Looks like this exploitation of U.S./China trade tensions is an extension of an already-established longer term trend:

The United States, Brazil, and China Soybean Triangle: A 20-Year Analysis

February 20, 2024

farmdoc daily (14):35

Recommended citation format: Colussi, J., G. Schnitkey, J. Janzen and N. Paulson. " The United States, Brazil, and China Soybean Triangle: A 20-Year Analysis." farmdoc daily (14):35, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 20, 2024. Permalink

Brazil’s 2023 soybean exports reached a record of 3,744 million bushels, up 29% from the previous year as Brazilian production hit a new record. Meanwhile, the United States’ shipments declined 14% to 1,789 million bushels in the same period. The United States and Brazil are major competitors and together supply over 80% of soybean global exports, while China accounts for about 60% of total soybean imports. Soybeans are the largest agricultural commodity exported to China by both the United States and Brazil. Over the last five years, Brazil has become heavily reliant on Chinese import demand; 73% of Brazil’s exported soybeans have headed to China, versus a 51% average for the United States. The United States’ reduced reliance on exports to China allows for greater diversification compared to Brazil. This article examines the last 20 years of Brazilian and American soybean exports and provides perspective on the future of global trade in soybeans.

Brazil Soybean Exports Are Double the U.S.

Historically, the United States was the world’s largest soybean exporter. In 2013, Brazil surpassed the United States in soybean shipments for the first time. Since then, Brazil’s share of the global soybean trade has grown steadily, with Brazilian soybean exports reaching a record 3,744 million bushels for the 2023 calendar year, according to the Foreign Trade Secretariat (Secex). At the same time, American soybean exports were reduced to 1,789 million bushels, half the Brazilian soybean export volume, according to the U.S. Department of Agriculture (see Figure 1).

Over the last two decades, Brazilian soybean exports jumped fourfold (431%), from 705 million bushels in 2004 to 3,744 million bushels in 2023. The jump occurred mainly in the second decade. Soybeans have become Brazil’s primary agricultural export commodity by volume, accounting for more than 60% of the soybeans grown domestically. The Brazilian soybean crop for the 2022/23 marketing year was 5,680 million bushels, a historic record, according to the National Supply Company (Conab) – Brazil’s food supply and statistics agency.

Revenues from Brazilian soybean exports totaled a record $53.2 billion in 2023 versus $46.5 billion in the previous year, according to the Foreign Trade Secretariat (Secex). Considering the soybean complex, which also includes soybean oil and soybean meal, the revenue reached $67.3 billion in 2023, representing 40% of the total export revenue for the country. For the first time since the 1997/98 season, Brazil displaced Argentina as the leading global exporter of soybean meal due to severe drought, which cut Argentine soybean yields by half (see farmdoc daily, September 6, 2023).

Over the past two decades, U.S. soybean exports have increased 94%, from 922 million bushels in 2004 to 1,789 million bushels in 2023. The U.S. soybean exports have plateaued since 2016, with an average annual volume of 1,993 million bushels. The roughly doubling of exports occurred over the first decade and stagnated in the second decade.

Revenues from soybean exports totaled $27.9 billion in 2023 versus $34.4 billion in the previous year, according to the USDA. On average over the past five years, the United States has exported 49% of total soybean production. The soybean crop for the 2022/23 marketing year reached 4,160 million bushels, slightly lower than the previous year.

The decreased prominence of the U.S. in global soybean markets reflects in part the growth of domestic soybean demand. Soybean crush capacity in the United States has been steadily growing since 2021. According to the USDA’s latest World Agricultural Supply and Demand Estimates, projected domestic US soybean crush use for the 2023/24 marketing year (which runs from September to August) stands at 2,300 million bushels. This expansion is primarily fueled by the increasing demand for soybean oil, particularly from the renewable diesel sector. The US Environmental Protection Agency (EPA) continues to enforce biofuel blending targets for refiners and gasoline or diesel fuel importers, further driving this demand (see farmdoc daily, November 13, 2023).

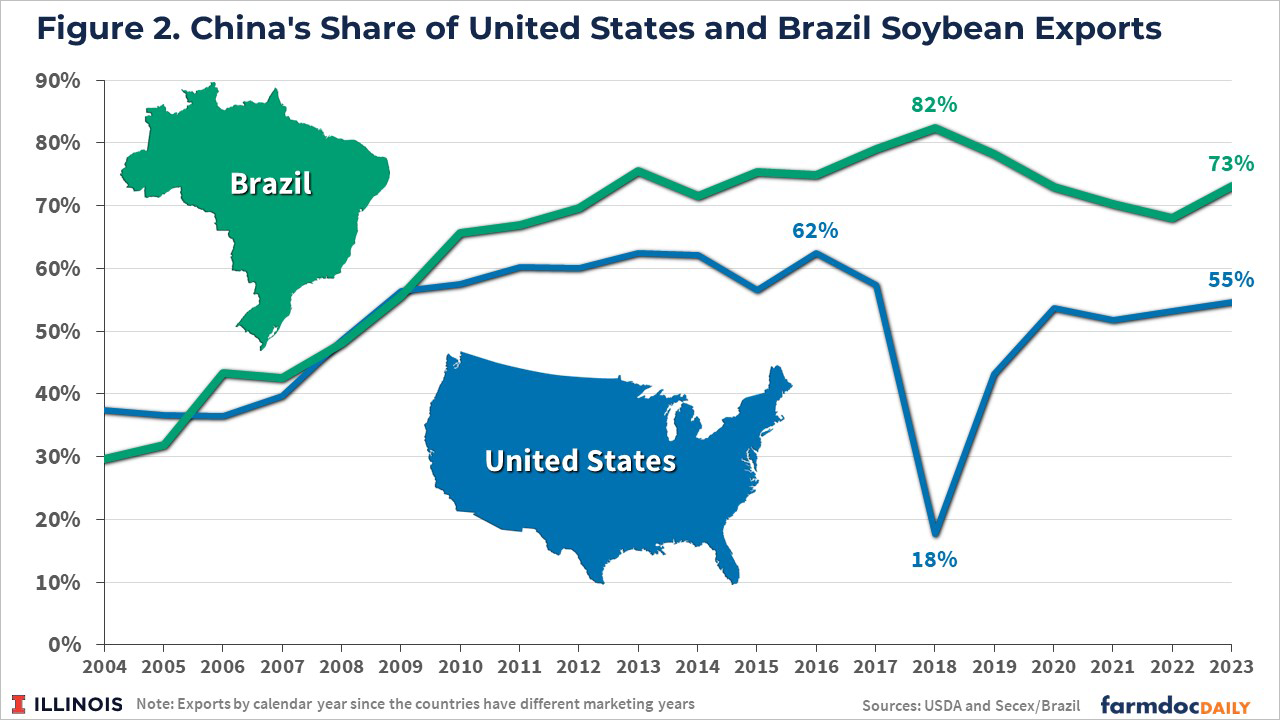

Brazil’s Heavy Reliance on the Chinese Imports

The dynamics of global soybean trade remain heavily influenced by China, which accounts for about 60% of worldwide soybean imports. China’s soybean imports are driven by demand for animal protein and edible oils, two essential components of a diversifying Chinese diet that reflects rising living standards. China predominantly sources its soybean supplies from Brazil and the United States. For many years, the United States was the top supplier, but in the last 15 years China has depended more on imports from South America, especially from Brazil. From 2019-2023, 73% of Brazil’s exported soybeans have headed to China, versus a 51% average for the United States (see Figure 2).

Brazilian exports to China surged to 70% in 2012 and peaked at 82% in 2018, coinciding with the U.S.-China trade war. In 2023, when Brazil’s soybean exports reached record levels, 73% of shipments went to China (see Figure 2). A bumper soybean crop and lower prices resulted in a 40% increase in Brazilian soybean exports to China compared to the previous year, reaching a record of 2,737 million bushels. Prior to 2023, the largest shipment of Brazilian soybeans to China had occurred in 2018 (2,521 million bushels), as purchases of U.S. soybeans plummeted due to the 25% retaliatory tariff put in place by China during the trade war.

The share of U.S. soybean exports going to China increased from below 40% in the mid-2000s to around 60% from 2011 until plummeting to just 18% during the trade war in 2018. China’s share of U.S. soybean exports has since increased but not fully recovered to pre-trade war levels, averaging just over 50% since 2020. Since the beginning of the trade dispute, the United States has searched for growth in markets outside of China – which reduced the American soybean imports to 977 million bushels in 2023, a 12% decrease compared to the previous year. Notable increases in U.S. trade occurred in Egypt and Mexico, with additional growth seen in Japan, Indonesia, Taiwan, and Bangladesh.

It is important to note that after two decades of near-constant increases, China’s soybean imports have seen periodic disruption since 2019. These fluctuations have been associated with the impacts of the COVID-19 pandemic and outbreaks of African swine fever within China’s pork industry. There is a perspective among several analysts that China’s soybean imports may have reached their highest point already. These trends coincide with China’s official strategies to increase domestic soybean cultivation and decrease import dependency. As part of its Five-Year Agricultural Plan, which runs through 2027, China has prioritized increasing self-sufficiency in soybeans and other grains and oilseeds.

Soybean Exports Outlook for 2024/25

The forecast for U.S. soybean exports in the 2024/25 marketing year stands at 1,875 million bushels, an increase of 155 million compared to current projections for the 2023/24 cycle. The projection was released during the USDA’s 100th Annual Agricultural Outlook Forum on February 15, 2024. Abundant global supplies are anticipated to drive down soybean prices, stimulating international demand. However, the U.S. share of exports is expected to remain below 30% of global exports, contrasting with the nearly 40% share observed during the 2013/14 to 2017/18 period, mainly due to higher South American supplies.

Meanwhile, Brazilian soybean exports should decrease in 2024 because of a smaller crop expected for the current season compared to last year’s record, especially in Mato Grosso – the largest soybean producing State in Brazil. Brazil’s soybean exports are projected to be 3,490 million bushels in 2024, down 8% compared to the previous year, according to the Conab. Even so, the Brazilian share of exports is expected to remain above 50% of global exports.

Final Considerations

Brazil had record soybean exports in 2023, while the United States’ shipments declined to just half the Brazilian soybean export volume. A bumper Brazilian soybean crop and lower prices resulted in a 40% increase in Brazilian soybean exports to China compared to the previous year. At the same time, between 2022 and 2023, the United States reduced by 12% its exports to China and increased domestic soybean crush capacity and use. In the last few years, American farmers have diversified the markets for their soybeans and reduced their reliance on China compared to Brazil.

Over the last 20 years, Brazilian soybean exports jumped fourfold, driven mainly by the Chinese market. The jump occurred primarily in the second decade, from 2017 to 2023. In contrast, the U.S. soybean exports have plateaued since 2016. The roughly doubling of American exports occurred over the first decade. Despite the plans to increase its own domestic soybean cultivation and decrease import dependency, China is expected to continue importing more soybeans from Brazil than the United States for price competitiveness and geopolitical reasons.

The recent history of the US-Brazil-China soybean trade triangle points to a trade-off between resiliency and growth in commodity marketing. The U.S. has managed to diversify its soybean use which may make markets for U.S. soybeans more resilient in the face of future shocks. However, it has failed to capture the growth in global soybean demand due to Chinese imports which has mainly gone to Brazil.

References

Braun, K. Massive Brazilian soybean exports too heavily leaning on China? Reuters, December 20, 2023. reuters.com

Colussi, J., S. Cabrini, N. Paulson, J. Baltz and C. Zulauf. " Brazil Breaks Soybean Export Record and Displaces Argentina in the Global Soybean Meal Market." farmdoc daily (13):161, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 6, 2023.

Irwin, S. " The Biodiesel Profitability Squeeze that Wasn’t." farmdoc daily (13):207, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 13, 2023.

U.S. Department of Agriculture (USDA), Agricultural Outlook Forum 2024. Grains and Oilseeds Outlook. February 14, 2024. usda.gov

farmdocdaily.illinois.edu

|