As Joe Granville said about The Bag Holders, decades ago, "The don't even ask politely. The just snatch the bag outta your hand." (disclaimer: no positions long or short)

(excerpted from)

zerohedge.com

<Hedge Funds Added To Record Treasury Shorts Ahead Of Yield Plunge, JPM 'Tactically Long' 5Y Bond

MONDAY, AUG 07, 2023 - 11:10 AM

Bill Ackman is not alone...

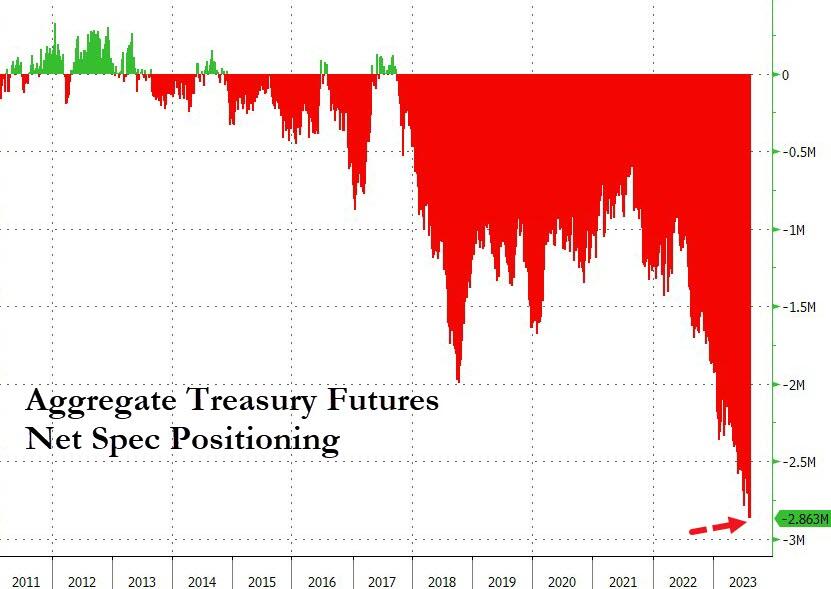

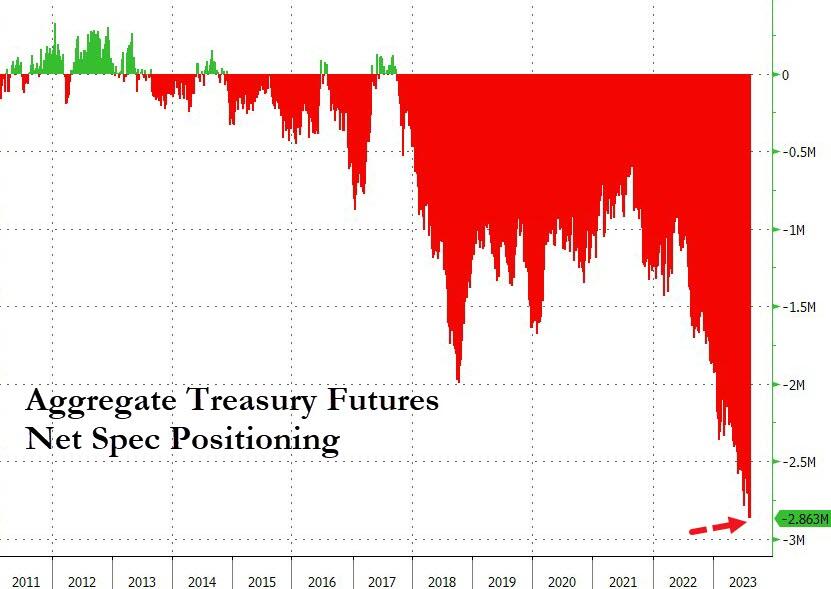

Hedge funds ramped up their bearish Treasuries bets to another new record last week (before yields plunged on Friday after the 'goldilocks' jobs data).

The aggregate Treasury Bond futures position pushed to a new record short across the whole curve...

Source: Bloomberg

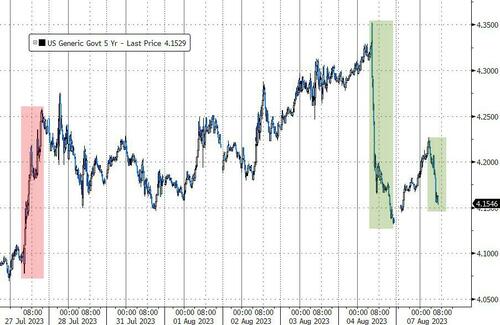

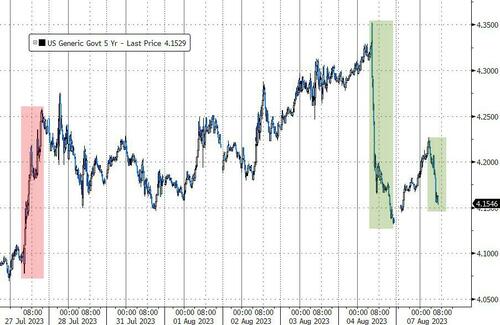

Right before yields puked Friday...

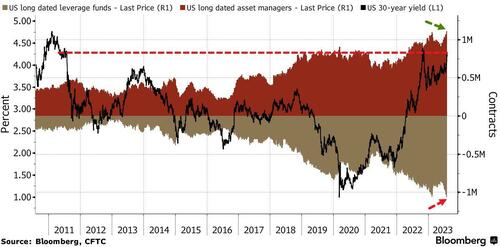

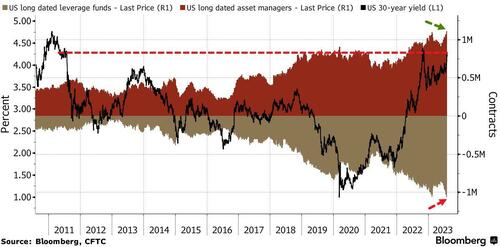

But, as Bloomberg notes, there is a big divergence between hedgies and traditional investors.

Leveraged fund increased net-short positions of longer-maturity Treasuries derivatives to the most since figures going back to 2010, according to an aggregate of Commodity Futures Trading Commission data for the week to Aug. 1.

Asset managers took opposite bets, taking their own net-bullish positions to an all-time high.

Additionally, Call Open Interest in TLT (the long-dated Treasury Bond ETF) is at a record high relative to Put Open Interest, adding to the bullish bond bias among more traditional investors...

We previously explained why the hedge fund Treasury short position could well be more related to the 'basis' trade which has seen a renaissance of late.

The strategy, which imploded spectacularly in 2020, has become popular once more as speculators seek to profit from small differences in the price between cash Treasuries and corresponding futures.

“Short positions in these few years seem to be largely due to the futures basis trade,” said Naokazu Koshimizu, senior rates strategist at Nomura Securities Co. in Tokyo.

The selling may continue “unless there is a huge disruption in the Treasury market which deteriorates the basis trade.”

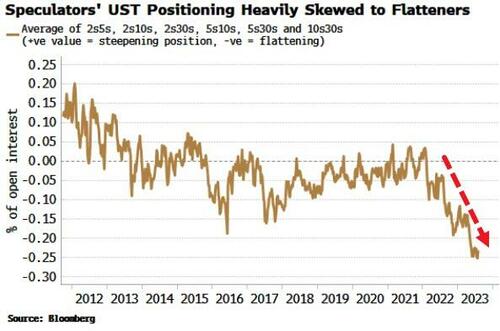

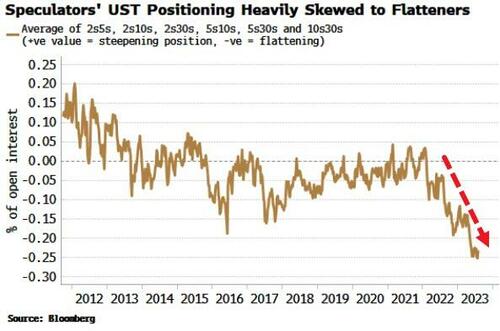

Additionally, as we highlighted earlier, stronger-than-expected data probably means higher yields in a market more acutely alert to inflation (and therefore supply) risks. As with last week, term premium would likely drive the move, meaning a curve steepening. After relentlessly flattening for the last two years, the pain trade is for a steeper curve. Implicit positioning of speculators from the COT report shows there is a heavy skew to a flatter curve.

The negative carry for most flatteners remains punitive (for 2s10s USTs it’s ~83bps over a year), but the large upside potential from supply/inflation worries and the covering of positions begins to make that look less insurmountable.

Speculative investors weren’t confined to just shorting longer-dated paper, also boosting five-year short futures positions to an all-time high, the CFTC data showed.> |