donsurber.blogspot.com The best 100 days in stock history

The stock market rebound happened so fast, it surprised even me.

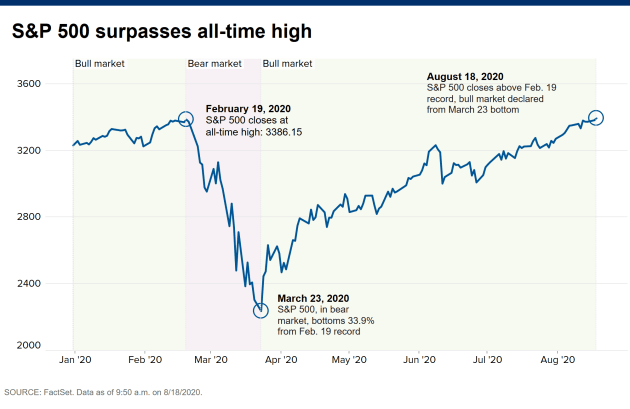

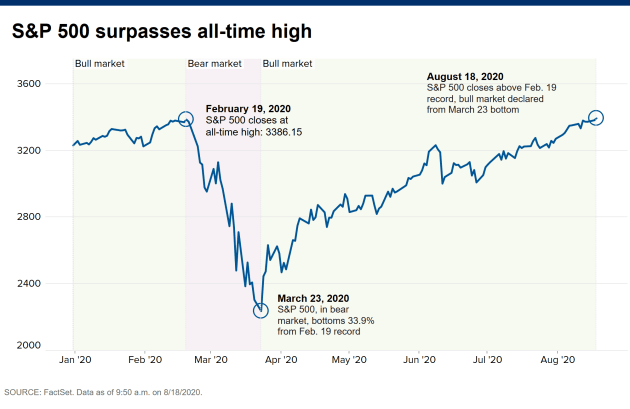

On March 12, the stock market ended an 11-year bull run, entering a bear market for the first time since 2008.

When experts said it could take decades for the stock market to recover from the pandemic panic, I told readers, "The history of bear markets is recovery will come sometime between September 12, 2020, and January 12, 2023, inclusive."

What?

A recovery in just 6 months?

That was crazy talk in March.

But it turns out I was off by 25 days.

It took the S&P 500 just 5 months and 6 days to recover. That stock index hit a new record for the first time since February 19.

President Donald John Trump's economic miracle is the quickest rebound ever from the worst drop in stock prices in history.

But channeling my inner Lee Greenwood, I also told readers in March, "But if losing everything I gained financially is the price paid, I still come out way ahead on having Donald John Trump as president. He's doing The Lord's work."

One month later, I wrote, "We are going to make it."

In it, I said, "Confidence matters. People lost confidence in stocks. And bonds. And even gold. The president's task is simple but also Herculean. He must restore the public's faith in itself."

Hercules delivered.

Ethan Wolff-Mann at Yahoo Finance managed to write a piece about the Trump Miracle without mentioning is name.

Wolff-Mann wrote, "The times have been uncertain, but those who were stayed on the sidelines missed the best 100 days ever.

"Up until recently, the best 100-day run was a 45.9% increase, beginning in July of 2009 after the Financial Crisis. That run and this current one are a head above the rest: According to analysis from LPL Financial, just four of the 17 best runs of all time have been gains of over 30%.

"The fact that the best 100 days of all time came amid one of the worst years for the economy in recent history underscores the key lesson advisers have continuously harped on: you, a regular person, are probably very bad at timing the market."

For the year, the S&P 500 is up 4.7%.

Wolff-Mann had more good news. He wrote, "And if you think that because the market is at an all-time high means we’re due for a reckoning, maybe! Or maybe not. According to LPL, the year after the 16 of the best 17 100-day runs, stocks were up."

The market peaked on February 19 and slid into a deep abyss. I stayed the course. The stock market is a roller coaster. It averages a gain of 6% per annum. But the ups and downs are not for the faint of heart.

Now we wait for the economy to recover as well. It will take some time because panicking and pulling all the plugs all at once created one heckuva mess.

But the stock market recovery is an encouraging sign that the recession, too, is almost over.

|