T2 Metals Secures Option to Acquire Shanghai Gold-Silver Project in Yukon's Tombstone Gold Belt and Appoints Shawn Ryan to Advisory Board Project Lies in Premier North American Exploration District Surrounded by Advanced Projects

newsfilecorp.com

September 10, 2025 8:00 AM EDT | Source: T2 Metals Corp.

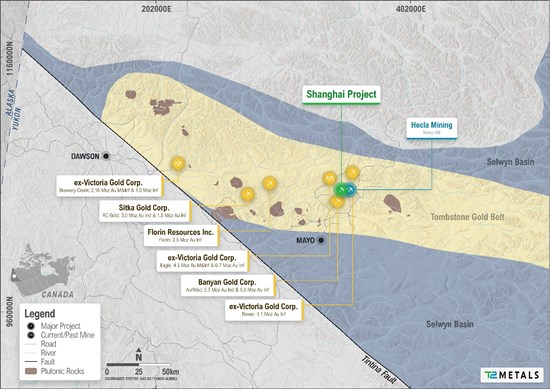

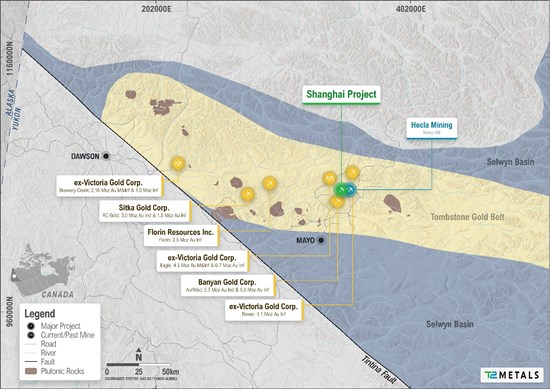

Vancouver, British Columbia--(Newsfile Corp. - September 10, 2025) - T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A2DR6E) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in the 27.4 sq km Shanghai gold-silver project in the Mayo Mining District, Yukon Territory, Canada. The project lies within the Tombstone Gold Belt, 12 km west of Hecla Mining's Keno Hill silver mine, and midway between the AurMac, Eagle and Raven intrusion-related deposits (see Table 1 for further information on these deposits).

The Shanghai project includes a Class 3 permit enabling drilling, road construction and installation of a camp.

Highlights:

- Large landholding in the Tombstone Gold Belt, one of North America's premier gold and silver mining districts;

- Project lies within 10 km of multiple resource-stage gold projects as reported within NI43-101 compliant technical reports since 2022 (see resource information pertaining to the Eagle, Olive, Raven, Airstrip and Powerline projects in Table 1 and www.sedarplus.ca for supporting technical reports);

- Similar geological setting to major discoveries by Sitka Gold Corp and Banyan Gold Corp;

- No prior exploration drilling on the property;

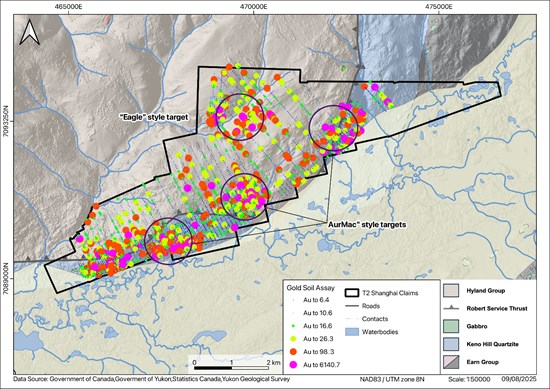

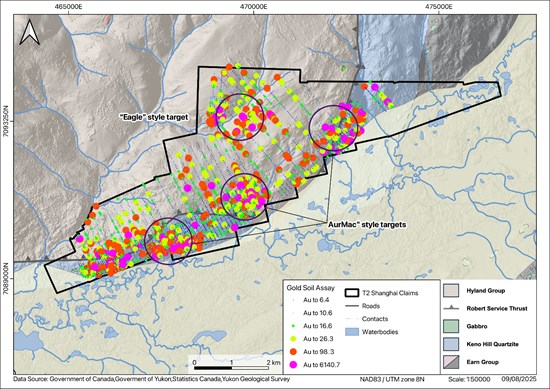

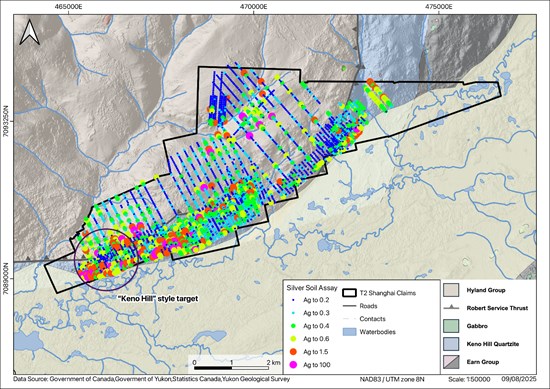

- High gold, silver, antimony and bismuth in soil samples provide immediate targets. Gold values in soil up to 6.1 g/t Au;

- Permits in place for road construction and drilling;

- Highly regarded and successful explorer Shawn Ryan to join T2 Metals' Advisory Board;

The Shanghai project sits within the northwest portion of the Yukon's Tombstone Gold Belt, one of North America's most active and gold-endowed mining districts, and home to the famous Klondike goldfield (Figure 1). Recent exploration of the Tombstone Gold Belt by Snowline Gold Corp (Valley project), Sitka Gold Corp (RC Gold project), Banyan Gold Corp (AurMac project) and Sanatana Resources Inc have highlighted the potential for major new gold discoveries and value creation.

Mark Saxon, CEO of T2 Metals Corp., said, "We have worked hard to identify high potential gold projects to augment our existing portfolio, and are very pleased to have secured Shanghai in one of North America's premier gold exploration districts. The project has been held by Shawn Ryan for over 20 years, during which time major gold projects have been discovered on the property boundaries.

New investment by a range of explorers in the Tombstone Gold Belt is progressively revealing significant gold deposits. We are very pleased to join the search, supported by one of the Yukon's most successful explorers in Shawn Ryan."

Project partner, Shawn Ryan, commented, "The geology and geochemistry of the Shanghai project look a lot like that from the surrounding resource-stage gold deposits, and it is a project well overdue for drilling. We are keen to see what T2 Metals will discover and I'm very happy to be advising their technical team."

Figure 1: Regional Location of the Shanghai Project, Yukon Territory, Canada.

See Table 1 for additional information on resource-stage projects and supporting NI43-101 report references.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

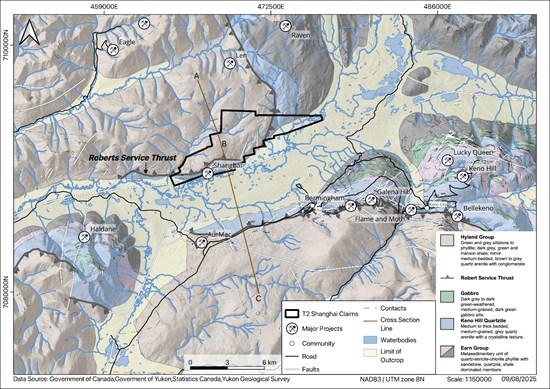

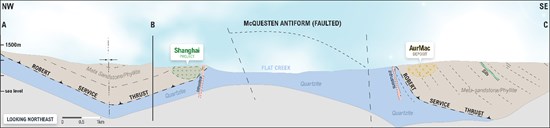

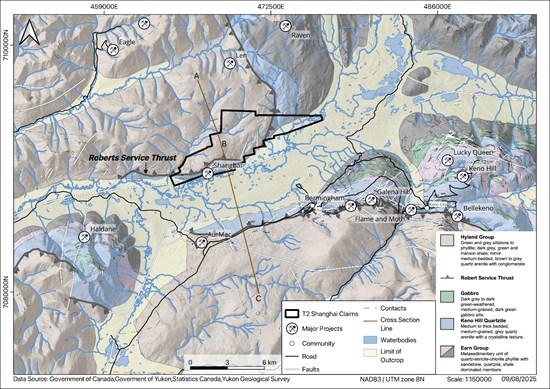

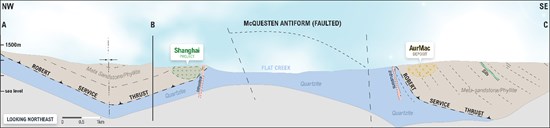

The Shanghai claims cover a large area of Hyland Group metasediments immediately above the Robert Service Thrust fault with mapped mid-Cretaceous (~90Ma) Tombstone Plutonic Suite intrusions (Figure 2, 3). This setting is analogous to the AurMac deposit of Banyan Gold Corp, which hosts 112.5 million tonnes at 0.63 g/t Au (for 2.28 million oz of gold) in the Indicated Resource estimate category; and 280.6 million tonnes at 0.60 g/t Au (for 5.50 million ounces of gold) in the Inferred Resource estimate category, only 6 km to the south of Shanghai (resource information for the AurMac deposit is based on a technical report prepared for Banyan Gold Corp titled Technical Report, Aurmac Property, Yukon Territory, Canada by Hantelmann, T. et al., with an effective date of June 28, 2025 and available at www.sedarplus.ca). See Table 1 for additional information.

The presence of the Tombstone Plutonic Suite is similar to the Yukon's most exciting recent discoveries that lie to the east (Snowline) and west (Sitka) of Shanghai.

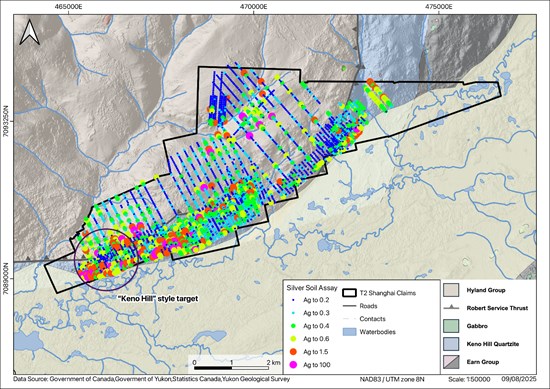

From 2004, Ryan staked the areas surrounding the historical Shanghai silver-lead-zinc mine north of Mayo, identifying overlapping potential for intrusion-related gold and high-grade silver. As the Hyland Group presents limited outcrop, Ryan applied the techniques utilised during his discovery of the White Gold and Coffee deposits and collected more than 4,000 auger soil samples. This sample data has defined areas of high gold-antimony-bismuth, an association that correlates well to the intrusion-related gold deposits being explored by Banyan Gold Corp, Sitka Gold Corp and Snowline Gold Corp; and areas of high silver-lead which correlates to Keno Hill style mineralization.

Auger soil data covers an area of 23 km2 with gold values ranging from <0.5 ppb to 6.1 ppm averaging 17 ppb; silver values ranging from <0.05 ppm to >100 ppm averaging 0.4 ppm; and lead ranging from 15 ppm to >1% averaging 27 ppm (4435 samples). In addition to auger soil sampling, Ryan completed ground magnetics and induced polarization ("IP") geophysics over much of the Shanghai property. The reader is cautioned that while this information is considered reliable the Qualified Person and the Company have relied on data provided by the Optionor and has been unable to verify the information independently. Additional information as to the history of the Shanghai project can be found in NI43-101 Technical Report titled "Shanghai Project Technical Report, Mayo Mining District, Yukon" dated July 15, 2022 by Doherty, R. A. (P. Geo.) on behalf of Targa Exploration Corp. on www.sedarplus.ca.

Despite the discovery potential of the project, and geological similarity to major deposits, no exploration drilling has been completed at Shanghai. T2 Metals proposes additional surface sampling and local geophysics to better refine and prioritise target areas, followed by drilling during 2026. The Shanghai project holds a valid Class 3 Quartz Mining Land Use permit which enables drilling, road construction and installation of a camp if required. The project lies within 5km of the Eagle Gold Mine road and 6 km from Baynan Gold Corp's AurMac camp.

Figure 2: Geological Map for Shanghai Project, Yukon Territory, Canada.

See Table 1 for additional information on resource-stage projects and supporting NI43-101 report references.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Figure 3: Cross Section from Shanghai Project to AurMac Deposit Area (see Figure for Section line).

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Option Terms

Subject to receipt of TSX Venture Exchange ("TSXV") approval of the Option Agreement, T2 Metals will have the option to acquire a 100% undivided interest in the Shanghai project, for a total consideration of $500,000 in cash and 3,000,000 common shares of T2 Metals to be paid to the Optionor in incremental amounts over a seven-year period, which may be accelerated at the discretion of T2 Metals. An initial cash payment of $50,000 and an initial payment of 300,000 common shares in T2 Metals will be made following TSXV acceptance of the Transaction. All shares issued under the Option Agreement will be subject to a four-month hold period from the date of issuance in accordance with applicable securities laws.

In order to exercise the Option, T2 Metals is also required to incur exploration expenditures on the Shanghai project totalling a minimum of $1,800,000 over six years, including $100,000 by November 15, 2026. Upon commencement of commercial production on the Shanghai project, the Optionor will retain a 2% net smelter return royalty on the property with 1% purchasable by T2 Metals for the cash payment of $1,000,000 to the Optionor.

The claims are located within the traditional territory of the Nacho Nyak Dun First nation, which has settled its land claim, and is a self-governing first nation.

About Shawn Ryan

As part of the Shanghai transaction, Shawn Ryan has agreed to join T2 Metals Advisory Board. Shawn is a well-known prospector and entrepreneur in the Yukon's mineral exploration industry. He is recognized for his innovative and systematic approach to gold exploration, which has been credited with sparking a "second Klondike gold rush". Ryan's career is marked by a methodical approach to sampling, including development of a novel auger soil sampling technique, a method particularly effective in the Yukon where thick soil layers often obscure bedrock.

Shawn Ryan's work led to several significant discoveries including the Golden Saddle and Arc deposits, which became part of the multi-million ounce White Gold Project acquired by Kinross Gold, and the Coffee project, which was sold to Goldcorp (now Newmont Corporation) for $520 million. His contributions to the industry have earned him numerous awards, including the Bill Dennis Award for prospecting from the Prospectors & Developers Association of Canada (PDAC). Shawn's work is seen as a major factor in modernizing exploration in the Yukon and drawing new attention to the territory's mineral potential.

Figure 4: Gold in Auger Soil Geochemistry from Shanghai Project, Yukon Territory, Canada.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Figure 5: Silver in Auger Soil Geochemistry from Shanghai Project, Yukon Territory, Canada.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

Figure 6: Site Visit to Shanghai Project. Photo looking south to AurMac Deposit.

To view an enhanced version of this graphic, please visit:

images.newsfilecorp.com

About the Historic Shanghai Mine

The Shanghai mine is hosted by the Keno Hill Quartzite immediately below the regionally extensive Robert Service Thrust fault. It lies on the northern limb of the McQuesten Antiform, presenting a mirror image of the Keno Hill camp found on the southern limb of this antiform.

During the 1960's the Shanghai Mine was explored by Silver Titan Mines Ltd with close to 800 m of underground development. Assays reported from underground workings that followed veins included 9.1 m @ 1182.8 g/t Ag, 8.2% Pb and 7.2% Zn (average width of 1.5 m) (Yukon Minfile 105M 028).

About the Tombstone Gold Belt

The Tombstone Gold Belt, a component of the larger Tintina Gold Province, is a highly prospective metallogenic province in the Yukon, with a range of well-known and emerging gold discoveries. The belt is characterized by a suite of mid-Cretaceous, reduced, felsic intrusions known as the Tombstone Plutonic Suite. These intrusive bodies and the surrounding host rocks have created conditions for the formation of numerous Intrusion-Related Gold Systems (IRGS). Exploration efforts have identified multiple mineralized corridors with gold hosted in sheeted quartz veins and disseminated mineralization within both the intrusive bodies and the hornfelsed country rocks.

Gold mineralization in the Tombstone Gold Belt is typically associated with a distinctive multi-element signature that includes bismuth, tellurium, and tungsten, along with arsenic and antimony. Gold-bearing fluids exsolved from cooling intrusions and preferentially deposited gold in brittle, structurally controlled environments. Both high-grade, structurally-controlled vein systems and lower-grade, bulk-tonnage deposits are known. The region hosts numerous significant deposits and is the site of recent discoveries by companies such as Snowline Gold Corp., Banyan Gold Corp. and Sitka Gold Corp.

Table 1: Gold Deposits in the Tombstone Gold Belt with NI43-101 References

| Project | EFFECTIVE

DATE | Author | Report For | Tonnes

(M) | Au

(g/t) | Contained

Gold | Status | | Brewery Creek | 18/01/2022 | Cook. C. et al., 2022. | Sabre Gold Mines Corp | 34.5 | 1.03 | 1.142 M oz | Measured & Indicated |

|

|

|

| 36.0 | 0.88 | 1.018 M oz | Inferred | | Report Title: Preliminary Economic Assessment. NI 43-101 Technical Report on the Brewery Creek Project Yukon Territory, Canada | | Eagle (Dublin Gulch) | 31/12/2022 | Harvey, N., 2022 | Victoria Gold Corp | 233.2 | 0.57 | 4.303 M oz | Measured & Indicated |

|

|

|

| 36.2 | 0.62 | 0.724 M oz | Inferred | | Report Title: Technical Report. Eagle Gold Mine. Yukon Territory, Canada | | Olive (Dublin Gulch) | 31/12/2022 | Harvey, N., 2022 | Victoria Gold Corp | 11.6 | 0.97 | 0.361 M oz | Measured & Indicated |

|

|

|

| 5.5 | 1.17 | 206,479 | Inferred | | Report Title: Technical Report. Eagle Gold Mine. Yukon Territory, Canada | | Raven (Dublin Gulch) | 15/09/2022 | Jutras, M., 2022. | Victoria Gold Corp | 19.9 | 1.67 | 1.071 M oz | Inferred | | Report Title: Technical Report On The Raven Mineral Deposit, Mayo Mining District Yukon Territory, Canada | | Blackjack (RC Gold) | 21/01/2025 | Simpson. R., 2025 | Sitka Gold Corp | 39.9 | 1.01 | 1.298 M oz | Indicated |

|

|

|

| 34.6 | 0.94 | 1.045 M oz | Inferred | | Report Title: Clear Creek Property, RC Gold Project NI 43-101 Technical Report Dawson Mining District, Yukon Territory | | Eiger (RC Gold) | 19/01/2023 | Simpson. R., 2025 | Sitka Gold Corp | 27.4 | 0.5 | 0.440 M oz | Inferred | | Report Title: Clear Creek Property, RC Gold Project. NI 43-101 Technical Report. Dawson Mining District, Yukon Territory | | Airstrip (AurMac) | 28/06/2025 | Jutras, M., 2025 | Banyan Gold Corp | 27.7 | 0.69 | 0.614 M oz | Indicated |

|

|

|

| 10.1 | 0.75 | 0.244 M oz | Inferred | | Report Title: Technical Report, Aurmac Property, Yukon Territory, Canada | | Powerline (AurMac) | 28/06/2025 | Jutras, M., 2025 | Banyan Gold Corp | 84.8 | 0.61 | 1.663 M oz | Indicated |

|

|

|

| 270.4 | 0.60 | 5.216 M oz | Inferred | | Report Title: Technical Report, Aurmac Property, Yukon Territory, Canada | | Florin | 6/04/2025 | Simpson. R., 2021 | St. James Gold Corp. | 170.9 | 0.45 | 2.474 M oz | Inferred | | Report Title: Florin Gold Project. NI 43-101 Technical Report. Mayo and Dawson Mining Districts, Yukon Territory | | Valley (Rouge) | 15/05/2025 | Burrell. H. et al., 2024 | Snowline Gold Corp | 75.8 | 1.66 | 4,047 M oz | Indicated |

|

|

|

| 81.0 | 1.25 | 3.256 M oz | Inferred | | Report Title: Rogue Project. NI 43-101 Technical Report and Mineral Resource Estimate. Yukon Territory, Canada |

Disclaimers

The qualified person (as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects) for the Company's projects, Mr. Mark Saxon, the Company's Chief Executive Officer, a Fellow of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists, has reviewed and approved the contents of this release.

Readers are cautioned that the discussion about adjacent or similar properties in this press release is not necessarily indicative of the mineralization or potential of the Shanghai property. The Company has no interest in or right to acquire any interest in any such adjacent properties.

About T2 Metals Corp (TSXV: TWO) (OTCQB: TWOSF) (WKN: A2DR6E)

T2 Metals Corp is an emerging copper and precious metal company enhancing shareholder value through exploration and discovery. T2 is focused on the Sherridon Project in Manitoba, the Shanghai Project in the Yukon, and the Cora Project in Arizona.

ON BEHALF OF THE BOARD,

"Mark Saxon"

Mark Saxon

President & CEO | For further information, please contact:

t2metals.com

1 (604) 685-93161305 - 1090 West Georgia St., Vancouver, BC, V6E 3V7

info@t2metals.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain information set out in this news release constitutes forward-looking information. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "intend", "could", "might", "should", "believe" and similar expressions. Forward-looking information in this press release include statements regarding the potential exercise of the Option and obtaining regulatory approval for the Option, and future exploration plans for the Company on the Shanghai project. Forward-looking statements are based upon the opinions and expectations of management of the Company as at the effective date of such statements and, in certain cases, information provided or disseminated by third parties. Although the Company believes that the expectations reflected in forward-looking statements are based upon reasonable assumptions, and that information obtained from third party sources is reliable, they can give no assurance that those expectations will prove to have been correct. Readers are cautioned not to place undue reliance on forward-looking statements.

These forward-looking statements are subject to a number of risks and uncertainties. Actual results may differ materially from results contemplated by the forward-looking statements. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. Such risks include uncertainties relating to exploration activities; risks in obtaining regulatory approval; the impact of exploration competition; unexpected geological conditions; changes in government regulations and policies, including trade laws and policies; failure to obtain necessary permits and approvals from government authorities; volatility and sensitivity to market prices; volatility and sensitivity to capital market fluctuations; the ability to raise funds through private or public equity financings; environmental and safety risks including increased regulatory burdens; weather and other natural phenomena; and other exploration, development, operating, financial market risks. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and should not place undue reliance on such forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof or the dates specifically referenced in this press release, where applicable. The Company does not undertake to update any forward-looking statements, except as may be required by applicable securities laws.

SOURCE: T2 Metals Corp. SOURCE: T2 Metals Corp. |