Uh, oh.....more inconvienient....facts!

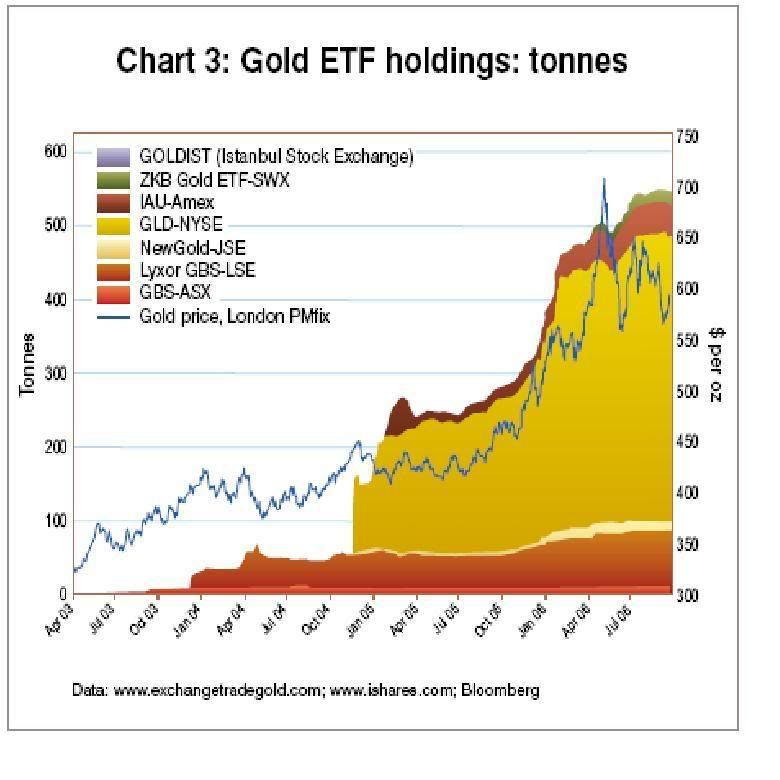

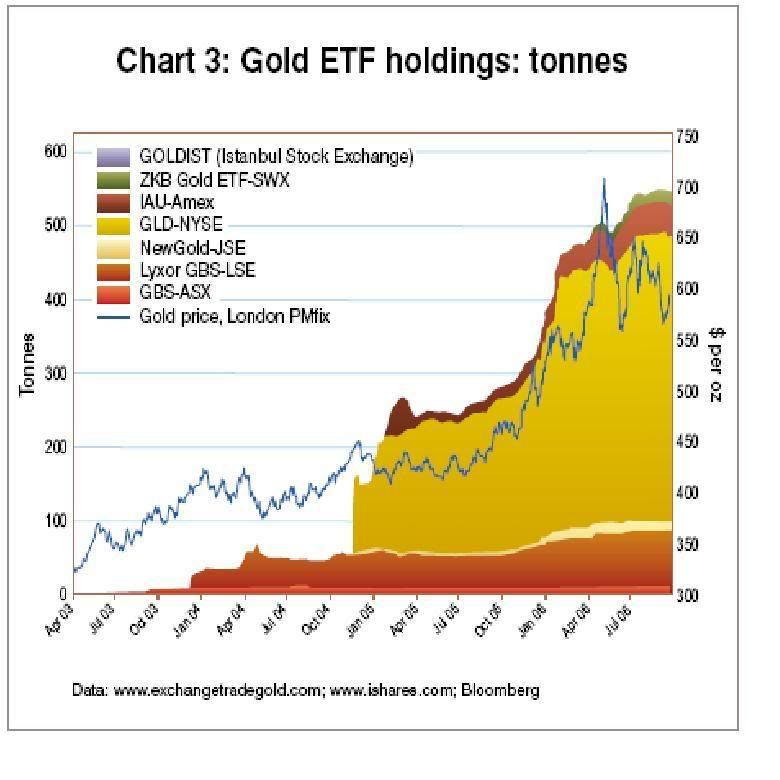

And in Q3 2006, as compared to Q3 2005…ETF demand fell by a staggering – 46%.

Physical demand is what separates speculative bull markets from secular bull markets, because it creates both a floor under the gold price and removes it’s ceiling.

Just as physical demand was collapsing, gold bugs were told to – “hold tight.”

They were told that gold would soon be re-priced in “1980-dollars.”

Just as ETF demand was cratering they were teased with – “The Chinese ETF.”

I dunno doesn't look to me like anyone is wandering away from the ETFs and there is selling going on. I looks like for the most part, while the ETFs may not be taking up additional gols as fast as they were earlier in the year, the levels have satbilized. But will the trend of the ETF's large take up of gold continue, if by some fluke the POG might go up again and challenge the 750 level again?

Source:

Gold Investment Digest: Quarter 3 2006

October 2006

World Gold Council

gold.org

[one may need to register in order to be able to see the doc.]

Source:

Gold Demand Trends: Third Quarter 2006

November 2006

World Gold Council

gold.org

[one may need to register in order to be able to see the doc.]

Now from the text of the second item, we have this....

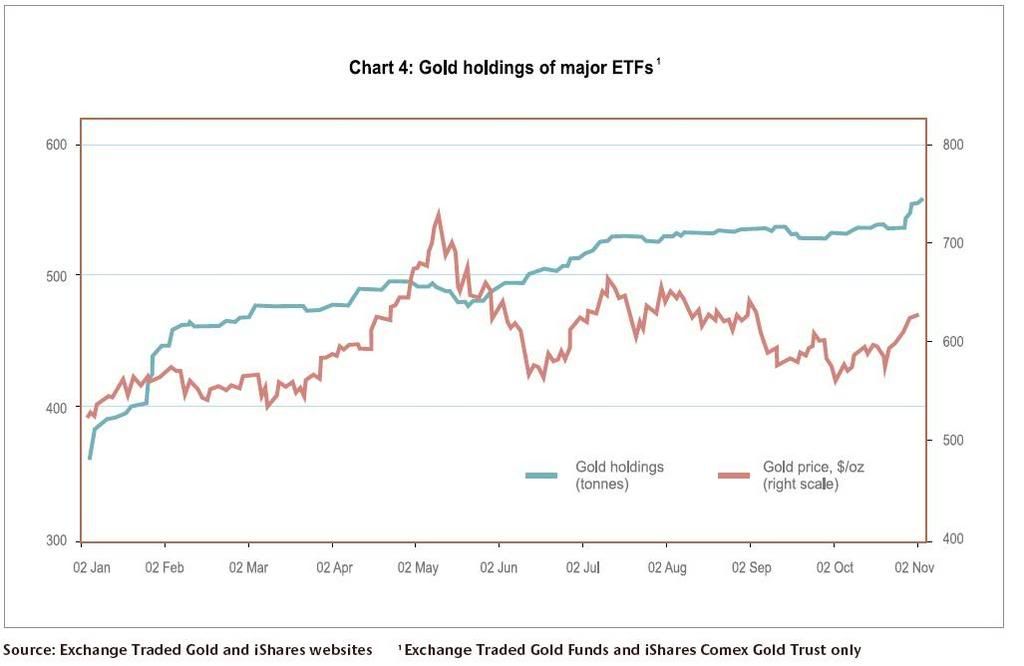

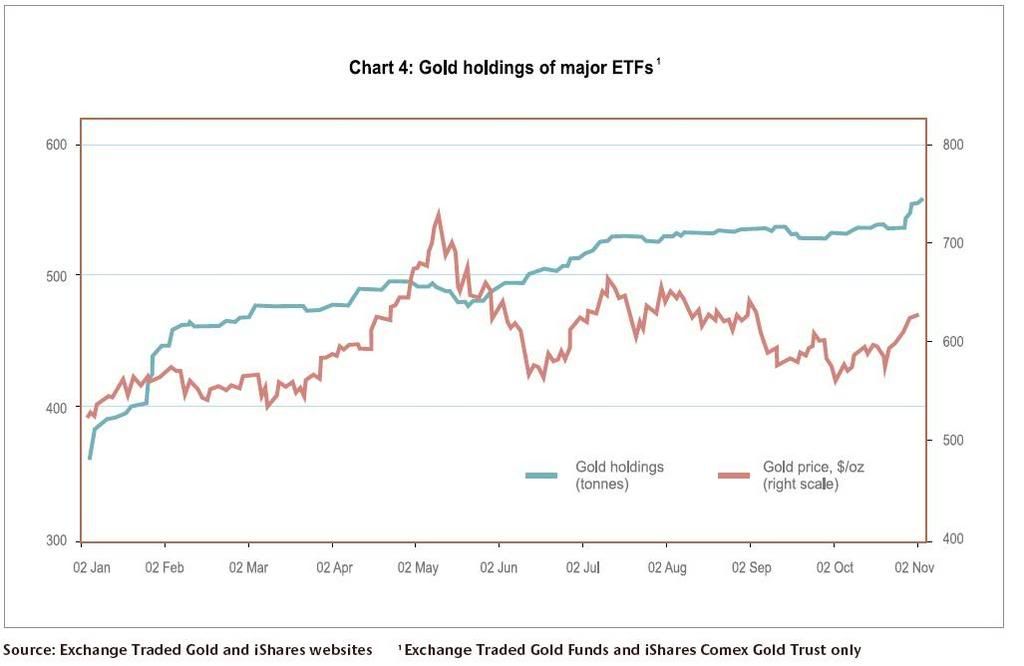

The growth in investment in Exchange Traded Funds (ETFs) and

similar products was lower than in most recent quarters at 19

tonnes. The bulk of the increase was accounted for by the largest

fund, streetTRACKS Gold Shares, where holdings increased by

14.5 tonnes. Month by month, both July and August saw gains in

overall ETF holdings of 15 tonnes and 9 tonnes respectively.

September saw a small fall but, as usual, the amount of disinvestment

was modest (less than 5 tonnes).

September also saw the launch of a new ETF in Turkey, managed by

Finans Portfoy, bringing the number of ETFs and similar funds to

nine. At the end of the quarter it held 1.2 tonnes of gold.

StreetTRACKS Gold Shares was listed on the Mexican and

Singapore exchanges in August and October respectively.

Since the end of the third quarter ETF holdings have risen again

and by November 8th, as GDT went to press, reported holdings of

all nine funds combined were just over 600 tonnes, up from 569

tonnes at the end of September. The graph shows trends in the

larger funds.

H3 |