Re <<black>>

Chaos is a gift, crisis a partner, volatility friend, lonely path right way, survive to survive another day, am reminded

Panic, best done when early, and is a survival trait, I seem to remember

zerohedge.com

Markets in Full-Blown Panic - VIX Goes Vertical

BY THE MARKET EAR

FRIDAY, APR 04, 2025 - 20:12

Panic

VIX has not closed this high since the Covid panic!

Source: Refinitiv

More panic

VIX 2/8 months futures spread exploding further. We traded even higher during the August panic, but back then we actually witnessed totally broken volatility markets. Current levels are extreme, but not broken, at least not yet...

Source: Refinitiv

"Overshooting" fear

VIX showing some of that pure panic look, as fear "overshoots" the SPX. Chart shows SPX vs VIX (inverted).

Source: Refinitiv

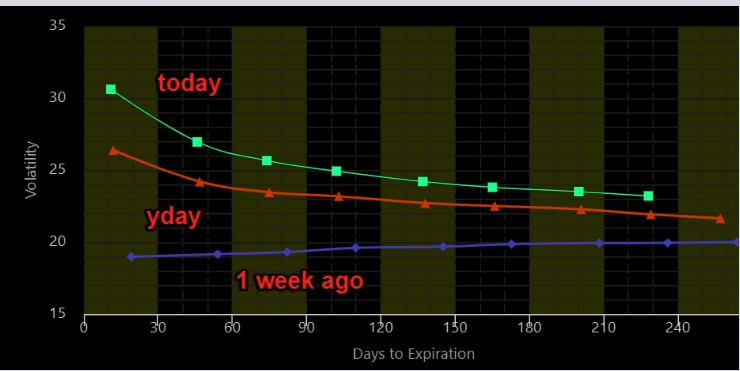

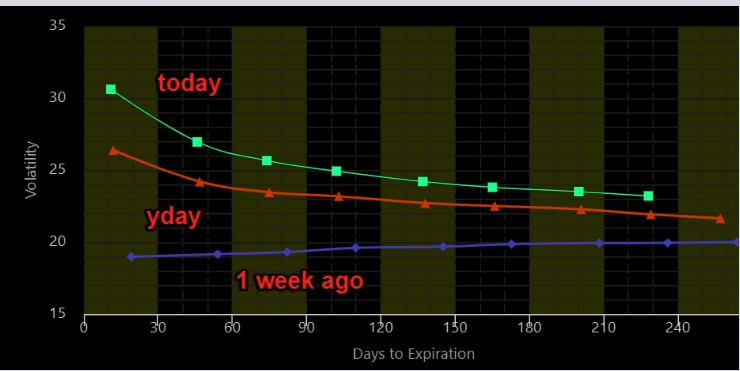

"Broken" VIX term structure

VIX term structure exploding to the uspide in pure panic fashion. Popular "volatility yield" strategies where investors have sold the short end of the curve vs buying the longer end of the curve in a "vol neutral" illusion, are being severely punished. Chart shows the curve 1 week ago, yesterday (already very stressed) and finally today's full blown panic shape.

Source: Vixcentral

Put love

Put call ratio at the highest levels since the August 2024 panic (note this is per yesterday's close).

Source: Tradingview

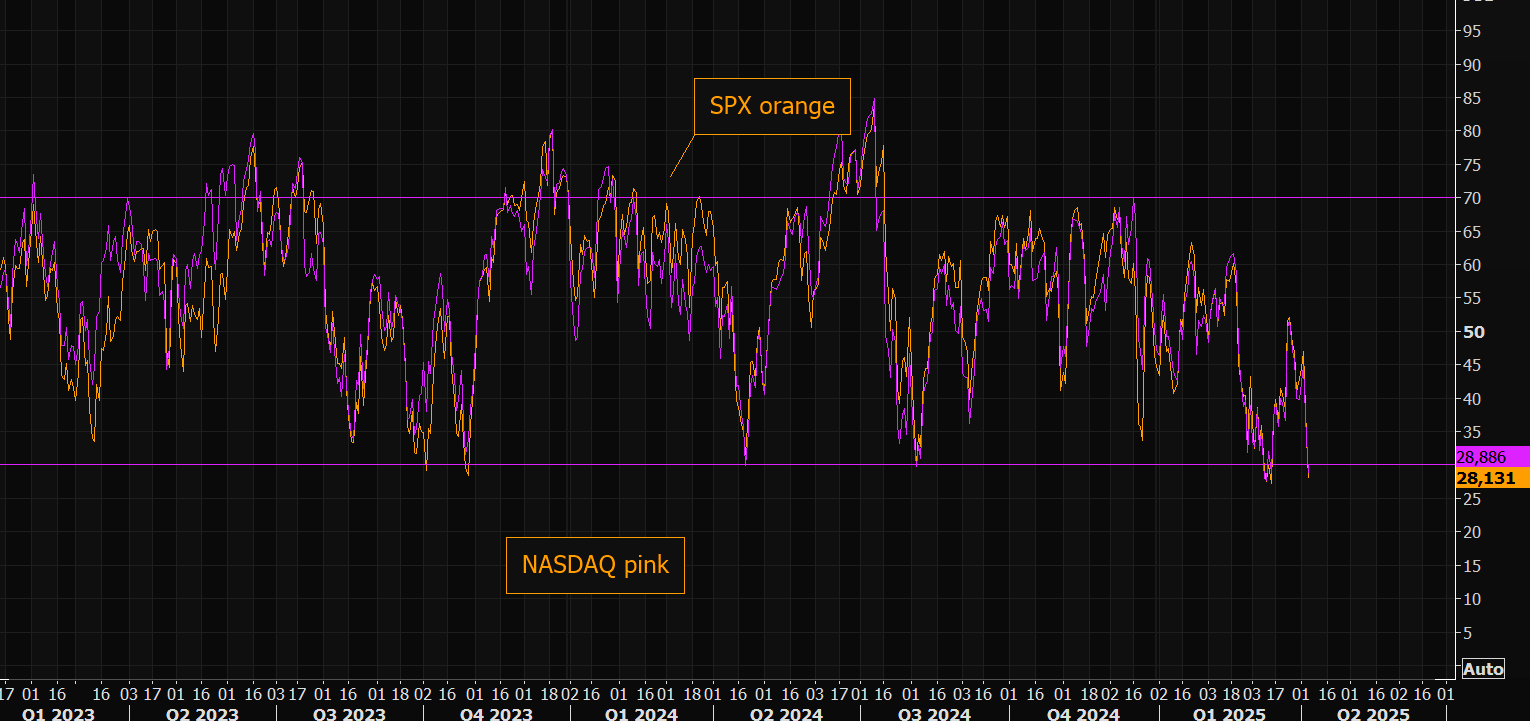

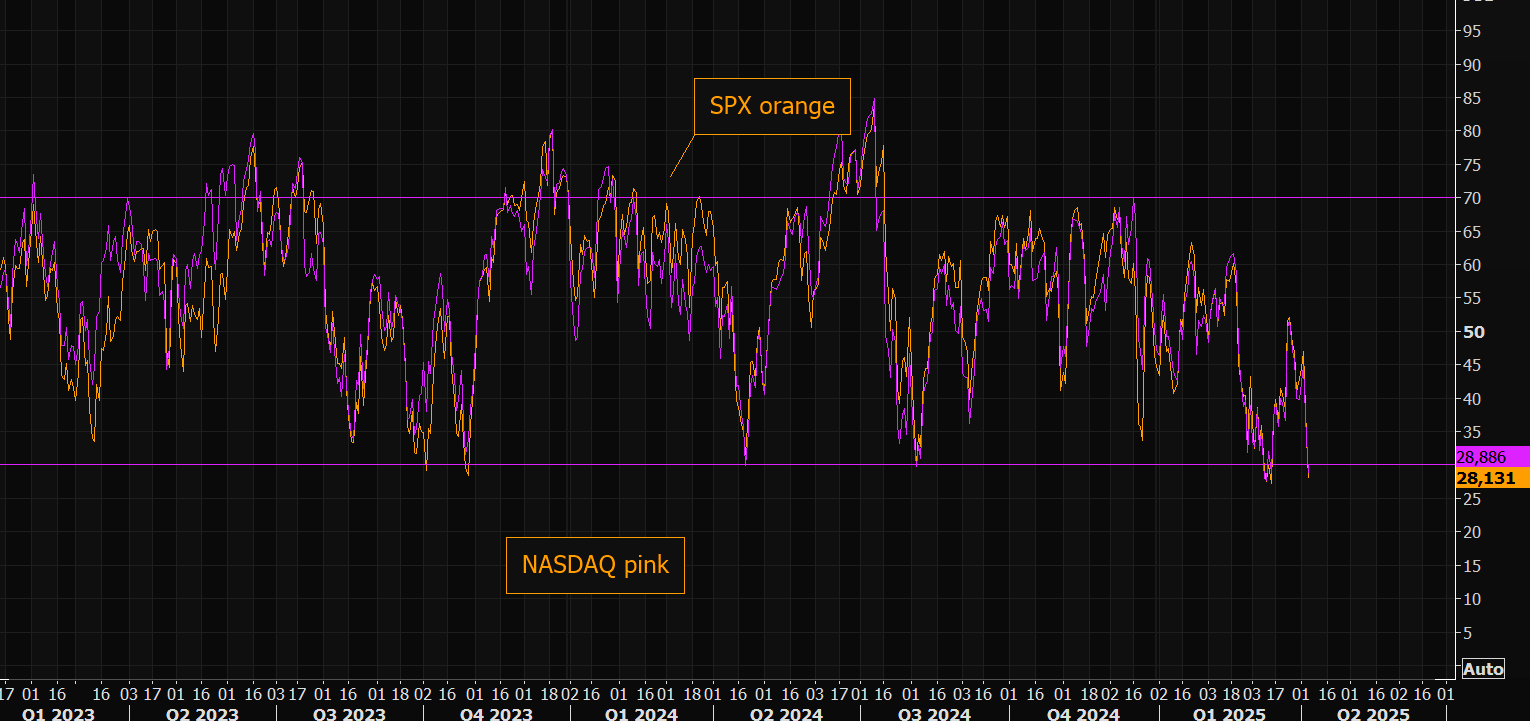

Oversold

RSI at rather extreme levels, but we all know things tend to stay in "over" territory for longer than most think possible.

Source: Refinitiv

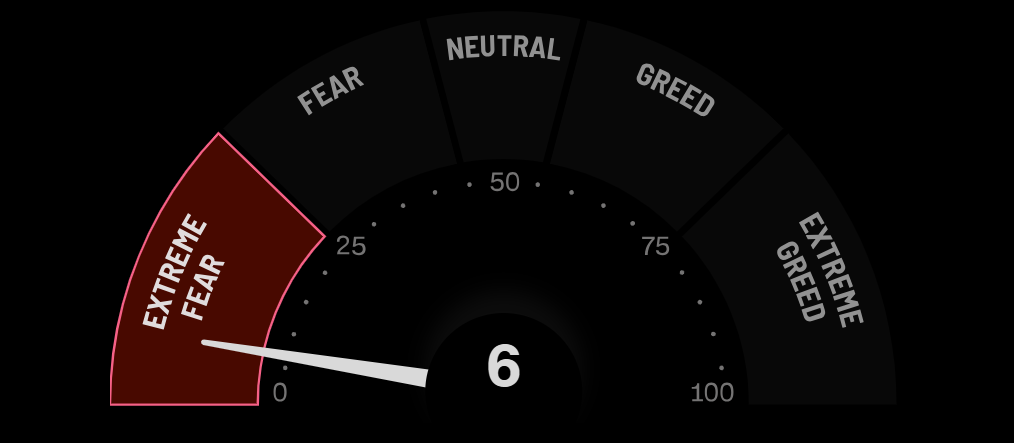

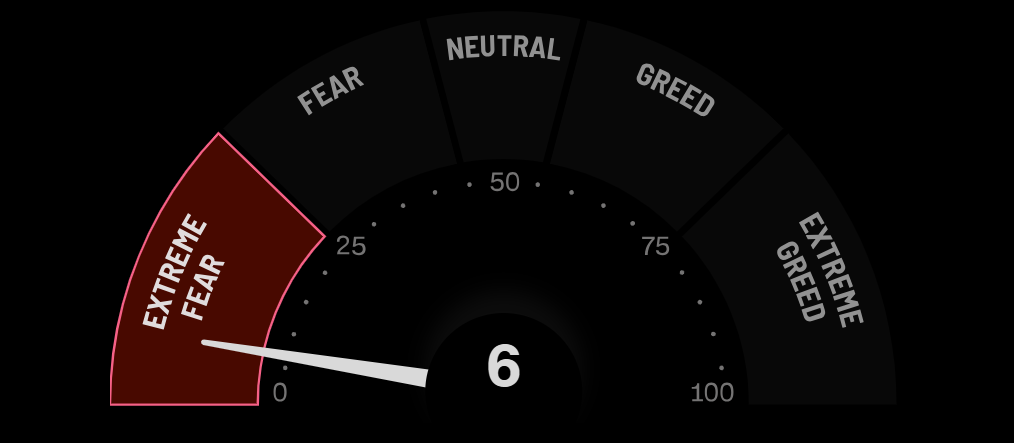

Getting extreme

We are hitting the most extreme fear levels in a long time. Time to be greedy soon, or stay away from catching falling knives?

Source: CNN |