QVC earnings are August 7th and should be interesting to see where they land.

I have data I manually collect frequently on companies I invest in, want to invest in, or just watch for fun (some folks collect coins, stamps, or whatever else and guess this is my hobby). My investment with QVC is just in their bonds and no equity anymore as I mentioned, so I keep tabs to see how their new venture in Tiktok will take them. If it does look promising then an equity position could look good again - I am not seeing an equity case from this though.

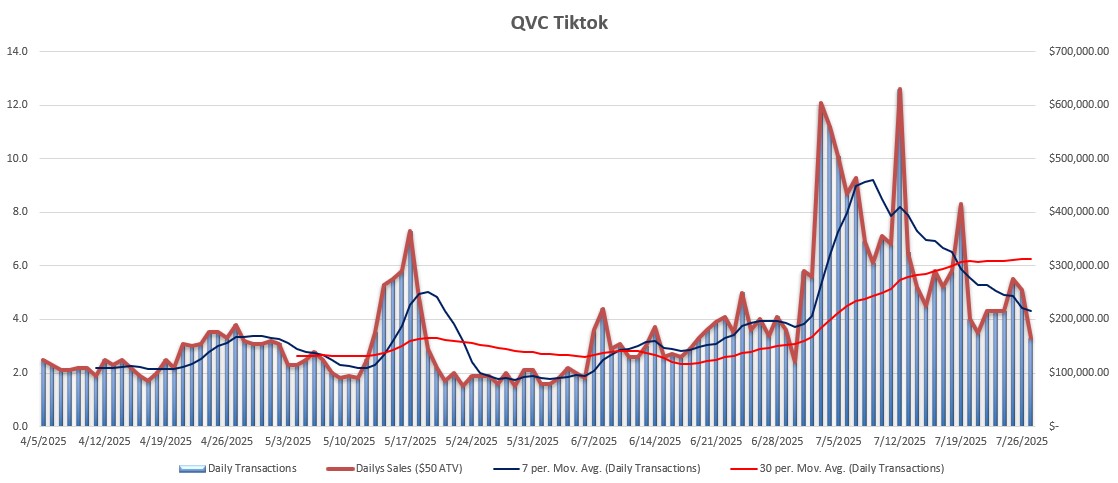

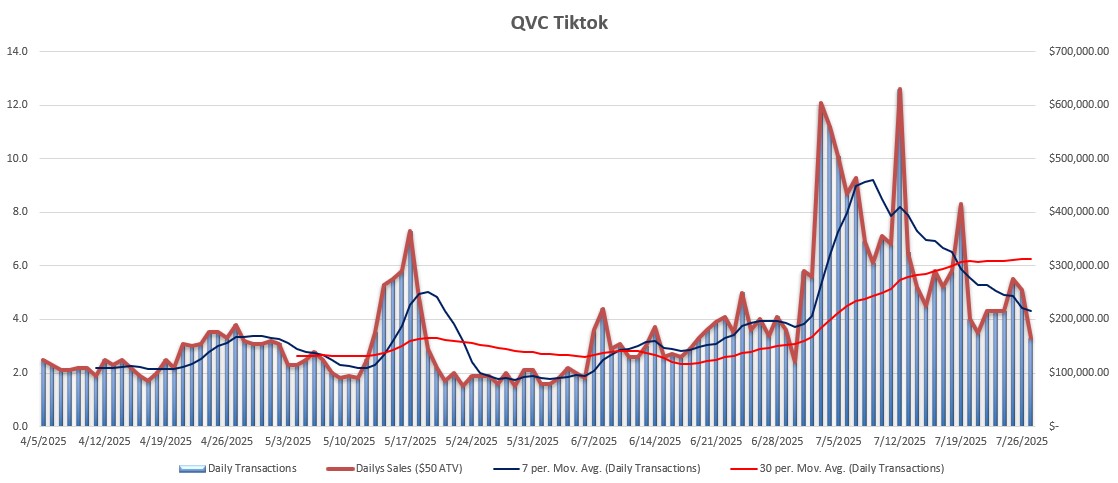

Some great blips from their May "Tiktok Super Event" and July being traditional "Christmas in July" promo, but outside that it's not impressive.

While there is some decent potential, the revenue here is too small to offset what they are losing from current distribution platform (linear TV). Data is not complete as I am not getting anything from their other streaming distribution channels, but my deduction is Tiktok has the broadest reach and fits their vCom model so it's best path forward.

The other thing to consider is what is the average transaction value (ATV)? If we peanut butter spread and assume $55 then this currently looks to be a $86M business which is only 1% of QxH 2024 revenue - so not much growth showing here. Problem is $55 is not accurate either as tracking things it looks like in July the ATV dropped below $30. This means lower ATV to get the growth, likely higher promotional spend to get the algo bump on Tiktok, and since 80-90% of what they do on Tiktok comes from affiliates maybe a higher commission spend for the preferential focus. Growth is good but not sure what the margins look like either.

That stated, all this Tiktok movement should make their new customers category pop in Q2 earnings so it's something to keep an eye on. Interesting to see what happens as historically 2% of new custoemrs would convert to a QVC "Best" customers, but I am skeptical this pattern holds in the new digital space. Tiktok itself seems to breed a more "mercenary" transaction than anything based on loyalty.

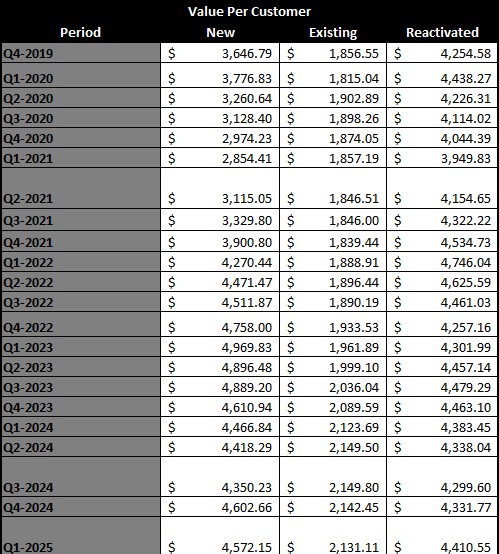

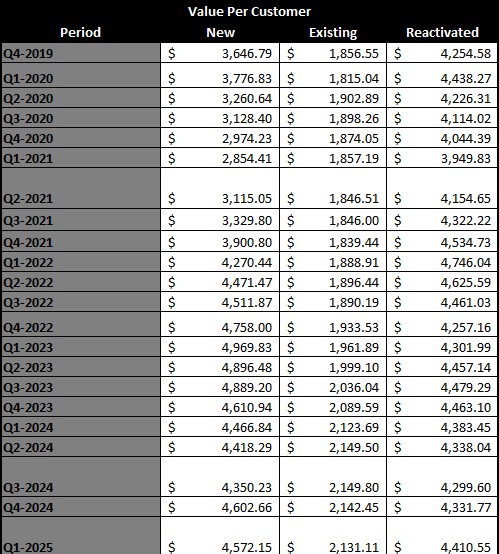

For their existing customers, I built a statistical model around them to try and predict where they may be each quarter and so far it has been holding pretty accurate:

This means I am "predicting" around ~3.797M existing customers in their Q2 earnings compared to last Q of 3.806M. So I am not seeing a clear path to how their revenue stabilizes here. The existing are what is most highly correlated to revenue so declines here mean the entire business is now at the mercy of mercenary transactions that come with no brand loyalty.

Interesting to note too I try and keep some measure on how valuable their customers are. And they are becoming more an more valuable or less? The declines are making the numbers in each category rise up which shows a clear picture there are problems here if this doesn't right-size. Each customer is more valuable today because the business is worse off.

We will see. I will write up more once earnings release.

I am curious to see how management responds on the new board members and what they're working on. No updates have come on credit facility refinance and nothing on their other senior notes. One can assume they're working with bond committees trying to get a pre-pack formed but only so long that can carry on until they either come to agreement or QVC is forced for free-fall. My view still is there is too much debt and of varying maturity to get a complete agreement.

I see some on platforms like X celebrating QVC Group is paying coupons on their current debt (LITNA) as if this is some good news the business is okay. Of course they are going to pay. Not paying doesn't help them negotiate with bond holders and makes them seem insolvent as it starts to trigger defaults - it's in their best interest to be business as usual until they make a move.

Happy investing.

-Sean |