Charted: The End of the Line For Checks?

September 26, 2025

By Jenna Ross

Article & EditingGraphics & Design

The following content is sponsored by Citizens Bank

Charted: The End of the Line For Checks?

Key Takeaways- Checks are in structural decline, while adoption of the Automated Clearing House (ACH) continues to accelerate.

- The acceleration of ACH continues as digital payment methods are faster and more secure.

Checks once anchored B2B payments. However, finance teams now prioritize speed, control, and data—and paper simply can’t keep pace.

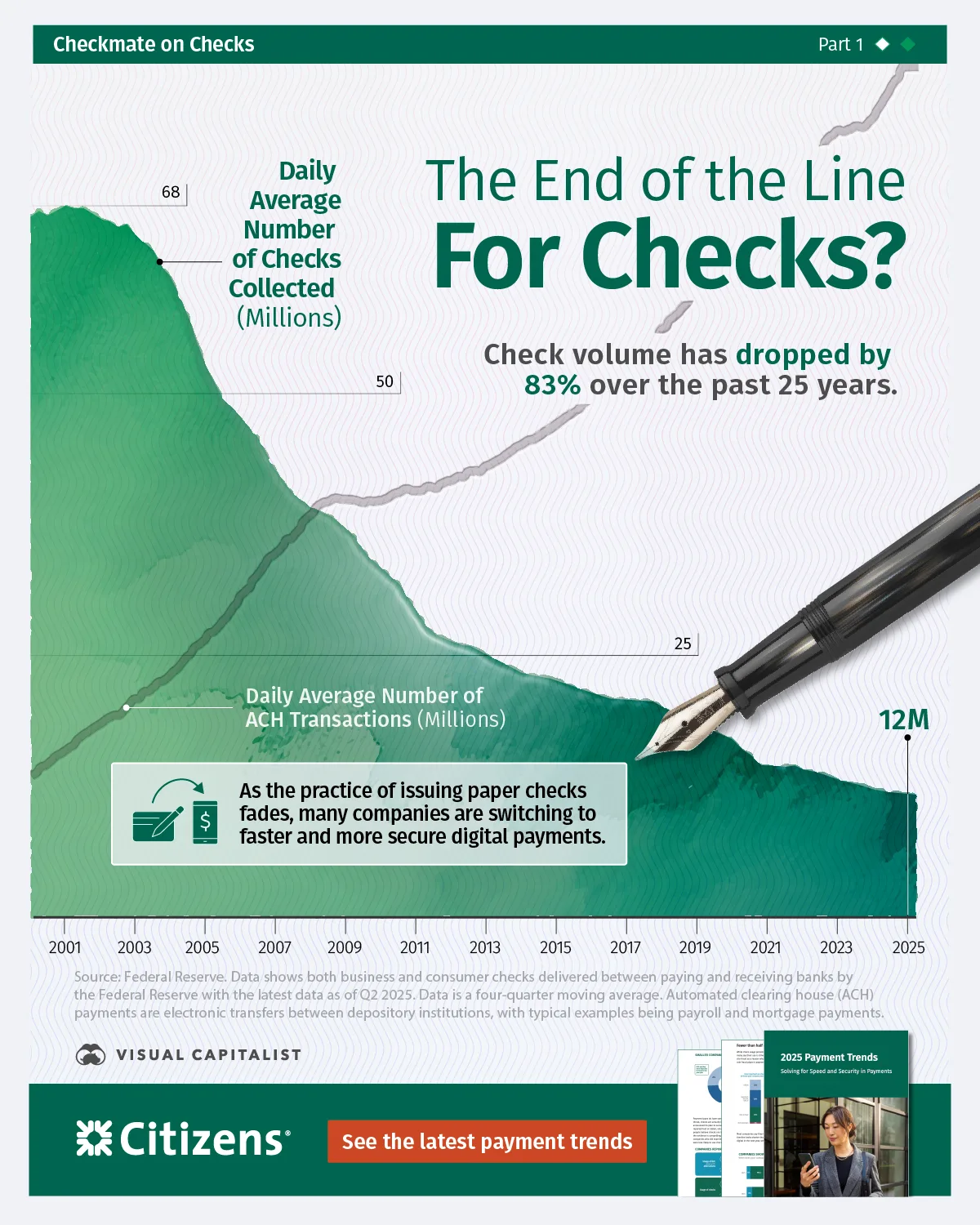

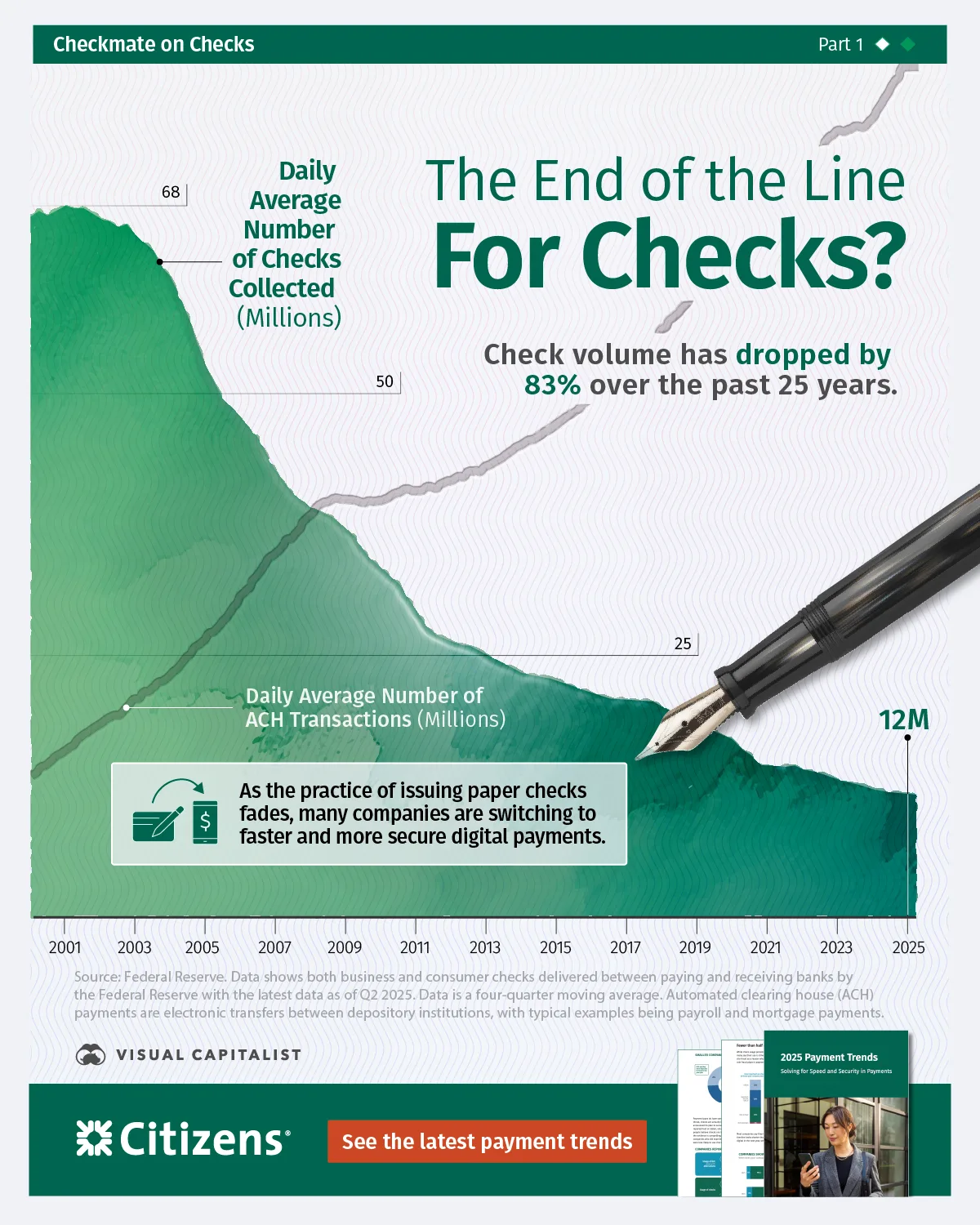

This graphic, created in partnership with Citizens Bank for our Checkmate on Checks series, shows the long-run decline of checks using data from the Federal Reserve.

Checks in Decline

Over the past quarter-century, check usage trends have decreased, while daily ACH transactions have accelerated. As the gap widens, it’s clear companies are shifting to digital payments for the long term.

Here is a table that shows the decline in check volume from both business and consumer checks delivered between paying and receiving banks. The table also shows the growth in daily ACH transactions from Q1 2000 to Q2 2025.

102550100entries per page

Year and Quarter

Average Daily Number of Checks (Millions)

Average Daily Number of Automated Clearing House (ACH) Transactions (Millions)

|

| 2000:Q1 | 68 | 14 | | 2000:Q2 | 68 | 14 | | 2000:Q3 | 68 | 15 | | 2000:Q4 | 68 | 15 | | 2001:Q1 | 68 | 16 | | 2001:Q2 | 68 | 16 | | 2001:Q3 | 68 | 17 | | 2001:Q4 | 67 | 18 | | 2002:Q1 | 67 | 18 | | 2002:Q2 | 67 | 19 |

Data shows both business and consumer checks delivered between paying and receiving banks by the Federal Reserve with the latest data as of Q2 2025. Data is a four-quarter moving average. Automated clearing house (ACH) payments are electronic transfers between depository institutions, with typical examples being payroll and mortgage payments.

Check volume is down roughly 83% over the past 25 years. Given this trajectory, many finance leaders are moving away from checks in favor of digital payments.

Meanwhile, daily ACH transactions have increased by 497% during the same period, demonstrating a sharper incline than the decline in check usage.

While every organization is different, the trend suggests that shifting recurring flows to ACH can deliver near-term benefits.

The Benefits of Digital Payment Methods

Digital payments—especially ACH—tend to move money faster and include clearer details that make invoice matching easier. In Citizens’ 2025 Payment Trends Survey, treasury leaders put speed and security near the top of their priorities.

Checks still play a role, but usage is shrinking: 47% of midsize businesses say they use checks today, down from 59% in 2024. Among firms that still use cash or checks, 33% plan to go all-digital within a year and another 42% within two to three years.

Given the direction of technology and artificial intelligence, many teams are gradually shifting routine payments toward digital options at a pace that fits their operations. |