Miata Metals Expands Near-Surface Gold System at Jons Trend with 27 m of 1.45 g/t gold and 16.5 m of 1.72 g/t Gold and Defines Three Mineralized Zones

globenewswire.com

October 15, 2025 08:00 ET | Source: Miata Metals Corp

VANCOUVER, British Columbia, Oct. 15, 2025 (GLOBE NEWSWIRE) -- Miata Metals Corp. (CSE: MMET) (FSE: 8NQ) (OTCQB: MMETF) (“Miata” or the “Company”) is pleased to announce further strong drill results from the Jons Trend Zone at its Sela Creek Gold Project (“Sela Creek” or the “Project”) in Suriname.

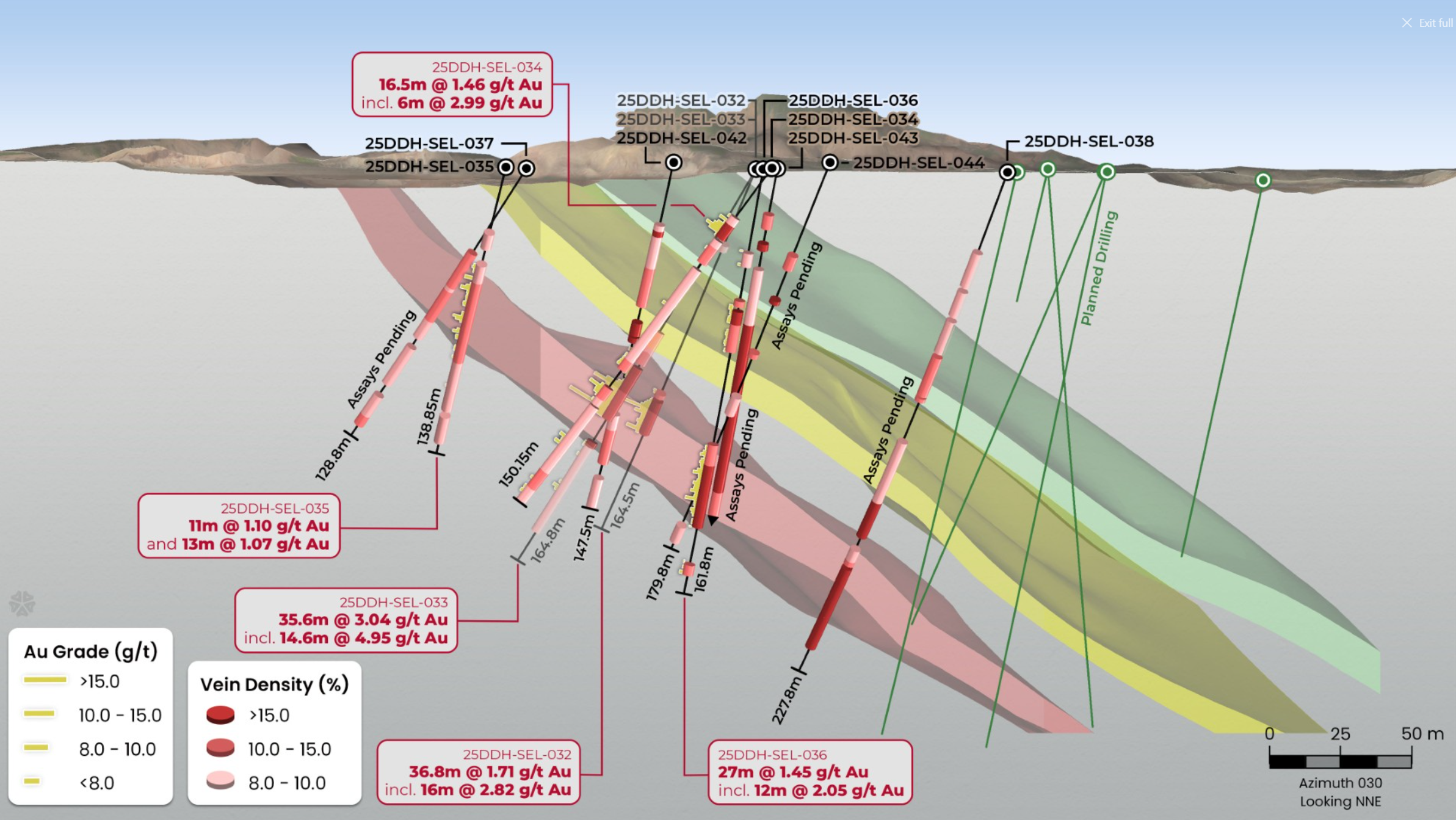

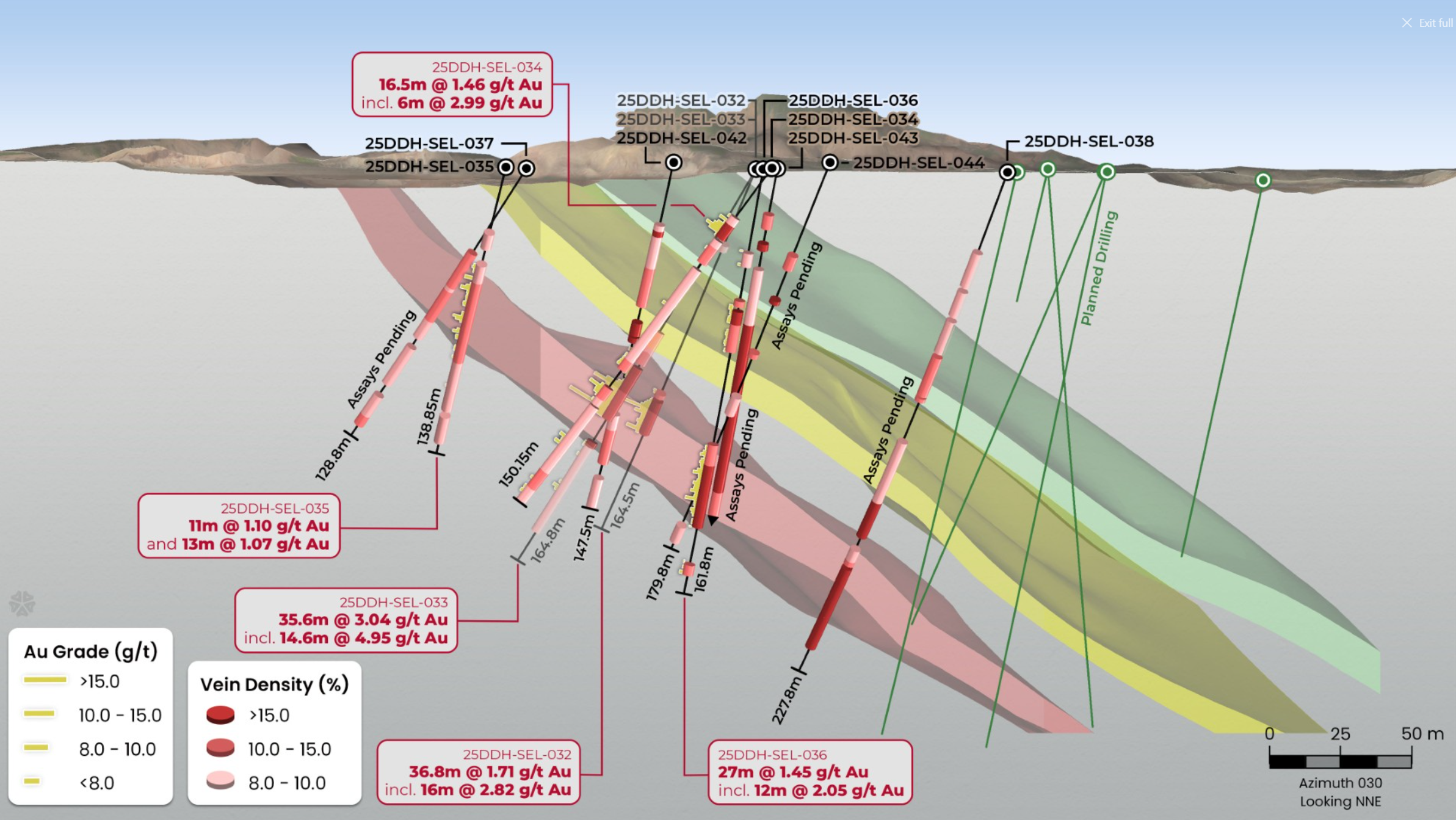

Results from holes 25DDH-SEL-034 through 36 confirm multiple stacked zones of gold mineralization and reinforce the interpretation of a large, continuous, and shallow dipping mineralized system at Jons Trend that remains open down plunge and along strike. The Jons Trend target continues to be assessed as an open pit target.

Highlights

- Drilling continues to yield wide gold intercepts which now define three shallow-plunging zones of mineralization that appear continuous for several hundred metres down-plunge

- 25DDH-SEL-036 yielded an intercept of 27.0 m of 1.45 g/t gold from 105 m1, including:

- 12.0 m at 2.05 g/t gold from 114.0 m

- 25DDH-SEL-034 yielded 16.5 m of 1.72 g/t gold from 14.6 m1, in the shallowest of three mineralized vein zones, including:

- 6 m of 2.99 g/t gold from 24.0 m

- Miata anticipates a further 3,000 m of drilling at Jons Trend prior to the end of 2025 to test its strike length and continuity

“Drilling at Jons Trend continues to deliver. Our results support that we are defining a substantial, continuously mineralized system that starts from surface,” stated Dr. Jaap Verbaas, CEO of Miata Metals. “They are significant for three reasons: (1) mineralization continues to appear where predicted based on vein density, validating our technical model; (2) 16.5 m at 1.72 g/t gold intercept demonstrates shallower mineralized zones can carry higher grades, enhancing the open-pit potential of this target; and (3) with these results we can define three separate zones of mineralization, pointing to a broader mineralized system than we first envisioned.

“The main lode at Jons Trend is holding up well as a 25-35 m thick zone of continuous mineralization, and outside of that our drilling indicates a high likelihood for additional parallel and stacked zones of mineralization. Hole 25SEL-DDH-036 is very telling in that regard as it yielded six separate mineralized intersects and a total of 59.4 m of mineralization over 0.5 g/t gold out of a 161.80 m hole. 25DDH-SEL-038 is a 100 m stepout down plunge of 25SEL-DDH-036.

“Our next 3,000 m of drilling will focus on defining the size, scale, and geometry of this expanding gold system. We are testing both the down-plunge projection and the full strike length of Jons Trend; and with every hole, the scale of this discovery continues to grow. Assays are pending from seven additional holes at Jon’s Trend, and we are confident this target will continue to deliver. Jons Trend is only one of numerous prospective targets at Sela Creek, four of which in total have yielded encouraging drill results.”

Figure 1. Section of Jons Trend drilling, the zone was intersected with hole 25DDH-SEL-032 through 25DDH-SEL-038. Further drilling in and around this zone focuses on determining its extent.

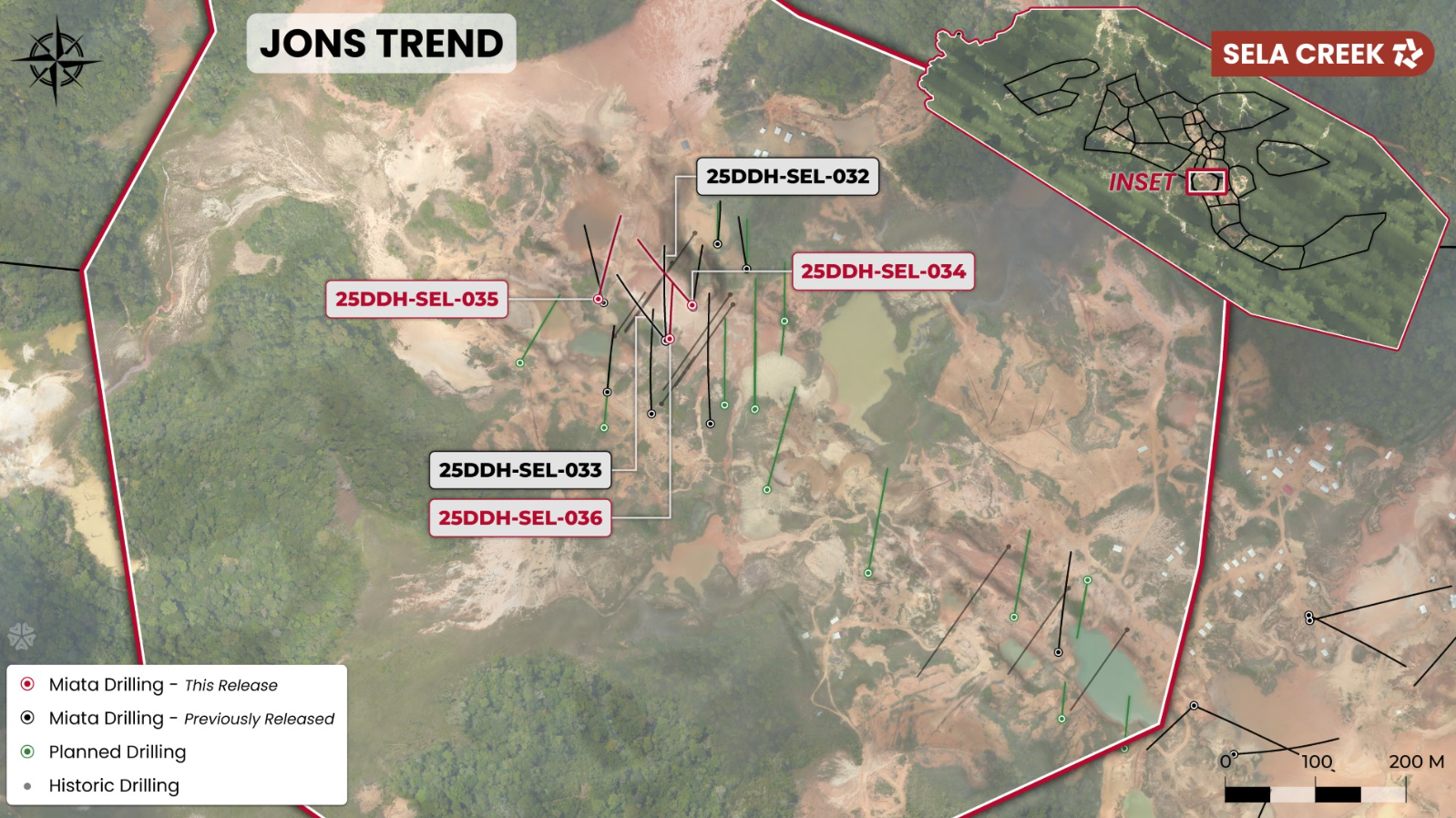

Jons Trend drill plan

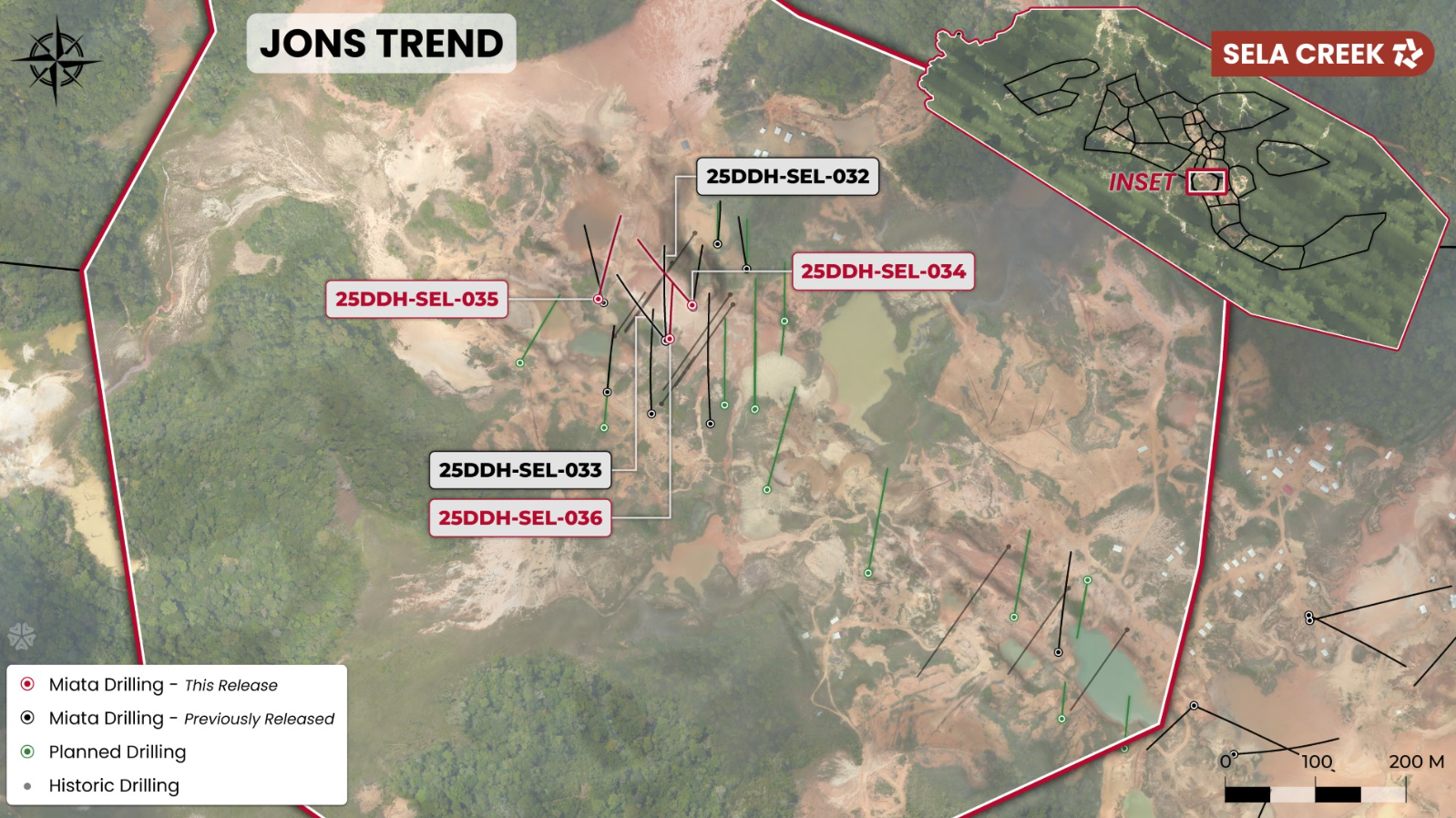

Following the drilling success at Jons Trend, the Company has allocated the balance of its 2025 drill program to further advance this highly prospective zone. Approximately 3,000 m of additional drilling is planned before the end of 2025 to define strike length, width, and down-plunge extent of this system. With the results of the Jons Trend drilling, Miata’s technical team expects that the geological data and understanding will allow for improved drill targeting at adjacent targets as well.

Figure 2. Drill plan in the Jons Trend target. Planned collars are shown in green. The NNW-SSE extent of the Jons Trend target will be tested over 800 m.

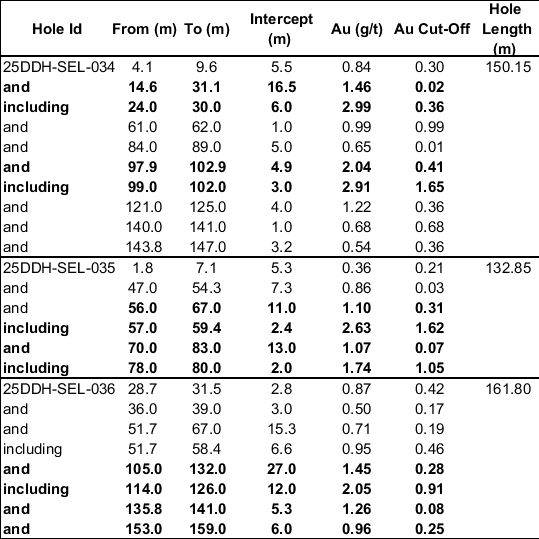

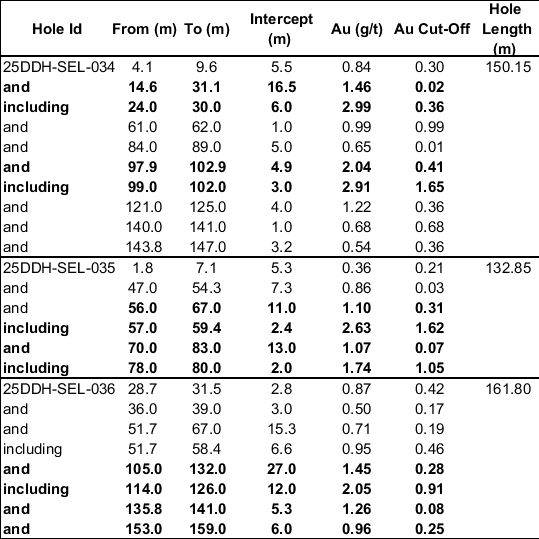

Results Summary

Drill hole 25DDH-SEL-034 cut a shallow mineralized vein zone grading 16.5 m at 1.72 g/t gold, including a high-grade core of 6.0 m at 2.99 g/t gold. This intersect demonstrates strong results in the shallowest zone of mineralization at Jons Trend.

Drill hole 25DDH-SEL-036 delivered another standout result, cutting 27.0 m at 1.45 g/t gold from 105 m, including a high-grade section of 12.0 m at 2.05 g/t gold. The consistency of the high-grade core of the zone was specifically encouraging in this intercept. The hole encountered nearly 60 m of gold mineralization in total, underscoring the strong continuity and thickness of mineralization at Jons Trend and highlighting the potential for a large, near-surface gold system.

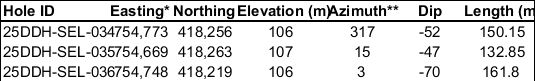

As in holes 25DDH-SEL-032 and 33 (see Miata news release dated 23 September, 2025), the gold grade correlates to dense sheeted quartz veins with minor pyrite and pyrrhotite within veins and disseminated in the silicified rock matrix. The mineralized zone occurs adjacent to, and within, interpreted fold hinge zones in metasedimentary rock. Drilling of holes 25DDH-SEL-037 to 38 suggest similar zones were intercepted in these drill holes with hole 25SEL-DDH-038 representing a 100 m step-out down plunge of hole 25DDH-SEL-036 (Fig 1). Artisanal mining activity2 in saprolite zones adjacent and along strike of these intercepts indicate considerable room for expansion of the Jons Trend target with similarly oriented zones of mineralization.

Figure 3. 25SEL-DDH-036 from 118m to 126.40m, showing consistent grade, silicification and veining.

Table 1. Drill results for hole 34-361. The cut-off for listing results is 0.5 g/t Au.

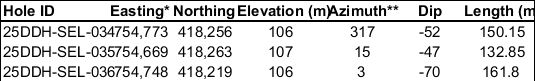

Table 2. Collar information.

All drill results are available on the Company website through this link.

Grades up to 67.83 g/t gold in 25SEL-DDH-030 at Puma East through Metallic Screen assay

Hole 25SEL-DDH-030, drilled at the Puma East target was reanalyzed using metallic screen assay and yielded 5.3 m at 8.25 g/t gold from 37.7m, including 0.5 m at 67.83 g/t Au from 39.7 m in bedrock. This significantly upgrades the original assays that yielded 5.3 m at 6.57 g/t gold. Metallic screen assay is used when coarse grained gold may be present to get a more accurate and representative result. The Puma East target remains a high-priority zone for follow-up drilling and trenching.

Investor Awareness and Marketing Agreement

The Company announces that further to its news release dated December 16, 2024, it has renewed its agreement with Bluehand Consulting AG (“Bluehand”) to provide ongoing digital media marketing services. Bluehand will continue to work to facilitate investor awareness about the Company and Suriname gold exploration portfolio. Bluehand will be paid USD$263,000 to develop required content and for advertising, for a term of one year, commencing October 15, 2025. The budget allocated to Bluehand may be adjusted during the term based on market conditions and Company requirements, and the agreement may be renewed upon mutual agreement. The Company will not issue any securities to Bluehand in consideration for the services. Bluehand and the Company deal at arm’s length. Contact information for Bluehand is as follows: email: info@bluehandconsulting.ch; mailing address: Bartholoméplatz 3, 7310 Bad Ragaz, Switzerland; phone: +41 764802584.

QAQC

Samples were analyzed at FILAB Suriname, a commercial certified laboratory under ISO 9001:2015. Samples are crushed and pulverized to 85% passing 88 µm prior to analysis using a 50 gram fire assay (50 gram aliquot) with an Atomic Absorption (AA) finish. For samples that return assay values over 5.0 grams per tonne (g/t), another cut was taken from the original pulp and fire assayed with a gravimetric finish. Samples likely to contain coarse gold may also be sent for metallic screen assay, yielding a more representative result through analysis of both the coarse and fine fraction of a 500 gram sample. Miata Metals inserts certified reference standards in the sample sequence for quality control.

QP Statement

The scientific and technical information in this news release has been reviewed and approved by Dr. Jacob Verbaas, P.Geo., a director of the Company and Qualified Person as defined under the definitions of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

1Hole 34 intercepts are approximately true width, true widths of hole 35 are approximately 60% of stated intercepts, true widths of hole 36 are approximately 85% of true width. These true widths are estimates based on preliminary modelling of vein zones and may change as modeling is refined with additional drill data.

2Miata does not generate revenue from artisanal mining activity.

About Miata Metals Corp.

Miata Metals Corp. (CSE: MMET) is a Canadian mineral exploration company listed on the Canadian Securities Exchange, as well as the OTCQB (OTCQB: MMETF) and Frankfurt (FSE: 8NQ) Exchanges. The Company is focused on the acquisition, exploration, and development of mineral properties. The Company holds a 70% interest in the ~215km2 Sela Creek Gold Project with an option to acquire a full 100% interest in the Project, and a 70% beneficial interest in the Nassau Gold Project with an option to acquire 100%. Both exploration properties are located in the greenstone belt of Suriname.

On Behalf of the Board

Dr. Jacob (Jaap) Verbaas, P.Geo | CEO and Director

info@miatametals.com

+1 778 488 9754

Forward-Looking Statements

Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “anticipates”, “anticipated” “expected” “intends” “will” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are from those expressed or implied by such forward-looking statements or forward-looking information subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different, including receipt of all necessary regulatory approvals. Although management of the Company have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com |