Allied Gold Reports Exploration Results at Sadiola Demonstrating Continued Discovery in a World-Class Gold Mineralized System

globenewswire.com

October 29, 2025 07:30 ET | Source: Allied Gold Corporation

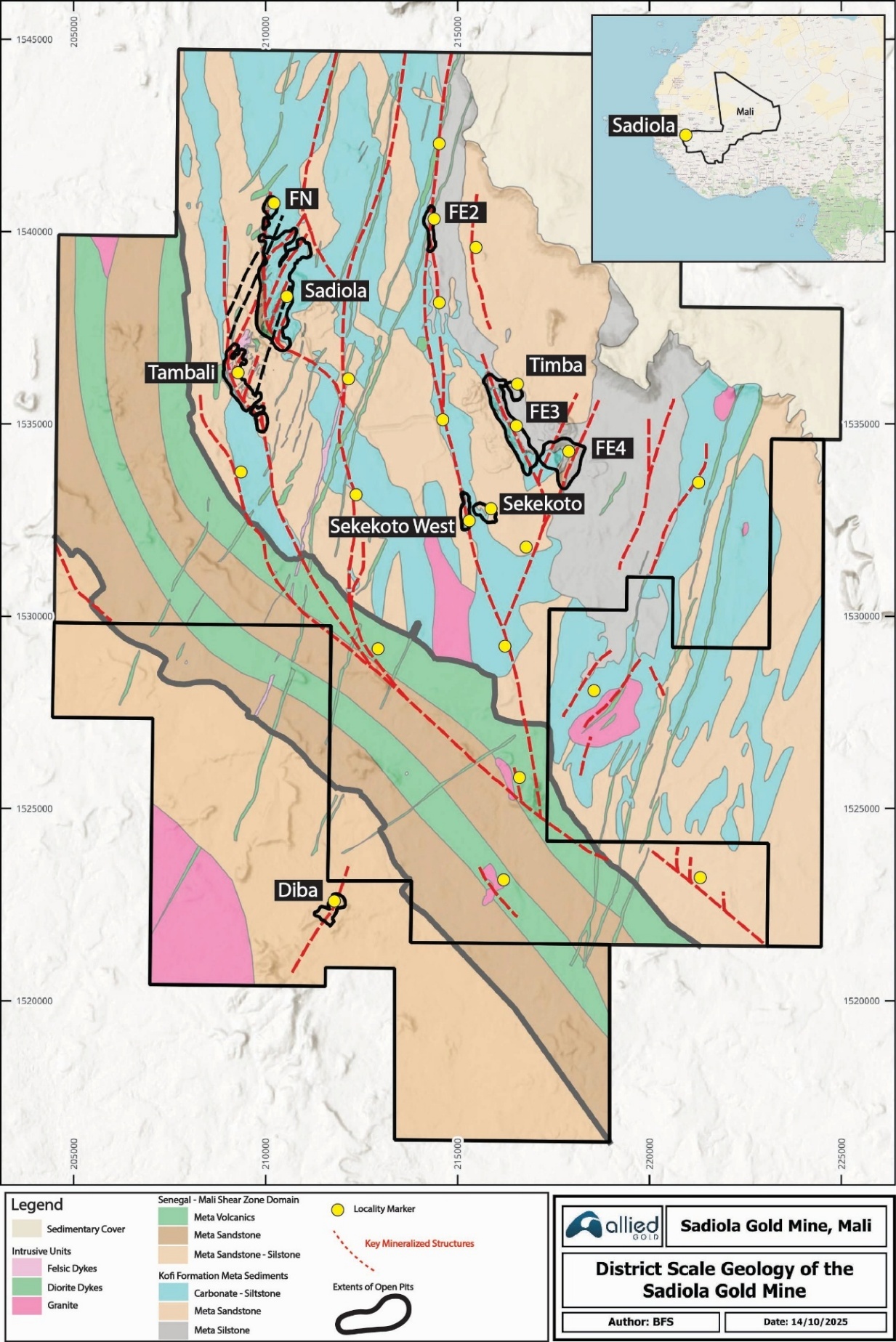

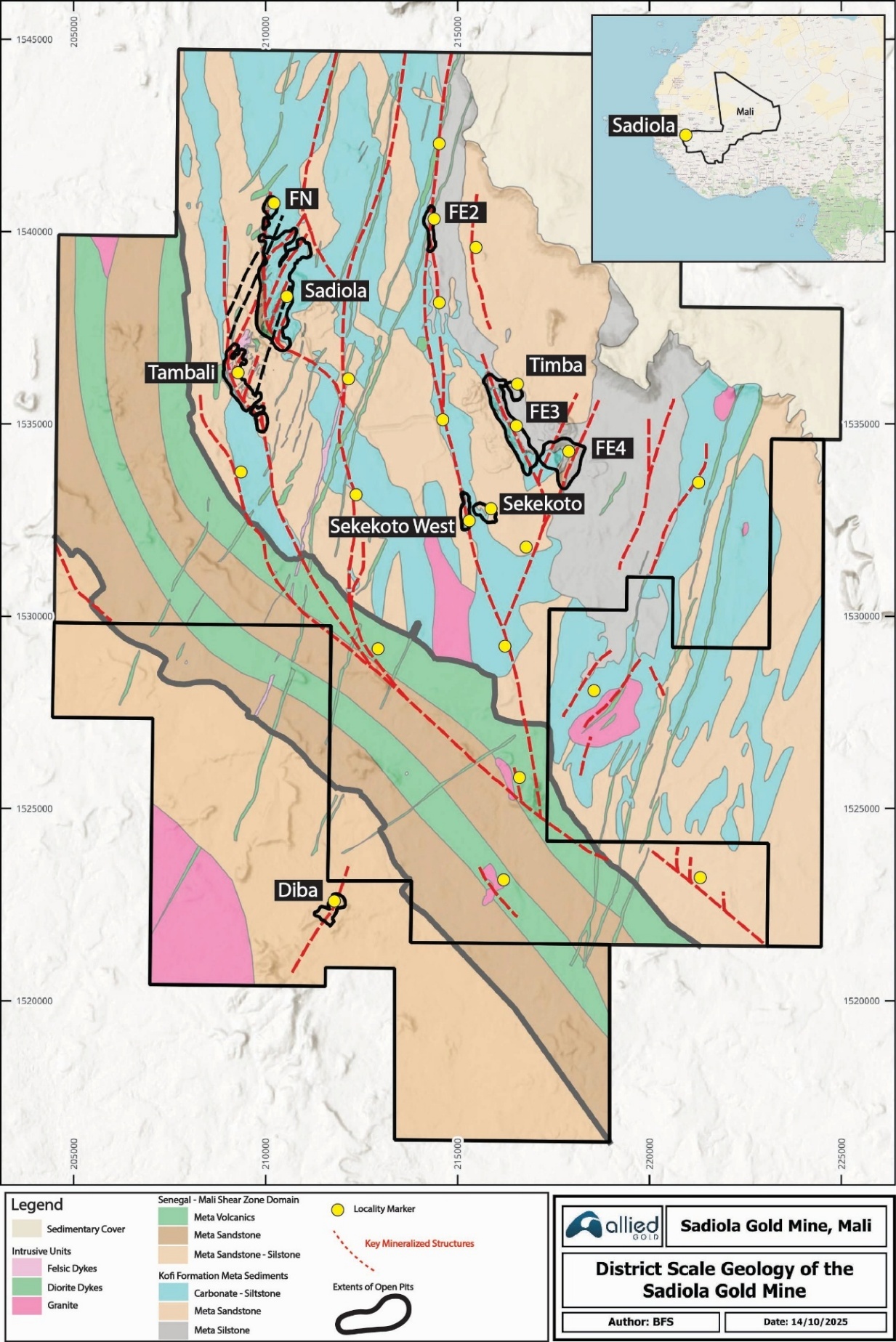

TORONTO, Oct. 29, 2025 (GLOBE NEWSWIRE) -- Allied Gold Corporation (TSX: AAUC, NYSE: AAUC) (“Allied” or the “Company”) is pleased to provide an update on the ongoing exploration and development activities at its Sadiola Mine in Mali, West Africa, highlighting continued discovery and resource expansion across multiple zones within this world-class gold mineralized system. This is the first of three planned exploration updates, with further releases covering the Company’s Kurmuk Project in Ethiopia and its Côte d’Ivoire assets expected in the coming months, all of which underpin the significant value and optionality in the Company’s portfolio, already characterized by peer-leading mineral inventories and production growth.

2025 Sadiola Exploration Program and Highlights

The Sadiola Mine is a long-life mine undergoing a transformational two-phased expansion plan, the first phase of which is expected to be completed this quarter. Over the longer-term, Sadiola is expected to produce up to 400,000 gold ounces per year at substantially lower costs, well below current costs and industry averages, which is planned to materially contribute to increasing cash flows. With a robust inventory of Mineral Resources and Mineral Reserves supporting increasing production for a long mine life, and with most, if not all mineralized zones open along strike and/or at depth, Allied has undertaken an extensive exploration plan for the following purposes, all of which are expected to create additional value at low finding costs: i) extending mine life likely well beyond the 19 years currently expected from existing Mineral Reserves, ii) increasing operational flexibility and efficiency with the identification and delineation of additional areas of mining, and iii) targeting new mineralized areas that appear to show better grades.

The Company’s five-year exploration goal for Sadiola is to reach over 14 million ounces of Mineral Resources, representing a sequential target of over 3.5 million ounces of new Mineral Resources in addition to the current inventory. The objective includes adding approximately 1.0 million ounces of new oxide, which, in turn, supports Sadiola’s medium-term and long-term expansion strategy, providing upside and optionality as discussed below. Mineral Resources and Mineral Reserves updates are planned to be presented on a yearly basis to document the ongoing mineral inventory buildout program, which is expected to be carried out with similar levels of annual expenditures to the approximately $12 million committed for the current year. Further, as the Phase 1 Expansion at Sadiola allows for the treatment of a higher proportion of abundant, higher-grade fresh ore, the Company expects an increase in the mine’s efficiency and overall performance by concentrating mining operations in fewer, bulkier areas and using new oxide areas as incremental production upside.

Five-Year and Near-Term Exploration Targets

- Sadiola Main: five-year target of 1.5 million ounces of dominantly fresh ore

- Tambali: three-year target of 1.0 million ounces of fresh/oxide ore

- Sekekoto/S12 Trend: two-year target of 0.35+ million ounces of oxide/fresh ore

- FE2 and FE3/4 Trends: three-year target of 0.70+ million ounces of oxide/fresh ore

New Discoveries and Zone Extensions Highlights

Exploration drilling has intersected significant new zones and extensions at Sekekoto West/S12, Tambali, FE2 Trend, and FE3/4 Trend (see Figure 1 for zone locations) with Sekekoto West and the southern part of the FE2 Trend (FE2.5) potentially providing short-term, new and more proximal high-grade oxide resources for the Sadiola mill as mining at Korali Sud winds down. Mineralization remains open along strike and at depth across all four target areas. Highlights include:

- Sekekoto West/S12: 33.0 m @ 15.23 g/t Au (SARC 1699) and 25.0 m @ 11.90 g/t Au (SARC1695)

- Tambali: 12.6 m @ 18.87 g/t Au (SADD181) and 6.7 m @ 8.74 g/t Au (SADD264)

- FE2 Trend: 3.0 m @ 28.19 g/t Au (SARC2318) and 8.0 m @ 6.55 g/t Au (SARC2321)

- FE3/4 Trend: 18.0 m @ 10.68 g/t Au (SARC1957) and 20.0 m @ 5.53 g/t Au (SARC1948)

Figure 1: Sadiola Project Plan Map

Exploration Progress Highlights by Zone

Sadiola Main

- This 2,500 m × 200 m deposit remains open down-plunge to the south and at depth beyond 800 m, with excellent potential for underground development

- Drill testing commenced in late Q3 2025 targeting down-plunge and down-dip extensions and additional oxide zones along the western side of the deposit

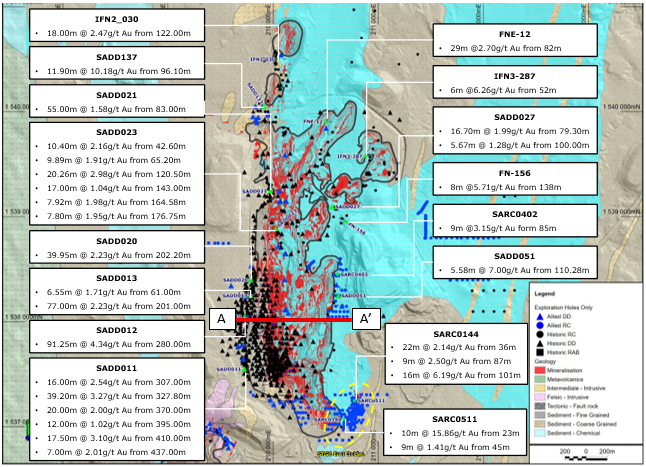

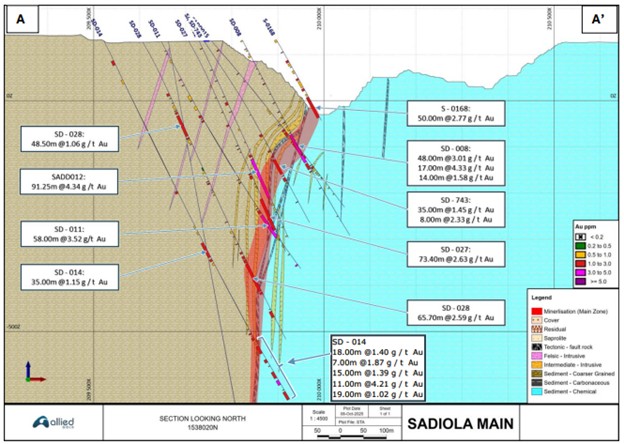

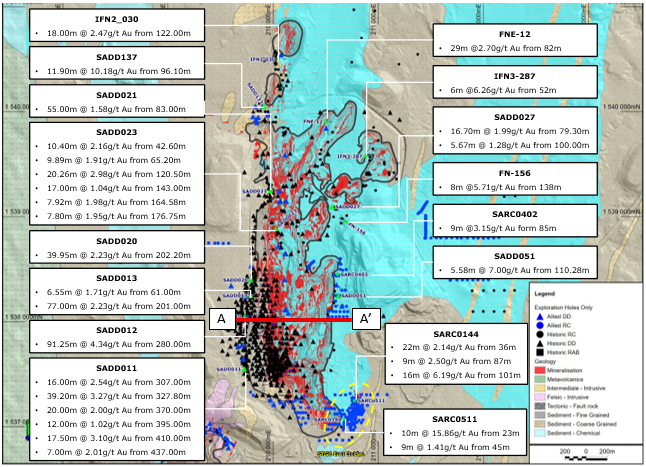

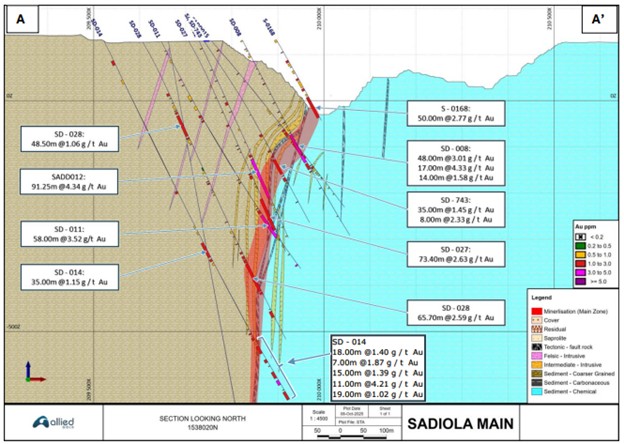

- See Figure 2 for Sadiola Main Deposit Geology and Drill Plan, and Figure 3 for Sadiola Main Deposit Reference Section

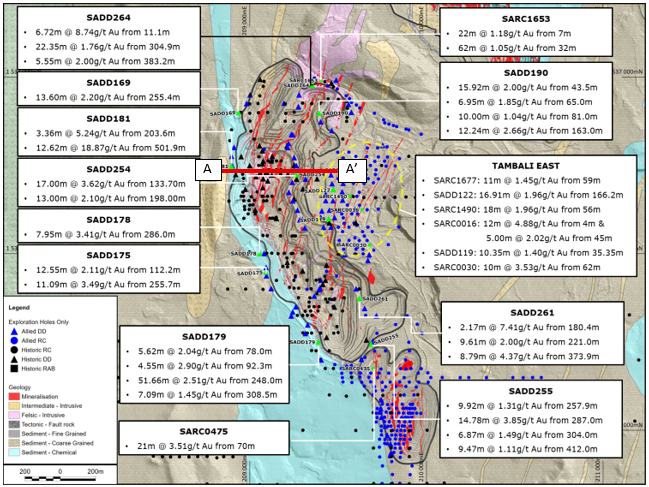

Tambali

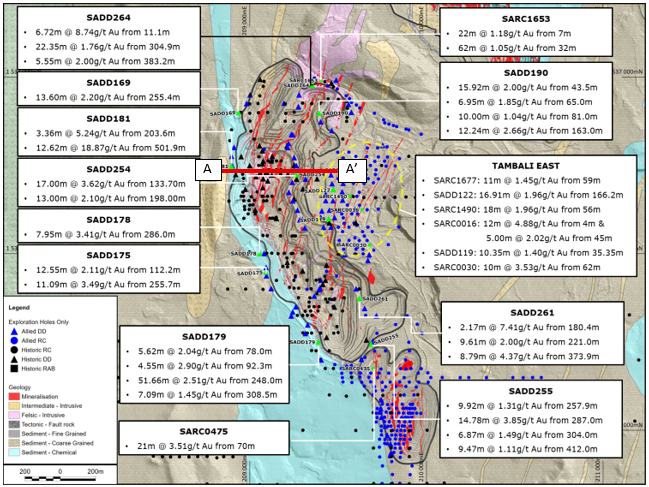

- A 2,200 m × 500 m mineralized zone, located 600 m to the west of the Sadiola Main Pit, that remains open to the north, northeast and at depth

- 2025 drilling (44 holes, 12,005 m) intersected multiple fresh rock zones including 12.6 m @ 18.9 g/t Au and 31.2 m @ 2.8 g/t Au

- A drill program targeting high-grade oxide targets is planned for late 2025/early 2026 with updated modelling and resource estimate updates in Q1 2026

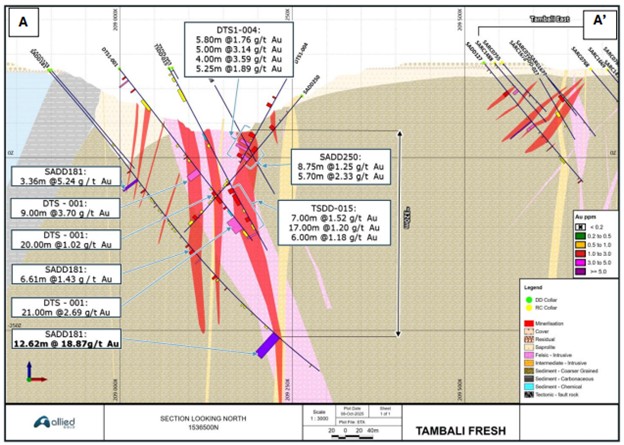

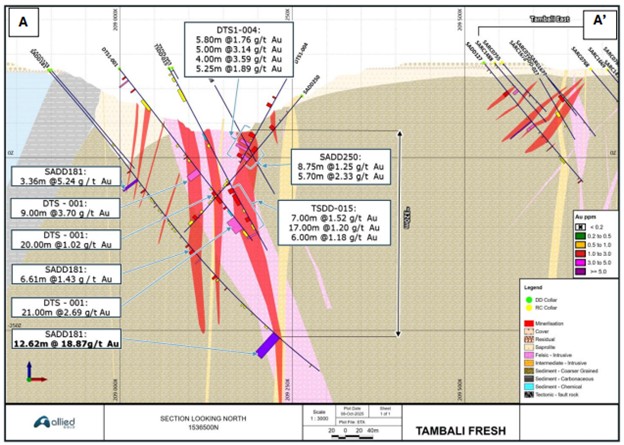

- See Figure 4 for Plan view Tambali Geology and Drilling, and Figure 5 for Tambali Type Section

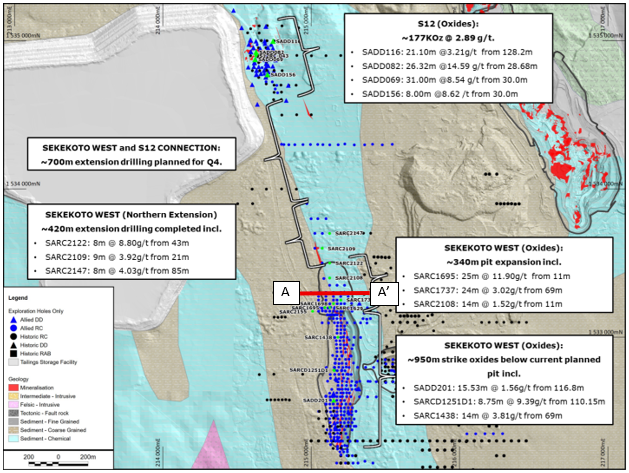

Sekekoto West and S12

- Sekekoto West oxide and fresh mineralization has been traced for 1,400 m along strike and remains open to the north towards S12

- 2025 drilling (91 holes, 9,281 m) intersected grades up to 25.0 m @ 11.9 g/t Au and 41.0 m @ 7.1 g/t Au.

- Geophysical surveys are planned to trace the mineralized contact zone north toward S12 and for another 1,400 m to the north of S12

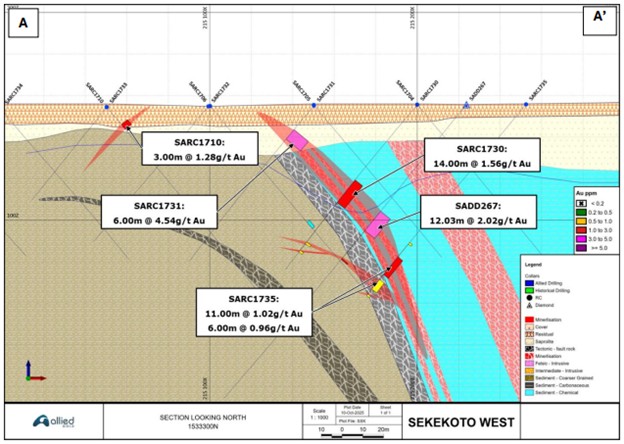

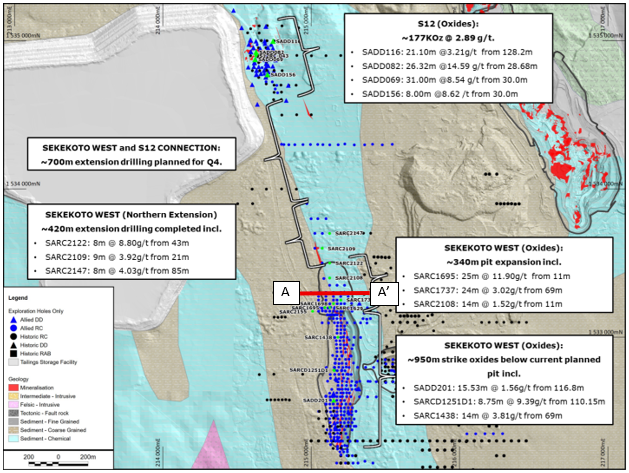

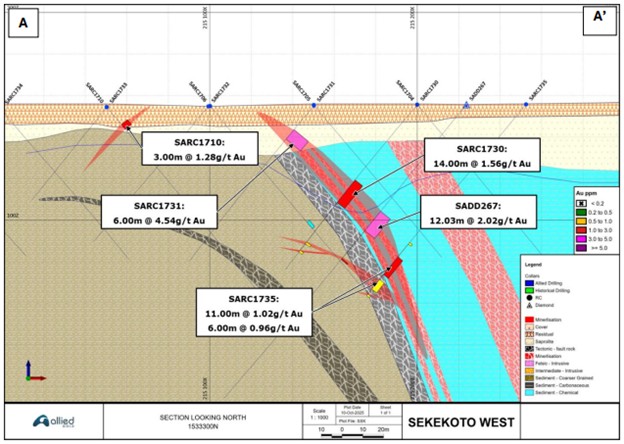

- See Figure 6 for Sekekoto West and Sekekoto Drill Plan and modelled/active pits, and Figure 7 for Type Section Sekekoto West Deposit

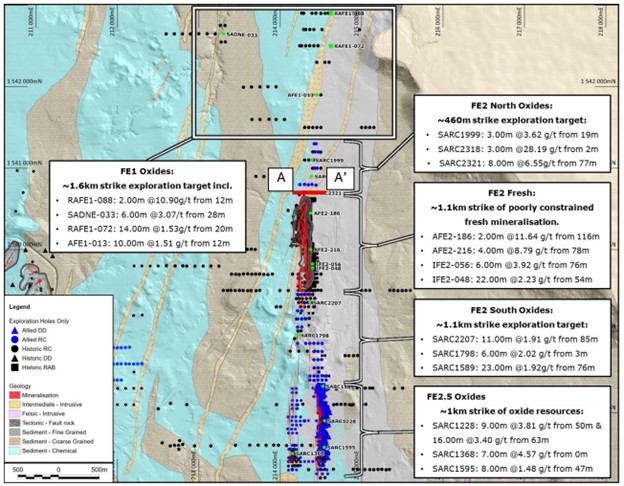

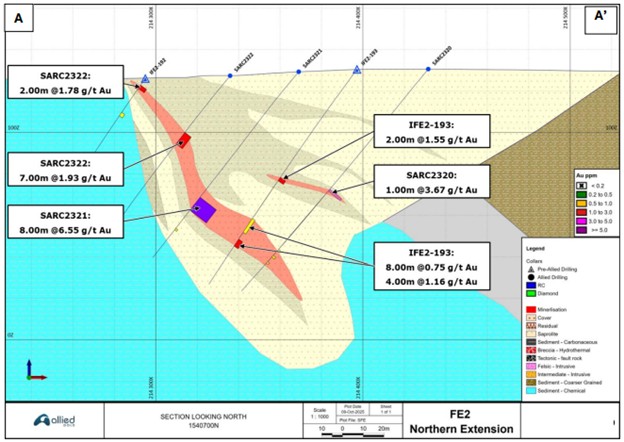

FE2 Trend

- Oxide and fresh gold mineralization has been traced continuously for over 3.9 km and remains open to the north and at depth

- 2025 drilling (452 holes, 26,378 m) returned intercepts including 3.0 m @ 28.19 g/t Au and 23.0 m @ 1.92 g/t Au, highlighting ongoing near-surface potential

- Additional drilling planned to extend mineralization to north and infill as necessary. An updated mineral resource is planned for Q1 2026

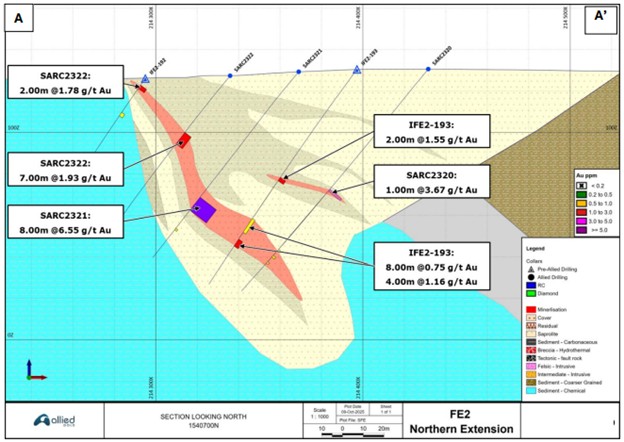

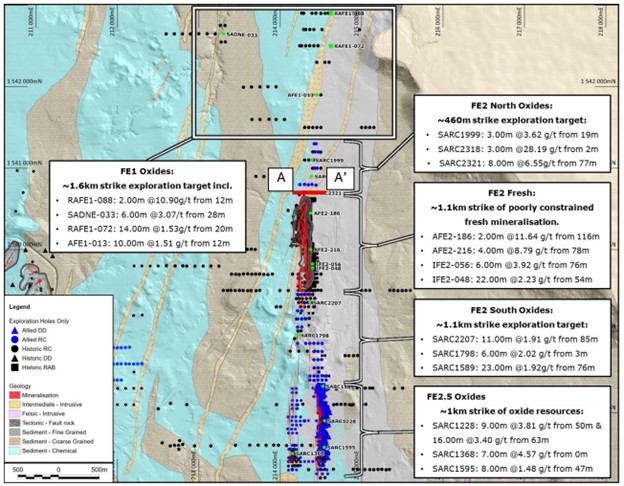

- See Figure 8 for FE2 Trend Geology and Drill Plan and Figure 9, as a typical section of FE2N

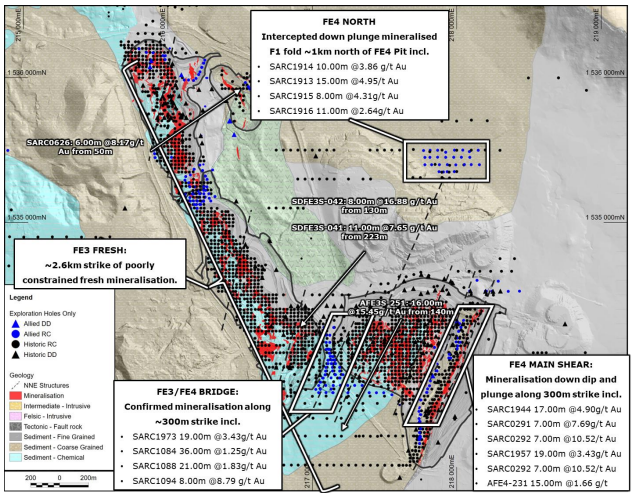

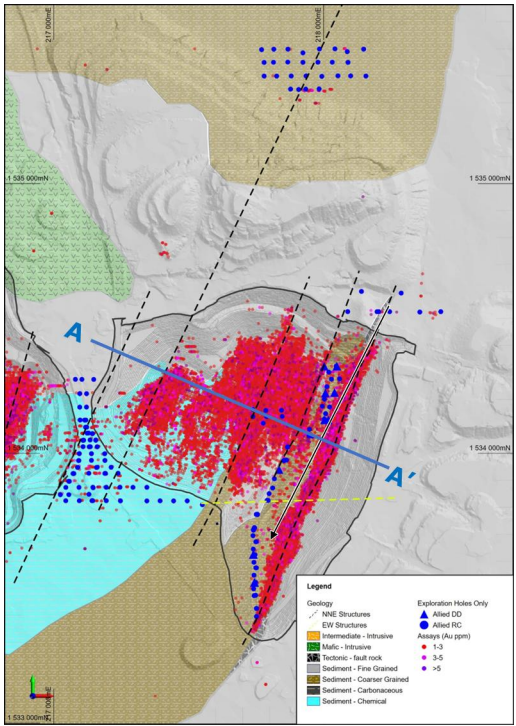

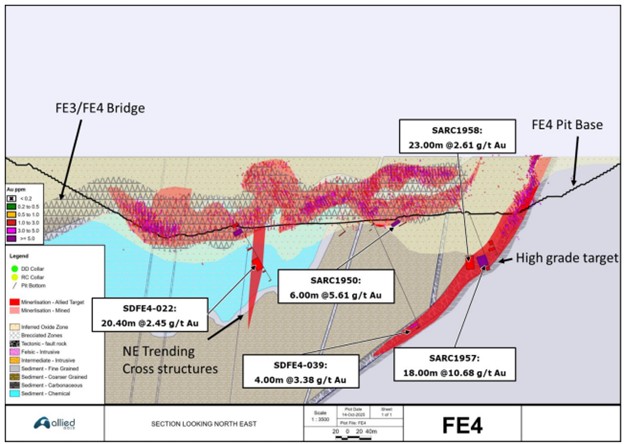

FE3/4 Trend

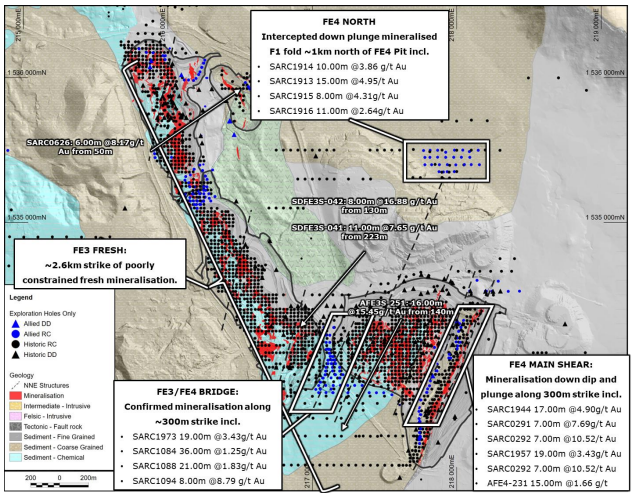

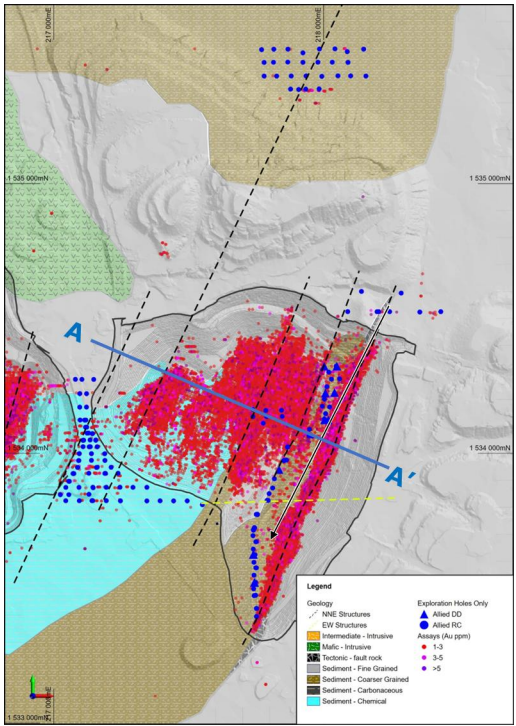

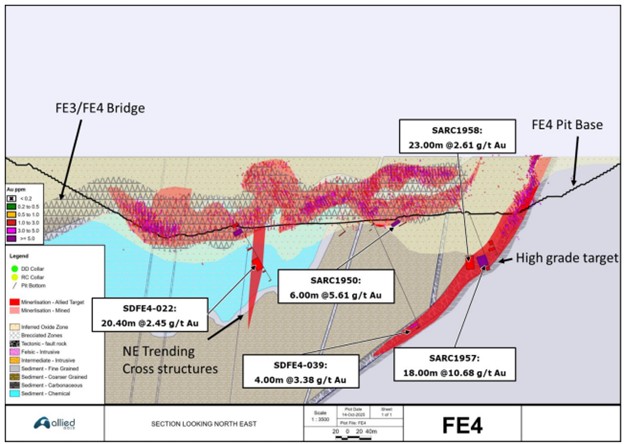

- Covers a 3.25 km × 1.1 km mineralized corridor with historic production of 1.33 Moz(1)

- Recent intercepts of 18.0 m @ 10.68 g/t Au and 17.0 m @ 4.90 g/t Au confirm the potential for resource expansion down-dip and along NE-trending shears subject to ongoing metallurgical studies

- 80 of a planned 200-hole resource conversion program now completed. Obvious additional places to test, especially along northeast-trending structures

- See Figure 10 for FE3/FE4 Pits, Summary Geology and Drill Plan, Figure 11 for FE4 Pit Grade Dot Plot, Allied Drilling and Section Location, and Figure 12 for Interpreted Geological and Drill Section Through FE4 Pit

Detailed Drill Data

Significant drill intercepts, with a 0.5 g/t Au cut-off, since January 2025, by zone, are available through the following link. Estimated true widths vary from 45% to 90% drilled length with true widths in Sekekoto holes SARC1631, 1632, 1685, 1691 and 1699, are not clear as they were drilled semi-parallel to the zone. A summary of drill hole collars can be found at this link.

Discussion and Next Steps

Since January 1, 2025, Allied Gold’s exploration, comprising 700 holes totaling 60,496 m of drilling (including sterilization drilling), has focused on targeting oxide gold mineralization with a lesser emphasis on fresh-rock-hosted gold mineralization. Significant amounts of oxide and fresh rock gold mineralization have been intersected at the Tambali, Sekekoto/S12 Trend, FE2 Trend and FE4 zones (see Figure 1 for locations). This ongoing work highlights Allied's commitment to creating long-term value through focused and sustained exploration. The next steps of the program are summarized below:

- Continued drilling across FE2 Trend, FE3/4, Sekekoto West/S12, Tambali and Sadiola through Q4 2025 and into 2026 and beyond

- Initiation of IP geophysical surveys along a 2.3 km gap between Sekekoto West and S12 and north of S12 to the boundary of the historic IP survey

- Resource modelling and updated mineral resource estimate for multiple zones expected in Q1 2026

- Ongoing 3D geological modelling integrating magnetic, gravity, and electromagnetic survey data to identify additional blind targets

Strategic and Development Context

Allied Gold’s 2025 exploration program continues to deliver strong results across multiple target areas, providing Sadiola with increased operational flexibility in the short term as well as optionality to leverage its increased sustainable production capacity after completing the Phase 1 Expansion later this year and in preparation for subsequent phases.

The completion of the initial expansion will allow Sadiola to treat up to 60% of fresh rock at a rate of up to 5.7 Mt/y in the modified process plant, allowing the mine to produce within an expected range between 200,000 and 230,000 ounces of gold per year in the medium term, with the higher end of the range driven by the addition of moderate-to-high-grade oxide ore to the plant feed.

The Phase 2 Expansion, currently planned as a new processing plant with capacity of up to 10 Mt/yr of fresh and oxide ore with targeted start production in late 2028, is expected to increase production to an average of 400,000 ounces per year for the first four years and 300,000 ounces per year on average for the mine's life, with AISC(2) expected to decrease to below $1,200 per gold ounce. Further, the Company is conducting engineering studies to determine the optimal path for expansion, including the option of progressively expanding the existing plant after the Phase 1 Expansion, with the aim of achieving similar ultimate production levels at a lower capital intensity. While this progressive expansion would also allow for the treatment of fresh and oxide ore, its installed capacity could be leveraged and maximized with additional oxide ore sources, as well as high-grade transitional ore in the medium to longer-term.

As such, although Sadiola showcases a long mine life underpinned by an impressive inventory of nearly 10 million ounces in Measured and Indicated Mineral Resources(3), and nearly seven million ounces in Mineral Reserves, its exploration strategy can materially improve its production profile, cash flows, optionality and value creation, leveraging its ongoing expansion plan.

Technical Discussion

The Sadiola Mine is a long-life mine that has produced approximately 8.8 million ounces of gold(1) primarily from oxide gold mineralization. Current end of year 2024 Reserves total approximately 7 million ounces of gold in 149.7 million tonnes grading 1.45 g/t Au. Mineral Resources, inclusive of reserves comprises Measured and Indicated Mineral Resources of 10 million ounces grading 1.46 g/t Au and Inferred Mineral Resources of 496,000 ounces grading 1.08 g/t Au. Most, if not all mineralized zones are open either or both along strike and to depth with high expectations that additional zones will be discovered.

Since January 1, 2025, Allied Gold’s exploration, comprising 700 holes totaling 60,496 m of drilling (including sterilization drilling), has focused on targeting oxide gold mineralization with a lesser emphasis on fresh-rock-hosted gold mineralization. Significant amounts of oxide and fresh rock gold mineralization have been intersected at the Tambali, Sekekoto/S12 Trend, FE2 Trend and FE4 zones (see Figure 1 for locations). This ongoing work highlights Allied's commitment to creating long-term value through focused and sustained exploration.

The Sadiola property overlies a regionally distinct part of the Western Malian Gold belt where there are more carbonates attesting to a regionally unique original basin architecture. A strong westward rotation of the Senegal-Mali Shear Zone, at the south end of the property, perhaps enhanced by the early basin architecture also created a low-pressure zone that supported the emplacement of felsic to intermediate intrusions and associated higher heat flow and shear zones. Structurally-hosted gold mineralization occurs in all rock types with a preference to the carbonate-clastic contact and in intrusions. Each of the Sadiola Main, Tambali, Sekekoto, FE2.5 and FE4 Zones lie along a limestone-clastic sediment contact that has been fold-repeated up to seven times across the Sadiola Property. This contact has been the focus of shearing, faulting, local carbonate dissolution and gold-bearing mineralization. Silicification, sulphidation (pyrite, arsenopyrite and stibnite), potassic (biotite) and skarns (Sadiola Main Deposit) are the dominant alteration types. The result is a world class series of gold deposits that will not be fully defined for quite a few years if ever.

The following sections provide additional details for the primary target areas including figures that present context and select drill hole intercepts, greater than 10 g/t Au x metres, from unmined areas. Thus, some hole assay summaries may not contain all drill hole intercepts for that respective hole.

Sadiola Main

The Sadiola Main deposit, including a group of smaller northeast-trending deposits, has been traced for 2,500 m along strike, up to 200 m across strike ( Figures 1 and 2), to approximately 800 m depth and remains open at depth. The oxidized portions of the deposit have been mined down to 200 m to 220 m below surface. Mining of the remaining oxide and transition facies mineralization is ongoing. A type section through the middle of the deposit ( Figure 3) shows the strong gold grades over good widths along the central part of the zone extending to below the area tested by drilling and numerous, secondary mineralized structures.

Drilling recently resumed testing the Sadiola Main deposit with goals of:

- better defining the numerous mineralized sub-structures within the reserve pit envelope to further reduce waste-to-ore ratios,

- extend oxide gold zones, especially where the northeast-trending Tambali zones would intersect the Sadiola Main deposit, and

- further trace the deposit to the south and at depth, to provide support for extending the Sadiola Pit to the south perhaps eventually linking up the Tambali Pit with the Sadiola pit.

Tambali

The 2,200 m by 500 m Tambali deposit lies approximately 600 m southwest of the Sadiola Main Deposit (see Figure 1). Its western extent is controlled by a graphitic unit which lies at a north-northwest trending, limestone-clastic sediment contact. Multiple corridors of northeast-trending intrusion- to sediment-hosted gold mineralization that extend towards the Sadiola Main open pit may be correlated to the northeast trending zones in the Sadiola Main Pit. The upper, oxide gold mineralization portion of the deposit was mined until 2023 with production of approximately 403,000 ounces of gold(1). Historic drilling indicates that the oxide gold mineralization is open to the north and in local areas within the pit. Over the last couple of years, Allied has carried out several modest drill campaigns to test the fresh rock portions of this deposit with dual goals of defining near surface fresh rock mineral resources which could be processed in the Sadiola mill as needed and testing for additional oxide gold mineralization.

Since January 2025, Allied has completed 44 holes totaling 12,005 m of drilling ( Figure 4), dominantly to further define the northeast-trending mineralized structures. Gold-bearing mineralization dominantly occurs in numerous discrete cross-cutting structures and along bedding planes along the entire strike length of the deposit with the deepest intercepts to a maximum of approximately 400 m below surface. It is likely that the mineralized trend continues to the north and to the northeast, towards the Sadiola Main Deposit and is open to depth. Allied drilling has intersected multiple mineralized structures with intercepts to 18.9 m @ 12.6 g/t Au in hole SADD 181 and 31.2 m @ 2.84 g/t Au in SADD138. Mineralization is hosted by felsic and mafic dykes and in the clastic sediments. Modelling of these multiple zones of gold mineralization is ongoing. A type-section of the deposit with select drill intercepts displayed is presented in Figure 5.

Figure 2: Sadiola Main Deposit Geology and Drill Plan

Figure 3: Sadiola Main Deposit Reference Section

Figure 4: Plan view Tambali Geology and Drilling

Figure 5: Tambali Type Section

Sekekoto West and S12

Exploration drilling in 2025 comprised 91 holes totaling 9,281 m including a significant amount of closely spaced drilling to support a dominantly oxide resource estimate ( Figure 6). Gold mineralization has been intersected in three areas, Sekekoto, S12 and Sekekoto West (most recent discovery).

Sekekoto is a northwest trending gold-bearing structure that lies on the east side of a carbonate unit that produced 41,000 ounces of gold(1). Sekekoto West lies adjacent to the western side of the same carbonate unit. IP resistivity data highlights the carbonate-clastic sediment contact and has provided a good guide for drilling to trace the mineralization along the geological contact to the north.

Sekekoto West is a relatively recent discovery. Oxide and fresh gold mineralization has been traced for approximately 1,400 m along strike and to 80 m depth (the limit of drilling) with a short-term focus on the oxide gold mineralization. Sekekoto West consists of one to two northerly-trending mineralized zones and at least one northeast-trending intersecting structure where drilling returned better-than-average widths and grades ( Figure 5). Significant intercepts include 1.82 g/t Au over 30.00 m, 2.57 g/t Au over 8.00 m, 5.19g/t Au over 10.00 m, 11.90 g/t Au over 25 m, and 7.06 g/t Au over 41.00 m. Higher grade zones appear to plunge moderately to the north, however, an overall shallow north plunge has also been inferred. Figure 7 presents a simplified cross-section through the north end of the Sekekoto West Deposit.

The S12 zone lies an additional 650 metres north of the northernmost Sekekoto West drilling. This zone, which lies just east of the tailings pond, has returned numerous significant results to 26.3 m grading 14.59 g/t Au. Modelling of this karst-like deposit will be carried out upon completion of a Q1 2026 resistivity survey to help define the karst open spaces, sand fill and breccias.

Drilling is advancing at 100 m step-outs to the north as we continue to intersect mineralization with the northernmost hole, with results returning a fresh rock, near-true-width intercept of 8 metres grading 4.03 g/t Au at approximately 70 m below surface. The zone appears to narrow to the south but will be tested further in the future.

Figure 6: Sekekoto West and Sekekoto Drill Plan and modelled/active pits

Figure 7: Type Section Sekekoto West Deposit

FE2 Trend

The at least 5,500 m long FE2 Trend also follows a carbonate-clastic contact. It comprises, from south to north, the 1.1 km-long FE2.5 oxide gold prospect, the 1.1 km FE2S zone, the historic 1.2 km long FE2 pit (produced 108,000 ounces(1)) and the FE2N portion for another 500 m to the north of the FE2 pit ( Figure 8). Oxide gold mineralization has now been followed, more or less continuously for 3.9 km and remains open to the north. Allied drilling along this trend in 2025 comprised 452 holes totaling 26,378 m of drilling. Only oxide gold mineralization was mined at the FE2 pit with reports that a material amount of oxide gold mineralization remains. As well, drilling below the FE2 pit continued to intersect economic-grade gold mineralization in fresh rock to approximately 140 m depth, beyond this the zone is still open.

The FE2.5 zone has been detailed drilled with potential for a modest-sized oxide gold mineral resource. Notable FE2.5, intercepts include 3.4 g/t Au over 16 m, 1.92 g/t Au over 23 m and 6.55 g/t Au over 8 m. The FE2.5 deposit comprises up to three mineralized lenses plunging approximately 10° to the north and dipping shallow to moderately east. The mineralization has been traced down to a vertical depth of 120 m and remains open to depth. Since completing the FE2.5 drilling, drilling was carried out on the 1.1-km-long portion of the trend (FE2S) between the FE2 pit and FE2.5 resource and north of the FE2 pit. Six short, 100 m spaced RC fences, completed north of the FE2 pit, all returned gold values with better intercepts in both oxidized and fresh rock returning 28.19 g/t Au over 3 m, 6.55 g/t Au over 8 m ( Figure 9 cross-section), 4.14 g/t Au over 4 m and 1.84 g/t Au over 6 m. Additional drilling is required to be able to potentially define a mineral resource.

Figure 8: FE2 Trend Geology and Drill Plan

Figure 9: Type section FE2N

FE3/FE4 Trend

Both the FE3 and FE4 pits, which cover an area 3.25 km by up to 1.1 km wide, have been partially mined for their oxide resources ( Figure 10) with 1.33 million ounces produced(1). Allied commenced work over these zones in 2021 resulting in partial oxide mineral resource extraction, with ongoing drilling aimed at expanding mineral resources. To date in 2025, 112 holes totaling 12,232 m of drilling have been completed with an average hole depth of 109 m. This drilling focused on converting Inferred Mineral Resources to Indicated Mineral Resources and defining additional oxide resources with occasional holes testing the fresh rock portions at the FE4 pit and along the bridge between the FE4 and FE3 pits. These two deposits lie in an area where northeast-trending fold hinges intersect the carbonate-clastic contact. Higher grades occur in the southeast portion of the historic FE4 pit, in contact with a graphitic shear with recent intercepts to 10.68 g/t Au over 18 m ( Figures 11 and 12). Fresh rock and locally oxidized portions of the FE4 pit have been metallurgically challenging with elevated levels of copper and arsenic with drill definition of the fresh rock high-grade zone pending further metallurgical test work.

Exploration is targeting strike extensions of the northeast-trending fold-parallel secondary shears (intercepts to 4.95 g/t Au over 15 metres), the folded interface between the carbonate and clastic rocks in the FE3/FE4 Bridge ( Figure 10) and the down-dip extensions of the oxide and fresh gold zones.

Figure 10: FE3/FE4 Pits, Summary Geology and Drill Plan

Figure 11: FE4 Pit Grade Dot Plot, Allied Drilling and Section Location

Figure 12: Interpreted Geological and Drill Section Through FE4 Pit

END NOTES

(1) Production ounce totals from Sadiola Mine production records

(2) This is a non-GAAP financial performance measure and ratio. Refer to the Non-GAAP Financial Performance Measures section at the end of this news release.

(3) See Allied Gold’s Reserve and Resources statement Allied Gold Corporation - Mineral Reserves and Mineral Resources

Sampling and QA/QC Procedures

All exploration work at Sadiola follows industry-standard sampling, assay, and QA/QC protocols. RC samples are collected at one-metre intervals and split using a 75:25 riffle splitter. Diamond core is cut in half and sampled systematically. Quality control samples (certified reference materials, blanks, and field duplicates) are inserted at a ratio of 1:20.

Most assays are performed externally at Bureau Veritas Bamako (50 g fire assay) and MSA Bamako (photon assay). Allied’s on-site lab analyzes the sterilization hole samples and occasionally supports exploration by processing samples on a dedicated sample preparation line. Laboratories are audited annually and maintain high standards of analytical accuracy. Data management and validation are maintained through the Company’s Fusion database platform.

Qualified Person

All scientific and technical information in this press release has been reviewed and approved by Don Dudek, P.Geo., Chief Exploration Officer, who is a Qualified Person as defined under National Instrument 43-101. Don Dudek has verified the data disclosed in this press release.

About Allied Gold Corporation

Allied is a Canadian-based gold producer with a significant growth profile and mineral endowment, operating a portfolio of three producing assets and development projects located in Côte d'Ivoire, Mali, and Ethiopia. Led by a team of mining executives with operational and development experience and a proven track record of creating value, Allied is progressing through exploration, construction, and operational enhancements to become a mid-tier, next-generation gold producer in Africa and ultimately a leading senior global gold producer.

For further information, please contact:

Allied Gold Corporation

Royal Bank Plaza, North Tower

200 Bay Street, Suite 2200, Toronto, ON M5J 2J3 Canada

Email: ir@alliedgold.com

NON-GAAP FINANCIAL PERFORMANCE MEASURES

The Company has included certain non-GAAP financial performance measures and ratios to supplement its Condensed Consolidated Interim Financial Statements, which are presented in accordance with IFRS, including AISC per gold ounce sold.

The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company.

Non-GAAP financial performance measures, including AISC, do not have any standardized meaning prescribed under IFRS and, therefore, may not be comparable to similar measures employed by other companies. Non-GAAP financial performance measures intend to provide additional information and should not be considered in isolation as a substitute for measures of performance prepared in accordance with IFRS and are not necessarily indicative of operating costs, operating earnings, or cash flows presented under IFRS.

Management’s determination of the components of non-GAAP financial performance measures and other financial measures are evaluated on a periodic basis, influenced by new items and transactions, a review of investor uses and new regulations as applicable. Any changes to the measures are described and retrospectively applied as applicable. Subtotals and per unit measures may not calculate based on amounts presented in the following tables due to rounding.

The measures of AISC, along with revenue from sales, are considered to be key indicators of a Company’s ability to generate operating earnings and cash flows from its mining operations. This data is furnished to provide additional information and is a non-GAAP financial performance measure.

AISC PER GOLD OUNCE SOLD

AISC figures are calculated generally in accordance with a standard developed by the World Gold Council (“WGC”), a non-regulatory, market development organization for the gold industry. Adoption of the standard is voluntary, and the standard is an attempt to create uniformity and a standard amongst the industry and those that adopt it. Nonetheless, the cost measures presented herein may not be comparable to other similarly titled measures of other companies. The Company is not a member of the WGC at this time.

AISC include cash costs, mine sustaining capital expenditures (including stripping), sustaining mine-site exploration and evaluation expensed and capitalized, and accretion and amortization of reclamation and remediation. AISC exclude capital expenditures attributable to projects or mine expansions, exploration and evaluation costs attributable to growth projects, DA, income tax payments, borrowing costs and dividend payments. AISC include only items directly related to each mine site, and do not include any cost associated with the general corporate overhead structure. As a result, Total AISC represent the weighted average of the three operating mines, and not a consolidated total for the Company. Consequently, this measure is not representative of all of the Company’s cash expenditures.

Sustaining capital expenditures are expenditures that do not increase annual gold ounce production at a mine site and excludes all expenditures at the Company’s development projects as well as certain expenditures at the Company’s operating sites that are deemed expansionary in nature, such as the Sadiola Phased Expansion, the construction and development of Kurmuk and the PB5 pushback at Bonikro. Exploration capital expenditures represent exploration spend that has met the criteria for capitalization under IFRS.

The Company discloses AISC as it believes that the measure provides useful information and assists investors in understanding total sustaining expenditures of producing and selling gold from current operations and evaluating the Company’s operating performance and its ability to generate cash flow. The most directly comparable IFRS measure is cost of sales. As aforementioned, this non-GAAP measure does not have any standardized meaning prescribed under IFRS and, therefore, may - 7 -

not be comparable to similar measures employed by other companies and should not be considered in isolation as a substitute for measures of performance prepared in accordance with IFRS, and is not necessarily indicative of operating costs, operating earnings or cash flows presented under IFRS.

AISC is computed on a weighted average basis, with the aforementioned costs, net of by-product revenue credits from sales of silver, being the numerator in the calculation, divided by gold ounces sold.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking information” including “future oriented financial information” under applicable Canadian securities legislation. Except for statements of historical fact relating to the Company, information contained herein constitutes forward-looking information, including, but not limited to, any information as to the Company’s strategy, objectives, plans or future financial or operating performance. Forward-looking statements are characterized by words such as “plan”, “expect”, “budget”, “target”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words or negative versions thereof, or statements that certain events or conditions “may”, “will”, “should”, “would” or “could” occur. In particular, forward-looking information included in this press release includes, without limitation, statements with respect to:

- the Company’s expectations in connection with the production and exploration, development and expansion plans at the Company’s projects discussed herein being met;

- the Company’s plans to continue building on its base of significant gold production, development-stage properties, exploration properties and land positions in Mali, Côte d’Ivoire and Ethiopia through optimization initiatives at existing operating mines, development of new mines, the advancement of its exploration properties and, at times, by targeting other consolidation opportunities with a primary focus in Africa;

- the Company’s expectations relating to the performance of its mineral properties;

- the estimation of Mineral Reserves and Mineral Resources;

- the timing and amount of estimated future production;

- the estimation of the life of mine of the Company’s projects;

- the timing and amount of estimated future capital and operating costs;

- the costs and timing of exploration and development activities;

- the Company’s expectations regarding the timing of feasibility or pre-feasibility studies, conceptual studies or environmental impact assessments; and

- the Company’s aspirations to become a mid-tier next generation gold producer in Africa and ultimately a leading senior global gold producer.

Forward-looking information is based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and is inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking information. These factors include the Company’s dependence on products produced from its key mining assets; fluctuating price of gold; risks relating to the exploration, development and operation of mineral properties, including but not limited to adverse environmental and climatic conditions, unusual and unexpected geologic conditions and equipment failures; risks relating to operating in emerging markets, particularly Africa, including risk of government expropriation or nationalization of mining operations; health, safety and environmental risks and hazards to which the Company’s operations are subject; the Company’s ability to maintain or increase present level of gold production; nature and climatic condition risks; counterparty, credit, liquidity and interest rate risks and access to financing; cost and availability of commodities; increases in costs of production, such as fuel, steel, power, labour and other consumables; risks associated with infectious diseases; uncertainty in the estimation of Mineral Reserves and Mineral Resources; the Company’s ability to replace and expand Mineral Resources and Mineral Reserves, as applicable, at its mines; factors that may affect the Company’s future production estimates, including but not limited to the quality of ore, production costs, infrastructure and availability of workforce and equipment; risks relating to partial ownerships and/or joint ventures at the Company’s operations; reliance on the Company’s existing infrastructure and supply chains at the Company’s operating mines; risks relating to the acquisition, holding and renewal of title to mining rights and permits, and changes to the mining legislative and regulatory regimes in the Company’s operating jurisdictions; limitations on insurance coverage; risks relating to illegal and artisanal mining; the Company’s compliance with anti-corruption laws; risks relating to the development, construction and start-up of new mines, including but not limited to the availability and performance of contractors and suppliers, the receipt of required governmental approvals and permits, and cost overruns; risks relating to acquisitions and divestures; title disputes or claims; risks relating to the termination of mining rights; risks relating to security and human rights; risks associated with processing and metallurgical recoveries; risks related to enforcing legal rights in foreign jurisdictions; competition in the precious metals mining industry; risks related to the Company’s ability to service its debt obligations; fluctuating currency exchange rates (including the US Dollar, Euro, West African CFA Franc and Ethiopian Birr exchange rates); the values of assets and liabilities based on projected future conditions and potential impairment charges; risks related to shareholder activism; timing and possible outcome of pending and outstanding litigation and labour disputes; risks related to the Company’s investments and use of derivatives; taxation risks; scrutiny from non-governmental organizations; labour and employment relations; risks related to third-party contractor arrangements; repatriation of funds from foreign subsidiaries; community relations; risks related to relying on local advisors and consultants in foreign jurisdictions; the impact of global financial, economic and political conditions, global liquidity, interest rates, inflation and other factors on the Company’s results of operations and market price of common shares; risks associated with financial projections; force majeure events; the Company’s plans with respect to dividend payment; transactions that may result in dilution to common shares; future sales of common shares by existing shareholders; the Company’s dependence on key management personnel and executives; possible conflicts of interest of directors and officers of the Company; the reliability of the Company’s disclosure and internal controls; compliance with international ESG disclosure standards and best practices; vulnerability of information systems including cyber attacks; as well as those risk factors discussed or referred to herein.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that could cause actions, events or results to not be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking information. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES

This press release uses the terms “Measured”, “Indicated” and “Inferred” Mineral Resources as defined in accordance with NI 43-101. United States readers are advised that while such terms are recognized and required by Canadian securities laws, the United States Securities and Exchange Commission does not recognize them. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve calculation is made. United States readers are cautioned not to assume that all or any part of the mineral deposits in these categories will ever be converted into reserves. In addition, “Inferred Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. United States readers are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable.

Photos accompanying this announcement are available at:

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

globenewswire.com

|