LPL's Mid-Year 2021 Outlook -

lpl.com

excerpts -

STOCKS: The second year of a bull market is often more challenging than the first, but historically still usually produces gains. Economic improvement should continue to support S&P 500 Index earnings, which had a stunning first quarter. While valuations remain somewhat elevated, we think they look reasonable after considering still low interest rates and earnings growth potential. Our 2021 year-end S&P 500 fair-value target range of 4,400–4,450 is based on a price-to-earnings ratio (P/E) of 21.5

and our 2022 S&P 500 earnings per share (EPS) forecast of $205.

--------

THE U.S. ECONOMY has surprised nearly everyone to the upside as it speeds along thanks to vaccinations, reopening, and record stimulus. All have combined to produce what should be one of the best years for growth ever.

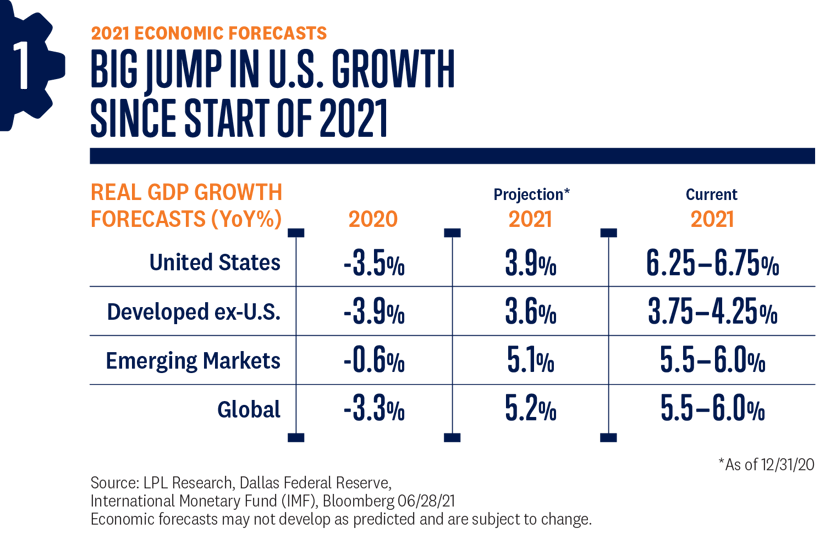

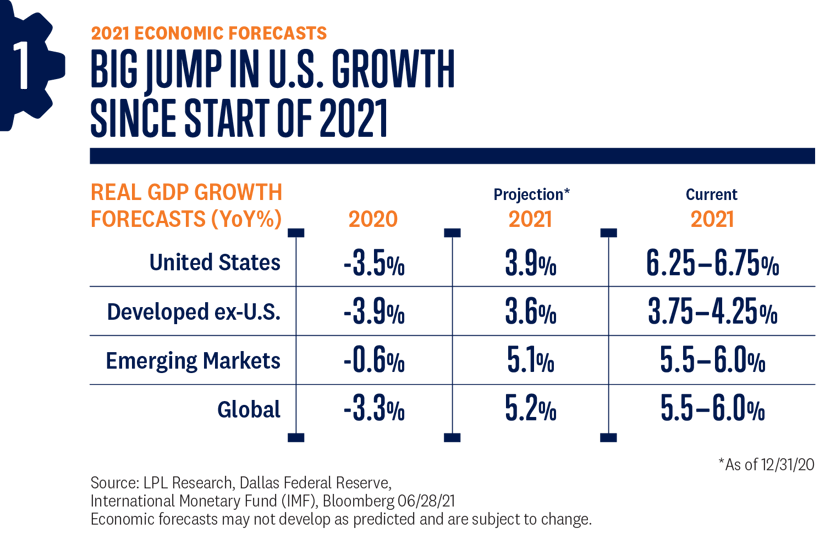

Despite the natural challenges of ramping back up, the recovery still seems capable of providing upside surprises. As a result of the strides made toward full reopening, rapid vaccine distribution, massive stimulus efforts, and support from the Fed, we maintain our 2021 forecast for U.S. GDP growth of 6.25%–6.75%. Last year’s 3.5% drop in GDP, the worst year since the Great Depression, may not be forgotten—but it has been left in the dust of 2020.

With various measures of output matching or exceeding pre-pandemic levels, it’s clear last year’s recession is in the rear-view mirror, and it may go down as the shortest one in history—even shorter than the six-month recession from the early 1980s.

Globally, Europe and Japan have been slower to move past the pandemic, but explosive growth may be forthcoming once they do. Meanwhile, emerging markets continue to be a source of solid global growth, with several Asian emerging markets being among the first to recover from the pandemic, though growth in the United States will likely be stronger [Figure 1].

THIS ECONOMIC CYCLE IS ONLY ON ITS FIRST LAP

Since World War II, economic expansions have lasted an average of five years, with the four most recent cycles going even longer. Before the pandemic, the most recent expansion was the longest ever at 11 years, and might have gone on even longer if COVID-19 hadn’t struck. However, this cycle may not continue on as long as the last one, considering this wasn’t your average recession.

Because the recession last year was likely the shortest ever, and the economy was supported by historic stimulus, some imbalances weren’t worked off like we tend to see in a normal recession. Corporate debt levels remain high, supported by low interest rates, and stock valuations never really reset. The good news is this new cycle of growth probably has enough going for it to be at least average, which would still give it another four years [Figure 2]. And there’s nothing wrong with being average!

|