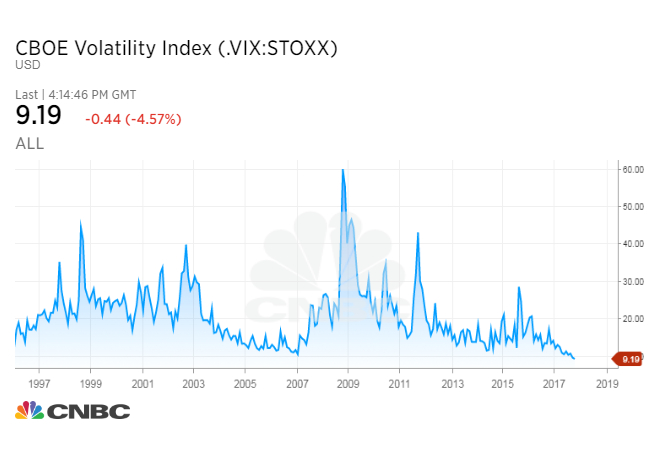

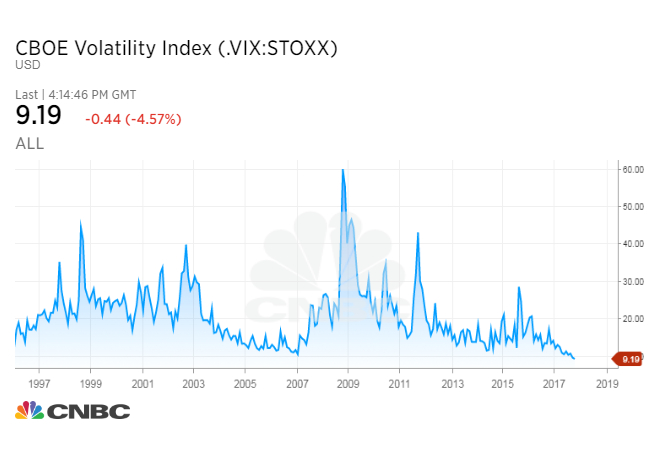

Wall Street's fear gauge posted its lowest close ever Thursday as U.S. stock markets continued to mark record highs in a seemingly unstoppable march higher.

The CBOE Volatility Index, or VIX, ended the day at 9.19, down nearly 5 percent since Wednesday. This widely followed index reflects the bets of options traders on the direction of the S&P 500. Right now it's saying traders are not worried about an imminent stock market sell-off.

The low level of volatility in the markets contrasts with supercharged indexes. The S&P 500 benchmark had its sixth-straight record high on Thursday, edging up 0.6 percent to 2,552.07. Technology-heavy Nasdaq hit intraday and closing highs, closing at 6,585.36, and the Dow Jones industrial average also closed at a record high 22,775.39.

Traders appear sanguine despite the uncertainties of tax reform getting through in Washington and escalated geopolitical tensions. But strong corporate profits this year have fueled the market rally, and third quarter earnings are expected to deliver the same.

The VIX has flirted with lows all summer. At one point in August some bold strategists were betting that it would bounce back to the double-digits, perhaps even above 20, now. Created in 1992 by Robert Whaley, a finance professor at Vanderbuilt University,the VIX is designed to measure the level of concern about the direction of the market in the next 30 days. |

|