Thunder Gold Reports Significant Results from Phase Two Drill Program Confirming Consistency and Expanding Discovery at Tower Mountain

newsfilecorp.com

September 08, 2025 7:30 AM EDT | Source: Thunder Gold Corp.

Thunder Bay, Ontario--(Newsfile Corp. - September 8, 2025) - Thunder Gold Corp. (TSXV: TGOL) (FSE: Z25) (OTCQB: TGOLF) ("Thunder Gold" or the "Company") is pleased to announce complete results for the Phase Two drill program at its 100%-owned, 2,500-hectare, Tower Mountain Gold Property, located 50 kilometres from the port city of Thunder Bay, Ontario. Phase Two drilling has confirmed Tower Mountain as a highly consistent and scalable gold system, with each additional drill hole building out the potential for a much larger discovery. Results mark another step forward in unlocking the district-scale potential of this project.

Wes Hanson, President and CEO, states, “Phase Two was another exceptionally successful drill program for Thunder Gold. The program not only met, but reinforced our conviction in the scale, consistency and quality of the Tower Mountain discovery. We successfully demonstrated clear potential for expansion at four distinct locations surrounding the Tower Mountain Intrusive Complex ("TMIC") contact, with results from the P-Target, on the eastern side of the intrusion, being statistically indistinguishable from the 41,000 metres previously drilled on the western side. The consistency of these results are extremely encouraging and demonstrate the continuity and predictability of the project.

Equally important, the program was completed safely, on schedule and under budget, with all-in drilling costs of less than C$250 per metre – emphasizing the efficiency of exploring Tower Mountain.

Together, these results highlight the core investment strengths of Tower Mountain: a discovery that is large, scalable and consistent, with low-cost exploration supported by existing infrastructure. We believe this combination positions Tower Mountain as a compelling growth opportunity and a source of long-term value creation for shareholders.”

Highlights:

- Expansion across four distinct targets with drilling completed at thirteen holes (totalling 1,773 metres), targeting gaps in existing drill coverage and testing new zones.

- Confirmation of mineralization consistency through sustained average grades demonstrating continuity at scale across the project.

- Major focus on efficiency with all-in drilling costs less than $250 per metre, representing the lowest 10th percentile in the country.

- 92% success rate, with 12 of 13 holes reporting significant gold mineralization over broad intervals within 150 metres of surface.

- Phase Two was completed on time and under-budget.

Thunder Gold's Phase Two drill program has delivered a compelling combination of consistency, expansion, and new discovery, underscoring the scale potential of the Tower Mountain gold system.

At the 3738-Target, drilling expanded the mineralized footprint, with all four holes returning broad, consistent intervals of gold. Standout results included 1.25 g/t Au over 103.5 metres (TM25-178) and 0.58 g/t Au over 187.5 metres (TM25-180), the latter ending in mineralization at depth.

The P-Target was successfully extended more than 100 metres down-plunge to the southeast, led by 0.83 g/t Au over 56.5 metres (TM25-170). Importantly, the zone remains open, leaving room for further growth.

At the A-Target, drilling extended mineralization by 100 metres in both directions. Results included broad intervals such as 0.78 g/t Au over 33.0 metres (TM25-175), alongside a spectacular high-grade intercept of 327.0 g/t Au over 1.0 metre (TM25-176), which featured visible dendritic gold.

Finally, the H-Target delivered an exciting first test, with 0.41 g/t Au over 19.5 metres (TM25-182) intersected directly from surface. This zone is interpreted as the northern extension of the same mineralized trend seen at the P-Target, located 1,000 metres to the southeast.

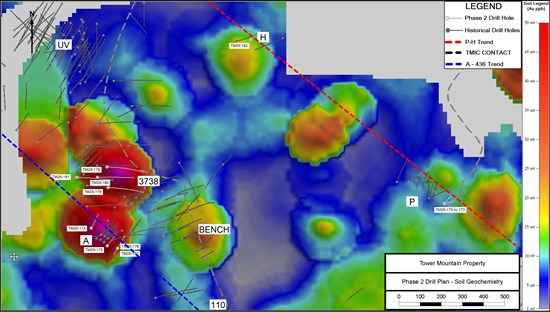

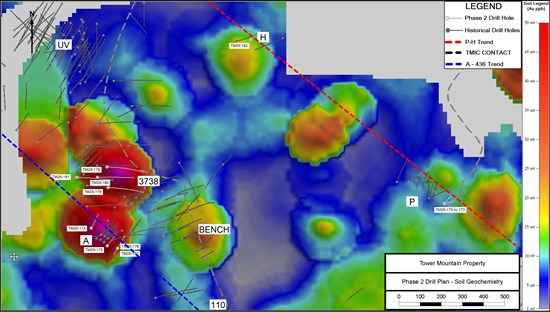

FIGURE 1.0 - Soil Geochemistry with Historical and 2025 Phase Two Drill Locations

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Phase Two Drill Program Summary (Reference FIGURE 1.0 and TABLE 5.0)

Phase Two drilling commenced June 15, 2025 and continued through July 10, 2025. Thirteen (13) holes (1,773 metres) testing four (4) distinct targets were completed at an estimated all-in drilling cost of less than C$250 per metre.

Objectives of the Phase Two Drill Program were twofold. The primary objective was to demonstrate opportunities for rapid expansion of the mineralization footprint through aggressive step-out holes targeting gaps in the existing drill coverage (Targets A and 3738) as well as initial drill testing of new zones (Targets P and H), along the eastern contact of the Tower Mountain Intrusive Complex TMIC.

The secondary objective was to demonstrate that the areas drilled offered the same grade - tonnage opportunity as that demonstrated by the 41,000 metres drilled along the western TMIC contact. Specifically, the drill program sought to demonstrate sustained average grades ranging from 0.75 to 1.25 g/t Au over interval lengths ranging from 10-100 metres. Both objectives were achieved.

Target areas drilled during Phase Two included:

1) 3738-Target, western contact of the TMIC

2) P-Target, eastern contact of the TMIC

3) A-Target, western contact of the TMIC

4) H-Target, eastern contact of the TMIC

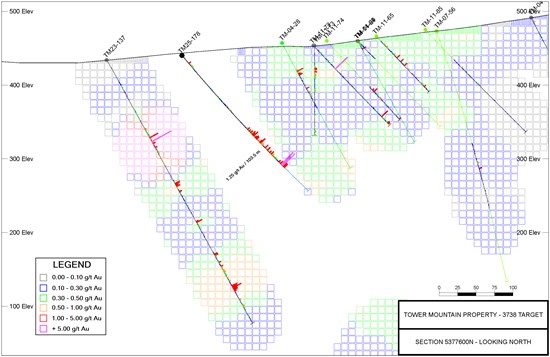

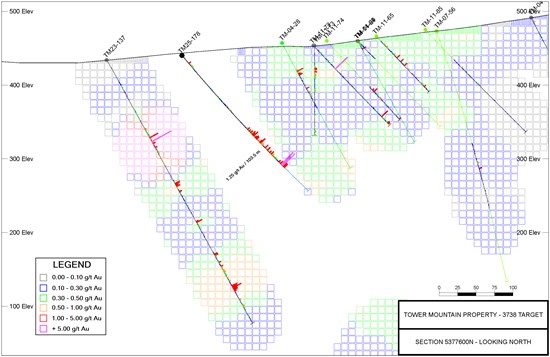

3738-Target

Four (4) holes (1,008 metres), tested the 3738-Target, identified in 2023 by holes TM23-137 (35.14 g/t Au over 41.0 metres including 941.0 g/t over 1.5 metres) and TM23-138 (0.71 g/t over 119.0 metres). TM25-178 and 179 were drilled 100 metres above holes TM23-137 and TM23-138 respectively. Holes TM25-180 and 181 were drilled between the discovery holes, an approximately 50-metre step-out from the original holes. The primary objective with this drilling was to demonstrate the opportunity to discover additional mineralization in undrilled areas along the western TMIC contact.

TM25-178 intersected 2.54 g/t over 24.0 metres within a broader mineralized zone averaging 1.25 g/t over 103.5 metres. The intersection lies within a significant (approximate 100-metre) gap in the historical drill coverage (REFERENCE FIGURE 2.0) and the results strongly suggest multiple opportunities to further increase the mineralization envelope with additional drilling.

TM25-180, fifty (50) metres north, between the initial discovery holes, also intersected a broad zone of mineralization. The highest grades were intersected at the end of the hole, assaying 1.87 g/t Au over 16.5 metres. This interval lies within a broader interval averaging 0.58 g/t Au over 187.5 metres.

TM25-181 was drilled 50 metres under TM25-180 on the same section. This hole also terminated in mineralization assaying 0.64 g/t Au over 13.5 metres. Table 1.0 summarizes the Phase Two drill results at the 3738-Target.

FIGURE 2.0 - 3738-Target - Section 5377600 N (Looking North)

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

TABLE 1.0 - 3738-Target Results - Phase Two Drill Program, Sept. 2025

| Hole ID | Cut-off | From | To | Interval | Au | True Width |

| (Au g/t) | (metres) | (metres) | (metres) | (g/t) | (est. metres) | | TM25-178 | 0.10 | 13.5 | 28.5 | 15.0 | 0.45 | UNKNOWN | | includes | 0.25 | 13.5 | 24.0 | 10.5 | 0.59 | UNKNOWN | | and | 0.10 | 73.5 | 102.0 | 28.5 | 0.25 | UNKNOWN | | includes | 0.25 | 87.0 | 100.5 | 13.5 | 0.32 | UNKNOWN | | and | 0.10 | 120.0 | 252.0 | 132.0 | 1.02 | UNKNOWN | | includes | 0.25 | 132.0 | 235.5 | 103.5 | 1.25 | UNKNOWN | | includes | 1.00 | 133.5 | 160.5 | 27.0 | 1.31 | UNKNOWN | | and | 1.00 | 168.0 | 181.5 | 13.5 | 1.06 | UNKNOWN | | and | 1.00 | 195.0 | 219.0 | 24.0 | 2.54 | UNKNOWN | | includes | 2.00 | 199.5 | 207.0 | 7.5 | 5.11 | UNKNOWN | | TM25-179 | 0.10 | 9.0 | 24.0 | 15.0 | 0.37 | UNKNOWN | | includes | 0.25 | 11.0 | 24.0 | 13.0 | 0.40 | UNKNOWN | | and | 0.10 | 76.5 | 120.0 | 43.5 | 0.21 | UNKNOWN | | includes | 0.25 | 85.5 | 91.5 | 6.0 | 0.28 | UNKNOWN | | includes | 0.25 | 109.5 | 120.0 | 10.5 | 0.36 | UNKNOWN | | and | 0.10 | 142.5 | 148.5 | 6.0 | 0.33 | UNKNOWN | | and | 0.10 | 165.0 | 210.0 | 45.0 | 0.34 | UNKNOWN | | includes | 0.25 | 183.0 | 195.0 | 12.0 | 0.49 | UNKNOWN | | and | 0.10 | 222.0 | 249.0 | 27.0 | 0.28 | UNKNOWN | | includes | 0.25 | 223.5 | 244.5 | 21.0 | 0.32 | UNKNOWN | | TM25-180 | 0.10 | 64.5 | 252.0 | 187.5 | 0.58 | UNKNOWN | | includes | 0.25 | 111.0 | 151.5 | 40.5 | 0.92 | UNKNOWN | | includes | 0.50 | 115.5 | 150.0 | 34.5 | 1.03 | UNKNOWN | | includes | 1.00 | 126.0 | 148.5 | 22.5 | 1.32 | UNKNOWN | | and | 0.25 | 172.5 | 252.0 | 79.5 | 0.73 | UNKNOWN | | includes | 0.50 | 201.0 | 252.0 | 51.0 | 0.95 | UNKNOWN | | includes | 1.00 | 235.5 | 252.0 | 16.5 | 1.87 | UNKNOWN | | TM25-181 | 0.10 | 234.0 | 252.0 | 18.0 | 0.51 | UNKNOWN | | includes | 0.25 | 238.5 | 252.0 | 13.5 | 0.64 | UNKNOWN | | includes | 1.00 | 240.0 | 246.0 | 6.0 | 1.09 | UNKNOWN |

Note: There is insufficient data to estimate True Width in the Table above.

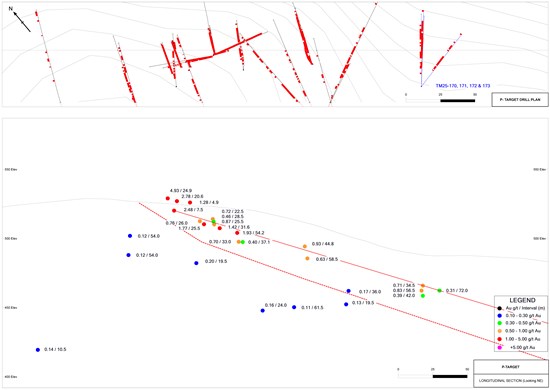

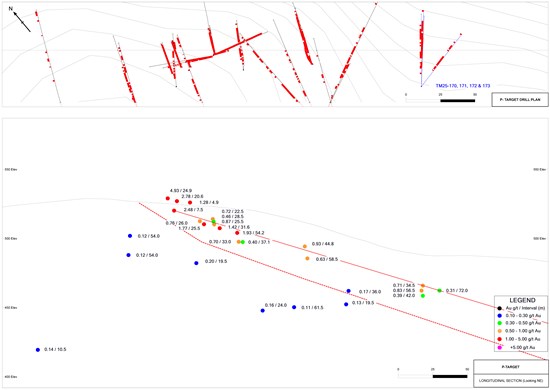

P-Target

Four (4) holes, 333 metres, targeted the down-plunge continuation of the P-Target. Four holes were drilled from a common drill pad located 100 metres southeast of hole TM25-159 (0.63 g/t Au over 58.5 metres) and TM25-160 (0.93 g/t Au over 44.8 metres). All four holes were probing for the continuation along an interpreted 20° southeast plunge vector. All four holes intersected the projected mineralized target along the target vector, returning average grades and interval lengths statistically indistinguishable from the 41,000 metres drilled west of the TMIC. Table 2.0 Summarizes the P-Target results.

To-date, twenty-nine (29) holes, 2,353 metres define a highly altered monzonite over a strike length of 210 metres (REF. FIGURE 3.0). The monzonite unit averages 1.37 g/t Au (at a cut-off grade of 0.30 g/t Au) and extends 40 metres below the topographic surface. Average true width to-date is estimated to be 40 metres. The target remains open down-plunge to the southeast, trending directly towards a large, multi-sample, gold-in-soil anomaly identified in 2024 (REF. FIGURE 1.0).

FIGURE 3.0 - P-Target Drill Plan and Longitudinal Section (Looking northeast)

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

TABLE 2.0 - P-Target Results - Tower Mountain Property, Phase Two Drill Program, Sept. 2025

| Hole ID | Cut-off | From | To | Interval | Au | True Width |

| (Au g/t) | (metres) | (metres) | (metres) | (g/t) | (est. metres) | | TM25-170 | 0.10 | 11.0 | 79.5 | 68.5 | 0.70 | 61.7 | | includes | 0.25 | 14.0 | 70.5 | 56.5 | 0.83 | 50.9 | | includes | 1.00 | 33.0 | 34.5 | 1.5 | 17.80 | 1.4 | | TM25-171 | 0.10 | 10.5 | 75.0 | 64.5 | 0.47 | 64.5 | | includes | 0.25 | 30.0 | 64.5 | 34.5 | 0.71 | 34.5 | | includes | 1.00 | 34.5 | 42.0 | 7.5 | 0.91 | 7.5 | | TM24-172 | 0.10 | 13.5 | 76.5 | 63.0 | 0.30 | 56.7 | | includes | 0.25 | 24.0 | 66.0 | 42.0 | 0.39 | 37.8 | | TM25-173 | 0.10 | 15.0 | 87.0 | 72.0 | 0.31 | 54.0 | | includes | 0.25 | 26.0 | 51.0 | 25.0 | 0.47 | 18.8 | | includes | 0.50 | 30.0 | 42.0 | 12.0 | 0.61 | 9.0 | | and | 0.25 | 58.5 | 73.5 | 15.0 | 0.33 | 11.3 |

A Target

Four (4) holes, (357 metres) tested the strike continuity of the A-Target, on the western TMIC contact. Historical drilling at this target did not close off the mineralization. The A-Target outcrops at surface, trends northwest - southeast and dips gently to the northeast. The southeast projection of the A-Target trend aligns with the 110-Target, 600 metres to the southeast. To the northwest, the A-Target aligns with the 436-Target, 800 metres to the northwest. This entire 1,500-metre-long trend offers little drilling outside the A-Target holes, with a total strike length of 100 metres. Table 2.0 Summarizes the A-Target results.

TM25-174 successfully extends the A-Target 50 metres to the northwest of TM21-117 (1.17 g/t Au over 34.5 metres). TM25-175, drilled was 50 metres below TM21-108 (3.95 g/t Au over 23.9 metres). Finally, TM25-176 extends the A-Target 50 metres southeast of TM21-108 where it intersected a spectacular specimen of dendritic visible gold measuring approximately 15 mm x 10 mm. (REFERENCE FIGURE 4.0)

FIGURE 4.0 - A-Target - TM25-176 Visible Gold in Core

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

TABLE 3.0 - A-Target Results - Tower Mountain Property, Phase Two Drill Program, Sept. 2025

| Hole ID | Cut-off | From | To | Interval | Au | True Width |

| (Au g/t) | (metres) | (metres) | (metres) | (g/t) | (est. metres) | | TM25-174 | 0.10 | 6.0 | 27.0 | 21.0 | 0.43 | 16.2 | | includes | 0.25 | 6.0 | 18.0 | 12.0 | 0.65 | 9.2 | | includes | 0.50 | 12.0 | 16.5 | 4.5 | 1.35 | 3.5 | | and | 0.10 | 51.0 | 67.5 | 16.5 | 0.21 | 12.7 | | TM25-175 | 0.10 | 12.0 | 21.0 | 9.0 | 0.33 | 6.9 | | and | 0.10 | 27.0 | 33.0 | 6.0 | 0.25 | 4.6 | | and | 0.10 | 39.0 | 73.5 | 34.5 | 0.75 | 26.6 | | includes | 0.25 | 39.0 | 72.0 | 33.0 | 0.78 | 25.4 | | includes | 1.00 | 45.0 | 51.0 | 6.0 | 1.69 | 4.6 | | and | 0.50 | 58.5 | 71.0 | 12.5 | 0.92 | 9.6 | | TM25-176 | 0.10 | 10.5 | 93.0 | 82.5 | 4.22 | 63.5 | | includes | 0.25 | 13.5 | 39.0 | 25.5 | 13.18 | 19.6 | | includes | 1.00 | 24.0 | 27.0 | 3.0 | 109.50 | 2.3 | | includes | 30.00 | 24.0 | 25.0 | 1.0 | 327.00 | 0.8 | | TM25-177 | NO SIGNIFICANT VALUES |

H Target

The final drill hole of the Phase Two Program tested the H-Target. Multiple rock samples at the H-Target returned elevated gold grades but initial drilling in 2021 did not intersect any significant values. Review of the data suggested the initial holes may have been drilled parallel to the dip of the H-Target. As a result, a short, 75 metre hole was drilled to the northeast, in the opposite direction to the initial holes.

TM25-182 intersected mineralization from the collar to a depth of 22.5 metres, averaging 0.41 g/t Au and included an interval averaging 0.73 g/t over 6.0 metres. The results strongly support the interpretation that the H-Target mineralization dips to the southwest, the same dip observed at the P-Target.

Quality Assurance and Quality Control

Diamond drilling utilizes NQ diameter tooling. The core is received at the on-site logging facility where it is, photographed, logged for geotechnical, physical properties and geological data. Samples are identified, recorded, and cut in half by wet diamond saw. Half the core is sent for assay at an accredited laboratory with the remaining half core stored on site. A standard sample length of 1.5 meters is typically employed, varying only at major lithological contacts. Certified standards and blanks are randomly inserted into the sample stream and constitute approximately 10% of the sample stream. Certified standards and blank performance is monitored with any failures evaluated and investigated to determine if said failure is a result of error during submission. Any unexplained failures are identified and the five samples preceding and following the failure are re-assayed. In addition, standards and blanks are inserted into the re-assayed interval stream to monitor analytical performance. Samples are shipped to the Activation Laboratories Ltd. facility in Thunder Bay, Ontario, where sample preparation and analyses are completed. All samples are analyzed for gold using a 30-gram lead collection fire assay fusion (FA) with an atomic absorption (AAS) finish. All assay results greater than 5.0 g/t Au are re-assayed using a gravimetric analysis. All assays greater than 30.0 g/t Au are re-assayed using screen metallics where a representative 1000-gram sample is split sieved at 149µm. Assays are performed on the entire +149 µm fraction and two splits of the -149 µm fraction. A final assay is calculated based on the weight of each size fraction.

Qualified Person

Technical information in this news release has been reviewed and approved by Wes Hanson, P.Geo., President and CEO of Thunder Gold Corp., who is a Qualified Person under the definitions established by National Instrument 43-101.

About the Tower Mountain Gold Property

The 100%-owned Tower Mountain Gold Property is located adjacent to the Trans-Canada highway, approximately 50-km west of the international port city of Thunder Bay, Ontario. The 2,500-hectare property surrounds the largest, exposed, intrusive complex in the eastern Shebandowan Greenstone Belt where most known gold occurrences have been described as occurring either within, or proximal to, intrusive rocks. Gold at Tower Mountain is localized within extremely altered rocks surrounding the Tower Mountain Intrusive Complex, a multi-phase, long duration intrusive complex that control gold distribution on the Property. Historical drilling has established anomalous gold extending out from the intrusive contact for over 500 metres along a 1,500-metre strike length, to depths of over 500 metres from surface. The remaining 75% of the perimeter surrounding the intrusion shows identical geology, alteration, and geophysical response, offering a compelling exploration opportunity.

About Thunder Gold Corp.

Thunder Gold is advancing the Tower Mountain Project in Thunder Bay, Ontario - an emerging gold system with the scale, consistency, and quality to support a long-life, open-pit operation. Results from our disciplined drill programs have consistently reinforced confidence in the continuity and predictability of the discovery, while highlighting significant potential for expansion across multiple zones of the Tower Mountain Intrusive Complex. With industry-leading drilling costs, existing infrastructure and a skilled local workforce, Tower Mountain represents a rare combination of size, scalability, and cost-effective growth.

At Thunder Gold, our vision is clear: to unlock a discovery that has the potential to become a transformational gold project, delivering long-term value for shareholders while contributing to the future of Canada's mining industry. For more information about the Company please visit:

www.thundergoldcorp.com

On behalf of the Board of Directors,

Wes Hanson, P.Geo., President and CEO

For further information contact:

Wes Hanson, CEO

(647) 202-7686

whanson@thundergoldcorp.com

Kaitlin Taylor, Investor Relations

IR@thundergoldcorp.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation (collectively, "forward-looking statements"). Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. All statements, other than statements of historical fact, are forward-looking statements and are based on predictions, expectations, beliefs, plans, projections, objectives and assumptions made as of the date of this news release, including without limitation; anticipated results of geophysical drilling programs, geological interpretations and potential mineral recovery. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to the gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty or reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise any forward-looking statements, other than as required by applicable law, to reflect new information, events or circumstances, or changes in management's estimates, projections or opinions. Actual events or results could differ materially from those anticipated in the forward-looking statements or from the Company's expectations or projections.

SOURCE: Thunder Gold Corp. SOURCE: Thunder Gold Corp. |