Interesting article on the memory chip companies.

Weak Smartphone Margins Are Motivating Samsung To Raise Memory Prices

Oct. 5, 2018 7:33 PM ET

About: Samsung Electronics Co., Ltd. (SSNLF), Includes: AAPL, HXSCL, LRCX, MU

Robert Castellano

Summary

- Profit margins on smartphones, Samsung Electronics' largest division, are eroding as the company's products are squeezed by Apple and Chinese manufacturers.

- Prices of NAND memory chips have been dropping for several months and DRAM spot prices are lower than contract prices, impacting Samsung's Semiconductor division profit margins.

- Combined, these forces have the effect of delaying Samsung's (and other memory companies) fab investments, reducing chip supply, and increasing chip prices.

- Push outs in fab equipment purchased are negatively impacting equipment companies such as Applied Materials.

According to an October 2, 2018, article in BusinessKorea in the smartphone business divisions of Samsung Electronics ( OTC:SSNLF), the operating profit estimate of the company’s’ IT & Mobile Communications Division could fall as much as 20% from $2.46 billion in Q2 2018 to $1.84 billion in Q3 2018 and further to $1.44 billion in Q4.

Samsung has seen its production costs increase in the process of improving the performance of new smartphone models but they have failed to take away loyal customers from Apple (NASDAQ: AAPL) in the high-end market.

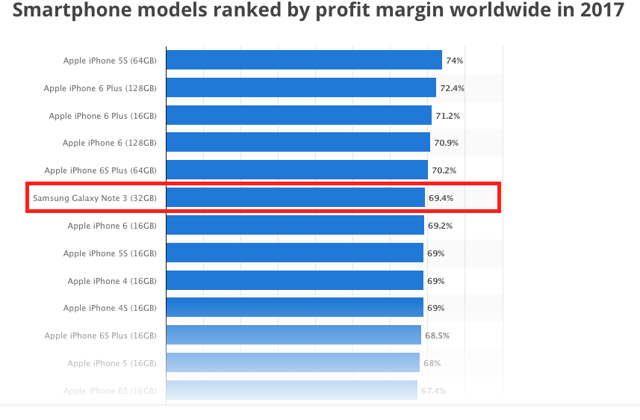

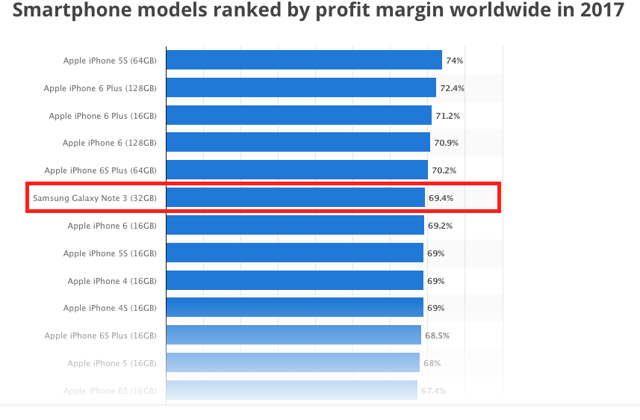

Chart 1 Shows that over the past several years, including models going back to the iPhone 4 in this chart, only one Samsung smartphone was among the top models by profit margin through the end of 2017.

Chart 1 - Source: The Information Network Chart 1 - Source: The Information Network

At the same time, Chinese companies have developed new technologies at a faster pace than expected, narrowing the technology gap with Samsung.

Although the company just launched the Galaxy Note 9 on August 24, a month earlier than other previous models, the company is facing headwinds from Apple on one side and Chinese producers on the other. The Galaxy Note 9 has hardware improvements, including camera modules, but it was released with the same price as the Galaxy Note 8, affecting operating margins.

Samsung could face bigger problems because of the launch of new products by Apple’s iPhone XS and Huawei Technologies “Mate 20 series.”

In early September 2018, Samsung announced a new strategy – the introduction of cutting-edge technology on its Mid-Range smartphones. Previously, this type of technology was incorporated into its higher-end smartphones like its Galaxy Note and Galaxy S lines, according to Samsung's mobile division CEO DJ Koh.

continues at seekingalpha.com |