Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Hong Kong, Taiwan and India fell more than 1%; China and South Korea were also weak. Europe, Africa and the Middle East are currently mostly down. The UK, Germany, Finland, Norway, Spain, the Netherlands, Israel, Austria and Sweden are down the most. Greece and Hungary are up. Futures in the States point towards a relatively big gap down open for the cash market.

—————

VIDEO: The Decennial Pattern – With a Focus on Years Ending in 7, 8 and 9

—————

The dollar is up. Oil is up; copper is down. Gold and silver are up. Bonds are flat.

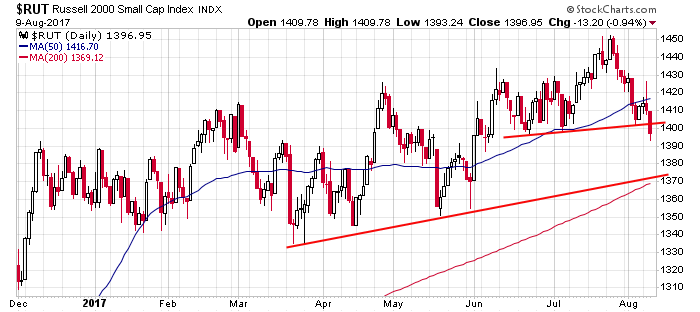

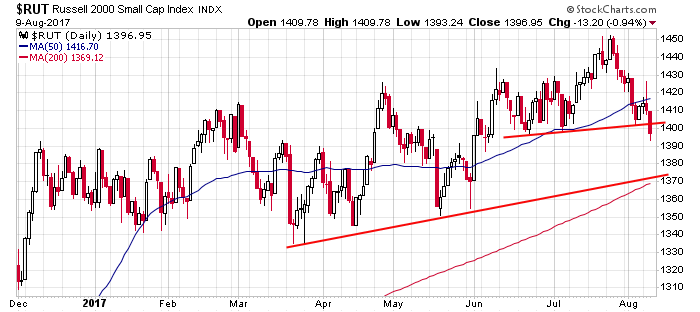

The Russell 2000, which has been lagging, broke a support level yesterday.

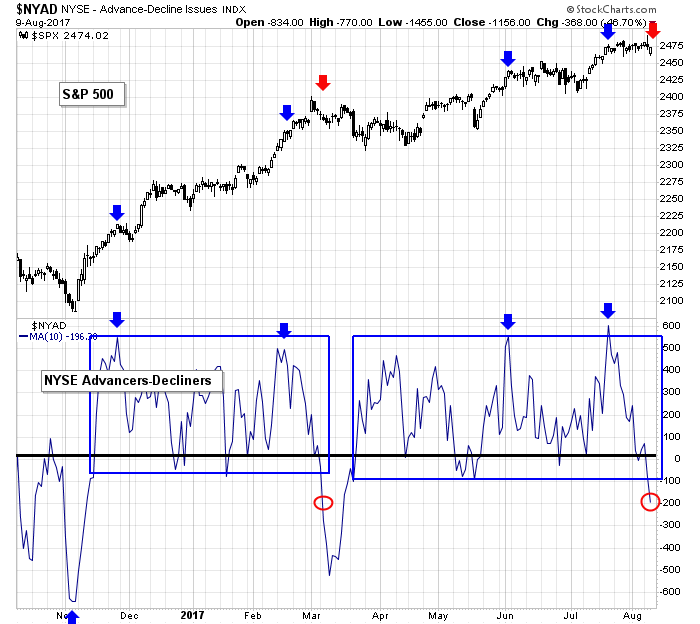

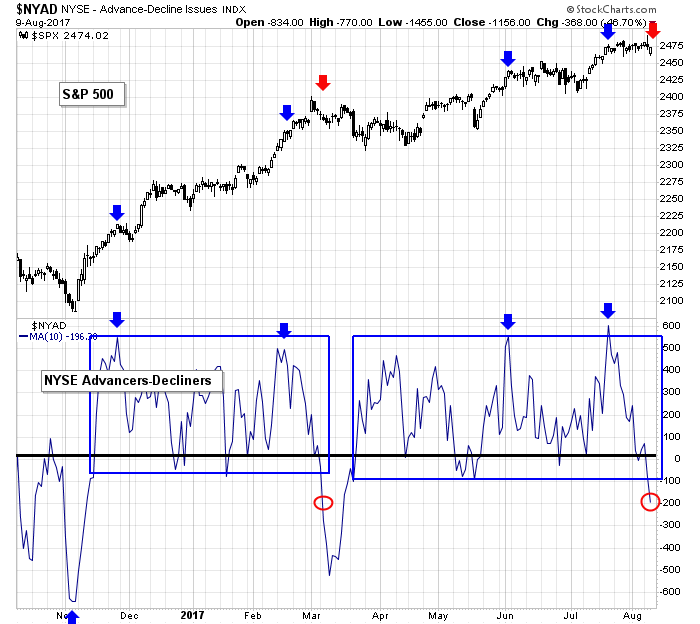

The AD line printed its lowest level in a month. This pushed the 10-day of the AD line to its lowest level since March. The last time the indicator dropped to this level, after having fluctuated in positive territory for an extended period (first red circle), the hint that trouble was brewing led to a relatively minor 6-week pull back.

Stock headlines from barchart.com…

Esterline (ESL +2.64%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

Diamondback Energy (FANG -0.42%) slid almost 2% in pre-market trading after it reported an underwritten secondary offering of 3 million shares of its common stock by holders.

Jack in the Box (JACK -0.17%) gained almost 2% in after-hours trading after it reported Q3 sales at its Qdoba brand unexpectedly rose +0.5%, better than estimates of -0.5%.

Pegasystems (PEGA +0.69%) lost 3% in after-hours trading after it reported Q2 adjusted EPS of 15 cents, below consensus of 17 cents.

Ambac Financial Group (AMBC +1.11%) rose nearly 5% in after-hours trading after it reported Q2 adjusted EPS of $1.54, well above consensus of $1.25.

Masonite International (DOOR -0.34%) tumbled almost 15% in after-hours trading after it reported Q2 adjusted EPS of 89 cents, weaker than consensus of $1.11.

Live Nation Entertainment (LYV -0.95%) rose over 4% in after-hours trading after it reported Q2 revenue of $2.82 billion, better than consensus of $2.37 billion

Chicago Bridge & Iron (CBI -0.49%) slumped 20% in after-hours trading after it reported Q2 revenue of $1.28 billion, much weaker than consensus of $2.45 billion, and then said it will suspend its dividend.

Planet Fitness (PLNT -0.73%) climbed almost 3% in after-hours trading after it reported Q2 adjusted EPS of 22 cents, better than consensus of 19 cents.

Amtech Systems (ASYS +2.12%) jumped 13% in after-hours trading after it reported Q3 revenue of $47.8 million, above estimates of $40.9 million.

Quantum (QTM -2.37%) sank over 20% in after-hours trading after it reported Q1 revenue of $116.9 million, below consensus of $119.3 million, and then said it sees fiscal 2018 revenue of $51 million-$515 million, weaker than consensus of $528 million.

Babcock & Wilcox Enterprises (BW -0.71%) plunged 30% in after-hours trading after it reported Q2 revenue of $349.8 million, well below consensus of $424.7 million.

Hudson Technologies (HDSN -0.87%) surged 20% in after-hours trading after it reported Q2 revenue of $52.2 million, better than consensus of $46.3 million, and then announced an agreement to purchase Airgas-Refrigerants for about $220 million.

Goldfield (GV -1.90%) tumbled almost 7% in after-hours trading after it reported Q2 Ebitda of $5.9 million versus $7.8 million y/y and said Q2 revenue decreased -9.8% y/y to $29.1 million.

Wednesday’s Key Earnings

Chicago Bridge (NYSE:CBI) -17.6% AH after a big Q2 loss.

Fox (NASDAQ:FOXA) +1.4% AH on strong cable results.

Mylan (NASDAQ:MYL) +0.9% deferring product launches.

Stratasys (NASDAQ:SSYS) -0.5% with revenue down on year.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Producer Price Index

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $12B, 30-Year Note Auction

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings from Morningstar

this week’s Economic Numbers/Reports powered by ECONODAY |