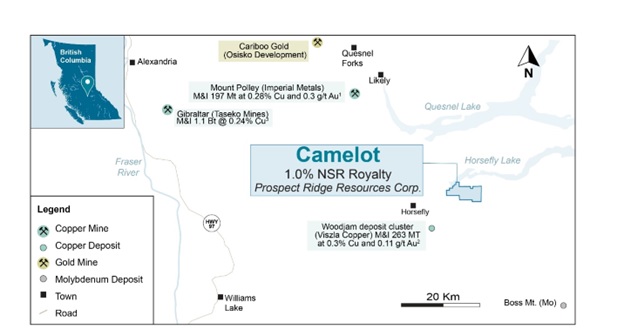

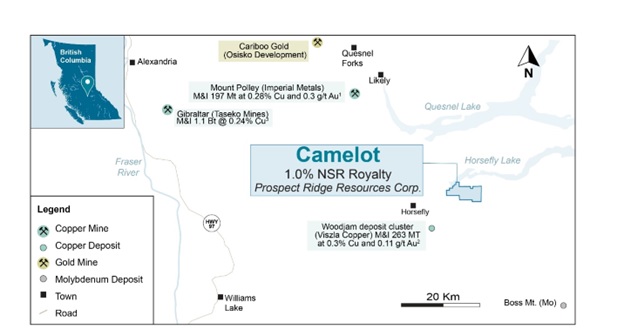

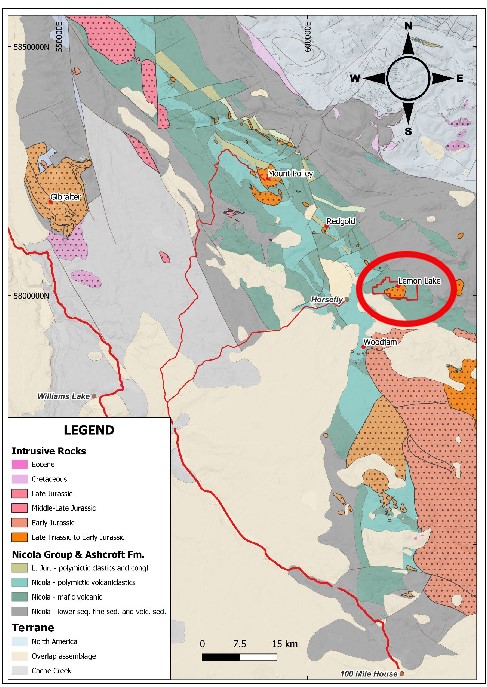

VANCOUVER, BC / ACCESS Newswire / September 2, 2025 / Prospect Ridge Resources Corp. (the "Company" or "Prospect Ridge") (CSE:PRR)(OTCQB:PRRSF)(FRA:OED) is pleased to announce that, subject to regulatory approval, it has acquired a 100% interest in the 2,646 hectare Camelot (formerly Lemon Lake) copper-gold porphyry project from Orogen Royalties Inc. ("Orogen"). Camelot is located in the Cariboo Mining district of central British Columbia (B.C.), a region with excellent road access and mining infrastructure that hosts copper-gold and copper-molybdenum porphyry deposits, including the nearby Gibraltar and Mount Polley mines.

Camelot is situated ~65 kilometres east of Williams Lake, B.C. and was identified by famed B.C. geologist Henry Awmack and acquired by Orogen during a province wide copper porphyry target review (Figure 1).

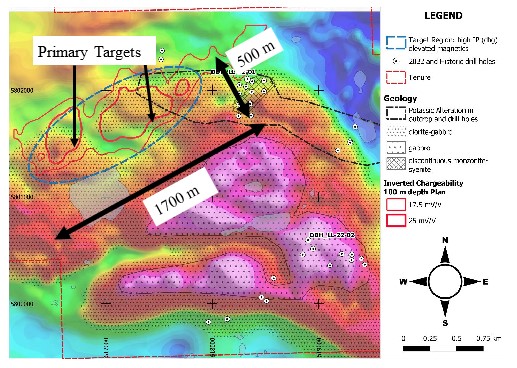

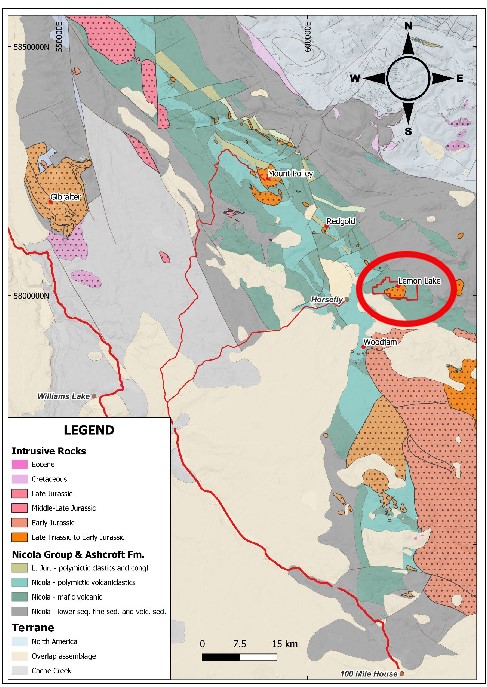

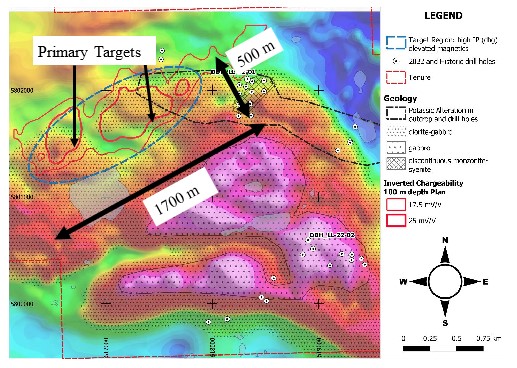

Orogen's acquisition of the property has, for the first time, consolidated project ownership and brought together a sizeable historical exploration database to provide a compelling drill target, defined by a 1700 m x 500 m northeast-southwest composite chargeability-magnetic anomaly that lies under shallow till cover and that has not been previously drill tested (Figure 2). The potential of the Camelot project is enhanced by its regional setting as the project is located in an area of producing mines and deposits in the Quesnellia Terrane and is on a structural, stratigraphic and plutonic trend in common with Mount Polley (Figure 3). The project comes with an area based drill permit that allows collaring of up to 255 Reverse Circulation ("RC") and diamond drill holes.

Mike Iverson, Chairman of the Board states: "Today's market challenges have created a rare window to secure high-quality, drill-ready copper-gold projects at attractive valuations. Camelot is exactly the kind of overlooked asset we target - projects with defined anomalies, permits in place, and the potential to deliver a major new discovery. With a strong treasury and a proven team, Prospect Ridge is well-positioned to aggressively advance Camelot and build significant shareholder value."

Len Brownlie, Ph.D., Chief Executive Officer, states: "British Columbia has a long history of world-class porphyry discoveries, but the next generation lies under shallow cover where previous explorers stopped looking. Camelot represents a textbook discovery opportunity: a striking geophysical anomaly, sitting on a proven porphyry trend, yet never drill tested. We intend to test this target aggressively before year-end with our exploration partner, Equity Exploration Consultants. We believe Camelot has the potential to become a cornerstone project in Prospect Ridge's portfolio."

Paddy Nicol, CEO of Orogen commented, "The Camelot project contains a fully permitted drill target outlined by the coincidence of anomalous copper in soils, a magnetic high, and a strong chargeability anomaly with an inferred area of potassically altered monzonite. Prospect Ridge is a well funded and managed exploration company with plans to drill this exciting target in 2025. Orogen maintains its upside exposure to the property through its retained royalty and we are excited to see drill results in the coming months."

About the Camelot Property

The Camelot project is a ~26 square kilometre land package located about 34 kilometres southeast of Imperial Metals' Mt. Polley mine and ~13 kilometres northeast of Vizsla Copper Corp's Woodjam project in central British Columbia (Figures 1 and 2). The property is centered on the Lemon Lake stock, a Late Triassic to Early Jurassic multi-phase pluton hosted in volcanic units of the Quesnellia terrane. The approximately 5 kilometres wide pluton was formed by early phases of gabbro and diorite cut by younger monzonite porphyries and breccias, as well as late-stage monzonite-syenite dikes. Moderate K-feldspar, biotite and local pyrite-chalcopyrite mineralization are primarily associated with the monzonite porphyry phases. Zones of sericite and pyrite interpreted as phyllic-style alteration are poorly developed and quartz veining is absent, consistent with the interpreted alkalic nature of the system. A compelling alkalic copper-gold porphyry target is defined by coincident soil geochemical and geophysical anomalies which have not been explored with modern drilling (Figure 3).

Soil sampling highlights a 3.5 by 2.5-kilometre copper anomaly which is spatially coincident with the Camelot stock. In 1974, the Hudson Bay Oil and Gas Company drilled 11 vertical percussion holes to a maximum of 61 metres depth, with PDH74-L04 intersecting 0.25% copper over 21.3 metres within a potassic-altered biotite monzonite. The holes were not assayed for gold nor followed up with any additional drilling.

Figure 1 - Camelot location map* Figure 1 - Camelot location map*

In 2011, a 3D Induced Polarization (IP) survey was completed over the soil anomaly and northern limit of the stock. The surveys outlined a 2,800 by 600 metre zone of chargeability centered on the altered monzonite phase of the intrusion. The copper intercept in the historic drilling is located on the northeastern margin of the IP anomaly, and no historic drilling has tested the core of the chargeability anomaly.

In 2022 a previous operator completed a two hole, steeply dipping, 501 m drill program targeting mineralization identified by historic percussion and RC drill holes. Both holes were drilled away from the north-eastern edge of the IP anomaly near the northern and southern margins of the property. The northerly hole confirmed the presence of moderate intensity potassic alteration and copper mineralization, whereas the southern hole intersected late post-mineralization fault. The limited 2022 drilling program did not test the most compelling target on the property.

Recent airborne magnetics from 2021 combined with the 2011 IP survey and geological mapping indicate a 1.7 -kilometre-long trend of coincident chargeability and moderate magnetic highs in an overburden covered area never tested by drilling. The target model is focused on an alkalic porphyry system lacking significant quartz-sericite-pyrite alteration (phyllic-style) where high chargeability and coincident magnetics may indicate pyrite-chalcopyrite mineralization in association with potassic (magnetite) alteration. Exploration on the Camelot Property has so far been focused in areas of outcrop exposure, however, considering the encouraging geophysical anomalies, future exploration should focus on till covered areas over large scale geophysical targets.

Figure 2: Property geology, soil geochemistry, and IP data compilation over Airborne TMI (total magnetic intensity) map (after Baknes, 2023 "2022 Drilling report on the Camelot Property: Assessment Report B.C. Ministry of Energy and Mines) Figure 2: Property geology, soil geochemistry, and IP data compilation over Airborne TMI (total magnetic intensity) map (after Baknes, 2023 "2022 Drilling report on the Camelot Property: Assessment Report B.C. Ministry of Energy and Mines)

Figure 3: Regional Geological Setting of the Camelot Property (formerly "Lemon Lake"); Logan et. al., 2010 Bedrock Geology of the QUEST map area, central British Columbia; British Columbia Geological Survey, Geoscience Map 2010-1, Geoscience BC Report 2010-5 and Geological Survey of Canada, Open File 6476) Figure 3: Regional Geological Setting of the Camelot Property (formerly "Lemon Lake"); Logan et. al., 2010 Bedrock Geology of the QUEST map area, central British Columbia; British Columbia Geological Survey, Geoscience Map 2010-1, Geoscience BC Report 2010-5 and Geological Survey of Canada, Open File 6476)

Acquisition Terms

Prospect Ridge can acquire a 100% interest in the Camelot property, subject to an aggregate 1% NSR royalty held by an underlying royalty holder and the granting of a 1% NSR royalty to Orogen, for a total consideration of $200,000 with $25,000 in common shares of Prospect Ridge based on a 10-day volume weighted average price ( "VWAP") to be paid within five days of regulatory approval (the "Approval Date"), and $175,000 to be paid in cash or common shares of Prospect Ridge (subject to a 10-day VWAP) at the sole discretion of Prospect Ridge within six months and two days of the Approval Date. All Shares issued by Prospect Ridge will be subject to a restricted resale period of four (4) months plus one (1) day in accordance with applicable securities laws. Prospect Ridge will be able to buydown 0.5% of the underlying 1% NSR royalty for a one time payment of $1,000,000. Prospect Ridge will also be responsible for an annual Advance Royalty payment of $10,000 and a onetime payment of $30,000 upon completion of a NI-43-101 mineral resource that will be due to the underlying royalty holder.

Land Acknowledgement

Orogen and Prospect Ridge acknowledge that Camelot is situated within the traditional territory of the Williams Lake Indian Band, Xatsull First Nation and the Neskonlith Indian Band. Both companies are committed to developing positive and mutually beneficial relationships with First Nations based on trust and respect and a foundation of open and honest communications.

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo. Vice President Exploration for Orogen Royalties Inc. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Prospect Ridge Resources Corp.

Prospect Ridge Resources Corp. is a British Columbia based exploration and development company focused on critical metals and gold exploration. Prospect Ridge's management and technical team collectively have over 100 years of experience in mineral exploration and believes the Company's Knauss Creek and the Holy Grail properties have the potential to extend the boundaries of the Golden Triangle into this vastly under-explored region.

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. The Company is well financed with several projects actively being developed by joint venture partners.

Contact Information

Prospect Ridge Resources Corp.

Mike Iverson - Chairman, Director

Email: mike@miverson.ca

*Sources for Figure 1 resources:

Mt. Polley: https://www.imperialmetals.com/assets/docs/mp-technical-report-may-20-2016.pdf

QR: https://osiskogr.com/en/osisko-gold-royalties-announces-spin-out-of-mining-assets-and-creation-of-a-premier-north-american-gold-development-company/

Woodjam: https://www.vizslacopper.com/projects/woodjam-project/overview/

Sources of Technical Information

- Baknes, M.. J. 2023. Drilling Report on the Lemon Lake Project. B.C. Mines Branch Assessment Report Event No.5993800

- Britton, R., 2021 2021 Geological - hand trenching, airborne Magnetic - VLF survey and petrological reports on the Lemon Lake property B.C. Mines Branch Assessment Report 39604

- Bailey, D. 2012 Lemon Lake property Horsefly Induced Polarization and Magnetometer Survey B.C. Mines Branch Assessment Report 33088.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This release includes certain statements and information ("FLI") that may constitute forward-looking information within the meaning of applicable Canadian securities laws. FLI relates to future events or future performance and reflect the current expectations or beliefs of the Company's management. Anything that is not historical fact is FLI. Generally, FLI can be, without limitation, identified by the use of forward-looking wording such as "plans", "intends", "believes", "expects", "anticipates" or "estimates", and statements or phrases that certain actions, events or results "may", "might", "could", "should" or "would" occur, and similar expressions. FLI is not historical fact, is made as of the date of this news release and includes, without limitation, statements and discussions of future plans, intentions, expectations, estimates and forecasts, and statements as to management's intentions and expectations with respect to, among other things, positive exploration results at the Camelot project. FLI involves numerous risks and uncertainties, and are based on assumptions, and actual results might differ materially from results suggested in any FLI. These risks and uncertainties include, among other things, the availability of financing to continue exploration activities, the availability and cost of qualified exploration personnel and service providers, and that future exploration results at the Camelot project will not be as anticipated. In making any FLI in this news release, the Company has applied several material assumptions, including without limitation, that future exploration results at the Camelot project will be as anticipated. Although management has endeavored to evaluate and use reasonable assumptions and to identify important factors that could cause actual results to differ materially from those contained in FLI, these assumptions may prove incorrect and there may be other factors that cause results not to be as intended, expected, anticipated or estimated. There can be no assurance that FLI will prove to be accurate, and actual results and future events could differ materially from those expressed in FLI. Accordingly, readers should not place undue reliance on FLI, and are further cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any FLI expressed or incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

SOURCE: Prospect Ridge Resources Corp

|

Figure 1 - Camelot location map*

Figure 1 - Camelot location map* Figure 2: Property geology, soil geochemistry, and IP data compilation over Airborne TMI (total magnetic intensity) map (after Baknes, 2023 "2022 Drilling report on the Camelot Property: Assessment Report B.C. Ministry of Energy and Mines)

Figure 2: Property geology, soil geochemistry, and IP data compilation over Airborne TMI (total magnetic intensity) map (after Baknes, 2023 "2022 Drilling report on the Camelot Property: Assessment Report B.C. Ministry of Energy and Mines) Figure 3: Regional Geological Setting of the Camelot Property (formerly "Lemon Lake"); Logan et. al., 2010 Bedrock Geology of the QUEST map area, central British Columbia; British Columbia Geological Survey, Geoscience Map 2010-1, Geoscience BC Report 2010-5 and Geological Survey of Canada, Open File 6476)

Figure 3: Regional Geological Setting of the Camelot Property (formerly "Lemon Lake"); Logan et. al., 2010 Bedrock Geology of the QUEST map area, central British Columbia; British Columbia Geological Survey, Geoscience Map 2010-1, Geoscience BC Report 2010-5 and Geological Survey of Canada, Open File 6476)