good news

that as Team China wishes, cross-border transactions to be denominated in RMB, is coming true

and no, China does not care to and in truth wishes to avoid the RMB becoming a reserve currency, and only wants transactions cross-border with China to be done in RMB, comma, and

as such goes, need for treasuries shall disappear

wondering when RMB can be swapped for gold on the international spot market - only 46% to go, for dollars and for chips, and then, TeoTwawKi 2026, and from there on we go forth to Darkest Interregnum 2032

three more USA POTUS elections to go

zerohedge.com

Yuan Dominates US Dollar In China Cross-Border Payments

BY TYLER DURDEN

WEDNESDAY, SEP 20, 2023 - 06:45 AM

By Ye Xie, Bloomberg Markets Live reporter and strategist,

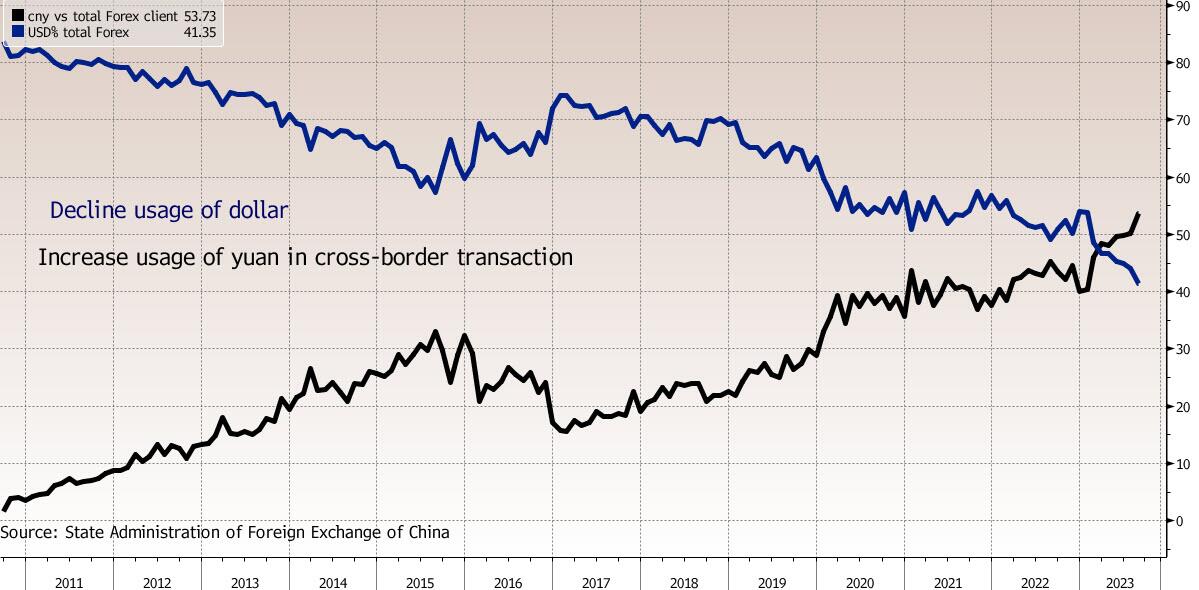

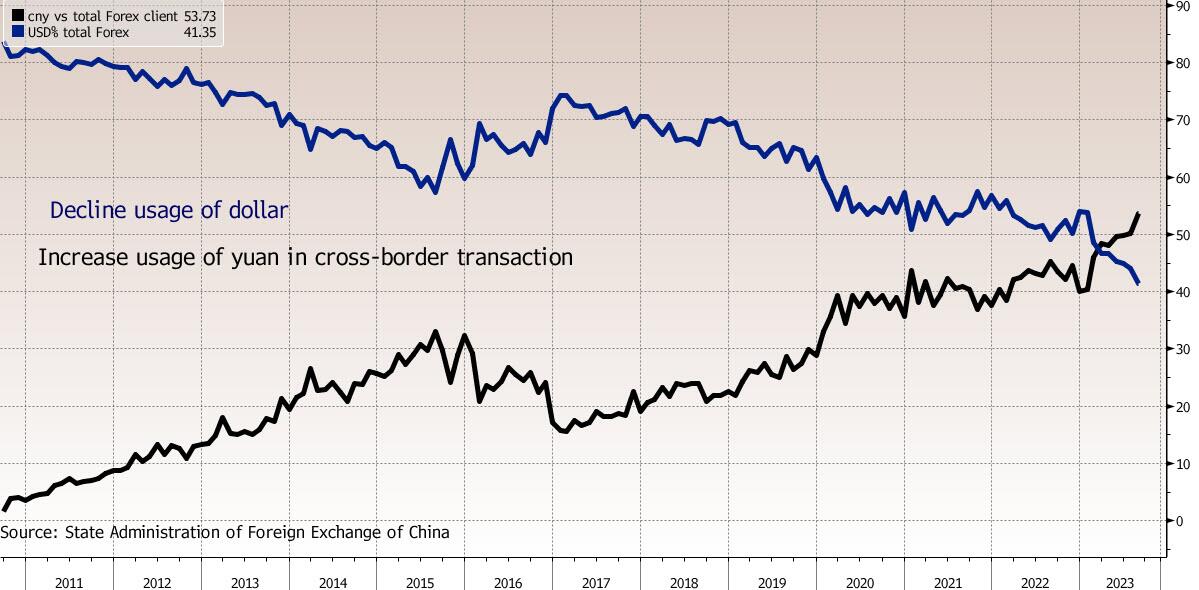

While the yuan is struggling in the foreign-exchange market, it continues to grow its market share in China’s cross-border transactions as the No. 1 payment currency.

That reflects progress of the yuan’s internationalization in trade, as well as growing influence of foreign capital flows to China’s financial markets.

The official settlement data Friday showed the yuan’s share in cross-border payments and receipts rose to a record 54% last month, compared with 41% for the dollar.

The data include goods and services transactions, as well as cross-border investments.

Since foreign investors trade Chinese stocks and bonds in the yuan, the ongoing opening of the capital market over the years has lifted the yuan’s market share in total transactions.

August, for example, saw foreign investors sell a record amount of Chinese stocks, which should inflate the yuan’s share in total cross-border transactions.

Even so, it’s still a long way before the yuan becomes a dominant international currency.

The latest data from SWIFT shows the yuan’s share in global payments rose to 3.1% in July, from 2.8% in June.It was dwarfed by the dollar’s 46% share and the euro’s 24%. |