AAOI: 100G rapidly replacing 40G. 200G order..........................................................................................

"AOI also secured a small customer for its 200G intra-datacenter transceivers, which is likely to be the next big battleground speed for optical players"

By '19? 400G prolly on the chart in a meaningful way.

AOI cites a faster than expected decline in 40G orders from a large customer, likely Amazon, stating:

As we look into Q3, we see softer than expected demand for our 40G solutions with one of our large data center customers that will offset the sequential growth and increased demand we expect to see in 100G. This slowdown in 40G demand has been anticipated for some time, but the decline in Q3 is greater than previously expected

100G capacity in the datacenter is still far from being filled as new datacenters continue to pop up and existing ones overhaul their infrastructure. These ongoing developments are the growth drivers for AOI's revenue and margins, not 40G:

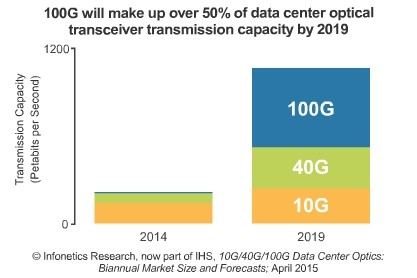

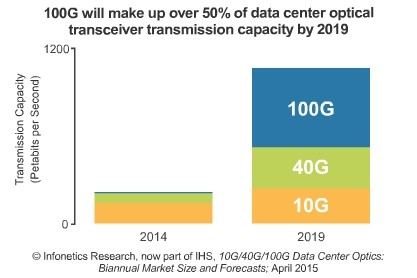

This graphic shows the shift that is going on in the industry right now as 100G, which was just a sliver of datacenter transceiver capacity in 2014, is rapidly becoming the new standard. The shift is going on throughout the optical communications industry but perhaps most notably in the datacenter, which is AOI's primary market. Revenues from datacenter applications in Q2 for AOI grew 140% YoY to nearly $100 million or 85% of overall sales, with a 62% YoY increase in 100G revenue driving the growth.

Demand for 100G solutions seems poised to only increase from here in the short and medium-term time frames as datacenters continue to upgrade and open. Interestingly, AOI also secured a small customer for its 200G intra-datacenter transceivers, which is likely to be the next big battleground speed for optical players. While 200G will likely provide negligible revenues for now, AOI's development in this area demonstrates an understanding of market dynamics and a commitment to future success |