More insight into trade war with China and the possible impact on Semis.

Link: seekingalpha.com

Why Memory Chips Won't Be Impacted By A Trade War In One Chart

Apr. 9, 2018 7:39 AM ET

Robert Castellano

Chipmakers, solar, macro, research analyst

The Information Network

Summary

Current bravado between the U.S. and China that could spark a trade war could also impact U.S. manufacturers of memory chips.

Despite massive investments to make China self sufficient is semiconductor production, China imports nearly all its memory chips from foreign companies.

Any trade war that would impact the flow of memory chips into China would have a deleterious affect on its internal production of high-tech consumer products utilizing memory chips.

President Trump has started to increase pressure on the Chinese with threats of tariffs on 1,300 Chinese goods imported into the U.S. While there is speculation about whether it would happen, more importantly for this article, there is speculation that memory chips would somehow be impacted. And if they were, then Micron Technology ( MU) would be impacted along with Intel ( INTC) through its IM Flash Technologies joint venture, and Western Digital ( WDC). All three memory companies have U.S. headquarters and hence would be part of a U.S.-China trade war.

While China's response to President Trump's initial list of items focused on imports of agricultural products into China, that list escalated to 106 items that do include items that use memory chips. Conversely, the U.S. government's list of 1,300 Chinese-made items include a plethora of high-tech products containing DRAMs and NAND memory chips.

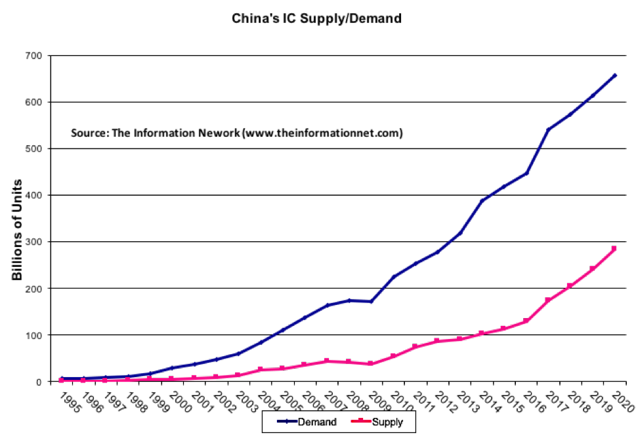

My contention is that China is far from becoming self sufficient in IC (integrated circuit) production, which is clearly illustrated in Chart 1 below. China needs these semiconductors, and a trade war that constricts the supply chain of components will negatively impact the production schedules of the consumer high-tech products made in China.

Chart 1 – Source: The Information Network Chart 1 – Source: The Information Network

According to The Information Network’s report entitled "Mainland China's Semiconductor and Equipment Markets: A Complete Analysis of the Technical, Economic, and Political Issues," massive investments in Mainland China are finally showing benefits as the ratio of integrated circuits made in China versus those imported into China increased from 29.1% in 2016 to 32.2% in 2017.

China produced 173.9 billion IC in 2017, up from 130.3 billion ICs in 2016. China's imported ICs were 366.1 billion ICs in 2017, up from 317.7 billion ICs in 2016.

In other words, China consumed more than 500 billion ICs to make smartphones and all the rest of the consumer products then sold worldwide.

However, China produced fewer than 200 billion. The shortfall of 366 billion imported ICs included DRAM and NAND memory chips from the U.S. memory companies above and Korea’s Samsung Electronics ( OTC:SSNLF) and SK Hynix, and Japan’s Toshiba ( OTCPK:TOSBF). Memory chips comprised about 25% of the chips imported.

Data in this article updates data from my February 21, 2017 Seeking Alpha article entitled “China's Semiconductor Surge: What Investors Need To Know.”

China Memory MarketAs an example of China’s need to import memory chips, Micron Technology's FY 2017 sales to customers outside the United States totaled $17.56 billion and included sales of $10.39 billion in China, $2.54 billion in Taiwan, $1.36 billion in Europe, $1.03 billion in Japan, and $1.81 billion in the rest of the Asia Pacific region. The sales to China represented 59.2% of outside sales. And of the $20.32 billion in overall sales, China represented 51.1% of sales. Clearly any tariff or trade war would have a profound impact on Micron's revenue.

In addition, revenues to China represented 22.37% of WDC’s $19.09 billion in revenues in FY2017, the highest of all geographic regions. These revenues are for NAND memory and hard disk drives. While exposure to China is half of Micron's in revenue, it is nonetheless substantial.

Obviously, China represents a significant market for these companies. But on the other hand, since Chinese chip manufacturers don’t make these devices yet, 100% of memory chips are imported into China yearly. In fact, China accounted for about 30% of overall memory consumption in 2017, with 22% of DRAM demand and 29% of NAND demand. And this is where the U.S. has leverage in trade negotiations.

On the other hand, the ubiquity of memory in electronics, which is the driving force in the growth of memory companies such as MU, could, in fact, be a detriment to this growth if a trade war were to escalate.

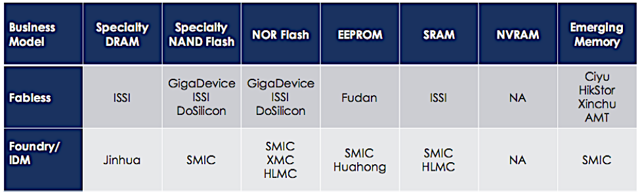

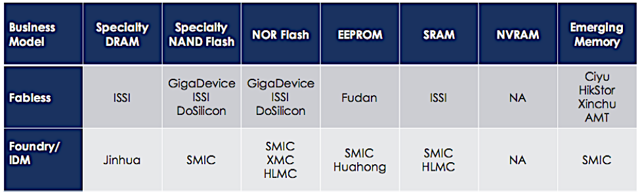

China has several companies involved in the specialty memory area. But China memory companies are too small to really be a concern for global memory companies, and could potentially help the industry as the industry is over consolidated.

China's Gigadevice Semiconductor has been historically a supplier of NOR flash. More recently the company has acquired ISSI, and is now also supplies specialty DRAM and NAND. Gigadevices purchases SLC NAND from Toshiba and is working with Broadcom ( AVGO), Marvel ( MRVL), and Qualcomm ( QCOM), and INTC. Chart 2 shows the list of Chinese companies with and without fabs.

Chart 2 - Source: GigaDevice Chart 2 - Source: GigaDevice

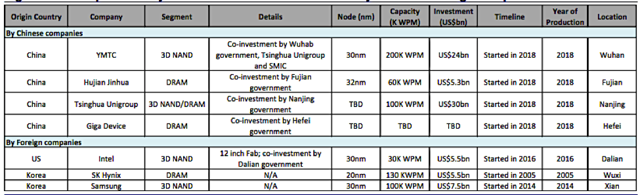

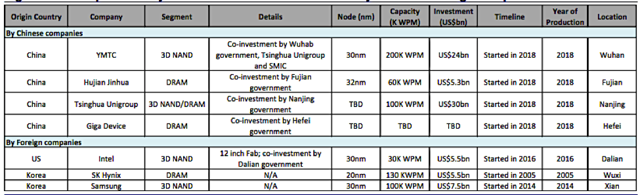

Credit Suisse is tracking 19 fab projects in China planned for new or upgraded capacity the next 3 years, with 2 DRAM fabs and 1 NAND fab planning a ramp in 2018 alongside expansion from Intel, as shown in Chart 3.

Chart 3 - Source: Credit Suisse Chart 3 - Source: Credit Suisse

President Trump's Alternatives Impacting MemoryThe current tariff talk and list of items include products that include memory chips. China's need for self-sufficiency in home-grown semiconductor production should be a catalyst to avoid a trade war as it would impact this policy.

If that doesn't work, President Trump could merely add memory chips to the tariff list. That would be devastating for U.S. memory companies as well as the supply chain for all products made in China such as Apple's ( AAPL) iPhones. This is a lose-lose situation.

Alternatively, President Trump could add semiconductor production equipment tariffs, or even an embargo on products made by U.S. equipment suppliers such as Applied Materials ( AMAT), Lam Research ( LRCX), and KLA-Tencor ( KLAC). In my opinion this would be the most effective strategy to prevent a trade war and get China to agree to the dictates of the U.S. administration as it relates to the technology transfer, intellectual property, and innovation issues discussed above. I presented these ideas in a November 29, 2017 Seeking Alpha article entitled "Restricting Semiconductor Equipment Shipments Could Force The Chinese To Stop North Korea." It was meant to influence China toward negotiation with North Korea, but would be appropriate in these trade issues.

Investor TakeawayChina has in the past and continues to spend significant capital to make the country self-reliant in semiconductor manufacturing that would, in effect, narrow the gap between the blue and red lines in Chart 1 above.

China has earmarked investments that total as much as $150 billion through funds coming from the National IC fund, various regional funds, and private equity funds. These funds were initially targeting both M&A and fab expansions. But greater M&A resistance, particularly by the U.S. government, is emphasizing greater focus on funding domestic companies. For example, in September 2017, CFIUS (Committee on Foreign Investments in the United States) blocked a deal by Canyon Bridge, a Chinese-backed private equity firm, to buy U.S. chipmaker Lattice Semiconductor.

The state-backed China Integrated Circuit Industry Investment Fund Co. raised about $20 billion in the past few years that went to more than 20 Chinese companies, including ZTE and foundry Semiconductor Manufacturing International Corp. ( SMI).

Currently the fund managers are in talks with government agencies and corporations to raise at least another $22 billion and as much as $95 billion for its second fund vehicle. The fund will again invest in a wide range of sectors from IC design and manufacturing to chip testing and packaging.

Then of course, there is Made in China 2025. This is China’s ten-year plan (initiated in 2015) for targeting ten strategic advanced technology manufacturing industries for promotion and development: (1) advanced information technology; (2) robotics and automated machine tools; (3) aircraft and aircraft components; (4) maritime vessels and marine engineering equipment; (5) advanced rail equipment; (6) new energy vehicles; (7) electrical generation and transmission equipment; (8) agricultural machinery and equipment; (9) new materials; and (10) pharmaceuticals and advanced medical devices.

Made in China 2025 calls for achieving “self-sufficiency” through technology substitution while becoming a “manufacturing superpower” that dominates the global market in critical high-tech industries. In fact, the Office of the United States Trade Representative's (USTR) 200-page report “FINDINGS OF THE INVESTIGATION INTO CHINA’S ACTS, POLICIES, AND PRACTICES RELATED TO TECHNOLOGY TRANSFER, INTELLECTUAL PROPERTY, AND INNOVATION UNDER SECTION 301 OF THE TRADE ACT OF 1974,” cites Made in China 2025 as a prime example of China's egregious behavior of ineffective enforcement of intellectual property, discrimination against foreign firms, and use of preferential industrial policies to unfairly promote and protect Chinese firms.

Nevertheless, China has a long way to go to become self sufficient in making chips that meet all its needs for the high-tech consumer products that it makes, primarily for foreign companies such as Apple and Samsung.

And this is why memory, as well as all ICs, will be a key talking point in President Trump’s tariff negotiations with China. China’s policy and financial programs to becoming self-efficient in semiconductor manufacturing will be the tipping point in trade negotiations that would eliminate the need for tariffs.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

***********************************************************************************************************************

UWG |

Chart 1 – Source: The Information Network

Chart 1 – Source: The Information Network Chart 2 - Source: GigaDevice

Chart 2 - Source: GigaDevice Chart 3 - Source: Credit Suisse

Chart 3 - Source: Credit Suisse