>Anyway, what's so impressive about the recovery in home construction?

SPDR S&P Homebuilders ETF (NYSEArca: XHB) and iShares Dow Jones US Home Construction (NYSEArca: ITB) added about 2% in morning trade. ITB is up 24.6% year to date, compared with an 11.3% gain for the S&P 500, according to Morningstar. Housing ETFs are outperforming on hopes the U.S. residential real estate market is finally on the mend.

In homebuilder earnings, Pulte reported a smaller first-quarter loss while orders for new homes increased 15% from the year-earlier period. Revenue was better than expected “primarily driven by increased sales into the move-up market, translating into a 5% increase in average selling prices,” Williams Financial Group said in a note.

Separately, Ryland said new orders increased about 46% from the year-ago quarter.

The builder “missed on revenue but delivered slightly better than expected earnings per share, with solid growth across all reporting segments in orders, backlog and deliveries,” Williams said.

Ryland shares rallied 9% while Pulte added 7% at last check after the companies announced their quarterly results.

Meanwhile, mortgage rates remain attractive. “Mortgage rates remained near record lows in the week ending April 26, with the 30-year fixed-rate mortgage average declining to 3.88% from 3.90% in the prior week, Freddie Mac said Thursday in its weekly report,” MarketWatch said.

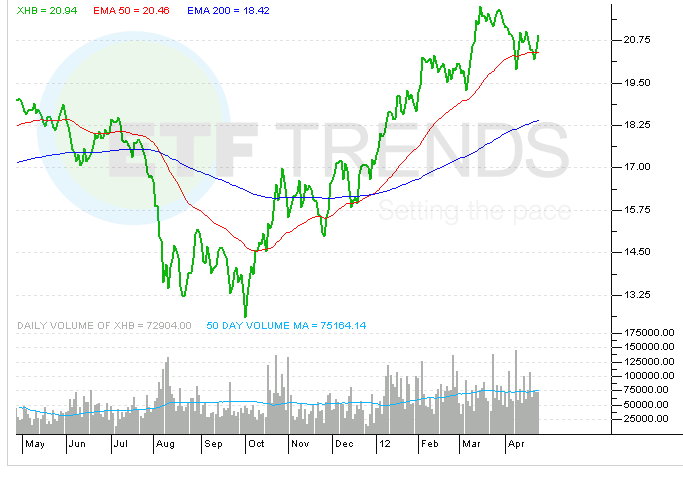

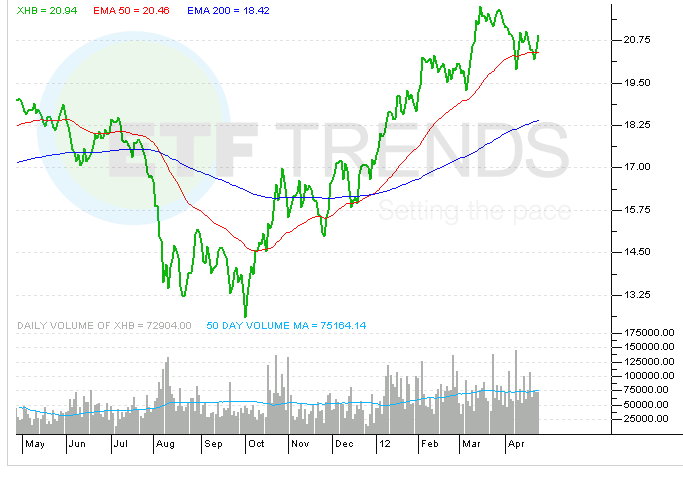

SPDR S&P Homebuilders ETF

Source: etftrends.com |