Scottie Resources Announces Impressive Economics in Preliminary Economic Assessment for Scottie Gold Mine Project

newsfilecorp.com

October 28, 2025 7:00 AM EDT | Source: Scottie Resources Corp.

Vancouver, British Columbia--(Newsfile Corp. - October 28, 2025) - Scottie Resources Corp. (TSXV: SCOT) (OTCQB: SCTSF) (FSE: SR80) ("Scottie" or the "Company") is pleased to announce the results of an independent Preliminary Economic Assessment ("PEA") completed by Tetra Tech Canada, Inc. ("Tetra Tech") for the Scottie Gold Mine project in British Columbia, Canada.

The PEA outlines a robust Direct-Ship Ore ("DSO") development scenario for the Scottie Gold Mine Project, with strong economics and leverage to the current gold price environment, and additional upside potential through toll milling. All dollar ($) amounts in this news release are in Canadian dollars ($) unless otherwise indicated. The base case DSO project delivers an after-tax NPV(5%) ranging from $215.8 million to $668.3 million at gold prices of US$2,600/oz and US$4,200/oz, respectively. Importantly, the PEA also presents the opportunity to utilize excess capacity at the nearby Premier mill through a toll-milling arrangement, which could significantly enhance project economics. Under this scenario, the after-tax NPV(5%) increases to $380.1 million at US$2,600/oz and $831.7 million at US$4,200/oz (note: no toll-milling agreement is currently in place). The PEA contemplates an initial capital cost of $128.6 million and average annual production of approximately 65,400 ounces of gold over a seven-year mine life. The project demonstrates a compelling after-tax payback period of 1.7 years for the standalone DSO case, and just 0.9 years under the toll-milling opportunity at a gold price of US$2,600/oz.

The Company will be hosting a webcast to review the PEA on Wednesday, October 29, 2025 at 8:00am PT. To join the webcast, please follow this link:

https://www.gowebcasting.com/14523

Table 1: Gold Price Sensitivity and Comparison table between DSO Base Case and Toll Milling Options for the Scottie Gold Mine Project.

| Gold Price | Description | DSO Base

Case | Toll Milling

Option* | $2600

US/oz | After-Tax NPV5% | $215.8M | $380.1M | | After-Tax IRR | 60.3% | 89.9% | | After-Tax Payback | 1.2 years | 0.9 years | | After-Tax NPV/CAPEX | 1.7 | 3.0 | $3400

US/oz | After-Tax NPV5% | $442.0M | $606.0M | | After-Tax IRR | 107.9% | 135.2% | | After-Tax Payback | 0.8 years | 0.7 years | | After-Tax NPV/CAPEX | 3.4 | 4.7 | $4200

US/oz | After-Tax NPV5% | $668.3M | $831.7M | | After-Tax IRR | 153.2% | 177.5% | | After-Tax Payback | 0.6 years | 0.5 years | | After-Tax NPV/CAPEX | 5.2 | 6.5 |

Note: Scottie Gold Mine Preliminary Economic Assessment Base Case assumes a gold price of US$2600/troy ounce ("oz") and a US$/CAD$ exchange rate of 0.72:1.00. NPV/CAPEX is the ratio between NPV value versus Initial Capex *At this time there is no toll milling arrangement in place with the nearby Premier mill.

"The Direct Ship Ore ("DSO") PEA marks a major milestone for Scottie," commented Brad Rourke, CEO. "It highlights a simple, low-capex project with robust economics and clear growth potential through ongoing discovery. The DSO scenario eliminates the need for a mill or tailings facility, streamlining both permitting and construction. In addition, the optionality of toll milling at a nearby facility presents a clear, low-risk development pathway with meaningful upside. As we advance engineering and permitting, our successful 2025 drilling campaign and planned 2026 program are expected to convert a substantial portion of the current resource to the Indicated category and add new ounces-extending mine life and further strengthening project economics."

PEA Summary

The DSO project is planned to commence with open pit mining at the Blueberry Contact Zone, closely followed by underground mining at the Blueberry Contact Zone, and subsequently the Scottie Gold Mine (see Figure 1 for production schedule). The mined material will be then jaw crushed and sorted using an XRF based ore sorting system. The upgraded product will be transported to the Stewart bulk shipping facility located 40 km down an existing road to be shipped overseas. The material would be then sold to Ocean Partners based on the negotiated terms in the existing offtake agreement ( see NR dated July 7, 2025).

The PEA is based on the mineral resource estimate, titled "NI 43-101 2025 Maiden Mineral Resource Estimate for the Scottie Gold Mine Project" for the Scottie Gold Mine Property, British Columbia, Canada, effective February 2, 2025 and announced on May 7, 2025 (the "February 2025 Mineral Resource Estimate").

Technical and Financial Details

Table 2: Scottie Gold Mine DSO PEA Summary (Base Case), assumes a 5% discount rate and a gold price of US$2600.

| Throughput (tpd) | 900 | | Mine Life | 7 years | | Milled Tonnage (Mt) | 2.19 |

| | Average LOM Gold Head Grade (gpt) | 6.86 | | Contained Gold oz | 483,000 | | Gold Recovery | 94.7% | | Payable Gold oz (LOM) | 457,600 | | Average Annual Production (LOM) - Gold oz | 65,400 | | Average Annual Production (Years 1-4) - Gold oz | 77,300 |

| | UG Mining Cost ($/t sorted) | $118.10 | | OP Mining Cost ($/t mined) | $6.95 | | Processing Cost ($/t sorted) | $17.96 | | G&A Cost ($/t sorted) | $31.23 | | Surface Services Cost ($/t sorted) | $16.76 | | Total Operating Cost ($/t sorted) | $185.30 | | Initial Capital Cost ($ million) | $128.6 | | LOM Sustaining Capital Cost ($ million) | $76.7 |

|

| | LOM AISC (US$/oz Au) | US$1452 | | Pre-Tax IRR | 82.5% | | Pre-Tax NPV (5%, $ million) | $326.1 | | Pre-Tax Undiscounted LOM net free cash flow ($ million) | $419.1 | | Pre-Tax Payback period | 1 year | | After-Tax IRR | 60.3% | | After-Tax NPV (5%, $ million) | $215.8 | | After-Tax Undiscounted LOM net free cash flow ($ million) | $283.5 | | After-Tax Payback period | 1.2 years |

The PEA presents a range of metal pricing scenarios on after-tax basis to evaluate the economics of the project in both base case and alternate commodity price scenarios:

Additional sensitivities to the price of gold, recovery, exchange rate, Capex, and Opex will be presented in the PEA Technical Report. The project economics are most sensitive to gold prices.

Diluted Resource Estimate

The resource estimate for the PEA is based on inferred resources as stated in the February 2025 Resource Estimate for the Scottie Gold Mine project. Certain mining factors have been applied to this resource estimate, to generate diluted resources using a conceptual mine plan for the PEA. The February 2025 Resource Estimate is summarized below:

| Blueberry Pit Resource | | Source | Cutoff Au | Tonnage | Au | NSR | Au Metal | | (g/t) | (ktonnes) | (g/t) | ($CDN) | (kOz) | | Blueberry Pit (Inferred) | 0.25 | 2,887 | 2.06 | 156.04 | 191 | | 0.3 | 2,712 | 2.17 | 164.69 | 190 | | 0.5 | 2,114 | 2.68 | 202.51 | 182 | | 0.7 | 1,707 | 3.17 | 239.73 | 174 | | 1 | 1,323 | 3.85 | 290.19 | 164 | | 2.5 | 600 | 6.61 | 492.83 | 128 | | 5 | 273 | 10.35 | 755 | 91 | | Total Underground Resource | | Source | Cutoff Au | Tonnage | Au | NSR | Au Metal | | (g/t) | (ktonnes) | (g/t) | ($CDN) | (kOz) | | Blueberry and Scottie Mine Underground (Inferred) | 2.5 | 1,897 | 8.66 | 678.51 | 528 | | 3 | 1,704 | 9.33 | 731 | 511 | | 3.5 | 1,549 | 9.94 | 778.78 | 495 | | 4 | 1,404 | 10.59 | 829.04 | 478 | | 4.5 | 1,269 | 11.26 | 881.69 | 459 | | 5 | 1,143 | 11.98 | 937.99 | 440 | | 10 | 520 | 18.05 | 1,413.75 | 302 |

| | Inferred | varies | 3,604 | 6.06 | 470.69 | 703 |

Notes to the 2025 Resource Table:

- Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines, as required National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101")

- The base case MRE has been confined by "reasonable prospects of eventual economic extraction" shape using the following assumptions:

- Metal price of US$2000/oz gold

- Metallurgical recovery of 90% gold

- Payable metal of 99% gold in doré

- Processing costs of CDN$24 / tonne milled, which includes milling, transport, smelter treatment, refining and General & Administrative (G&A) costs

- Underground production cost of CDN$78 / tonne, and underground development costs to be CDN$90 / tonne, for a total underground mining cost of CDN$168 / tonne

- Open pit mining costs of CDN$3.00 / tonne for mineralized and waste material

- The 130% price case pit shell is used for the confining shape with elevation adjustment of the main Blueberry pit for the underground resource.

- The resulting net smelter return is NSR = Au g/t* CDN$98.60 / g * 90% recovery rate

- Numbers may not add due to rounding.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the estimated mineral resources will be converted into mineral reserves.

It is noted that the prices and costs used for the resource estimate are not identical to the updated values used for the mining and cash flow calculations. The costs and Au price used for the resource reflect those considered reasonable at the effective date of the resource estimate. A check has been done on these values compared to the current values and it is found that the resource is somewhat conservative on price resulting in a similar cutoff for open pit mining and somewhat higher cutoff for underground than that used for the mining study and cashflow.

The Qualified Person is of the opinion that issues relating to all relevant technical and economic factors likely to influence the prospect of economic extraction can be resolved with further work. These factors may include environmental permitting, infrastructure, sociopolitical, marketing, or other relevant factors.

Mining Method

The Project is planned as a combined open pit and underground mining operation utilizing contractor mining. Open pit development is expected to utilize a conventional truck-and-shovel method, whereas underground development will be based on longitudinal longhole stoping. A nominal average production rate of approximately 900 tonnes per day (tpd) has been assumed for the combined operation.

For the base case scenario, resource material selected as run-of-mine (ROM) mill feed will be stockpiled and subsequently processed using an ore sorter. The ore sorter concentrate will be shipped directly to overseas markets. This mining and processing strategy has been applied to both the open pit and underground components and forms the basis of the PEA.

Table 3: Combined Resource Material for Ore Sorter Feed

| Phase | Rock

(Mt) | Ore Sorter

Feed (Mt) | Waste

(Mt) | Au

(g/t) | Au contained

(kOz) | Au Recovered (kOz) | | Total OP | 5.86 | 0.32 | 5.54 | 7.71 | 79 | 76 | | Total UG | 2.55 | 1.87 | 1.73 | 6.72 | 403 | 384 | | Total | 8.41 | 2.19 | 7.27 | 6.87 | 482 | 460 |

Note: BB = Blueberry, OP = open pit, UG = underground, Au = gold grade (g/t), Mt = million tonnes, kOz = thousand ounces

The Blueberry deposit was assessed to a combination of open pit and underground mining. The Scottie deposit, which was previously mined utilizing shrinkage stoping approximately 50 years ago, was assessed as underground only.

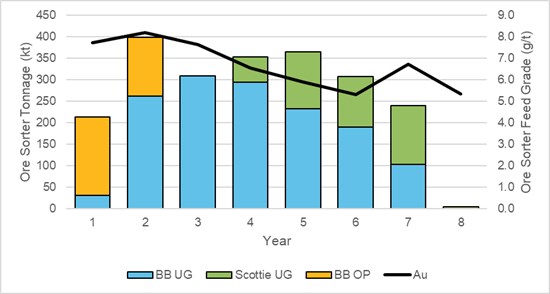

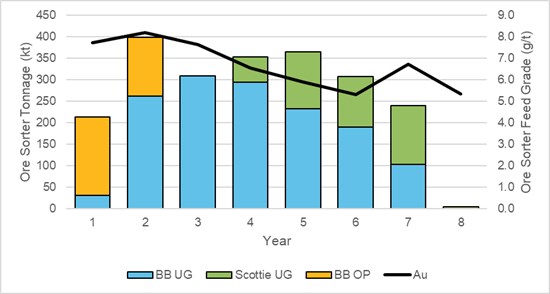

The combined Resource material selected as ore sorter feed is summarized in Table 3 and the base case production schedule used in the preliminary cashflow analysis is shown in Figure 1.

Figure 1: Base Case Production Schedule over LOM

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Note: BB UG = Blueberry underground, Scottie UG = Scottie underground, BB OP = Blueberry open pit, Au = gold grade (g/t), kt = thousand tonnes

Metallurgy

Since 1980, numerous phases of metallurgical testing have been conducted on Scottie samples to investigate the gravity-recoverable gold content, the cyanide leaching performance of head composite samples, and the response of gravity tailings to flotation and cyanidation processes. These early studies laid the groundwork for understanding the mineralization's behavior under conventional recovery methods.

Beginning in 2024, the focus of metallurgical work shifted toward mill feed pre-concentration using ore sorting and dense media separation (DMS).

Scottie Resources launched a particle sorting test program involving 210 quarter-core samples - 70 each from the Blueberry Open Pit (BBOP), Blueberry Underground (BBUG), and Scottie Gold Mine Underground (SGMUG) zones. These samples, roughly 3 inches in size, were derived from broken drill core and represented a broad spectrum of gold grades from each zone.

The primary objective of the program was to evaluate the effectiveness of separating target mineralization from waste using X-ray scanning technologies. The results were analyzed across several operational metrics, including feed grade, mass pull to product, gold recovery, sorted product grade, rejected waste grade, and upgrade ratio.

Overall, the test program ( see NR dated April 1, 2025) demonstrated that particle sorting was highly effective across all zones using both XRT and XRF technologies. Notably, XRF outperformed XRT in terms of mass pull to recovery ratio, particularly within the 30-60% mass pull range. Additionally, XRF offered the advantage of enabling a three-way sort, allowing for the creation of a low-grade stockpile in a single stage using commercially available sorting equipment.

Process Plant

Based on the results of the test work, a cost-effective processing flowsheet was developed to recover and upgrade the mill feed into a saleable concentrate using ore sorting technique. The processing plant includes the following components:

- A primary crusher operates in closed-circuit with a triple-deck dry screen.

- Coarse product from the dry screen is washed using a double-deck wet screen to prepare the feed for ore sorter. Fine product from the dry screen is stockpiled and later blended with sorter concentrate.

- The two fractions (coarse & fine) from the wet screen are sorted separately using two X-ray fluorescence (XRF) sorters to produce final concentrate, which is shipped directly overseas for sale.

- Wash water from the wet screen is recycled using a belt filter.

- All the associated utilities required for plant operation are included.

Initial and Sustaining Capital Cost Estimates

The PEA estimates initial capital requirements of $128.6 million and cumulative sustaining capital of $76.7 million (Table 4).

Table 4: Initial and Sustaining Capital Costs

| Initial Capital Item | Initial Capital

($ million) | | Mining Infrastructure | $6.8 | | Site Access & Pads | $5.0 | | Site Services Mobile Equipment | $7.8 | | Process Plant | $26.2 | | Surface Infrastructure | $38.8 | | Project Indirects | $23.7 | | Owners Costs | $3.4 | | Contingency | $16.9 | | Total | $128.6 | | OP Mining - Preproduction | $4.5 | | Sustaining Capital Item | Sustaining Capital ($ million) | | Mining | $73.1 | | Others | $3.6 | | Total Sustaining Capital | $76.7 | | Reclamation/Closure Costs | $15.0 |

All capital incurred up to the end of construction period, except pre-production mining ($4.5M), is included in the Initial Capital. The PEA is based on contractor open pit and underground mining model. Any capital required from operation commencement is included in Sustaining Capital. A total of $16.9 million in contingencies have been included in the Initial Capital which is approximately 20% of the Initial Directs Costs.

Operating Cost Estimates

LOM operating costs for the Scottie Gold Mine DSO project are estimated to average $185.38 per tonne sorted. During the start-up period, processing and general and administrative ("G&A") costs per tonne are slightly higher until sorting throughput ramps up to design capacity. The PEA is based on contractor open pit and underground mining, which has an estimated UG LOM cost of $118.1 per tonne sorted and OP LOM cost of $6.95 per tonne mined. Processing costs are estimated at $17.96 per tonne sorted, G&A and site services costs are estimated at $31.23 and $16.76 per tonne sorted, respectively. The processing, G&A, and site services costs per tonne sorted are based on an estimated plant operating time of 50% over the LOM with potential to improve these unit costs with potential utilization of a leaching plant nearby (see section entitled Scottie Gold Mine Opportunities to Enhance Value below).

All-In Sustaining Cash Costs per Ounce of Gold Equivalent

AISC are estimated to be US$1,452/oz Au produced, based on LOM production of 457,600 recoverable ounces Au.

Scottie Gold Mine Opportunities to Enhance Value

Of the studied project design components, the PEA demonstrates that the most profound improvement to the project economics is toll milling the product at the nearby Premier mill (i.e. Table 1). No toll milling arrangement is currently in place with the Premier mill, it is considered in the PEA as a recommendation for further study work. The Premier mill is located halfway along the trucking route to the Stewart Terminal. The model assumes appropriate operating costs derived from Ascot's 2020 Feasibility Study, with an additional toll milling premium applied, similar to comparable toll milling projects. At US$2600/oz gold the AISC for the toll milling model is calculated to be US$935 (versus US$1452 in the base-case DSO model).

Several opportunities have been identified that may significantly enhance the economic return outlined in the PEA, including but not limited to the following:

- Toll milling: Additional opportunities of refinement on this concept include: (1) optimizing mine plan and resource for reduced shipping costs (i.e. include more lower grade ounces), (2) removal of the crushing/ore sorting plant, and (3) further metallurgical test work on the mineralization to maximize recovery in a toll milling scenario. The results from our preliminary metallurgical test-work suggested intensive leaching recoveries of up to 97% for both gold and gold gravity concentrates. In the PEA, the cyanide leaching recoveries is set at 89.1%. Historic production and recent test work suggests potential for improved gold recoveries of approximately 91-95% for gold. Scottie intends to follow up these promising results with further test work to be completed and incorporated into the Feasibility (FS).

- Exploration Potential: The resource estimated for the PEA is based on the February 2025 Mineral Resource Estimate, which includes the Blueberry Zone, Scottie Gold Mine, and Bend vein. With success on further drilling, there are several ways that expanded resources could improve the economics of the project, including higher throughput, extended mine life, and bringing in additional isolated stopes left off the PEA mine plan due to development costs.

- Throughput Expansion: The mine plan for the PEA is based on a 900 tpd throughput scenario, which results in a 7-year mine life. Expanded resources have the potential to justify increased mine and mill throughput. As part of the upcoming Feasibility Study (FS), Scottie will evaluate the potential costs to expand the process plant capacity to 1,500-2,000 tpd with potential benefits to unit costs for processing and G&A with respect to economies of scale.

- Reduced Development Cost per Ounce: Blueberry and Scottie Gold Mine underground deposits have relatively high development costs per ounce of mineral resource. Expanding the resource for these areas would spread the relatively high development capital over more ounces, improving economics and reducing the AISC per ounce.

- Power Line: The PEA assumes the use of onsite generated power using conventional fuel at $0.26/KWH or higher and exposes the operation to fluctuations in the price of fuel. The FS will investigate the contemplation of the connection of the site to the BC Hydro grid via power available at an estimated cost of $0.07/KWH.

Feasibility Study

With the PEA completed, Scottie is moving forward with a Feasibility Study for the Scottie Gold Mine project. The Company is targeting completion of the FS in H1, 2027 and making a production decision following the release of a positive study. The on-going FS data collections and engineering will allow us to conduct detailed feasibility work including further metallurgy, assess geotechnical conditions, reconcile underground grades with the resource model, complete test mining to define the optimum mining method, and determine more accurate development costs.

The recommended budget for the FS, field support for the study, ongoing exploration work, environmental work, infill drilling, upgrading mineral resources to mineral reserves and construction planning over the next 12 months is estimated at $25 million.

Tetra Tech's work to complete the PEA, demonstrates that the Scottie Gold Mine project has robust economic potential and recommends that Scottie continue developing the project with emphasis on the exploration work required to improve confidence in inferred resources.

Qualified Persons

The Independent Qualified Persons, as defined in NI 43-101 for the PEA and who have reviewed and approved the contents of this news release are Hassan Ghaffari, P. Eng., M.A.Sc., Jianhui (John) Huang, PhD, P. Eng. from Tetra Tech, and Damian Gregory, P. Eng. from Snowden Optiro, and Sue Bird, P. Eng. from Moose Mountain Technical Services.

The Technical Report, "NI 43-101 2025 Maiden Mineral Resource Estimate for the Scottie Gold Mine Project" for the Scottie Gold Mine Property, British Columbia, Canada, effective February 2, 2025 and announced on June 24, 2025, has been filed on SEDAR+.

Dr. Thomas Mumford, P.Geo., President of the Company and a non-independent qualified person under National Instrument 43-101, has reviewed and approved the technical information contained in this news release on behalf of the Company.

ABOUT SCOTTIE RESOURCES CORP.

Scottie Resources holds 100% interest in the Scottie Gold Mine Property, which includes the high-grade, past-producing Scottie Gold Mine and the adjacent Blueberry Contact Zone. The Company also owns a 100% interest in the Georgia Project, host to the past-producing Georgia River Mine, as well as the Cambria, Sulu, and Tide North properties. In total, Scottie controls approximately 58,500 hectares of highly prospective mineral claims within the Stewart Mining Camp in British Columbia's Golden Triangle-one of the world's most prolific mineralized districts.

Scottie's current resource estimate on the Scottie Gold Mine Project includes a total of 703,000 gold ounces at an average grade of 6.1 g/t (Inferred category), highlighting the potential for a significant near-surface, high-grade deposit. The Company's strategy is to continue expanding this resource and to define additional mineralization around past-producing mines through systematic drilling and surface exploration.

In parallel, Scottie is evaluating a potential Direct Shipping Ore (DSO) scenario at the Scottie Gold Mine. With permits in hand, a 10,000-tonne bulk sample is underway. This initiative provides an opportunity to collect key geotechnical and metallurgical data while assessing a low-capex path to potential near-term revenue through toll milling or third-party processing. This DSO concept does not imply a production decision but reflects the optionality embedded in Scottie's portfolio.

Additional Information

Brad Rourke

Chief Executive Officer

+1 250 877 9902

brad@scottieresources.com

Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of Canadian securities legislation. These include, without limitation, statements with respect to: the economics and project parameters presented in the PEA, including IRR, AISC, NPV, and other costs and economic information; possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; the strategic plans, timing, costs and expectations for the Company's future development and exploration activities on the Scottie Gold Mine Property, including metallurgical test, mineralization and resource estimates and grades for drill intercepts, permitting for various work, and optimizing and updating the Company's resource model and preparing a feasibility study; information with respect to high grade areas and size of veins projected from underground sampling results and drilling results; and the accessibility of future mining at the Scottie Gold Mine Property. Such forward-looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: the reliability of mineralization estimates, the conditions in general economic and financial markets; availability and costs of mining equipment and skilled labour; accuracy of the interpretations and assumptions used in calculating resource estimates; operations not being disrupted or delayed by unusual geological or technical problems; ability to develop and finance the Scottie Gold Mine Project; and effects of regulation by governmental agencies. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors including: fluctuations in precious metals prices, price of consumed commodities and currency markets; uncertainty as to actual capital costs, operating costs, production and economic returns, and uncertainty that development activities will result in profitable mining operations; risks related to mineral resource figures being estimates based on interpretations and assumptions which may result in less mineral production under actual conditions than is currently estimated; the interpretation of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project cost overruns or unanticipated costs and expenses; and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Scottie Resources Corp. SOURCE: Scottie Resources Corp. |