Let's see what Perplexity.AI says:

Several publicly traded companies manufacture natural gas generators, which are increasingly relevant as demand for reliable power sources for data centers grows. Here are some notable manufacturers: Major Manufacturers of Natural Gas Generators- Caterpillar Inc.

A leading manufacturer known for its heavy machinery and power systems, Caterpillar offers a range of natural gas generators suitable for various applications, including industrial and commercial use

3. - Cummins Inc.

Cummins provides natural gas generator sets designed for high-hour base load and Combined Heat & Power (CHP) systems. Their products are known for reliability and efficiency in various sectors, including automotive and healthcare 5

. - Generac Power Systems, Inc.

Generac specializes in backup power solutions and has a significant range of natural gas-powered generators for residential, commercial, and industrial markets 3

. - Kohler Co.

Kohler manufactures natural gas generators that are used in both commercial and industrial settings, offering models that range from 300 to 500 kW 3. - Aggreko

Aggreko provides temporary power solutions and has a variety of natural gas generators that cater to industries such as construction and events 3. - MTU Onsite Energy

A subsidiary of Rolls-Royce Power Systems, MTU offers natural gas generator sets designed for high availability and efficiency in critical applications 1.

These companies are well-positioned to meet the growing demand for natural gas generators as data centers increasingly seek reliable energy sources.

Of the group with the lowest PE at 18x is Cummins Inc (CMI)

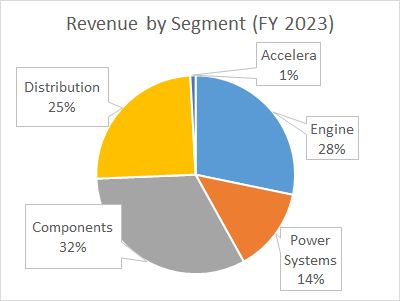

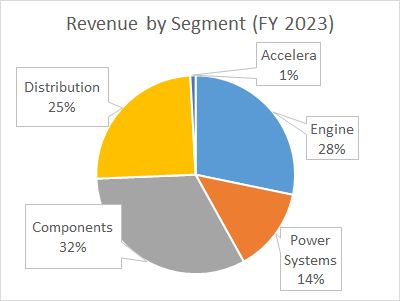

Cummins Inc. has a significant presence in the natural gas generator market, which is part of its broader Power Systems segment. Here are the details regarding the percentage of Cummins' business attributed to natural gas power generators, the margins for this product, and their manufacturing locations :Business Percentage- Natural Gas Generators Contribution: In the second quarter of 2024, Cummins reported that revenue from power generator sales totaled $987 million, which is part of the overall Power Systems segment revenue of $1.589 billion. This indicates that power generation contributes approximately 62% to the Power Systems division's revenue. However, the exact percentage of total company revenue that comes from natural gas generators specifically is not explicitly stated in the available data.

Margins- EBITDA Margins: The EBITDA margin for the Power Systems segment, which includes natural gas generators, was reported at 19.4% in the third quarter of 2024 and around 18.9% in the second quarter of 2024. This suggests that Cummins maintains healthy profit margins on its power generation products.

Manufacturing Locations- Manufacturing Facilities: Cummins operates multiple manufacturing plants globally, including facilities in:

- Columbus, Indiana: The headquarters where various engines and power systems are produced.

- Jamestown, New York: Known for heavy-duty engine production.

- Other global locations may also contribute to manufacturing specific components or complete systems for their natural gas generators.

These details reflect Cummins' commitment to providing reliable power generation solutions, particularly as demand increases in sectors like data centers and industrial applications.

-----------------------------------------------------

I like to see American companies and CMI appears to have a good foothold in this sector (Power Systems Division). Might be worth nibbling at CMI. 16.45x Forward PE and expectations of 10% - 15% Growth going forward.

----------------------------

Cummins Inc. (CMI) has experienced notable growth in its Power Systems division, particularly driven by the demand for natural gas generators in data centers. Here’s an overview of the growth trends and management's forecasts for the coming years: Recent Growth in Power Systems Division- Sales Performance: In Q3 2024, Cummins reported that the Power Systems division generated $1.687 billion in sales, reflecting a 17% increase from $1.444 billion in Q3 2023. This growth was largely attributed to heightened demand for power generation products, especially from data center applications 2 5

. - Power Generation Revenue: The revenue from power generation specifically surged by 80%, reaching $1.091 billion in Q3 2024, compared to $606 million in the same quarter of the previous year 2

. This indicates a strong market response to the growing needs of data centers for reliable power solutions.

Management Forecast- Future Growth Projections: Cummins management anticipates continued robust growth in the Power Systems division, with expectations for sales increases of 10% to 15% in their Power Generation business due to ongoing demand from data centers and new product introductions

1

. They have concrete plans to ramp up production of their larger generator sets, which are reportedly sold out through 2025. - Long-Term Outlook: The company is optimistic about maintaining a growth trajectory in the Power Systems segment, particularly as global demand for natural gas generators rises. The overall growth forecast for the Power Systems division is projected at 5% to 10% annually over the next several years 1.

Summary Cummins is well-positioned to capitalize on the increasing demand for natural gas generators, especially in the data center market. With significant sales growth already observed and optimistic projections from management, the Power Systems division is set to play a critical role in Cummins' overall strategy and financial performance moving forward. |