Lahontan Drills Thick, Shallow Gold at York: 90m grading 0.23 g/t Au Plus a Second High Grade Zone: 18m grading 0.73 g/t Au, All Oxide

accessnewswire.com

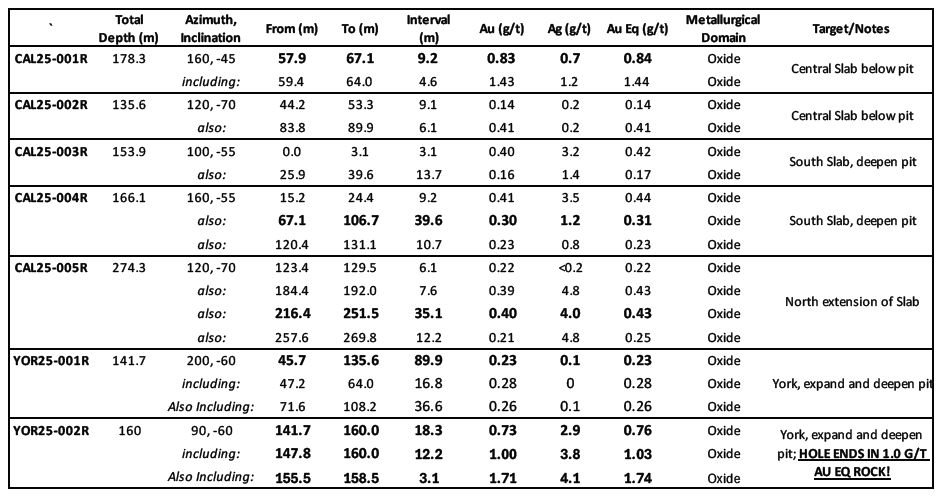

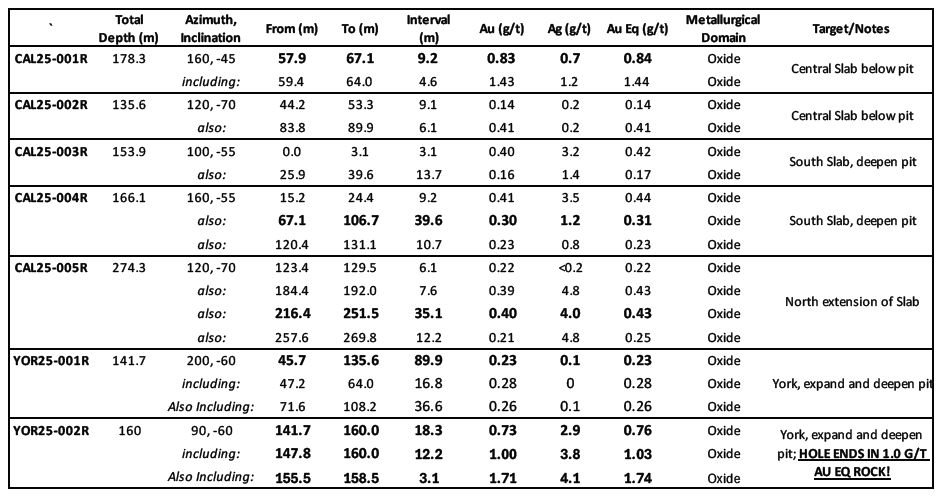

TORONTO, ON / ACCESS Newswire / September 2, 2025 / Lahontan Gold Corp. (TSXV:LG)(OTCQB:LGCXF)(FSE:Y2F) (the "Company" or "Lahontan") is pleased to announce the results from our 2025 Phase One drilling program at the Company's flagship Santa Fe Mine Project located in Nevada's prolific Walker Lane. Lahontan completed seven reverse-circulation rotary ("RC") drill holes totaling 1,210 metres (please see table below). Significant results include:

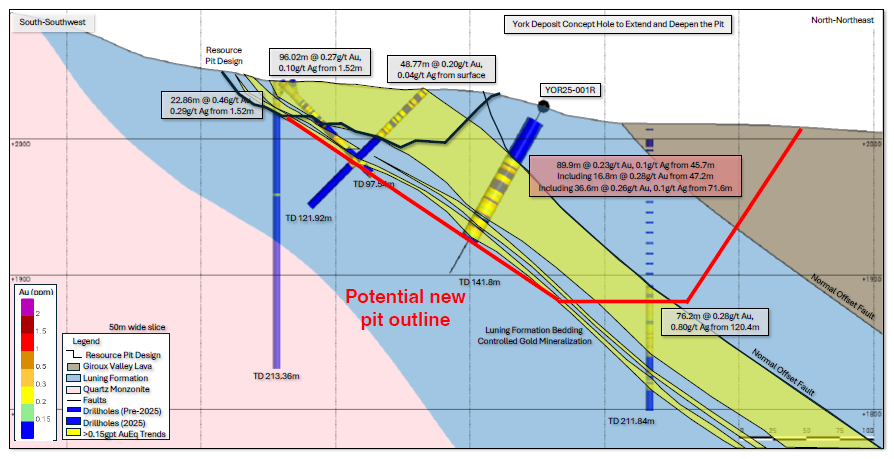

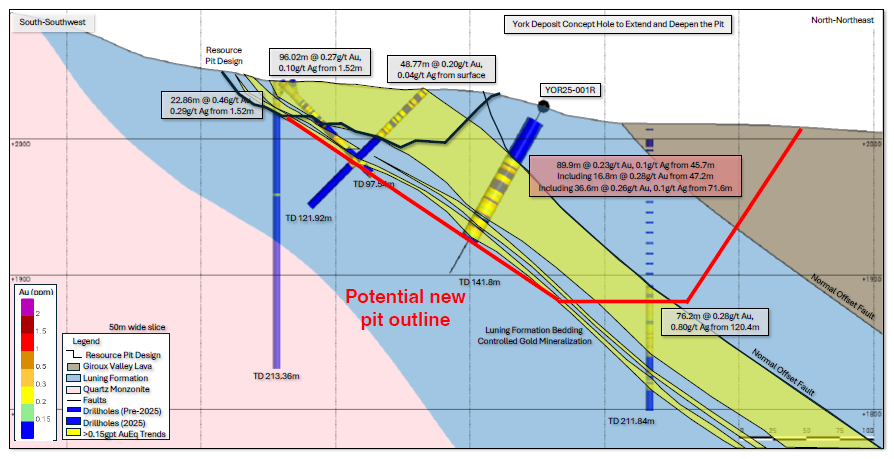

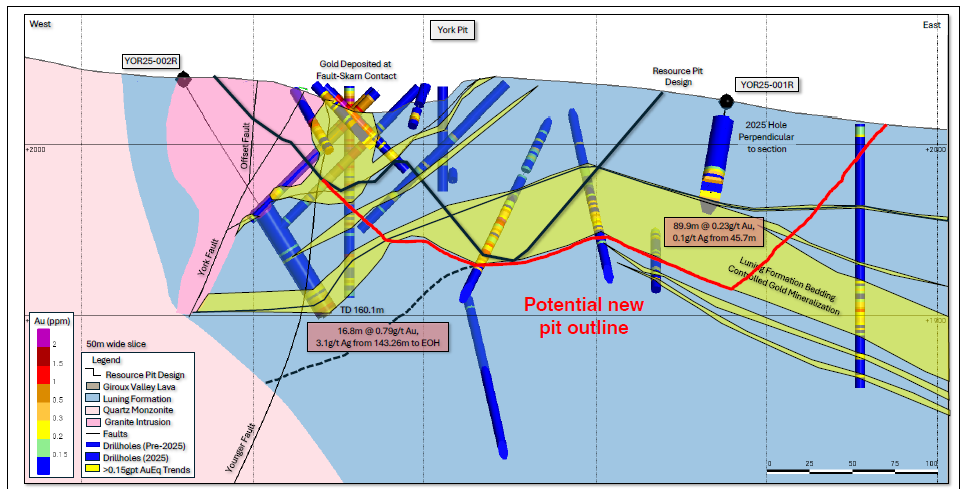

- York: 89.9 metres (45.7 - 135.6m) grading 0.23 g/t Au (YOR25-001R): A very shallow, thick, intercept of oxide gold mineralization that greatly expands the footprint of the York gold zone and confirms the potential to expand the York gold resource along strike and down-dip, leveraging the upside value of the recently announced York claim acquisition (please see cross section below).

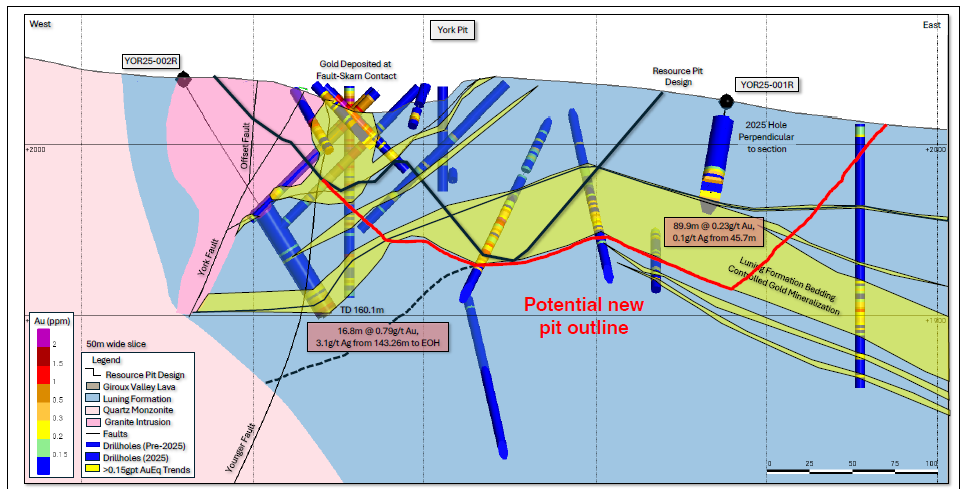

- York: A second higher grade zone at York: 18.3 metres (141.7 - 160.0m) grading 0.73 g/t Au including 12.2m grading 1.00 g/t Au (YOR25-002R). This drill hole bottomed in oxidized gold mineralized rock and is open up and down-dip, and along strike, defining a second gold trend at York.

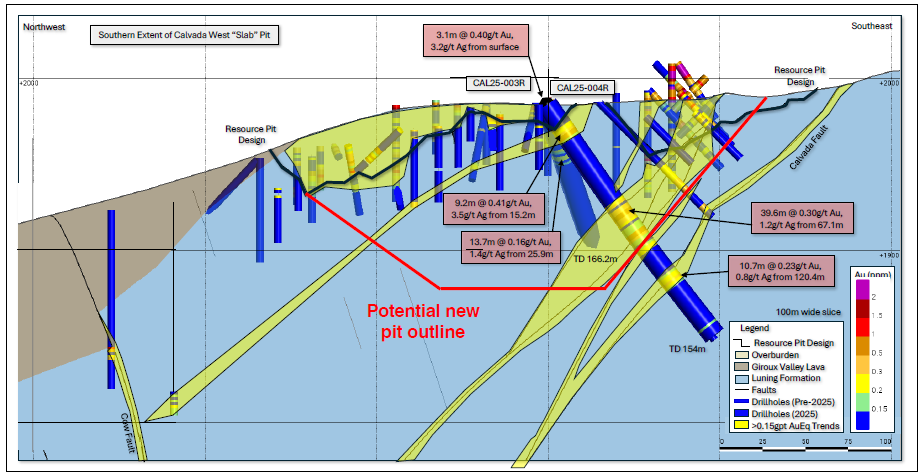

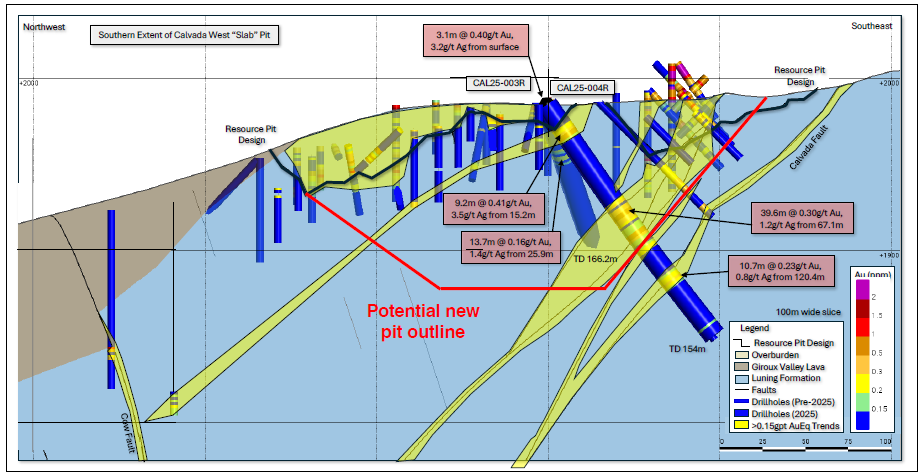

- Slab: 39.6 metres (67.1 - 106.7m) grading 0.30 g/t Au immediately below the south end of the Slab open pit (CAL25-004R). This drill hole defines a second, strataform, oxide gold horizon that mimics the geometry of the Slab mineral resource defined by prior drilling* and confirms a new target for gold resource expansion.

Cross section through drill hole YOR25-001R. The thick oxide gold intercept correlates with adjacent drill holes demonstrating excellent continuity to gold mineralization and the potential to greatly expand the conceptual pit shell used to constrain the gold mineral resource estimate at York. Note that the true thickness of the gold intercept is approximately equal to the drilled interval.

The 2025 Phase One RC drilling program was intended to confirm multiple target concepts in the York and Slab gold resource areas at the Santa Fe Mine Project. Based on the very positive results described in more detail below, the Company is in the process of planning additional drilling at both York and Slab for later this year.

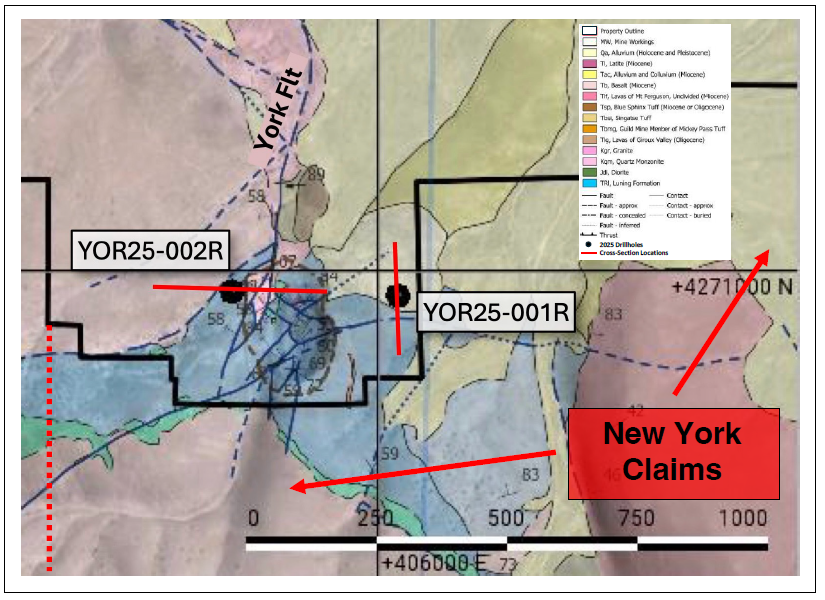

York Drilling: Both RC drill holes completed at York successfully defined new extensions to known oxide gold mineral resources*. As shown above, YOR25-001R confirmed the down-dip continuity of shallow oxide gold mineralization east of the York open pit along the Columbia Fault. Gold mineralization in the drill hole shows excellent correlation with previous drilling, in both thickness and gold grade. As noted above, oxide gold mineralization is open to the north where the gold zone appears to become shallower, and to the south, where mineralization is unconstrained by drilling. Importantly, the newly acquired York claims (please see Lahontan press release dated August 19, 2025) provide ample room for further oxide gold resource expansion, without the constraint of a claim boundary.

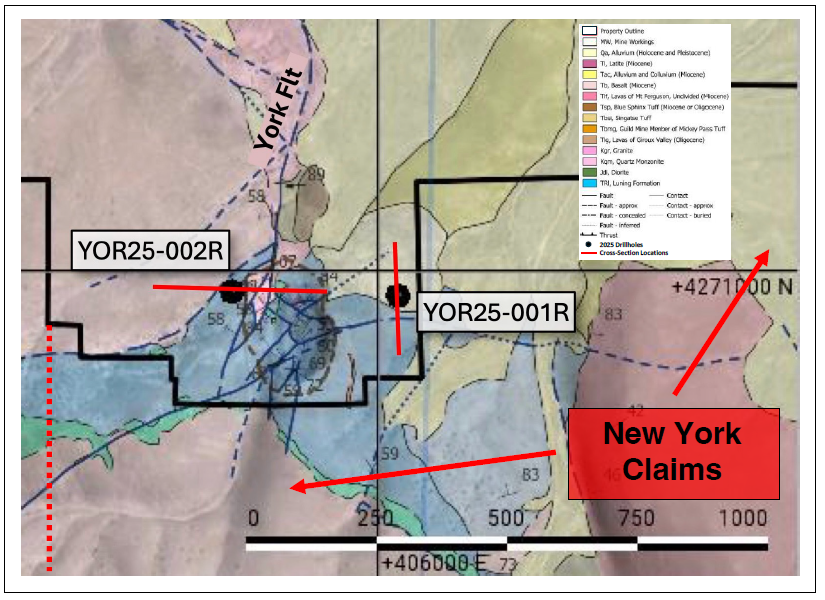

YOR25-002R is particularly interesting as it validates the geologic model for the York Fault, an important north-south striking fault that is a key control for gold mineralization in the York area (please see map and section below). YOR25-002R bottomed in good grade oxide gold mineralization (1.0 g/t Au) that may be corelate to the gold zone defined in YOR25-001R, and is likely the upper portion of a much thicker gold zone: another target for resource expansion drilling in the Fall (please see section below). The York Fault gold system remains open up-dip, down-dip, and along strike.

These two drill holes at York underscore the potential to greatly expand the York gold resource and demonstrate the considerable upside of the York area at Santa Fe, amplified by the recently acquired new claims at York.

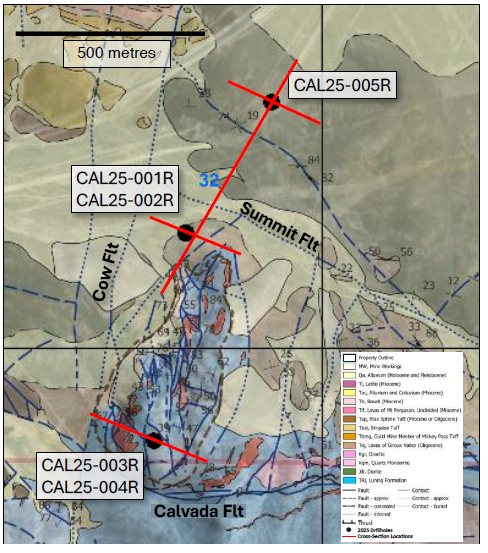

York area drill hole location map. Line(s) of the York cross sections are shown in red, the western boundary of the newly acquired York claims is shown by the dashed line. North is up.

Cross section through drill hole YOR25-002R (see location map for line of section). Combined with the results from YOR25-001R, the drilling confirms the potential to expand the York conceptual pit shell as shown in red. YOR25-002R bottomed in oxide gold mineralization grading 1.0 g/t Au Eq. This intercept may correlate with the thick zone defined by YOR25-002R and therefore defines an excellent target for future resource expansion drilling (black dashed line).

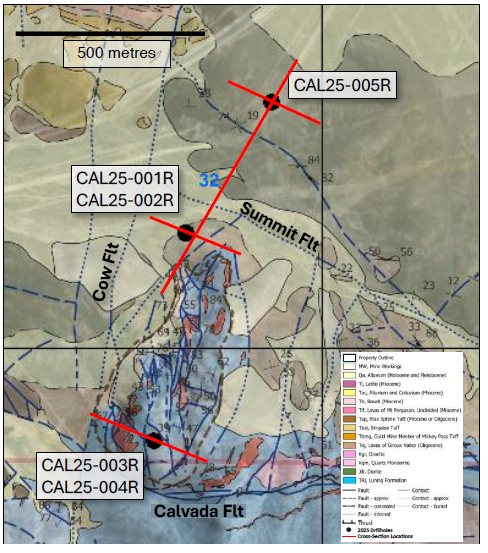

Slab Drilling: Lahontan completed five RC drill holes in the Slab gold resource area (see map below). All the drill holes cut oxide gold mineralization (please table below), however the results for drill holes CAL25-003R and -004R are very encouraging, defining a new, stacked zone of oxide gold mineralization below the resource defined by previous drilling and the Slab open pit*.

Drill hole location map, Slab open pit and resource area. The line of the cross section is in red. North is up.

CAL25-004R cut 39.6 metres grading 0.30 g/t Au and 1.2 g/t Ag (0.31 g/t Au Eq, see table below), all oxide, and directly below gold mineralization seen in the Slab open pit and defined by historic drilling (see section below), providing an excellent opportunity to expand the conceptual pit shell at Slab. Additional drilling along strike and northwest of CAL25-004R (left in section) can add to potential gold resources at Slab and improve future project economics.

Northwest - southeast cross section through the south end of the Slab open pit. A potential conceptual pit shell is shown in red.

The other drill holes at Slab, CAL25-001R through -003R all hit zones of gold mineralization and will require additional drilling to refine drill targets for future resource expansion.

Kimberly Ann, Lahontan Gold Corp CEO, Executive Chair, and Founder commented: "Lahontan is excited with the results from Phase One drilling at Santa Fe. In particular, the results from the York area, thick, shallow intercepts of oxide gold mineralization, highlight the tremendous upside potential of York, amplified by the recent expansion of our land package at York. We are in the process of designing a Phase Two drilling program for York and Slab, to take place in the Fall".

Notes: Au Eq equals Au (g/t) + ((Ag g/t/83)*0.60). Silver grade for calculating Au Eq is adjusted to consider historic metallurgical recovery as described in the Santa Fe Project Technical Report*. True thickness of the intercepts is estimated to be 80-100% of the drilled interval. Numbers may not total precisely due to rounding.

QA/QC Protocols:

Lahontan conducts an industry standard QA/QC program for its core and RC drilling programs. The QA/QC program consisted of the insertion of coarse blanks and Certified Reference Materials (CRM) into the sample stream at random intervals. The targeted rate of insertion was one QA/QC sample for every 16 to 20 samples. Coarse blanks were inserted at a rate of one coarse blank for every 65 samples or approximately 1.5% of the total samples. CRM's were inserted at a rate of one CRM for every 20 samples or approximately 5% of the total samples.

The standards utilized include three gold CRM's and one blank CRM that were purchased from MEG, LLC of Lamoille, Nevada (formerly Shea Clark Smith Laboratories of Reno, Nevada). Expected gold values are 0.188 g/t, 1.107 g/t, 10.188 g/t, and -0.005 g/t, respectively. CRM's with similar grades are inserted as the initial CRM's run out. The coarse blank material comprised of commercially available landscape gravel with an expected gold value of -0.005 g/t.

As part of the RC drilling QA/QC process, duplicate samples were collected of every 20th sample interval at the drill rig to evaluate sampling methodology. Samples were collected from the reject splitter on the drill rig cyclone splitter. Samples were collected at each 95- to 100-foot (28.96 - 30.48m) mark and labeled with a "D" suffix on the sample bag. No duplicates were submitted for core.

All drill samples were sent to American Assay Laboratories (AAL) in Sparks, Nevada, USA for analyses. Delivery to the lab was either by a Lahontan Gold employee or by an AAL driver. Analyses for all RC and core samples consisted of Au analysis using 30-gram fire assay with ICP finish, along with a 36-element geochemistry analysis performed on each sample utilizing two acid digestion ICP-AES method. Tellurium or 50-element analyses were performed on select drill holes utilizing ICP-MS method. Cyanide leach analyses, using a tumble time of 2 hours and analyzed with ICP-AES method, were performed on select drill holes for Au and Ag recovery. AAL inserts their own blanks, standards and conducts duplicate analyses to ensure proper sample preparation and equipment calibration. We have all results reported in grams per tonne (g/t).

About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 26.4 km2 Santa Fe Mine project, had past production of 359,202 ounces of gold and 702,067 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing. The Santa Fe Mine has a Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,539,000 oz Au Eq(48,393,000 tonnes grading 0.92 g/t Au and 7.18 g/t Ag, together grading 0.99 g/t Au Eq) and an Inferred Mineral Resource of 411,000 oz Au Eq (16,760,000 grading 0.74 g/t Au and 3.25 g/t Ag, together grading 0.76 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report and note below*). The Company plans to continue advancing the Santa Fe Mine project towards production, update the Santa Fe Preliminary Economic Assessment, and drill test its satellite West Santa Fe project during 2025. The technical content of this news release and the Company's technical disclosure has been reviewed and approved by Michael Lindholm, CPG, Independent Consulting Geologist to Lahontan Gold Corp., who is a Qualified Person as defined in National Instrument 43-101 -- Standards of Disclosure for Mineral Projects. Mr. Lindholm was not an author for the Technical Report* and does not take responsibility for the resource calculation but can confirm that the grade and ounces in this press release are the same as those given in the Technical Report. Mr. Lindholm also could not directly verify the QA/QC procedures described above, but the protocols are similar to those described in the Technical Report*. For more information, please visit our website: www.lahontangoldcorp.com

* Please see the "Preliminary Economic Assessment, NI 43-101 Technical Report, Santa Fe Project", Authors: Kenji Umeno, P. Eng., Thomas Dyer, PE, Kyle Murphy, PE, Trevor Rabb, P. Geo, Darcy Baker, PhD, P. Geo., and John M. Young, SME-RM; Effective Date: December 10, 2024, Report Date: January 24, 2025. The Technical Report is available on the Company's website and SEDAR+. Mineral resources are reported using a cut-off grade of 0.15 g/t AuEq for oxide resources and 0.60 g/t AuEq for non-oxide resources. AuEq for the purpose of cut-off grade and reporting the Mineral Resources is based on the following assumptions gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, and oxide gold recoveries ranging from 28% to 79%, oxide silver recoveries ranging from 8% to 30%, and non-oxide gold and silver recoveries of 71%.

On behalf of the Board of Directors

Kimberly Ann

Founder, CEO, President, and Executive Chair

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, and Executive Chair

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange("TSXV") nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedarplus.com

SOURCE: Lahontan Gold Corp

|