Terrible Q2 QVC ( $QVCGA, $QVCGP ) print. Especially since Q2 & Q4 are their more power quarters.

The thing that really caught my eye was they stated they borrowed $975M under their credit facility; this is a typical prepetition move to use up all the credit you can before you file. They now have $200M left on the facility! It is pretty clear to me they are going to file and would be beyond surprised if they do not. They also had no live Q&A on their investor call which itself is a tell and to be fair is normal given their legal hires. It's still a tell....

Bill Wafford stated they halted the QVCGP dividend and drew on the revolver to strengthen their cash position; i.e., war chest building. He hinted they are continuing to explore financial moves but no decisions have been made yet.

FCF was ($156M) which is of course now putting massive pressures on Q3/Q4 to deliver and that is unlikely. Core FCF to adjust for WC was ($59M). If you take that ($156M) and adjust for debt borrowing and repayment FCF was still negative at ($13M).

QxH revenue dropped 11% going from $1,558M to $1,391 but on some positive note international QVC grew from $576M to $593M. Cornerstone continues its decline going from $273M to $252M. They took another massive impairment on goodwill/tradenames of $2.4B. SG&A was 18.9% of revenue which is a decent spike.

My existing customer model continues to hold up within the range as existing this quarter ended up at 3,720,000 and my prediction range was 3,732,221-3,797,691.

2.26% QoQ decline in existing customers is terrible though and is highest decline since Q2 2024. With the correlation to revenue it makes the pivot to streaming look far too late to matter.

Worth noting their customer counts do not include anything via Tiktok shop, but revenues tell me that doesn't matter. Even with the estimates I made on Tiktok it has proven to be far too small to matter to the overall direction. CEO Rawlinson touted social is seeing 30% revenue growth but these are marketing numbers in my eyes because where's the beef? It's not in their revenue that's for sure.

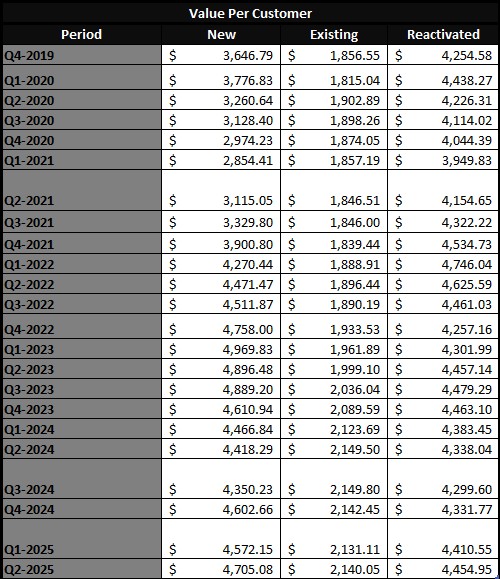

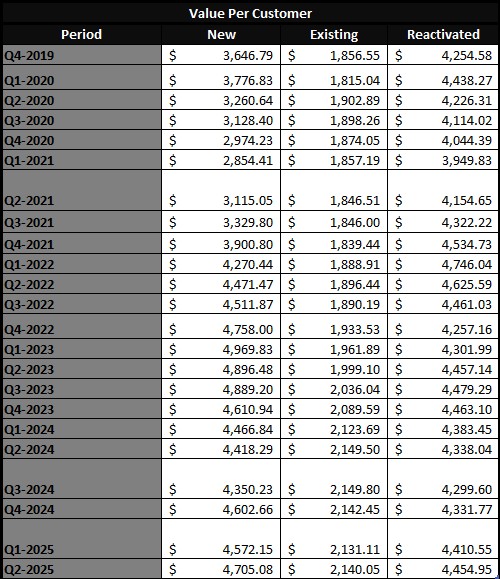

Update on Value Per Customer metric. They continue to become more valuable because the business is in such decline. Dangerous path the company is on.

I continue with my bankruptcy play here as I believe this is where QVC is headed now.

Happy investing,

Sean |