Is Nvidia Stock A Good Long-Term Investment? If You Own It, Don't Ever Sell It

Nov. 23, 2021

JR Research

Summary

NVIDIA is the leading authority when it comes to the metaverse. It has already been building its technological lead through NVIDIA Omniverse.Today, NVIDIA is not just a GPU company anymore. Instead, the company has completely transformed itself into a full-stack technology company.We discuss why we think NVDA is such a good long-term stock that we will never sell.

Justin Sullivan/Getty Images News

Investment Thesis

NVIDIA Corporation ( NVDA) released yet another set of phenomenal beats for FQ3 recently. Jensen Huang & Co. kept on delivering in 2021 that it has almost made our previous Neutral calls look very foolish in hindsight.

Now, let us clarify. First and foremost, we are NVDA shareholders, and we have never sold a single share. We have been absolutely thrilled with NVIDIA this year as the company seems to have attained breakthroughs. CEO Jensen Huang communicated at NVIDIA's GTC recently on the new technological milestones that only became possible lately. He emphasized (edited for clarity and brevity):

- You'll see how leading edge computer graphics, physics simulations and AI came together to make Omniverse possible and how the computing platforms and accelerated libraries we built lay the foundation to make Omniverse a reality. But before we jump into data centers, I want to show you something we've been building, a conversational AI, ToyMe. ToyMe was made with some amazing technologies that have become possible only recently and barely so... Today, we're announcing the NVIDIA Quantum-2, the most advanced end-to-end networking platform ever built. Quantum-2 is the first networking platform to offer the performance of a supercomputer and the shareability of cloud computing. This has never been possible before. Until Quantum-2, you get either bare metal high performance or secure multi-tenancy, never both. With Quantum-2, your valuable supercomputer will be cloud-native and far better utilized. ( from NVIDIA GTC Keynote)

If you have not watched Huang's brilliant Keynote, we strongly encourage you to do so. We believe that you will be thrilled and thoroughly blown away by the scale and depth of NVIDIA's deep expertise and capability of its technology stack.

As NVIDIA charts its way towards the $1T market cap, we discuss two of our top considerations in evaluating a long-term investment. We discuss whether NVIDIA stock fits the bill.

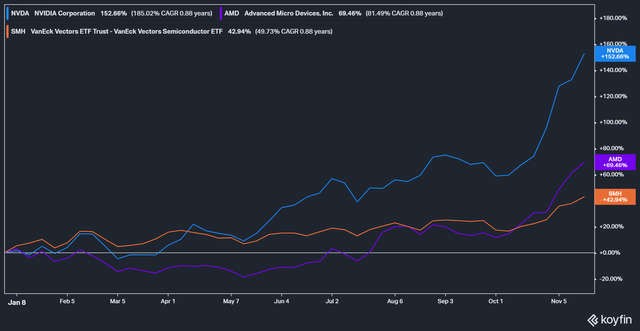

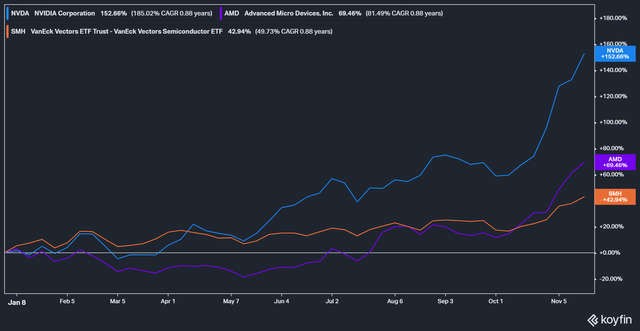

NVDA Stock YTD Performance

NVDA stock YTD performance (as of 19 November 21).

NVDA stock has been on an incredible run this year, which even trumped 2020's stupendous performance. NVDA stock led the VanEck Vectors Semiconductor ETF ( SMH) and AMD stock ( AMD) with a 152.66% YTD performance. Coupled with 2020's breathtaking run where NVDA stock notched a 121.2% gain, it has been a phenomenal two years for NVDA investors.

We have been NVDA shareholders for less than two years, as we joined the Jensen Huang's bandwagon midway through 2020. We have continued to add the stock until May this year. Nevertheless, we are thankful that NVDA continued on its monstrous rally in H2'21, moving on to break new highs.

Key Consideration One:

The #1 or #2 Market Share Leader

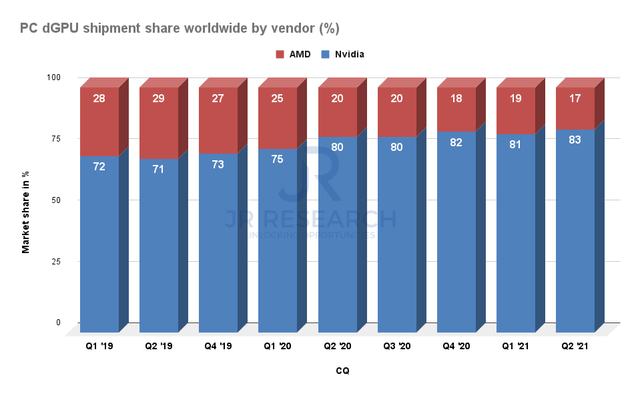

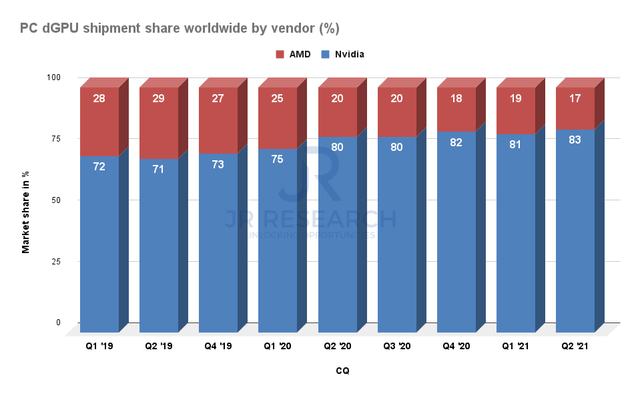

PC d-GPU shipment share worldwide. Data source: Jon Peddie Research

Before we even look at valuations, we will always consider the company's moat first. In NVDA's case, the argument is straightforward. The company is the leading player in the discrete GPU (d-GPU) market. The company's leadership in its GPU dominance has never been threatened. AMD is a competitor, but it's not even close. Intel ( INTC) investors will point out that the company will soon enter the market in Q1'22. However, whether they can outcompete NVDA in this segment of the market is highly questionable. Moreover, the company also has a stranglehold in the high-end data center segment. NVIDIA holds a share of more than 90% globally. Therefore, the market is NVIDIA to lose in accelerated computing in the consumer and data center segment.

But, will NVDA end up like Intel, losing its edge following a series of key missteps by its previous management? I will never bet against Jensen Huang & Co.

Key Consideration Two:

Founder-led Company

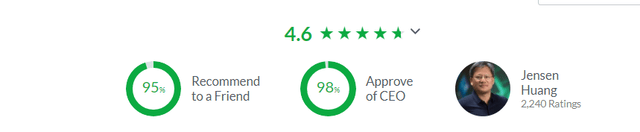

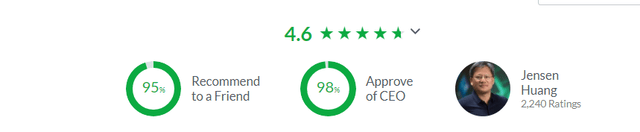

NVDA glassdoor ratings. Source: glassdoor

The second most important consideration:

Who's the Boss?

NVIDIA is a founder-led company. CEO Jensen Huang co-founded the company in 1993, and he's still leading the company from the front 28 years later. It's truly amazing. Whenever we watch his presentations, we can feel his passion, drive, and intelligence. Huang is a true visionary that we believe is at the same level as Apple's ( AAPL) Steve Jobs. It would have been incredible if Jobs and Huang could both compete or cooperate to define the next-gen computing platform. Therefore, we believe Huang has no equal in his field now. He's simply the best. But don't take our word for it. 98% of reviewers on glassdoor approved of Jensen Huang as the CEO. That's a tip-top rating. In contrast, Apple CEO Tim Cook received a 93% approval rating, while Microsoft ( MSFT) CEO received 97%. In a particular review about NVIDIA, we picked up a piece of very telling information. The reviewer wrote (lightly edited):

- Pros: Jensen, our President/CEO is very intelligent, driven, articulate, encouraging, warm, and approachable. What you see on stage is the same person you bump into in the halls or overhear at the bar. Yes, we have a really nice bar in our building. NVIDIA's success and amazing culture clearly comes from the top. During Covid, he firmly repeated this message: "Put family first!" During the holidays, we don't have a big expensive company dinner, we volunteer or donate to our local communities. The work is challenging and meaningful. Compensation and benefits are great. I love my coworkers. I've been here almost five years. It's real and I still can't believe how lucky I am.

- Cons: NVIDIA innovates at a crazy pace. There is more work to do than time to do it. But everyone around you is working super hard. And doing what you love, with people you care about, for a president that seems genuinely to be one of the nicest human beings I've ever met makes me want to work extra hard, too. So the biggest negative is really self-inflicted. ( from NVIDIA glassdoor review)

We actually found one of the sentences in the review very meaningful: "NVIDIA innovates at a crazy pace." It's exactly what we want for a high-tech company leading from the front. That passion, creativity, and thirst for innovation have kept Huang going for the last 28 years. It's why founder-led companies often have a special place in our hearts. Because we know the founders have a very long-term vision and are not just there as a CEO for their lucrative compensation package. NVDA made its mark as a GPU company. But, that totally downplays NVIDIA's technological capability today.

NVIDIA has become a full-stack company and now leads in the software front through NVIDIA Omniverse that it built years ago, which others have only started to experiment with. Notably, it highlights the advantage that NVDA has as a founder-led company. As a result, Huang can implement his vision with continuity. Huang shared recently that NVDA's vision of being a full-stack company has taken almost 30 years since he founded NVDA. Huang emphasized (edited for brevity and clarity):

- Chips are enablers, but chips don't create markets. Software creates markets... We've been advocating accelerated computing for some time, and now people really see the benefit of it. But it does require a lot of work... And so it takes a fair amount of expertise, and that's why we say that over the course of 30 years, we've become a full-stack company because we've been trying to solve this problem practically through decades. But the benefit, once you have the ability, then you can open new markets. And we played a very large role in democratizing artificial intelligence and making it possible for anybody to be able to do it. One of the areas that we spoke about this time, of course, was Omniverse. You saw the pieces that are being built in over time. It took half a decade to start building Omniverse, but it's built on a quarter-century of work. ( from NVIDIA FQ3'22 earnings call)

So, is NVDA Stock a Buy Now?

The excitement surrounding NVIDIA's Omniverse is palpable. Many investors and analysts have taken the opportunity to jump on the bandwagon as NVIDIA charts its future to be the operating system for the metaverse. Jensen recently highlighted the scale of the company's Omniverse opportunity. He added (edited for brevity):

- We waste a whole bunch of things to overcompensate for the fact that we don't simulate. We want to simulate all factories in metaverses, in this Omniverse. We want to simulate plants in the Omniverse. We want to simulate the world's power grids in the Omniverse. By doing that, we could decrease the amount of waste, and that's the reason why the economics are so good for companies. They're willing to invest a small amount of money to buy into this artificial intelligence capability. But what they save is hopefully hundreds and hundreds and hundreds of billions of dollars. ( from CNBC article)

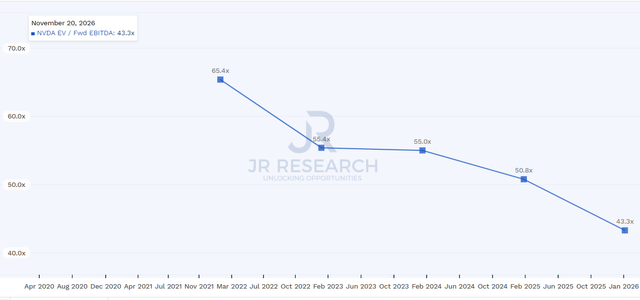

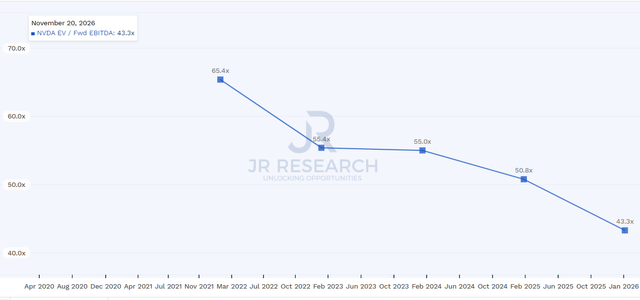

NVDA stock EV/NTM EBITDA 3Y mean.

NVDA stock EV/Fwd EBITDA valuation trend. Data source: S&P Capital IQ

NVIDIA stock trades at an EV/NTM EBITDA of 62.5x. It's expensive, but it's not at its peak valuation over the last three years. It hit 75.7x in July 20. NVDA is experiencing gangbusters growth. Therefore investors have been willing to pay up to own this incredible company. The Street's estimates have also been revised upwards to reflect the company's Omniverse opportunity. Notwithstanding, we think these estimates are likely subjected to changes since it's still a nascent opportunity. Therefore, there's a tremendous amount of uncertainty on modeling the market potential accurately. However, its current valuation seems to have reflected a few years of growth premium. Therefore, if you are a new investor, the risk/reward ratio might not be as attractive currently.

Notwithstanding, NVDA has taken apart our Neutral calls in the past with ease. Therefore, if you are aggressive, you can still add if you have a very high conviction in Jensen Huang & Co. and are willing to hold for the long term, through the ups and downs.

However, we will stick to our Neutral rating for now. But, we will monitor the price action very closely, as it seems to be in the process of forming a bull-trap now. If there's a meaningful retracement, we will be waiting to add more exposure.

Otherwise, we are more than happy to continue holding our existing positions in NVDA. We also encourage existing investors to continue holding NVDA stock and never sell. Not when Jensen Huang is still at the helm.

seekingalpha.com |