Is AMD Stock a Buy at New Record Highs?

Patrick Sanders - Barchart - 51 minutes ago Columnist

Share

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

Advanced Micro Devices Inc_ office sign-by Poetra_RH via Shutterstock

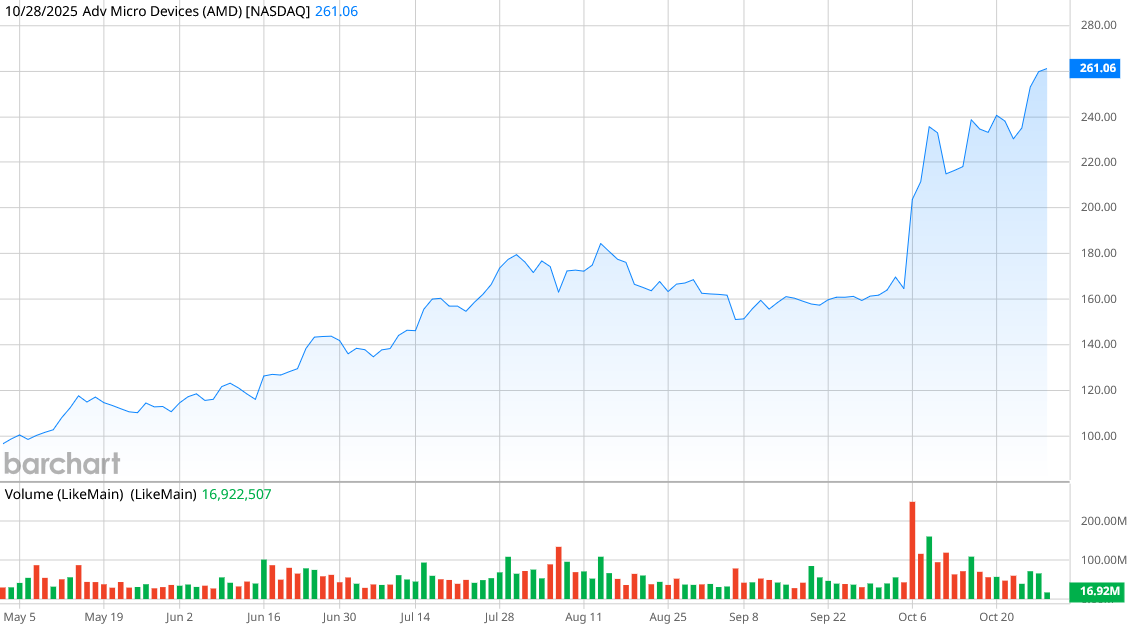

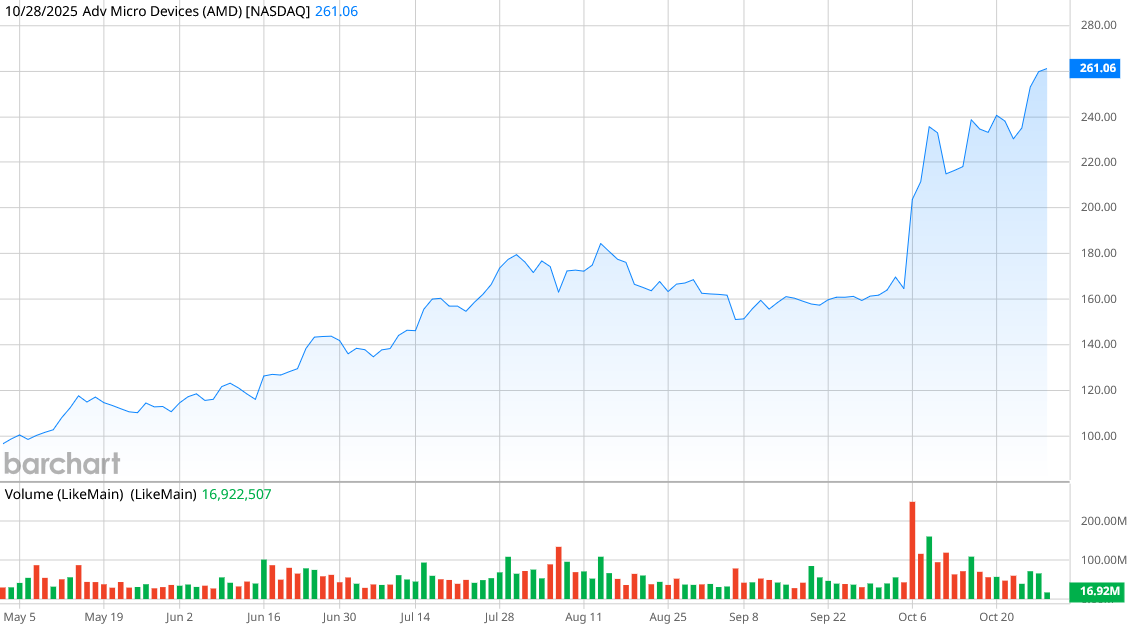

Advanced Micro Devices (AMD) just keeps rolling. The stock hit all-time highs last week and then did it again today. Now AMD stock appears poised to make even more new highs in advance of its third-quarter earnings report on Nov. 4.

AMD is one of the best-performing stocks on Wall Street in recent weeks, rising 64% in just a month. That means soaring returns—if you had invested $10,000 into AMD stock just a month ago, you’d be sitting on a profit of over $6,000.

The key question for AMD is whether it will be able to continue its run after reporting earnings. Has AMD stock gotten too hot? Or is the market finally recognizing the value of this chipmaker?

About AMD StockAMD is a maker of graphics processing units (GPUs), central processing units (CPUs), and other hardware used in computing. The company, which is based in Santa Clara, California, has a market capitalization of $410 billion.

Shares, as mentioned before, have been soaring, with much of the gains coming in the last month. So far this year, AMD stock is up 117%, by far outperforming the tech-heavy Nasdaq Composite's ($NASX) year-to-date (YTD) gain of 23%.

www.barchart.com www.barchart.com

AMD’s data center CPUs are commonly used in cloud computing environments, and its desktop computer processing business is growing rapidly as the company seeks to take market share from Intel (INTC). Intel has a 67% share in the desktop computer processing market, while AMD has 32.2% of the business, but that’s grown by more than 9% on a year-over-year (YoY) basis.

But the biggest factor in AMD’s stock performance is its recently announced deal with OpenAI, the maker of ChatGPT. AMD signed an agreement for the chipmaker to supply up to 6 gigawatts of data center capacity powered by AMD Instinct GPUs. The agreement allows OpenAI to take a 10% stake in AMD, worth up to 160 million shares of stock as deployment and share-price milestones are met.

The deal was seen as a huge endorsement of AMD’s GPU product. Nvidia (NVDA) has the overwhelming market share in the data center GPU business, but OpenAI’s deal with AMD shows that it’s a player, too.

AMD Misses on EarningsAMD’s dramatic run higher is all the more impressive when you consider its second-quarter earnings miss. It posted adjusted earnings per share of $0.48, missing analysts’ consensus estimate by a penny. On the plus side, revenue was $7.69 billion, which was better than the expected $7.42 billion and up 32% from a year ago.

The company’s data center revenue was $3.2 billion, which was up 14% from a year ago—solid numbers, particularly considering export restrictions that kept AMD from shipping its MI308 chips to China.

AMD issued guidance for the third quarter of revenue in a range from $8.4 billion to $9 billion—the midpoint for the guidance would show 28% growth from a year ago. AMD’s third-quarter earnings report is scheduled for after the closing bell on Nov. 4.

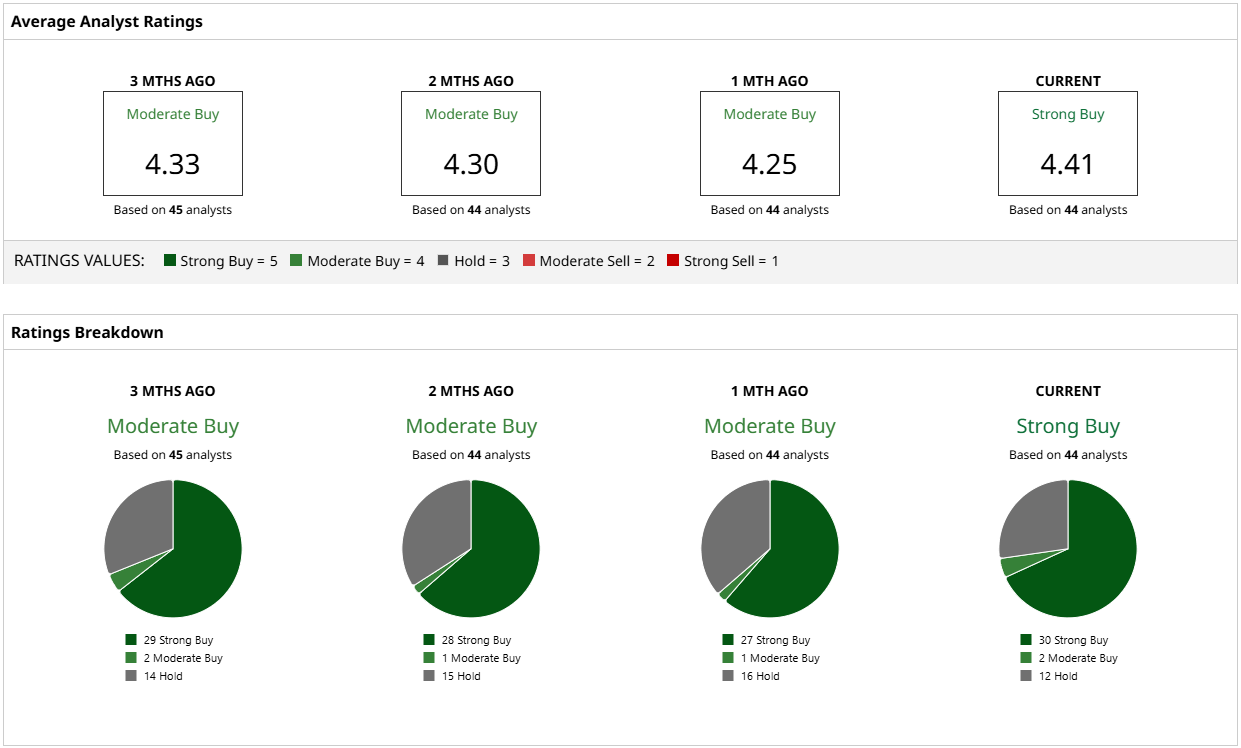

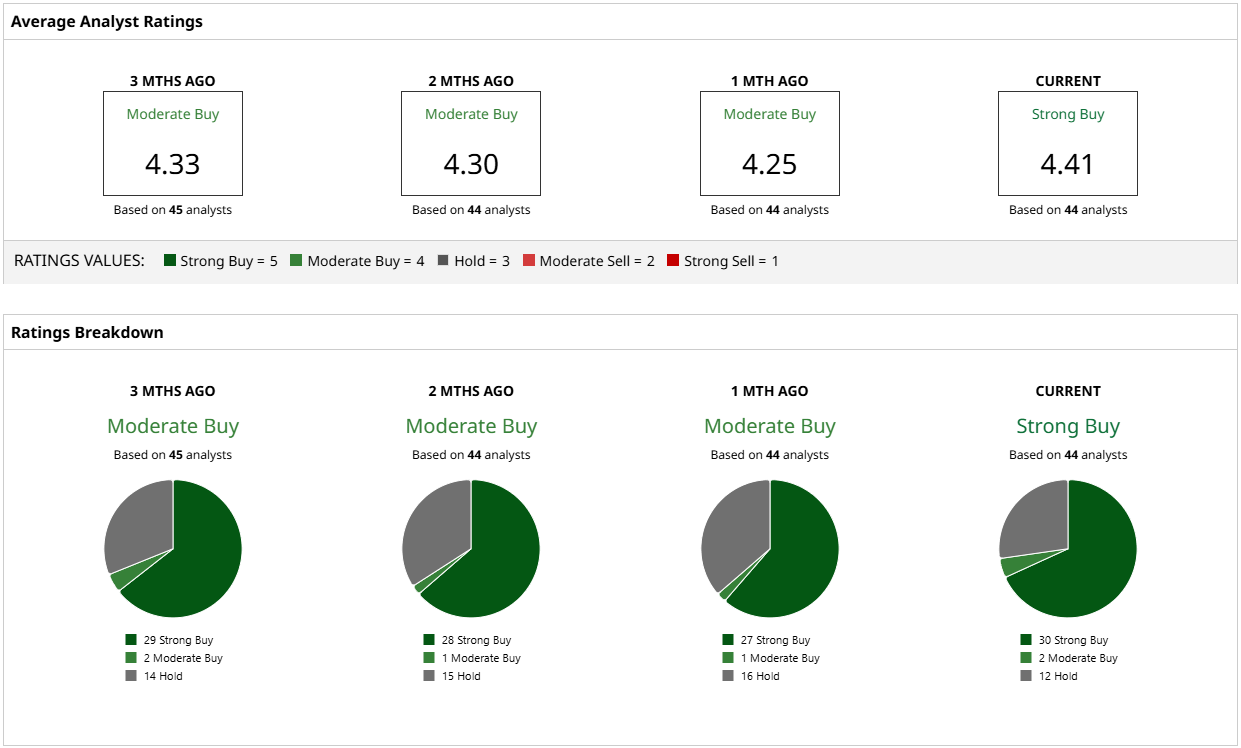

What Do Analysts Expect for AMD Stock?AMD is closely watched by analysts, and they’ve become more bullish over time. A month ago, 27 of 44 analysts covering the stock rated it a “Strong Buy,” and one rated it a “Moderate Buy,” as all the rest suggested holding. But today, 30 analysts put AMD as a “Strong Buy,” and two more have it as a “Moderate Buy,” with only 12 recommending holding. Tellingly, no analyst suggests selling.

AMD is already trading a bit above its mean price target of about $253, but the most bullish analyst’s target of $310 suggests the price could see another 18% gain in the short term.

I’m inclined to be on the bullish side as well. As the demand for computing power and data center capacity increases, and as the company continues to grow its personal computing business, AMD should remain a reliable generator of revenue and profits for the foreseeable future.

www.barchart.com www.barchart.com

On the date of publication, Patrick Sanders had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)