Global warming.... the variability and rate of change in our Star's SUNSPOT activity and the Geothermal

activity that has been literally exploding all around the ring of fire along the west coast of North and South

America and then continues on over in Japan... the country wiped out by the massive natural disaster last

week..... and when You go to New Zealand you can stop by my Very old and dear friend Brett Higgin's mother's nature resort... called Hells gate because of all the geothermal activity and boiling hot water that naturally comes up from the earth...... If you have not been All over Australia, New Zealand, Japan.... and

slogged through some of India.... then there are just some things you are gonna miss out on.....

I spent 4 solid years in Sydney...... and only left Australia less than 10 -15 times in that time window.

| To: Yorikke who wrote (14150) | 6/8/2013 10:48:08 PM | | From: John P | 1 Recommendation of 21394 | | | Yorikke, I do want to add... and my edit time was up that I was thinking specifically about 2 groups of people when I was writing early today.... I got to watch a bit of the funeral ceremony for the firefighters and first responders in the very tiny town of west texas... who were volunteer firefigters and went to put out the fire at the fertilizer plant and were incinerated when the fertilizer blew up like a mushroom, crowd...... when you saw the large pictures of each of the men which were above their flag drapped coffin (I was in Chicago and was missing Texas, but really I was missing the small one stop light town that I grew up in, in New Jersey and the one that my mother, my Maternal Grandfather lived his whole life in and my great grandparents lived in .... up at the foothills of the Adironacks in upstate New York.... )

when I saw the pictures of the men, their faces ... a couple of them with Cowboy hats and a couple with other distinctive aspects to their portraits, the thought went through my mind that these were the kind of descent close knit community folks that I would like to spend time with.

The other thing rambling through my mind this morning.... I watched about an hour of different You tube videos shot by non professionals the day that the planes hit the twin towers in New York City..... in one particular video... I saw footage of the firefighters... loaded down with heavy loads of gear and marching single file into one of the buildings when it was on fire... the look of grim foreknowledge of where they were going was plainly on their face.... at least to me it was.....

it was as if they were thinking we are marching straight into hell or into a volcano and they knew that they probably would not make it out alive..... or they would be darn lucky if they did..... It was the same type of look on the soldier's faces at the start of the Normandy invasion on D Day in Stephen Spielberg's epic movie "Saving Private Ryan"..... they knew that if they looked at the man to their left and the man to the right ... that one out of two or one out of 3 would survive the next hour...... That takes something... some call it courage, others call it stupidity.... "i'm not giving my life for someone else, screw them"

I have had an insurance licenses twice before in the past as I have had series 7 licenses..... I took a 3 day Kaplan course... in early April... Party because it was paid for... second because I learned some things, as the laws and tests are always evolving.... ( much more focus on ethics, after Dodd-Frank and the Great Financial Crisis of 2007-2008).... and a third of the test is State Law and the last time I took it ....it was in Deland Florida... Florida Law...

People would be surprised if they knew how much state law differs from state to state... The course was so enjoyable because some of the best teachers of these courses are very successful professionals that have their own brokerages and own firms and they get to meet and impress entire new waves of people going into the business.... whether it's at a Morgan Stanley, or a New York Life or ABC corp... and the newbies will then often call them in 6 months later to help them with a more complex estate or tax minimization plan for a client.... or because the instructor... Walt Bronson of the Bronson Group, was my instructor and he was funnier than Jay Leno, Jimmy Fallon, Letterman and Kimmel combined.....

go check out www.bronsoncompany.com and you will get an idea of his unique sense of humor.....

when Walt was done at the end of the third day, he said we were all going to do great and pass the state licensing exam..... He then commented and this is more or less verbatim.... " You are going to get your score and see you have passed and you will feel so great.... the sky will look a richer shade of azure, the grass will seem profoundly greener, blue birds will be singing on your shoulders and you will be on cloud nine.... he then continued.... as you drive back towards your home stop off at a nursing home.... not one of the super cheap and impoverished ones... but not one of those that run 350,000$ a year...... a grade B nursing home..... and walk in and down the hall.... no one will stop you and ask you who you are.... people do not go to nursing homes and steal old people.. and as you walk down the hall you will see faces in each room turning to the door.... they will mostly be women..as the men die younger.... and each of the women will look up hopefully has someone come to visit me.... Walt said go in and talk with a few of them... He said he wears an extra jacket and layer of clothes due to the fact that the people are so starved to talk to someone from the outside that they wlll literally hold on to you and not let you go and the extra layer prevents bruising..... ( I believe he was embellishing on this specific point.... but that was BECAUSE he was trying to make a point....)

He then tied it back into our annual budget deficit and our $17 Trillion cummulative Debt that we will be talking about come labor Day...

I would encourage everyone to kick the tires and try it out....or else go to the local library and get involved with a literacy program for 1 month..... |

| | Share | RecommendKeepReplyMark as Last ReadRead Replies (1) |

|

| To: John P who wrote (14152) | 6/8/2013 11:27:47 PM | | From: John P | of 21394 | | | ..... continued from previous page..... or go to your local house of worship and try going once a week for a month.... I have been involved with Bible Study fellowship, albeit with periods of absence due to travel, moving, illness etc... since Dec of 1999.

I got interested in the bible due to reading WD Gann's book "Tunnel Through the Air" and he said to read the novel 3 times and then read the Bible 3 times and he said that one would see it was the greatest book ever written..... So I got interested in the Bible for the Crassest , most callous of reasons... so that it would teach me the secrets of time and price cycles and how to make money out of the markets....

Nothing Noble about it.....It was straight out of Jerry McGuire... "show me the money" along the way I learned way too late that it's not all about the money.... We all need money..... when we or our family and loved ones get sick.... it can take a shitload of money to try to get our health back.... but Wealth, Money and Fame do not absolutely lead to a happy fulfilled life.... In fact, a number of famous people and several of my friends I went to school with were ill served by having it too easy and having a trust fund.... or parents that substituted parenting, spending time with their kids and providing love, support and role models .... and just felt that money would ameliorate the situation and expiate any guilt the parents might have....

Kids who have rich parents have to live with the put downs and pervasive talk that Daddy got him his job and his family name is responsible for anything positive in their lives...

Look at the innumerable people who have had drug and alcohol problems and committed suicide and yet they were rich......

OK.... Yorikke... so now that I have really been up on my soapbox.... I will yield the floor.... I was more of an adult at 15 and 22 than I was at 35 and 40..... I feel that I was pretty old by the time I truly became an Adult and by that I mean a responsible, accountable someone who is able to be honest about all of my endless string of screw ups.... But I believe that when and if one does reach adulthood... then their is no turning back...

peace be unto us, John |

| | Share | RecommendKeepReplyMark as Last ReadRead Replies (1) |

|

| To: John P who wrote (14153) | 6/9/2013 1:29:10 AM | | From: Yorikke | of 21394 | | | I have a tendency to use the pronoun 'you' in the universal plural sense, the reader, and not as a directed personal indicator.

"But I believe that when and if one does reach adulthood... then their is no turning back..."

You are right there...but for too many of us adulthood and death come in the same instant. People learn a great deal as they fall of the edge. Or at least it appears that way,

As far as volunteering....you either do, or you don't. Those who don't generally have a 1000 explanations why they don't, and those who do, generally don't really care to explain.

The road to hell is paved with good intentions and its easier for a rich man to get there than for him to buy his way into heaven....Billy C probably got more cred for going down to Haiti than raising money.....unless, of course, he was pumping a Haitian volunteer at the time of his near demise. But that's a moral conundrum that was flogged to death in his time.

Have a good Sunday. |

| | Share | RecommendKeepReplyMark as Last ReadRead Replies (1) |

|

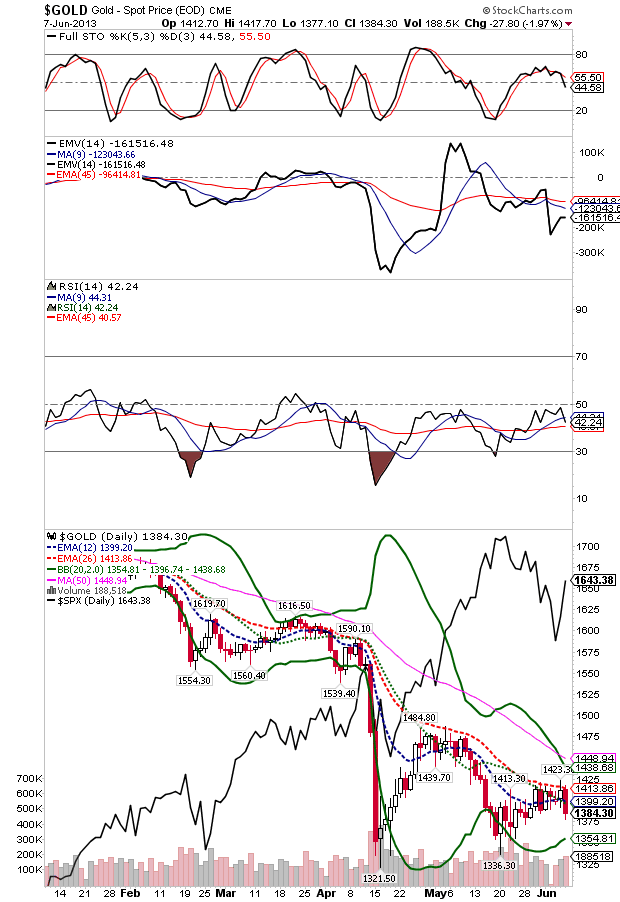

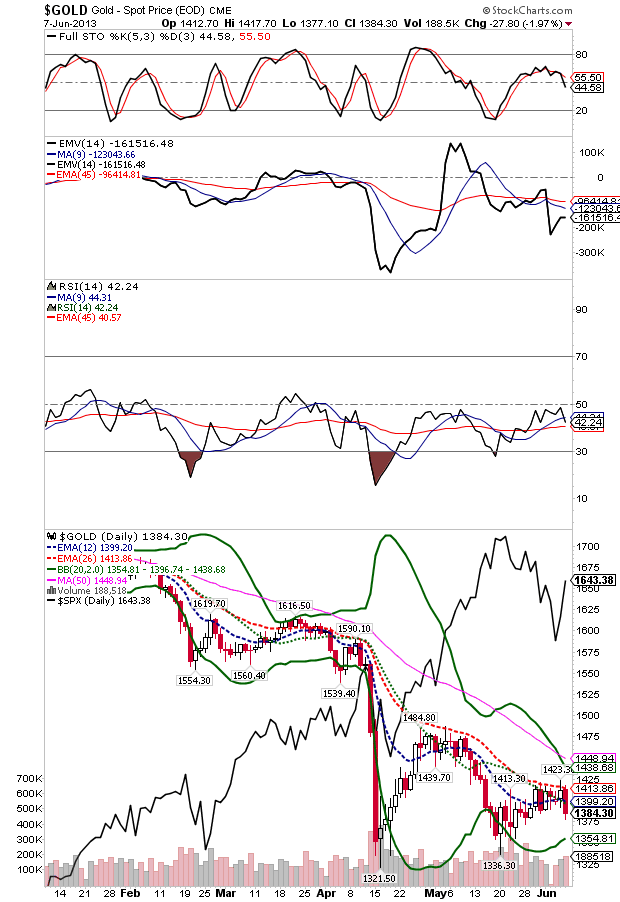

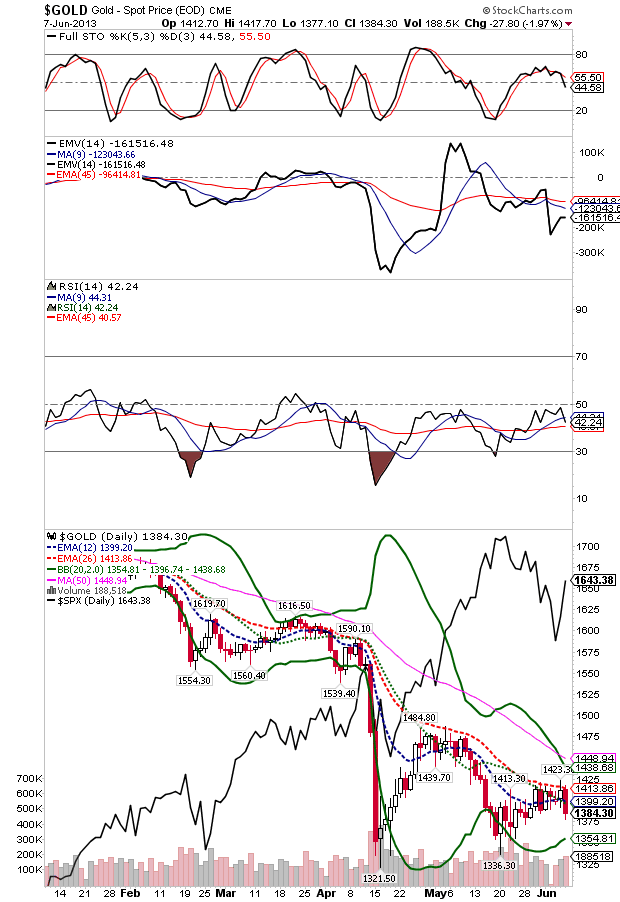

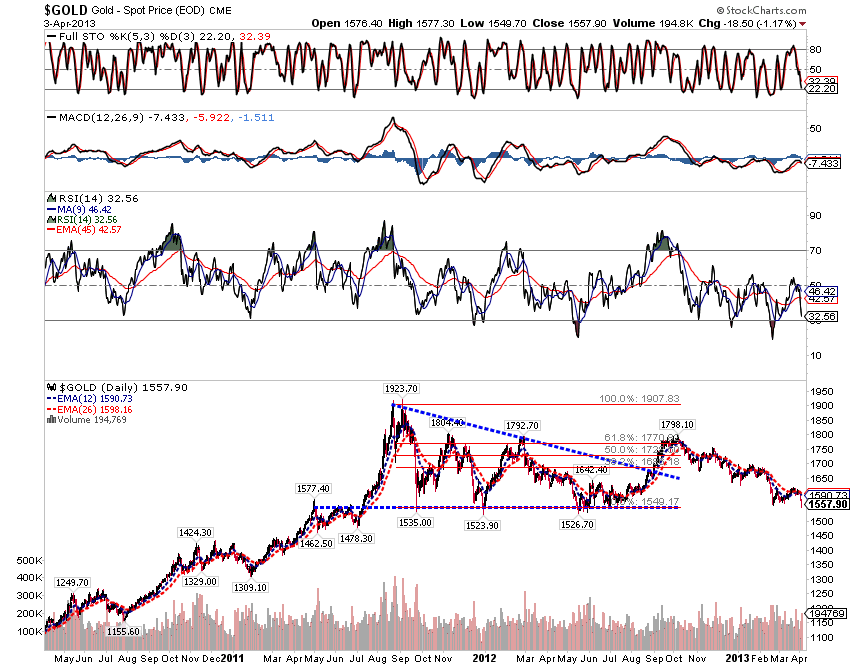

| To: Augustus Gloop who wrote (14125) | 6/10/2013 1:03:16 PM | | From: John P | 1 Recommendation of 21394 | | |  The Outlook for Gold continues to look negative..... as we will recall I illustrated on April 4th how the 2 year Gold Chart was in a very bearish descending triangle and when support broke in the low $1500's.... the most logical read was for an intermediate term decline of $400 dollars.....we knocked $225 off when it broke down the Thursday after Goldman piled on to the trade "piling on was originally a Rugby term" The Outlook for Gold continues to look negative..... as we will recall I illustrated on April 4th how the 2 year Gold Chart was in a very bearish descending triangle and when support broke in the low $1500's.... the most logical read was for an intermediate term decline of $400 dollars.....we knocked $225 off when it broke down the Thursday after Goldman piled on to the trade "piling on was originally a Rugby term"

as we can see by from this chart....the price actions on the rallies has been feeble, Gold is just quitely rolling over and is getting ready to take out the 336 and the $321 price support levels.

the technical traders have sold it at the 26 day Exponential moving average and Gold has not even been strong enough to rally to the 50 day Simple moving average where many professionals have been hoping it would get to so that they can put out more shorts...After the initial $225 plummet we had a reasonable rally that retraced about half of the first major thrust down. When the SPX bottomed and we had the 300 point move in the $/JPY and the EUR on June 6th... it pushed the 10 year yield down, fueled a rally in SPX ........

a quick review of the bigger picture in Gold and the talk about a $400 decline....

---------------------

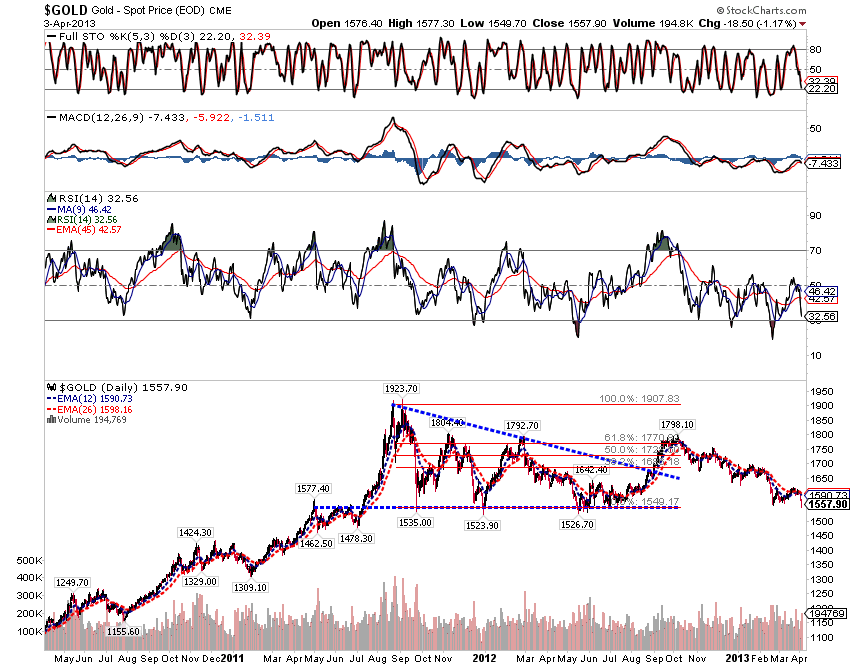

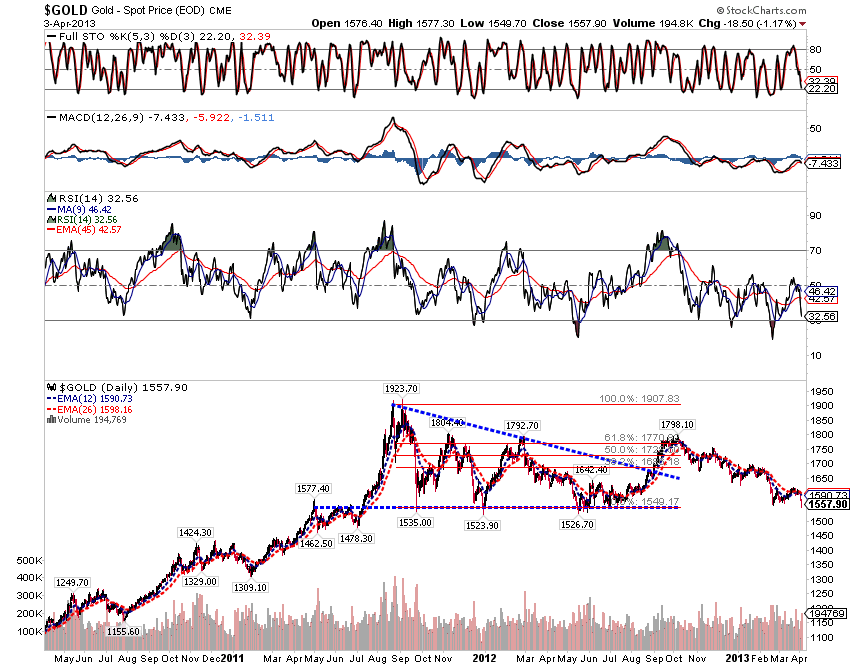

| To: Yorikke who wrote (13977) | 4/4/2013 1:59:05 AM | | From: John Pitera | 1 Recommendation Read Replies (2) of 14155 | |  Hi Y, Hi Y,

here is a chart........GOLD is in a very interesting and fairly complicated pattern.....it has many elements

of a market that is in a descending triangle which usually one of the most reliable chart patterns to which would suggest that we will break the horizontal baseline support and in that case a reasonable target for the ultimate end of the decline would be about $400 lower than 1923$ price top out in Sept of 2011 and these jagged lows

in say thw 1528-1535 range....... the chart looks lousy and I would not be looking to buy this support but would be shorting it on a break 2 day close below $1500 andwondering what will be happening in the global economy if it goes down $400 bucks from here.

The very deep momentum generated on the RSI on it's Feb 2013 decline almost mandates that this chart is going go break down and the price of GOLD denominated in USD is going lower.

The XAU is down 50% and, is showing a double momentum buy signal but a quarter of those companies are on the financial rocks....... if GOLD breaks down and we see a meaningful decline, then I do not know how you can say that TA is Nonsense.

Our FED and the Central Banks of the world have driven us off into fantasy worlds........ but I would not throw the baby out with the bathwater......... Interesteing the XAU..... which is down from 228 to 128...... that chart is actually showig a double momentum buy divergence...... but remember its for the companies that stay in business....

John

PS constance brown has written an excellent book on TA that has been updated in 2012.....she has a very interesting of using a methodology of using specifice ema averagers overlaid on the RSI and I believe she's on to something good.

I hope to discuss her methodology..... and maybe generate a few books sales for her sometime soon.

John |

|

| | Share | RecommendKeepReplyMark as Last ReadRead Replies (1) |

|

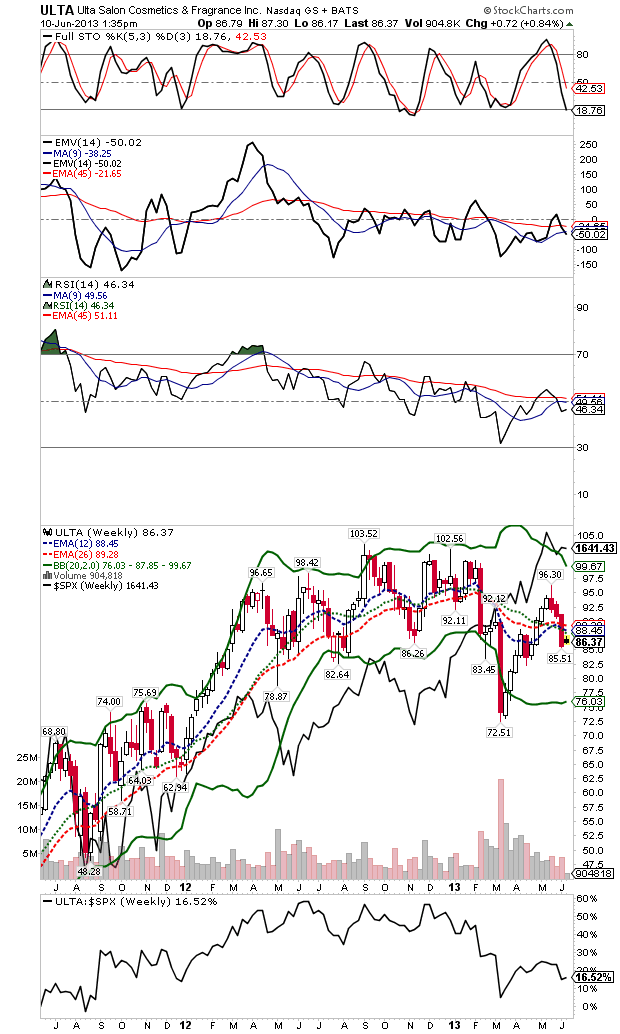

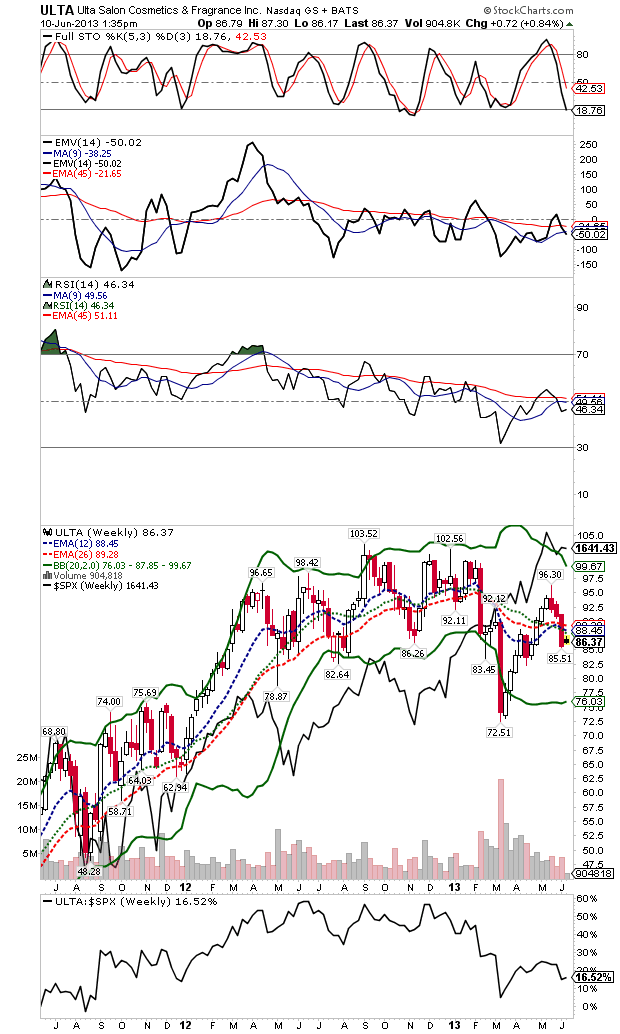

| To: golfer72 who wrote (14148) | 6/10/2013 2:34:37 PM | | From: John P | of 21394 | | | | To: John Pitera who wrote (4) | 6/10/2013 2:12:06 PM | | From: John Pitera | of 5 | |   ULTA-- Reporting this week, GS downgrades... another firm says buy prior to earnings ULTA-- Reporting this week, GS downgrades... another firm says buy prior to earnings

Cramer in his CNBC mad dash prior to the open this morning starts off talking about 3 stocks, the first one is ULTA-- Ulta Salon, Cosmetics & Fragrance, Inc. (ULTA) Cramer describes it as a barometer of high growth, high multiple stocks and thus it may have predictive value for those types of companies that have been one of the cornerstones of this ebullient bull market period of the past couple of years and especially since last Summer and Particularly kicking into Turbo Warp Overdrive in November when the Bank of Japan and the Japanese Government went beyond all in at the Last Chance Saloon of 190 proof Quantitative Easing which they cubed (grade school math operation.....) with direct purchases of equities, ETF's and other assets.... even the wallpaper on the walls as Art Cashin so Aptly put it.... -vbg-

Ok so let's go to the chart on ULTA......... It is bad....... (still working on the formating when inserting pictures and when using the quotation boxes),,,,, and I am more from the John Lennon school of ...ok we have a take...I don't bloody care if it's a little rough, I'm going to go have a smoke and chase down those bits that I left up town......... (kids, do not try this at home, for entertainment purposes....no....instructional.......my lawyer is demanding boilerplate verbiage.... always consult your Financial Advisor, CPA and Tax attorney and only do what they all sign off on in triplicate....) so we can not always be so nimble in trading and investing....

which brings me to the weekly chart of ULTA........ the weekly chart is way back up at the top... It is a broken stock...... One of my very best indicators which I normally hide.... or make people consult with me and pay me money to explain this stuff for them is the Moving Average Cross over system on the RSI...

as you Know Welles Wilder developed the 14 day Relative Strength Index in his late 1970's book.... in Calculus terms.. the RSI is a derivative since it is derived first from the daily price close and then the 14 day average of the last 14 trading days and then it is calculated to reflect a number between zero and 100.

back in the stone age before we had PC's this stuff took a lot of work..... people that I have worked with used slide rules.....once upon a time....anyway.... now life is easy in theory....

we can now with a requisite amount of programming knowledge and a really STRONG grasp of what it is we are looking for in this sea of info.. we can go back to the chalk board and trying to figure out how we were ever going to use a second or 3rd derivative.... I personally thought it was complete nonsense... I was not working for NASA and building ICBM's....

but it turns out that when we put some different moving averages and exponetial moving averages and calculate them on the 14 day RSI some interesting things emerge when we have the really good systems programmers run through all the data.

We have found that the 45 day EMA is usefully and when the 9 period EMA goes beneath the 45 period it got us short ULTA at 98.46.... kept us short at the all time high of 103.25 last August and still has us short...on the weekly chart.... the daily and 6 hourly time periods ..... help to fine tune entry points.

BOTTOM LINE POSITION TRADERS ARE EITHER SQUARE OR SHORT THIS STOCK.

JJP

|

|

| | Share | RecommendKeepReplyMark as Last Read |

|

| To: Yorikke who wrote (14154) | 6/10/2013 3:43:41 PM | | From: John P | of 21394 | | | Hi Yorikke, I was not offended by anything you wrote and I know full well how when you put things in an email, a voice mail or in a post ... one can not use the nuances of vocal inflection, modulation and other verbal techniques.... nor can one make a midcourse correction by making a joke or laughing..... or bringing up a parable when we sense we are not communicating well with the people or audience that we are addressing/ talking too.

obviously we can not use body language nor our ability to alter one's prepared remarks to adjust to a question, an objection or to take a different approach if we are encountering a bad response to what we are trying to communicate.

Most Wealthy people and people who do good-works volunteering... absolutely downplay and or don't talk about it... Mitt Romney evidently falls in that camp and I can easily believe it...... why do you think so many major donations come from Anonymous.....(clearly the world's wealthiest person!!!)

.... speaking of this topic.... let me see if I can find an email I received 2 weeks ago.....

Your good friend,

John

--------------------------------------------------------------

Love this guy!!

Class cannot be bought, sold, or acquired through high profile jobs. When you have it, YOU HAVE IT!!!!!

When I first saw this I thought the girl was one of his daughters.

Check this out:

CLASS DOESN'T MAKE THE NEWS!

Green and white shirt, black tee shirt, gray pants and tennis shoes.

How many people know that he hosts a few Wounded Warrior 10 weekends at his ranch every year?

Every year!

Not what you expect to see!

Dancing with a "Wounded Warrior" she has lost a leg but still dances.

I guarantee we will Never see a story or picture like this from NBC, CBS, ABC, The New York Times, The Washington Post.

Michelle, the Kids, and Mom go on vacation 14 weekends a year |

| | Share | RecommendKeepReplyMark as Last ReadRead Replies (1) |

|

| To: richardred who wrote (14146) | 6/11/2013 1:21:33 AM | | From: John P | 2 Recommendations of 21394 | | | Red River Richard...... I have too much time on my hands.... since I gave up drinking and I have been losing weight and obviously have too much time on my hand..... the Jack of Hearts over on the Canadian Crude thread wanted a spread chart of WCS vs WTIC.... which I provided.... but then he got me going about Houston and Texas......

and here is how that went....

--------------------------------------------------------------------------

| To: The Jack of Hearts who wrote (21549) | 6/11/2013 1:16:33 AM | | From: John Pitera | of 21554 | | ... having issues with SI Beta... pretty sure that Bloomberg is the source chart for that..... You need to ask these Energy Questions to Houstonians.... after all this is the energy service sector capital of the world.... and that is energy in all forms.... solar, bio, wind....... Tesla.... wireless energy...... We've got information management for everything down here.... that why we have had so many Texan's up in DC... since the 40's.....

Houston was actually founded by the Allen Brothers of New York in 1836 and Houston and New York have had a very tight connect since day one.. And the Stillman's of First National City Bank Fame had ancestors up on the east coast but also down in Brownsville Texas in the Rio Grande Valley.....

3 of Stillman's sons married three of John and William Rockefeller's daughters.. .or visa versa.... Stillman's bank... just celebrated it's 200th anniversary last year.... it is better known as Citi..... and they did iignominiously have a 10 for 1 reverse stock split due to 2008...... nothing to brag about..... they had the worlds biggest cash cow FX Global operation back when Henry Volquardsen, John Rice, Adam Greene, Stephen Hains, Martin Tau.... David Bickford, Tony Jaladoni and many others worked there back in the 1980;s

--------------------

An

Samuel Taliaferro "Sam" Rayburn (January 6, 1882 – November 16, 1961) was a Democratic lawmaker from Bonham, Texas, who served as the Speaker of the U.S. House of Representatives for 17 years, the longest tenure in U.S. history.

One of the most influential Speakers in history was Democrat Sam Rayburn. [10] Rayburn was the longest-serving Speaker in history, holding office from 1940 to 1947, 1949 to 1953, and 1955 to 1961. He helped shape many bills, working quietly in the background with House committees. He also helped ensure the passage of several domestic measures and foreign assistance programs advocated by Presidents Franklin D. Roosevelt and Harry Truman.

then in 1960 JFK put LBJ on the ticket... and made a really lousy calculation of "icing" LBJ out of all of the Government's policy initiatives..... I personally am a huge fan of JFK........ but that was a lack of judgment...

Then in 68.... we put Nixon and Agnew.....into office... what an incredible pouch screw ... that turned out to be, although Nixon was smart enough to have G H W Bush run the CIA and also made him the first ambassador to China after Kissinger and Nixon opened relations... to triangulate the USSR.

Agnew..... left in disgrace... as did Nixon and Gerald Ford... actually got Uncle Rocky "Nelson Rockefeller" David Rockefeller's brother with Political ambitions into the Vice Presidency..... The Rockefeller of Standard Oil, Banking, Insurance, Real Estate, Mining, Shipping, Railroads.... and Financing in General.... involved with the Government.... Then we had the lost years of the Carter Administration.... Not to much to write home about the Georgia Crew he brought in..... I guess his brother Bill made beer....

Then Reagan, who gave a hell of a speech at the Goldwater convention in 1964...... it's a heck of a speech and is on YOUTUBE in it's entirety...... Reagan was a Real Genius where he was a business man... who felt the squeeze of the studio system... and then became a manager and politician as the head of the screen actors guild..... so saw Big business from both management and Labor's perspective and then of course he went on to be Governor of California and gained some reasonably good experience managing government of one of the worlds biggest economies.... and as present day California's can tell you life was not bad out in Cali back in the 50's and 60's.... heck Johnny Carson even packed up from NY and went out to California in 1972...

Reagan came close to being the candidate in 1976 and there was even a trial balloon of some kind of co presidency...... but the economic cycles were so bad that who ever was going to be in office for those years was screwed... so it may as well be the nuclear physicist.

Now comes 1980 and Reagan, was strong and Bush also ran and Reagan was smart enough to put

Bush on the ticket... the real hidden Gem in that deal was James Addison Baker III.... the smartest mind of the 20th century in terms of those involved in the intersection of politics, business, banking, Law, Public Relations , Global GeoPolitical Relations.... a serious student of History..... and also well versed in the Global Energy Industry.... The Bakers... founded helped build out RICE University, the Law Firm of Baker and Botts, Texas Commerce Bank...... Texas's biggest bank that was rolled up into Chemical Bank.... the Very same Chemical Bank that bought up Manufacturers Hanover, and then Chase Manhattan... which was itself a roll up of several banks... when Chemical bought Chase.. they wisely kept the Chase Name and went on to roll up JP Morgan into the Bank that I presently do my personal and business banking with....

so back to James Addison Baker.... He and George Herbert Walker Bush were best friends in Houston going all the way back to the late 1930's or 40's when they played tennis , cards and maybe a round of golf at the River Oaks country Club..... When Baker's first wife died of Cancer at a young age in the mid 1960;s

---------------------------------------- One of the most influential Speakers in history was Democrat Sam Rayburn. [10] Rayburn was the longest-serving Speaker in history, holding office from 1940 to 1947, 1949 to 1953, and 1955 to 1961. He helped shape many bills, working quietly in the background with House committees. He also helped ensure the passage of several domestic measures and foreign assistance programs advocated by Presidents Franklin D. Roosevelt and Harry Truman.

then in 1960 JFK put LBJ on the ticket... and made a really lousy calculation of "icing" LBJ out of all of the Government's policy initiatives..... I personally am a huge fan of JFK........ but that was a lack of judgment...

Then in 68.... we put Nixon and Agnew.....into office... what an incredible pouch screw ... that turned out to be, although Nixon was smart enough to have G H W Bush run the CIA and also made him the first ambassador to China after Kissenger and Nixon opened relations... to triangulate the USSR.

Agnew..... left in disgrace... as did Nixon and Gerald Ford... actually got Uncle Rocky "Nelson Rockefeller" David Rockefeller's brother with Political ambitions into the Vice Presidency..... The Rockefeller of Standard Oil, Banking, Insurance, Real Estate, Mining, Shipping, Railroads.... and Financing in General.... involved with the Government.... Then we had the lost years of the Carter Administration.... Not to much to write home about the Georgia Crew he brought in..... I guess his brother Bill made beer....

Then Reagan, who gave a hell of a speech at the Goldwater convention in 1964...... it's a heck of a speech and is on YOUTUBE in it's entirety...... Reagan was a Real Genius where he was a business man... who felt the squeeze of the studio system... and then became a manager and politician as the head of the screen actors guild..... so saw Big business from both management and Labor's perspective and then of course he went on to be Governor of California and gained some reasonably good experience managing government of one of the worlds biggest economies.... and as present day California's can tell you life was not bad out in Cali back in the 50's and 60's.... heck Johnny Carson even packed up from NY and went out to California in 1972...

Reagan came close to being the candidate in 1976 and there was even a trial balloon of some kind of co presidency...... but the economic cycles were so bad that who ever was going to be in office for those years was screwed... so it may as well be the nuclear physicist.

Now comes 1980 and Reagan, was strong and Bush also ran and Reagan was smart enough to put

Bush on the ticket... the real hidden Gem in that deal was James Addison Baker III.... the smartest mind of the 20th century in terms of those involved in the intersection of politics, business, banking, Law, Public Relations , Global GeoPolitical Relations.... a serious student of History..... and also well versed in the Global Energy Industry.... The Bakers... founded helped build out RICE University, the Law Firm of Baker and Botts, Texas Commerce Bank...... Texas's biggest bank that was rolled up into Chemical Bank.... the Very same Chemical Bank that bought up Manufacturers Hanover, and then Chase Manhattan... which was itself a roll up of several banks... when Chemical bought Chase.. they wisely kept the Chase Name and went on to roll up JP Morgan into the Bank that I presently do my personal and business banking with....

so back to James Addison Baker.... He and George Herbert Walker Bush were best friends in Houston going all the way back to the late 1930's or 40's when they played tennis , cards and maybe a round of golf at the River Oaks country Club..... When Baker's first wife died of Cancer at a young age in the mid 1960;s

He went into a mild depression as he dearly loved his wife….. His dear friend George wanted to get him out of his funk and to get his mind off the death of his beloved wife….So Bush decided he would run for Office and James Baker would manage the campaign… and much as Humphrey Bogart says at the end of Casablanca……. I sense the beginning of a beautiful relationship….

SO as to not make this a novel and leave room for a few reasons to buy the book…. Instead of reading it all online for free…. –vbg-…. We get to 1980 and Reagan Bush win in a massive Transformative Election as President Barrack Huessin Obama describes it…. Reagan brought in a really professional crew… MER’’s Regen at treasury, Casey at the CIA…. An Excellent secretary of state…. And was smart enough to make James A. Baker his Chief of Staff…. Which is arguably the single most important Job there is beyond being the President… as you are the conductor that makes the trains run on time…. Provide access and info to the President and create the timetable and arrange everything that needs to be arranged… and obviously he was very tight with Bush 41 who has had the most accomplished curriculum vita of anyone who has ever been President…… Baker went on to be promoted to Secretary of the Treasury and we all know how important that job is……. And when Bush became president in 1988….. Baker went on to become Secretary of State.. and we witnessed the collapse of the Berlin Wall in 1989 and the disintegration of the Soviet Union…. Bush would have been handly reelected in 1992….. except and no one really pays any attention to history, but fellow Texas….. and anti establishment Billionaire H Ross Perot ran a third party candidacy and siphoned off 19% of the vote…. Largely from George Herbert Walker Bush….. Clinton became president… winning only 43% of the vote.

Now Perot is a whole long story in himself…. A man from the Texarkana part of Texas… which is where the Men from Hope Hail from…… Perot was a marine…. Went to work for IBM … sold his entire years quota in the first two weeks of January and got pissed at IBM when they would not let him sell more… So he went off to form Electronic Data Systems and became wealthier than Gates or Buffett in Inflatiion Adjusted terms when LBJ created his great society… his guns and butter…. Approach to creating Medicaid, Multiple other government assistance programs…. And the Millions upon Millions of Dollars and Payments were contracted out to Perot’s EDS making him Uber wealthy and was the point of departure in the market classic book the Go-Go Years… which I happen to have by my bedside reading shelve….

So Clinton gets in… we have the roaring secular Bull Market and Bill Clinton is one of the smartest politicians and is arguably the world’s best public speaker…… I know when I watched him address the Australian Parliament Live on C-Span… he made me tremendously proud to be an American….. I would actually love to meet him and his wife….. Just as he was so fortunate to meet JFK when Bill was 14 and already a leader….

As a side Note W J Clintonl was actually born William Jefferson Blythe…. And his dad was killed in an auto accident before Bill was born…. He did not have a great repoire with his step dad and only took his name at around the again of 13 or 14 when he realized that someone named Billy Bythe….. was going to have poets making poems “

“ Billy Blythe, Billy Blythe…. Blithely going through life”……. So that was a Good calculation…. As was his FulBright Scholarship…. He is a great man… He and JFK had a lot iin common…

So in keeping with the Texas theme…. We get to 2000….. and Bush 43 would never have even run for governor…. If it were not for Governor Ann Richards…. If you are made at 43 and or Chaney… you can go and piss on her grave….. She had this big ol’ turkey gobbler of a neck and became Governor of Texas back in 1988 or 1992….. when her Republican opponent took way too many shots of Bourbon wth mescal chasers and made some insane comment that sometimes “ women should just sit back and enjoy it”…. Just a total lack of class…. A total idiot…at least on that day……

Ann Richards in 1992 loved to get on camera and spoke at the democratic convention and like a parrot in her best Good old Texas Girl accent proclaimed too many times… “ Put a fork in him (43) he’s done…..”

No one speaks of her in Texas and I can not think of her name coming up in any conversation in years…… So George W. Bush ran for Governor simply to put the old Texas Gobbler Richards out to pasture and obscurity… and that the fact that Dick Chaney had been in Presidential administrations going back to Ford….. and was Secretary of Defense in the Late 1980’s and of course he ended up in Houston.. with Halliburton rolled up the World Famous Brown and Root Infrastructure company that was one of the best of breed back in the days…. These days, it’s KBR….. which is Kellogg Brown and Root… so we are still back talking about Texas…. Houston and of course Dallas fits into all of this too. Texas is a big state….

So when the 2000 election comes down to pregnant chads in Florida……and everyone is all in the Final Hand of Texas No Hold em…..what happens….. James Addison Baker III is dispatched to Florida takes control of the situation and makes the more articulate and persuasive case that George W. Bush is the President….. the Supreme Court acceded to the wisdom of his Logic….. The Trade Center bombings and Radical Islam has become a Global and pervasive force …. A Future ……… Round of Texas No Hold em and Let me tell you that the Germans, Dutch, the Swedes, the British, the French, the Swiss, the Italians, the Polishs, the USA and Russia…… (Moscow was and is considered part of Europe in the 1800’s)…… well that is a pretty darn powerful coalition..

I was commenting a year ago that the Rumor was that Google got seed money from the NSA…. And now it seems like a big deal….. Bill Gates Dad was a Big League Seattle Corporate attorney with widespread ties… how do you think MSFT the rights to develop the DOS operating system for the IBM PC standard….

Now I was shooting from the Hilltops about the coming blow up in Credit Default Swaps going all the way back to August 2005…so everyone had plenty of warning and as a matter of fact New York Life totally recalibrated their portfolio and holdings and did not miss a beat when the Great Financial Crisis came down the pipe in 2008.

Since 2009, we have had the Chicago Crowd running the show…. And President Obama…much to his credit has actually gotten the message about 2 months ago and if he can survive all of these “uprisings”…..

His biggest problem is that the Chief Justice in his infinite wisdom deemed the Affortable Health Care act a Tax and thus the IRS…. Your friend and mine…. Is in charge of helping to administer it…..

Obama is going to need some additional consulting and he is starting to listen…. But he should took his sweet time in deciding to actually talk to the other branches of Government.

I think that will do it for now…….now this is a rough draft that I am putting out…… It needs editing and maybe some info needs to be expunged…. Or blacked out….. but a quote that will live on arguably as long as any you can think of …… outside of the Talmud, The Bible the Quran …. The Buddist scriptures….well the quote is

“Houston, the Eagle has Landed” as Man set foot on the moon and the follow up quote…. “Houston we have a problem”…. But luckily we know how to solve problems in Houston and in Texas….. So it’s all good ……

John Jacob Pitera……

This is a rough and crude rough draft that I may develop into a larger more cohesive book, especially if I get a co author... because I simply don't know if I will have the time or the burning passion to write all this by myself...

Also, I was watching the most excellent 2 hour documentary on Dr. Hunter S Thompson... GONZO: The Life and Work of Dr. Hunter S. Thompson" which is a fantastic movie....he bent the rules..... I have read just about all of his books multiple times... and his book on the 1972 campaign... where he actually travelled with McGovern's press coverage was groundbreaking..... there are video quotes from Pat Buchanan, Gary Hart, Muskie, McGovern and the entire panoply of characters who made up the media and politics back in the second half of the 60 and the 70's....... Thompson's review of Jimmy Carter's speech to the Governors association in 1974 is said to be how he became the candidate for 76 he got Thompson's endorsement....

|

|

| | Share | RecommendKeepReplyMark as Last ReadRead Replies (1) |

|

| To: John P who wrote (14157) | 6/11/2013 1:33:37 AM | | From: Yorikke | of 21394 | | | Gave up drinking....too much time on your hands.....Dude you NEED to go for long fast walks. A few hours a day will burn some of this stuff out. Or find some other low impact sport you can charge the endorphins and serotonin up with. But w.Walking and thinking go hand in hand, Share a long tradition.

.I wish you well. |

| | Share | RecommendKeepReplyMark as Last ReadRead Replies (2) |

|

| To: Yorikke who wrote (14159) | 6/11/2013 2:41:21 AM | | From: John P | of 21394 | | | | Long walks are good ... ... I need to spend more time out In the country...... Hawaii is nice....Sydney is better... I am making changes.... trying to decide if I want to take on something that has me spending significant time in a fairly radically different part of the world. |

| | Share | RecommendKeepReplyMark as Last Read |

|

| To: John P who wrote (14158) | 6/11/2013 2:09:44 PM | | From: John P | 1 Recommendation of 21394 | | | We have witnessed a selling of risk assets since the Japanese stock market and the $/ Yen Topped on Wed May 23rd..... @ 103 and change as quoted in the interbank market...

Art Cashin was right on the target when he talked about the issues in the Japanese bond market specifically the spike in the yield curve especially the 5 year note moving from 60 to 86 basis points.... that put many of the major Japanese financial firms with mismatched books and unhedged exposure..... and the Japanese equities had the initial 7% single day decline... and the fact that QE and the aggressive Japanese inflation program started to fray at the edges and some Global asset Macro Managers saw this as a harbinger of things to come in other countries.....

John |

| | Share | RecommendKeepReplyMark as Last Read |

|

---------------------------

got to get Walt's site more prominence in this postathon.........

| ABOUT OUR TEAM

| Bronson Company is a surprisingly small, agile enterprise that values the strengths that each member contributes to the whole. We value expertise, entrepreneurship, tenacity and (not-suprisingly) humor.

However, above all else, we value character.

Our President, Walt Bronson

Speculation persists as to Mr. Bronson's origins. Rumors have circulated for years that Walt was, variously, born in a log cabin, born in a manger late in December or mysteriously abandoned by his parents and raised by wolves.

When asked, Walt demurs and explains that his youth was unremarkable; he was raised simply by his father and mother, Jor-El and Lara.

At the age of 6, young Walter was discovered by a pair of stranded Jedi who proclaimed the boy as “the chosen one” and proceeded to tutor the lad in an obscure blend of martial arts, swordplay and mind-control.

At age 15, the boy was given a small ring by an uncle and instructed to dispose of the object in a distant volcano. While a minor task in and of itself, the story of his journey has evoked some peripheral interest.

At age 21, Walt founded Genco Olive Oil Company and became titular head of an obscure group known as the Five Families. During this time, he played 3rd base for the NY Yankees and was the driving force behind “The White Album.”

He has become best known as the spokes abs for the Abercrombie & Fitch line of apparel.

Today Walter continues as an Independent Businessman specializing in the SMB (Small/Medium Business Market). He continues to be a highly sought-after speaker/trainer and he still writes on a number of subjects (both fiction and non-fiction) under his chosen 'pen name' of William Patrick..

Mr. Bronson maintains a personal blog at www.memuneh.com

|

bronsoncompany.com

bronsoncompany.com

Walt Bronson

Walt Bronson 1st degree connection1st

Independent Financial Services ProfessionalHouston, Texas Area

MessageSend a message to Walt Bronson More…

Southern Illinois University, CarbondaleSee contact infoSee contact infoSee connections (129)See connections (129) Southern Illinois University, CarbondaleSee contact infoSee contact infoSee connections (129)See connections (129)

Highlights

Gilbert M. Araiza, CPA, CFP®

Chase Browning

4 Mutual ConnectionsYou and Walt both know Gilbert M. Araiza, CPA, CFP®, Chase Browning, and 2 others

Education

Southern Illinois University, Carbondale

Showing 4 results

Gilbert M. Araiza, CPA, CFP®

Gilbert M. Araiza, CPA, CFP® 1st degree connection1stVice President & Trust Officer at Frost Wealth Advisors

Houston, Texas Area

Chris Brown

Brenda Rollins

Michael Lawch CPA, CGMA, MBA, BSIE

8 shared connections

Message

Andrew Smith

Andrew Smith 1st degree connection1stFinancial Advisor at Edward Jones

Houston, Texas Area

Lou Stoler

Walt Bronson

2 shared connections

Message

Salim Fidai

Salim Fidai 1st degree connection1stSales Manager at MassMutual Texas Gulf Coast

Houston, Texas Area

Caley Baillio

Joe Mastriano, CPA

Franklin Hu

7 shared connections

Message

Chase Browning

Chase Browning 1st degree connection1stDistrict Retail Executive, Senior Vice President at BBVA Compass

Dallas/Fort Worth Area

C. Dean Kring-Entrepreneurship Research-Mentor

Lou Stoler

Walt Bronson

3 shared connections

---------------------------------------------------------

POLITICSPASTIMES

| To: John P who wrote (3) | 6/10/2013 1:27:24 PM | | From: John P | Read Replies (1) of 20 | | | | Gold Update for Monday June 10th 2013 |  The Outlook for Gold continues to look negative..... as we will recall I illustrated on April 4th how the 2 year Gold Chart was in a very bearish descending triangle and when support broke in the low $1500's.... the most logical read was for an intermediate term decline of $400 dollars.....we knocked $225 off when it broke down the Thursday after Goldman piled on to the trade "piling on was originally a Rugby term" The Outlook for Gold continues to look negative..... as we will recall I illustrated on April 4th how the 2 year Gold Chart was in a very bearish descending triangle and when support broke in the low $1500's.... the most logical read was for an intermediate term decline of $400 dollars.....we knocked $225 off when it broke down the Thursday after Goldman piled on to the trade "piling on was originally a Rugby term"

as we can see by from this chart....the price actions on the rallies has been feeble, Gold is just quitely rolling over and is getting ready to take out the 336 and the $321 price support levels.

the technical traders have sold it at the 26 day Exponential moving average and Gold has not even been strong enough to rally to the 50 day Simple moving average where many professionals have been hoping it would get to so that they can put out more shorts...After the initial $225 plummet we had a reasonable rally that retraced about half of the first major thrust down. When the SPX bottomed and we had the 300 point move in the $/JPY and the EUR on June 6th... it pushed the 10 year yield down, fueled a rally in SPX ........

a quick review of the bigger picture in Gold and the talk about a $400 decline....

---------------------

| To: Yorikke who wrote ( 13977) | 4/4/2013 1:59:05 AM | | From: John Pitera | 1 Recommendation Read Replies (2) of 14155 | |  Hi Y, Hi Y,

here is a chart........GOLD is in a very interesting and fairly complicated pattern.....it has many elements

of a market that is in a descending triangle which usually one of the most reliable chart patterns to which would suggest that we will break the horizontal baseline support and in that case a reasonable target for the ultimate end of the decline would be about $400 lower than 1923$ price top out in Sept of 2011 and these jagged lows

in say thw 1528-1535 range....... the chart looks lousy and I would not be looking to buy this support but would be shorting it on a break 2 day close below $1500 andwondering what will be happening in the global economy if it goes down $400 bucks from here.

The very deep momentum generated on the RSI on it's Feb 2013 decline almost mandates that this chart is going go break down and the price of GOLD denominated in USD is going lower.

The XAU is down 50% and, is showing a double momentum buy signal but a quarter of those companies are on the financial rocks....... if GOLD breaks down and we see a meaningful decline, then I do not know how you can say that TA is Nonsense.

Our FED and the Central Banks of the world have driven us off into fantasy worlds........ but I would not throw the baby out with the bathwater......... Interesteing the XAU..... which is down from 228 to 128...... that chart is actually showig a double momentum buy divergence...... but remember its for the companies that stay in business....

John

PS constance brown has written an excellent book on TA that has been updated in 2012.....she has a very interesting of using a methodology of using specifice ema averagers overlaid on the RSI and I believe she's on to something good.

I hope to discuss her methodology..... and maybe generate a few books sales for her sometime soon.

John |

|

|

|

|

The Outlook for Gold

The Outlook for Gold  Hi Y,

Hi Y,

Southern Illinois University, CarbondaleSee contact infoSee contact infoSee connections (129)See connections (129)

Southern Illinois University, CarbondaleSee contact infoSee contact infoSee connections (129)See connections (129)