PTA.V in Colombia and its peers there:

Summary - Petroamerica made a transformative deal by acquiring Suroco Energy, and addressed all the challenges it was facing.

- This acquisition significantly strengthens and diversifies the company's asset base.

- Now, Petroamerica has everything: strong production growth, high netbacks, stellar balance sheet with a strong cash position and an aggressive management.

- With management focused on continuing to grow, the tremendous valuation gap with the peers can close anytime and Petroamerica's shareholders stand to benefit a lot.

Petroamerica Oil (OTCPK: PTAXF), which is a grossly undervalued Colombian gem with a pristine balance sheet.

Given that I have been closely monitoring the energy sector in Colombia over the last two years, I am a strong believer that this is an opportune time to deploy capital to this strong growth energy company. Right now, an investor is paying depressed multiples to get access to the stock, while the company's potential is through the roof.

Investors should note that Petroamerica's primary listing is on the Toronto Stock Exchange under the ticker PTA with an average daily trading volume of approximately 3,000,000 shares, according to Google Finance. The company also trades in the US under the ticker PTAXF.

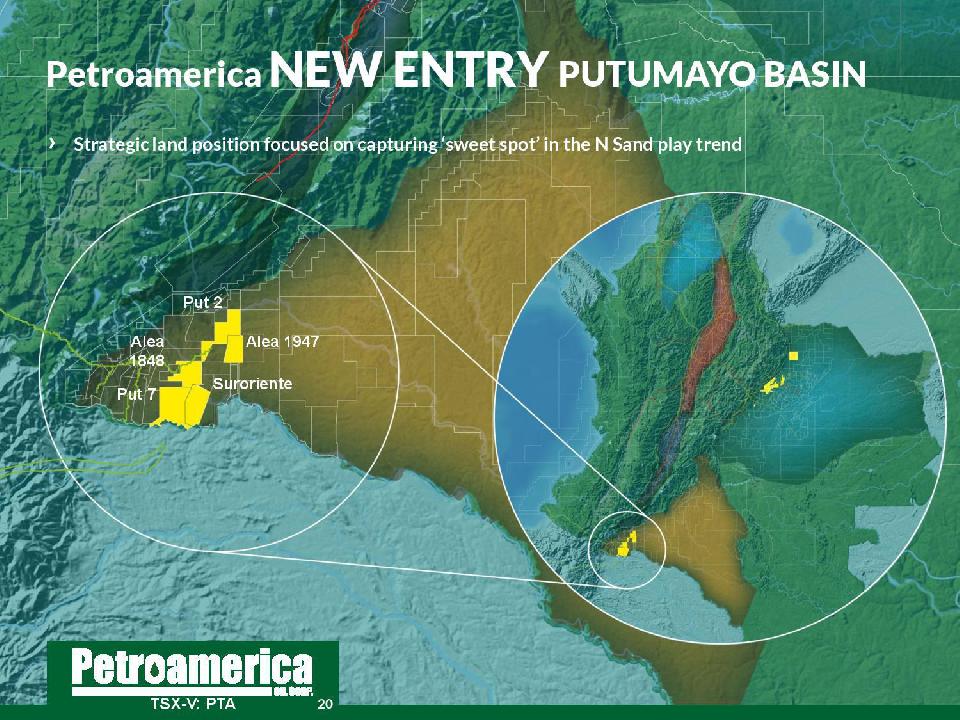

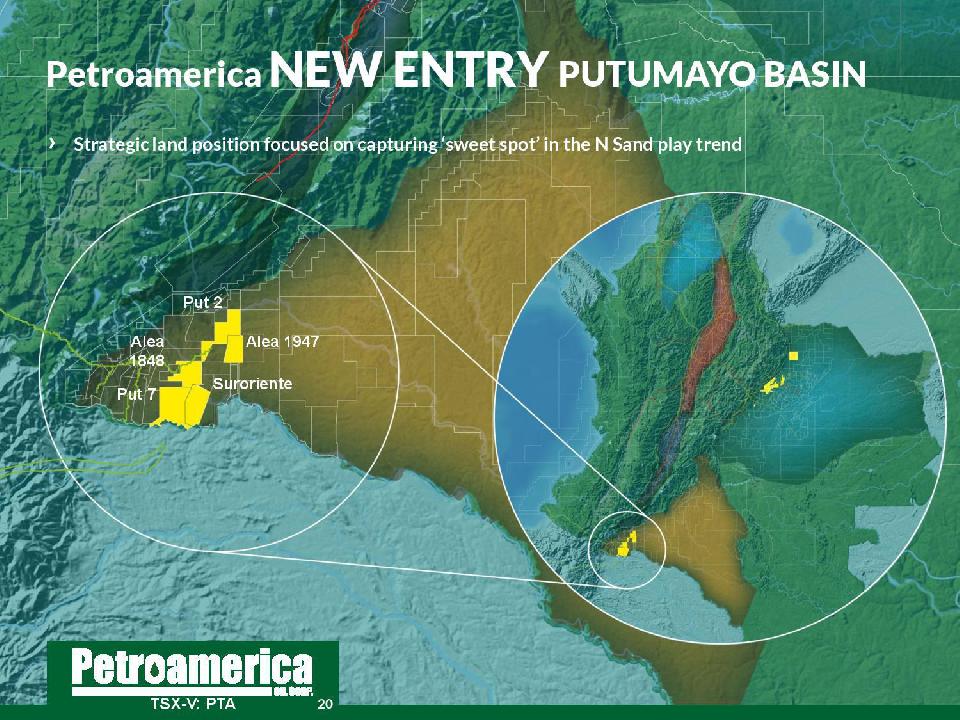

The Transformational Deal With Suroco EnergyIn late June 2014, Petroamerica finalized its offer and confirmed its intention to proceed with its proposed business combination with Suroco Energy (OTC: SROYF), a growing junior producer whose assets are located in the Putumayo Basin in Colombia.

First, this acquisition gave Petroamerica four blocks in Putumayo and boosted the company's production and 2P reserves by approximately 50% and 100% respectively.

Through that deal, Petroamerica also addressed both the single asset risk and its relatively short RLI (Reserves Life Index), while the company added operatorship, given that Suroco was qualified as a restricted operator in the 2010 bid round. On top of that, the combined company intends to apply to become an unrestricted operator over the next months.

Furthermore, it matters a lot to me the fact that Suroco's technical team who has gained substantial experience working in Ecuador will remain part of the combined company. This will facilitate Petroamerica's potential expansion to Ecuador, if needed.

And believe it or not, I owned Suroco Energy. I bought Suroco at C$0.29 in early April 2014. And I was preparing a bullish article about Suroco, when the stock was halted suddenly one day in late April 2014. I suspected that Suroco was the next acquisition target during this vibrant M&A activity in the Colombian energy patch over the last two years.

But I was shockingly surprised to see that Petroamerica's first acquisition offer was just C$0.57 per share. The analysis I was writing for that bullish article, had all the facts why Suroco should be sold at C$1 or higher. This is why, I emailed the company and its CFO (Mr. Travis Doupe) several times, explaining him why they should not accept this low ball offer. In addition, I let them know that I was not going to vote in favor of this low ball offer.

I was glad to see that the first offer was improved a few weeks later and Petroamerica offered C$0.80 per share. And that was another triple digit return from a Colombian energy stock. I do have all these emails to Suroco and its CFO (Mr. Travis Doupe), and they are available to all doubting Thomases anytime, if needed.

The fact that I owned Suroco and I was writing a bullish article about it when the deal was announced, was also the reason why I had stored in my database several pictures from Suroco's previous website. I incorporated those pictures in the following paragraphs. These pictures are not publicly available anymore and Suroco's website does not exist anymore either.

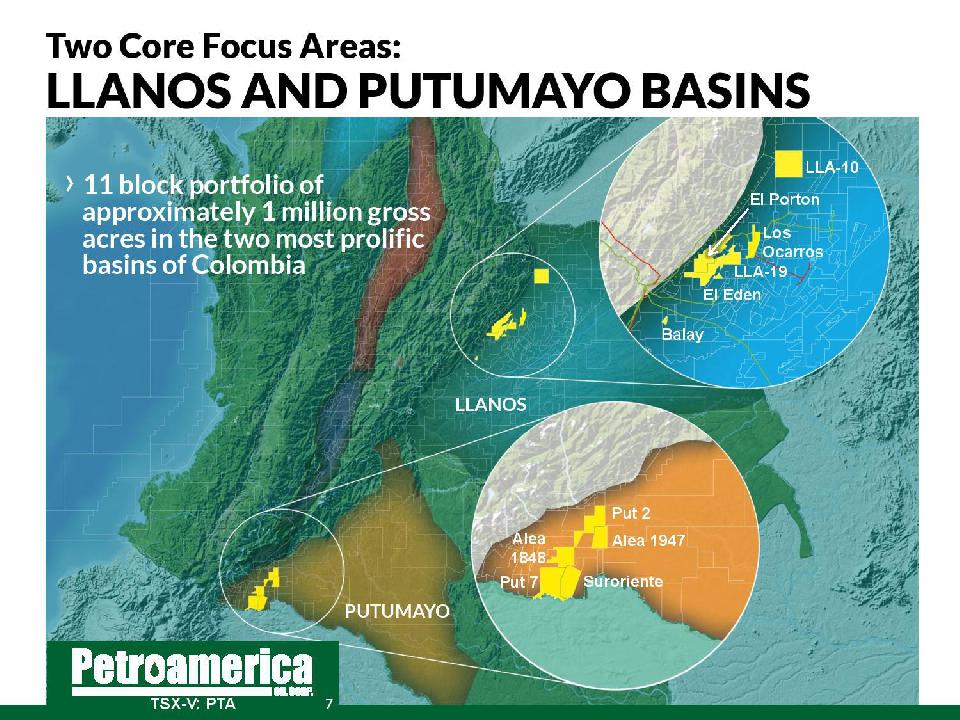

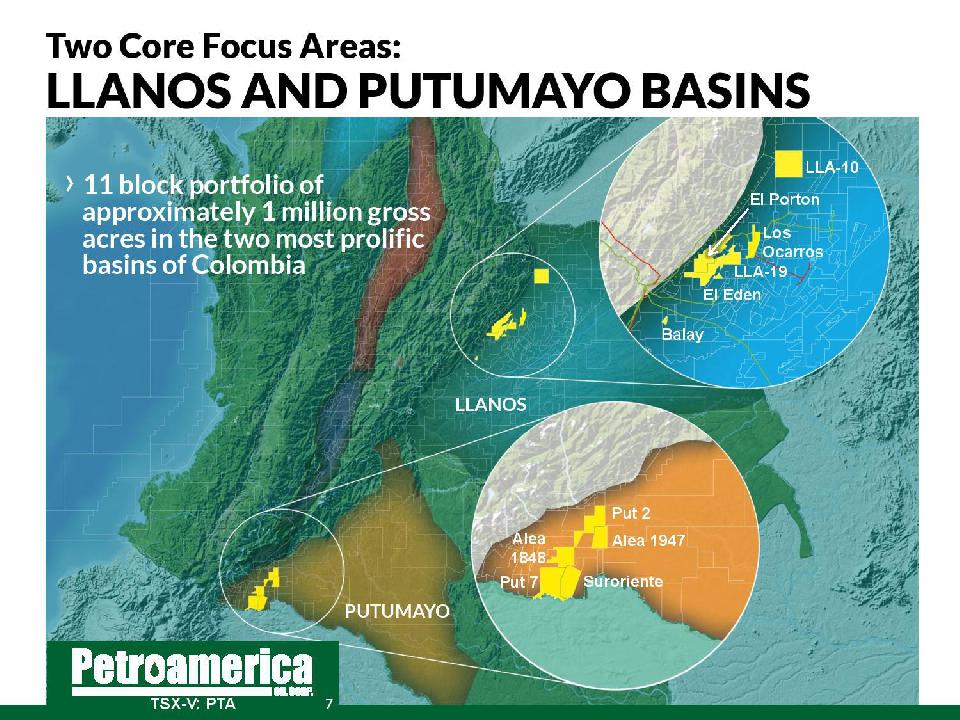

The AssetsPetroamerica's assets cover 11 block portfolio of approximately 1 million gross acres in the two most prolific basins of Colombia, the Llanos Basin and the Putumayo Basin, as illustrated below:

he Balance Sheet Is PristinePetroamerica is in the enviable position of having a stellar balance sheet with zero net debt, a low-risk multi-year drilling inventory (thanks to two recent reserves upgrades that will be presented in another paragraph) and plenty of running room in two proven oily Basins. he Balance Sheet Is PristinePetroamerica is in the enviable position of having a stellar balance sheet with zero net debt, a low-risk multi-year drilling inventory (thanks to two recent reserves upgrades that will be presented in another paragraph) and plenty of running room in two proven oily Basins.

Pro forma Suroco's deal, the combined company has approximately 858 million basic shares outstanding, produces approximately 9,000 boepd (~97% light/medium oil and NGLs) and owns 11.8 MMboe of 2P reserves (~95% light/medium oil and NGLs).

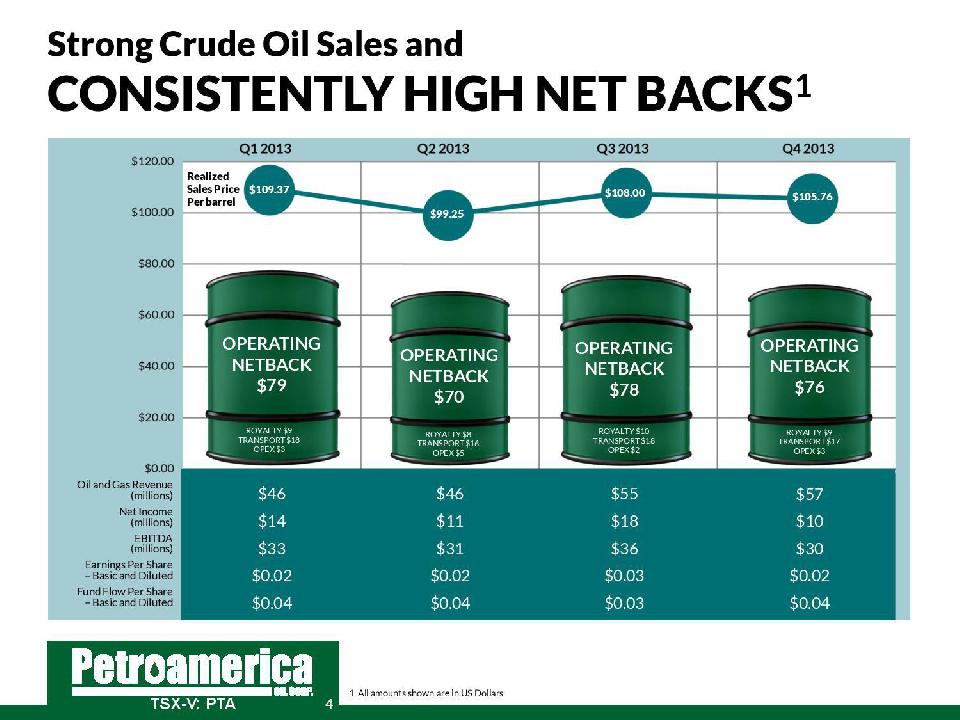

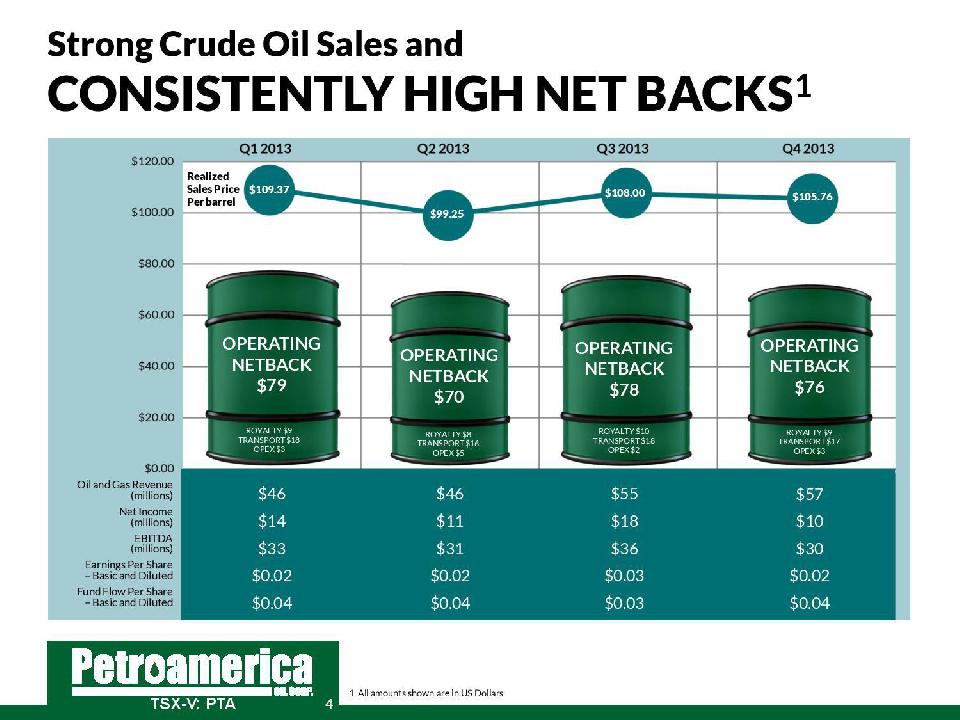

Petroamerica is also a cash machine that has been printing money over the last couple of years. After a profitable 2013, the trend continued in 2014. Petroamerica's net income was $6.4 million and $24.4 million in Q2 2014 and H1 2014 respectively. Given that Suroco was also profitable in Q1 2014, the profitability of the combined company will definitely continue for the remainder of 2014. Currently, Petroamerica has a cash balance of approximately $63 million after accounting for the Suroco acquisition costs, which results in negative net debt of approximately $35 million.

It projects a combined 2014 cash flow from operations of approximately $116 million, which fully funds the combined CapEx for 2014 of approximately $85 million and results in free cash flow of approximately $36 million.

Thanks to this growing free CF:

1) The company initiated a share buyback program in late March 2014 and is authorized to purchase up to approximately 10% of the public float.

2) The company says that it will continue to pursue new business opportunities to both enhance its current and projected land holdings to provide additional future growth.

It is clear that Petroamerica generates a higher margin per barrel of oil produced than the oil-weighted companies operating in Canada and the US. More importantly, a high netback allows the company to fully fund its capital program from cash flow and cash on hand. Petroamerica does not need to fund capital expenditures through debt and thus can maintain the strength of its balance sheet.

These high netbacks is the result of the following factors:

1) Petroamerica's production consists of light and medium oil.

2) The company is indexing its oil price to Brent that has been consistently trading at a premium to WTI over the last years.

3) The bottlenecks that were hampering the production growth of the Colombian producers until 2011 have been resolved. Fortunately, oil transportation infrastructure in Colombia has caught up with production over the last years. Last year, the Bicentenario line began operating, while the Ocensa pipeline was expanded. Calgary-based Enbridge (NYSE: ENB) is also considering building a line to Colombia's Pacific coast. And according to Parex's CEO: "At present there is lots of excess capacity in pipelines."

The Valuation Is A StealIn this paragraph, I will compare Petroamerica to its peers. Due to the increasing M&A activity in Colombia over the last two years, there are not many companies left with light oil-weighted production and assets exclusively in Colombia. This is why, I had to broaden a bit the criteria as below:

1) The peers are either big junior producers (production at approximately 10,000 boepd) or small intermediate producers.

2) They have light oil-weighted production coming from onshore assets.

3) All their producing properties are located in South America, and all or most of their production is coming from Colombia.

Based on these criteria, here are Petroamerica's peers:

1) GeoPark Limited (NYSE: GPRK).

2) Amerisur Resources (OTC: ASUXF).

3) Canacol Energy.

4) Parex Resources.

5) Gran Tierra Energy (NYSEMKT: GTE).

Based on the average metric above, Petroamerica's enterprise value would be: 5.25 X $170 million = ~$893 million.

Calculation SummaryTo sum it up, this is Petroamerica's enterprise value based on the average metrics of the peers:

1) Per EV/Production = $687 million.

2) Per EV/2P Reserves= $298 million.3) Per EV/EBITDA= $893 million.Based on the average metrics of the peers, Petroamerica's enterprise value should be: 687 + 298 + 893 = 1878 / 3 = $626 million.

Since Petroamerica's net debt is negative and currently stands at approximately $35 million, the market cap will be approximately $661 million. Dividing this market cap by 858 million outstanding shares, I get $0.77/share or C$0.85/share (1 USD = 1.097 CAD).

Given that Petroamerica's current price is C$0.39/share, there is an upside of approximately 115% from the current levels.

At the time of writing, Petroamerica trades at C$0.39, and the NAV of C$0.76 per share (low estimate) represents an upside of 95% from the current levels.

I must also point out that the aforementioned market value of C$500/acre is very low, given the fact that Petroamerica's acreage (Llanos, Putumayo) is surrounded by producing oil fields. To give you an idea, Canacol Energy sold part of its undeveloped acreage to ExxonMobil (NYSE: XOM) for C$850/acre back in early 2012. Canacol's acreage was in the Middle Magdalena Basin and had zero production or reserves associated with it. As also linked above, Canacol sold two more sections of its undeveloped acreage (zero production, zero reserves) in the Middle Magdalena Basin for C$1,250/acre and C$3,300/acre in 2012 and early 2013 respectively.

The Strong Management Is HerePetroamerica has a strong management team with a very long experience in the energy sector. For instance:

1) Mr. Navarrete, President and CEO, has over 24 years of oil and gas experience through his extensive career in Ecopetrol (NYSE: EC), Colombia's state-owned energy company with a market cap of $70 billion.

Mr. Navarette has held various positions with Ecopetrol, namely: E&P Executive Vice President, Production Vice President and Reservoir Manager. During his tenure at Ecopetrol, he was instrumental in leading and consolidating new business opportunities and for taking Ecopetrol public. Mr. Navarette was also responsible for the development of producing oil fields through his association contracts with BP (NYSE: BP), Chevron (NYSE: CVX), Petrobras (NYSE: PBR), Meta Petroleum (a subsidiary of Pacific Rubiales Energy which operates the Rubiales oil field, Pirri and Quifa), Occidental (NYSE: OXY) and others.

Mr. Navarrete has also held several board positions with some of the subsidiaries of Ecopetrol: Ecopetrol America, Ecopetrol Peru, Ecopetrol de Brasil, Savia (Peru) and Hocol S.A.

2) Mr. Wagner, the CFO, has worked with many international oil and gas companies including EnCana (NYSE: ECA), Talisman Energy (NYSE: TLM) and Sherritt International ( OTCPK:SHERF), supporting operations in Brazil, Cuba, Colombia, Australia and Norway.

3) Mr. Gillcrist, the COO and Executive Vice President Exploration, has more than 24 years experience worldwide in exploration & production, including extensive exposure to Colombia. Prior to joining Petroamerica, Dr. Gillcrist worked for CEPSA (Compañia Española de Petroleos, S.A.) where he was the Group Exploration Manager. CEPSA is a Spanish integrated energy company with international assets. CEPSA is Spain's fourth-largest industrial group, and acquired Coastal Energy ( OTCPK:CENJF) for $2.2 billion in late 2013.

Mr. Gillcrist has also worked for the oil independents LASMO, and Union Texas Petroleum, and has evaluated exploration and production projects throughout South America, Europe, Africa and the Far East.

The Insider Ownership And Frank GiustraFirst, the basic insider ownership is 3.4% (pro forma Suroco's acquisition). Given that the company currently has approximately 858 million basic shares outstanding, the insiders' basic stake is approximately 29.2 million shares, which translates into approximately C$11.4 million, based on the current price of C$0.39 per share. Obviously, the management team has enough skin in the game and is incentivized to grow Petroamerica and sell it for the highest possible price.

Second, the insiders keep adding to their positions. According to the Toronto Stock Exchange, an insider bought 246,000 shares at approximately C$0.37 (average) a couple of days ago.

Last but not least, a Canadian tycoon, Frank Giustra, is an experienced natural resources investor who is a large and independent shareholder of Petroamerica. Aside from being the founder of Lionsgate Films, he is a proven natural resource developer, having created no less than 5 billion-dollar commodities firms.

Giustra looks for a management team with a track record of success and likes to back them early: "Then I watch and see if they deliver on their promises".

According to the link above, Giustra also notes that: "Now Petroamerica forecasts 30,000 bopd over the next couple years." And he believes the projection is realistic based on management's track record, so he is calculating what the company could be worth. This is how he ends up saying that Petroamerica is a 10-bagger from the current levels.

However, he notes that: "The way to get 10 baggers is not by waiting until they have achieved 30,000 barrels. You have to recognize a few things before your typical institutional investor or analyst, who waits for all the proof before he or she invests."

Petroamerica is not Giustra's first Colombian energy venture. In 2008, he seeded Serafino Iacono's Pacific Stratus Energy, with $5 million in early stage capital. Today that firm is Pacific Rubiales, Colombia's largest non-state owned oil and gas firm. Giustra says: "I like to focus on something and make sure it's worth my while. Wheaton River was the same idea, a great management team with nothing when we started."

Wheaton River, which Giustra and Ian Telfer took over in 2001, went on to become Goldcorp, and spin out Silver Wheaton, creating tens of billions of value for shareholders over the decade that followed.

Reasons For The Current MispricingPetroamerica was penalized due to the following two reasons:

1) The Warrant Overhang: Petroamerica's trading discount has also been attributed to a significant warrant overhang. The company had almost 88 million warrants at an exercise price of C$0.35 with an expiration date in early May 2014.

However, the C$0.35 warrants expired, while the next warrants that expire in October 2014 have an exercise price at C$0.75, which is almost 100% higher than the current levels of C$0.39.

2) Relatively Low RLI (Reserves Life Index): As of December 2013, Petroamerica had a relatively small reserve base (2P reserves of 4.9 MMboe), and their reserve life index was 2.1 years.

However, this issue was addressed in August 2014, when Petroamerica announced a mid-year update by external reserves auditors GLJ. According to that update:

A) Petroamerica's 2P reserves grew by 20% and were 5.9 MMboe as of June 2014, compared to 4.9 MMboe as of December 2013.

B) Thanks to the gushers in the Quinde field of Suroriente, Suroco's 2P reserves grew by 87% and were 5.9 MMbbls as of June 2014, compared to 3.1 MMbbls as of December 2013. Suroco's 2P reserve life index also increased from 4.0 years to 5.4 years.

Thanks to this news, Petroamerica's RLI currently is 4.5 - 5 years.

Catalysts1) Production Growth: It will be organic growth and growth through acquisitions. Let's see some more details:

A) Organic Production Growth: In June 2014, the company's CEO stated that Petroamerica plans to more than double output in two to three years after buying Suroco Energy. In fact, he expects Petroamerica's production to rise to 20,000 bopd (100% light/medium oil), as the takeover gives the company access to the southern Putumayo Basin in Colombia.

|

he Balance Sheet Is PristinePetroamerica is in the enviable position of having a stellar balance sheet with zero net debt, a low-risk multi-year drilling inventory (thanks to two recent reserves upgrades that will be presented in another paragraph) and plenty of running room in two proven oily Basins.

he Balance Sheet Is PristinePetroamerica is in the enviable position of having a stellar balance sheet with zero net debt, a low-risk multi-year drilling inventory (thanks to two recent reserves upgrades that will be presented in another paragraph) and plenty of running room in two proven oily Basins.