Companies Are Furiously Guiding Down Analyst Earnings Estimates

By Lu Wang

October 3, 2018, 11:41 AM EDT

- CEO sentiment goes sour amid trade tensions, global slowdown

- Early results suggest reward for earnings beats hard to get

On the bull market villains list, it’s public enemy No. 1: peak earnings. At what point does the profit bubble pop? Ever since Caterpillar Inc. mentioned a “high water mark” in growth, Wall Street has been on alert.

To date, the worries have been unfounded. Earnings soared 24 percent in the first quarter and did it again in the second. And while nothing is likely to prevent another blowout quarter in the third, one trend bears watching: the rate at which executives are guiding down forecasts.

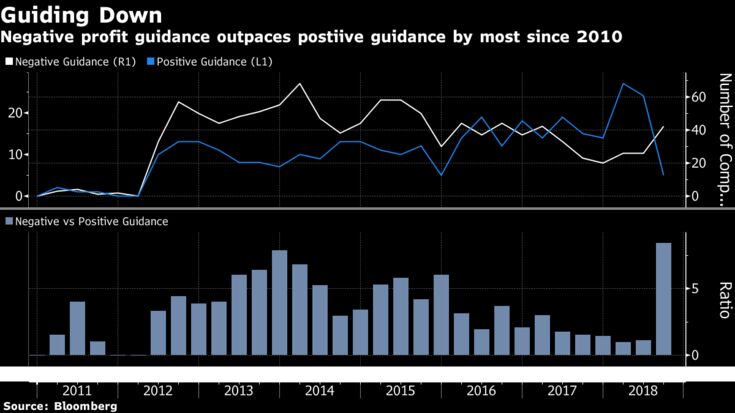

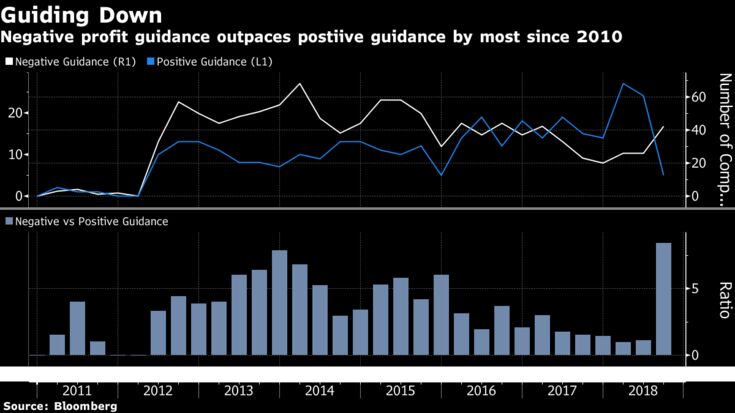

Led by high-profile warnings from Netflix Inc. and Applied Materials Inc., the number of S&P 500 companies saying profits will trail analyst estimates outnumbered those saying they’ll beat them by a ratio of 8-to-1 in the third quarter. That’s the most in Bloomberg data going back to 2010.

Several conclusions are possible, among them that analysts -- who saw their predictions trounced at record rates in the first half -- got tired of being wrong and lifted estimates to unrealistic heights. Or, it could be that companies, which hate merely to match estimates, are making room for the quarterly ritual in which they beat every forecast by a penny.

Still, that happens all the time, without being occasion for this quarter’s lopsided guidance. For skeptics looking for evidence income growth is peaking, a more ominous take-away is forming. It comes at a time when everything from rising costs to weakening overseas demand threaten to damp growth, according to Tobias Levkovich, Citigroup’s chief U.S. equity strategist.

“Given ebullient investor sentiment, we do not think there is much room for companies to disappoint without taking a hefty toll on share prices,” he wrote in a note. “Notably stronger dollar and higher interest rates plus some softness in emerging economies all intimate the potential for misses.”

Companies are expected to earn $42.11 a share in the June-September period, a quarterly record. Yet with valuations elevated, the margin of error is getting thin. At 16.8 times forecast earnings, the S&P 500 traded at a multiple that’s 14 percent higher than its 10-year average.

Early results suggest the bar is getting higher. Among 19 S&P 500 companies that have reported results this season, all but two exceeded profit estimates. Their stock fell an average 2.8 percent in first-day reactions.

continues at bloomberg.com |