We need lots of wind as well as batteries to move peak prices lower

MacIntyre wind farm. Source: Acciona Energia

David Leitch

Nov 1, 2024

9

Commentary

Wind

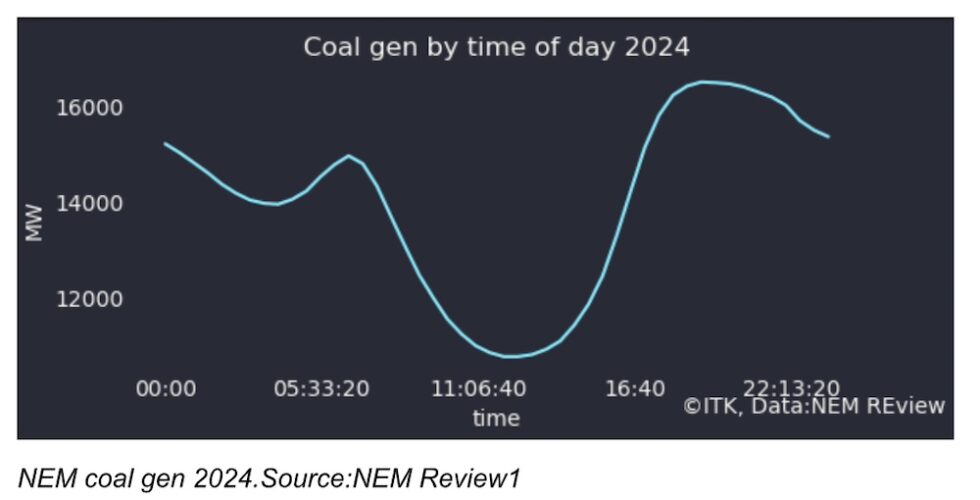

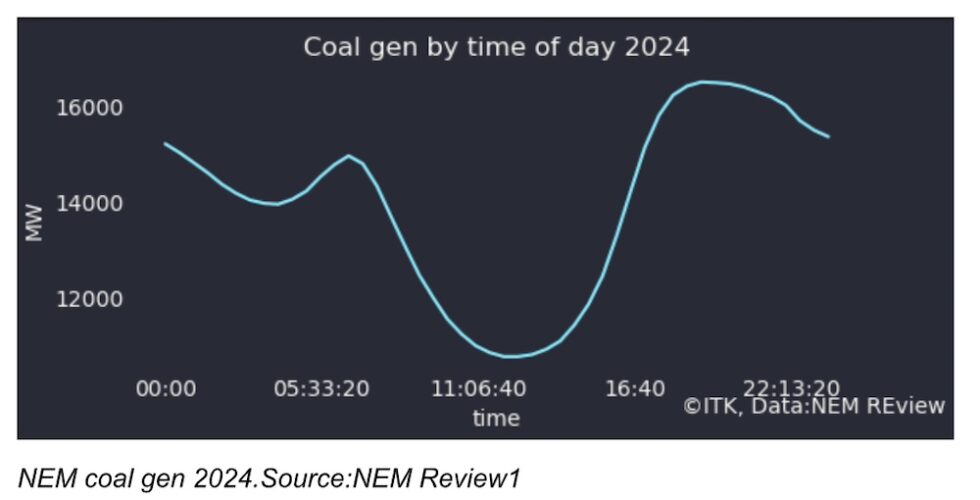

The following note basically shows that coal has lost some revenue share since 2018, but it’s still responsible for close to two thirds of evening peak sales across the National Electricity Market (NEM). And it seems the best way to manage spilled solar and accomodate more behind the meter is to shut down coal generation during the day.

Coal, unlike gas, batteries and hydro, does earn revenue steadily through 48 half hour periods of every day and is therefore less impacted by a decline in peak prices compared to peak oriented fuels like gas, hydro and now batteries.

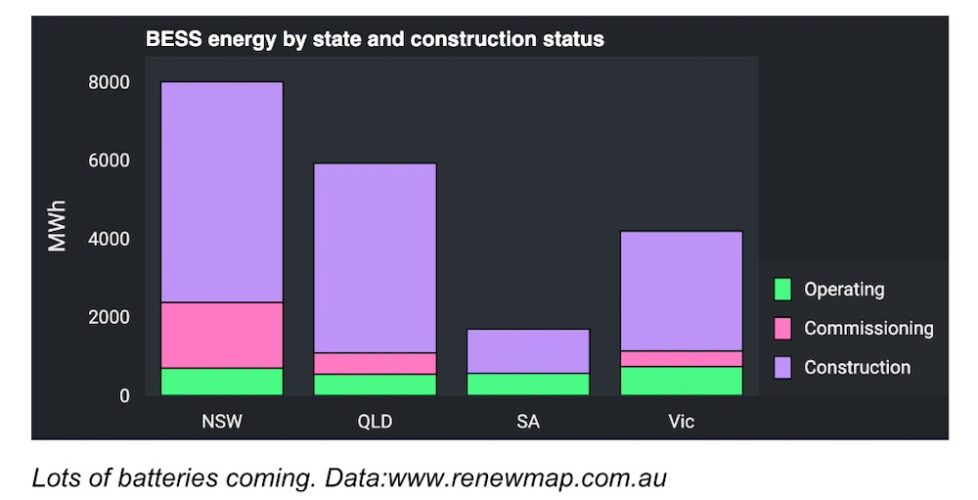

So far batteries have had an almost invisible impact on peak prices. However, battery capacity under construction will soon enable batteries to supply about 40 per cent of demand for say almost 2 hours, assuming they start full and operated at once.

More realistically, allowing for other uses such as system integrity and transmission ITK expects batteries to be capable of supply 25% of peak demand within 3 years, probably less. But that’s not enough. Coal is 63% of peak demand and it all has to be replaced.

So we need lots of wind as well.

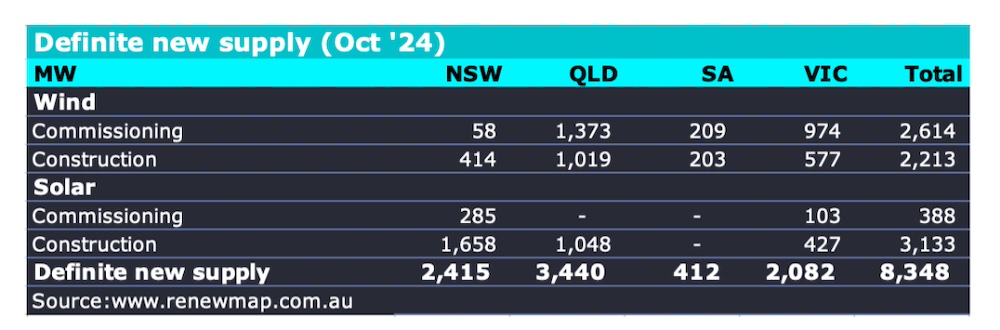

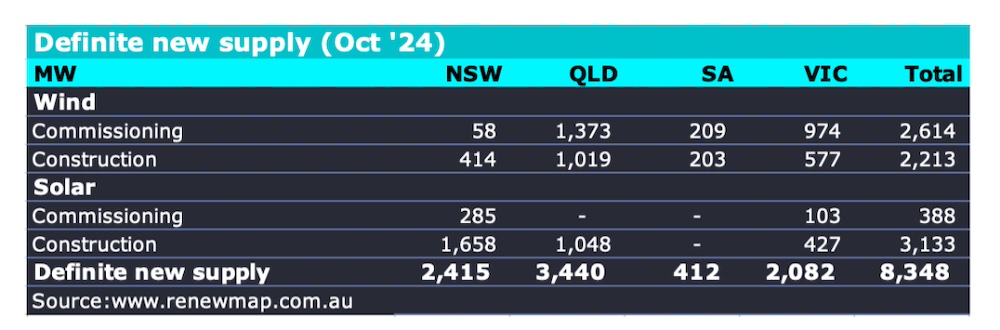

It’s also worth making the point that there is still a respectable amount of new supply coming on board. The number of projects is down but that’s offset by the increased size.

For sure, it’s true that not many notices to proceed have been made this year but that, in my view, is possibly because of the Capacity Investment Scheme (CIS). It’s still entirely possibly to see 70% plus of renewable energy by 2030 provided the transmission and CIS plans are executed well.

Of course, a change of Federal Government would slow things down a lot, but that’s all it would do, delay things. Business, in my opinion, wants Australia to get it done. We are virtually half way done, I cannot see Australia turning back. I never have been able to see it and these days even less so.

And then the best way to deal with the spilled solar and the ever increasing rooftop supply is to close more coal generators. At the moment midday coal supply is still 10 to 12 gigawatts (GW). That’s only another 5 years of rooftop supply or probably 3 years if we allowed for spilled utility solar at least during Spring.

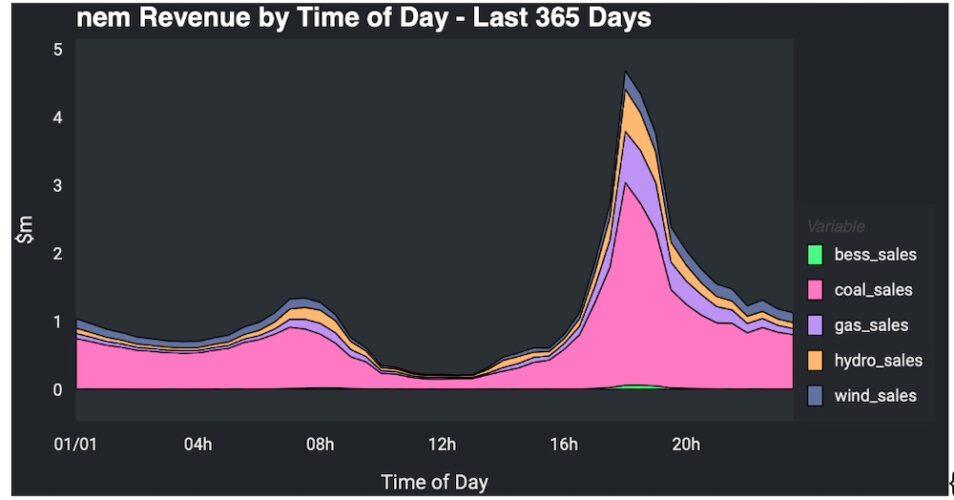

Coal still dominates NEM revenue ITK spends a lot of time looking at electricity prices and volumes and for consumers price is what matters and for the environment carbon and therefore volume by fuel is what matters.

For producers though what matters is revenue and profits. Its revenue that pays salaries and fuel costs, covers maintenance, end of life clean up and the myriad of other costs that determine the returns on a project.

For instance using Victoria, because it’s a large consuming region relatively advanced on its decarbonisation journey, coal still captures 60% of total revenue.

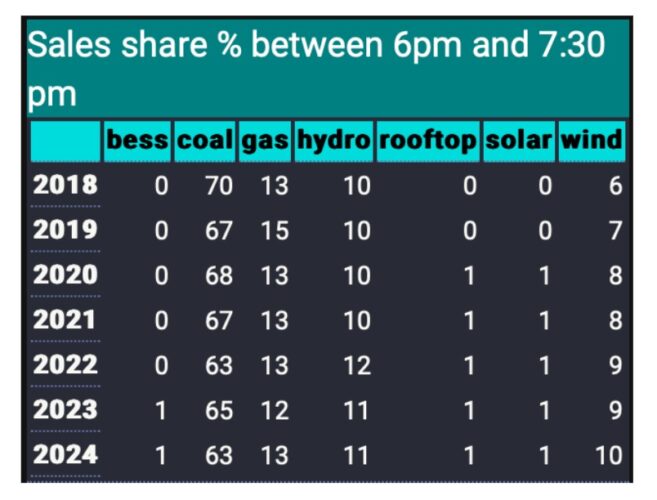

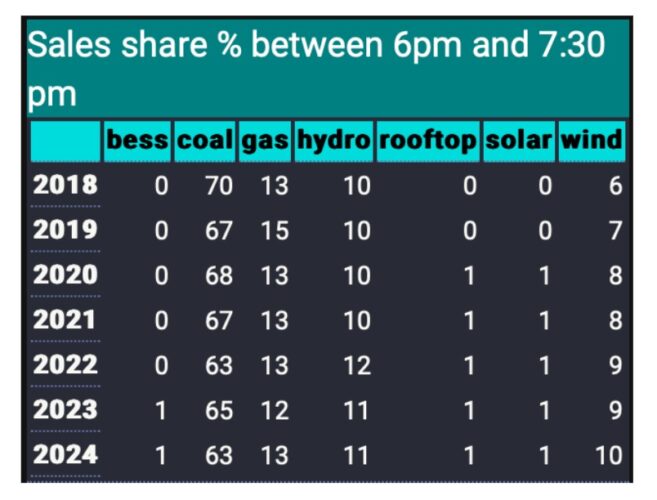

Looking at the 6pm to 7:30 PM window and looking across the whole NEM, coal has lost 7% of available pool revenue since 2018 almost entirely to wind. The little bit of solar in the table probably reflects daylight saving effects where QLD doesn’t adopt daylight saving and the NEM runs on QLD time.

Table 1: NEM wide evening peak revenue share.Data source:NEM Review

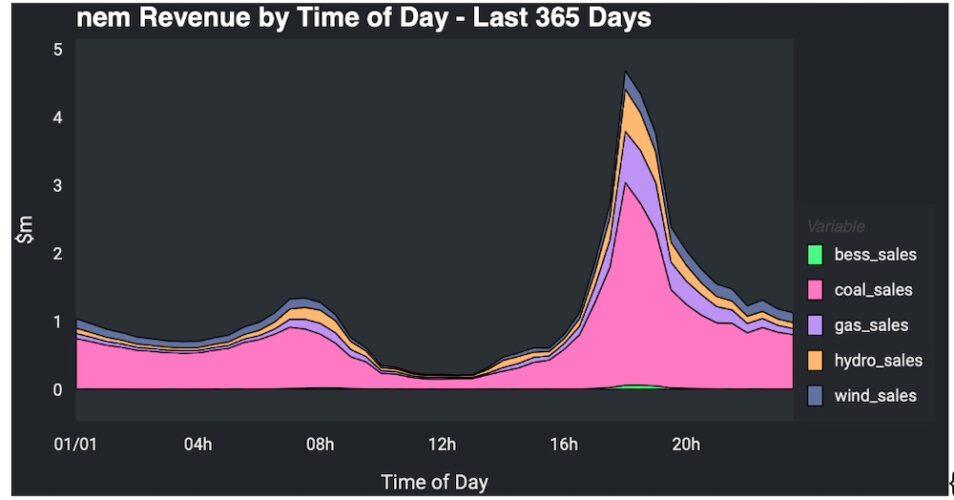

If we now look at the revenue by time of day, and – for simplicity – I exclude solar of all sorts, then then the picture is that evening peak is important but not dominant for coal as it is for some other fuels.

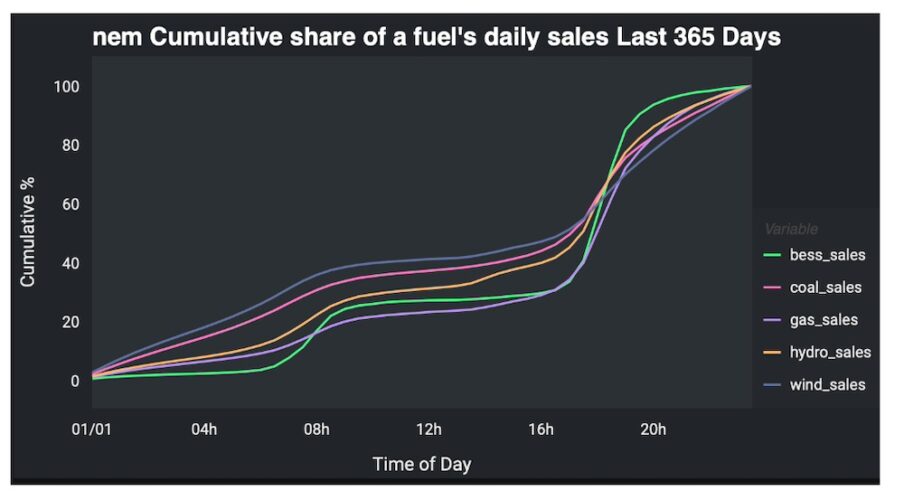

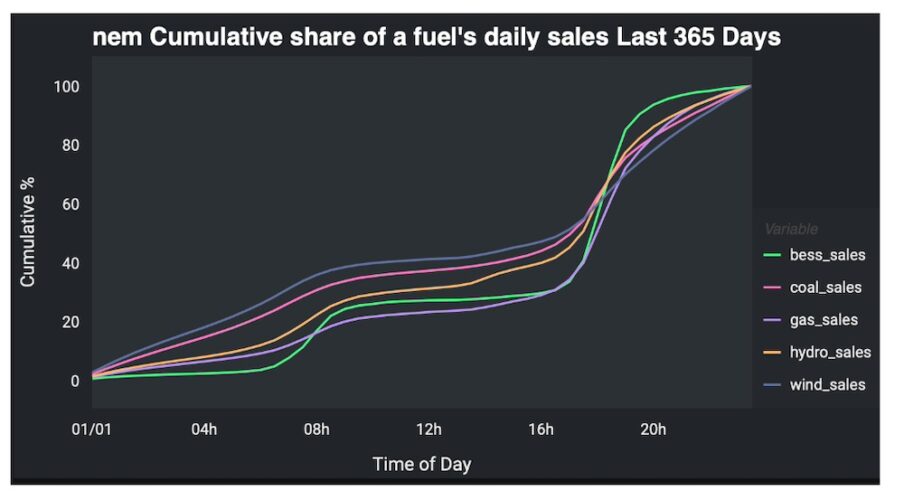

And this is clearer in the cumulative share of sales for a fuel per average day, here for the NEM over the past year ie same data as the prior figure.

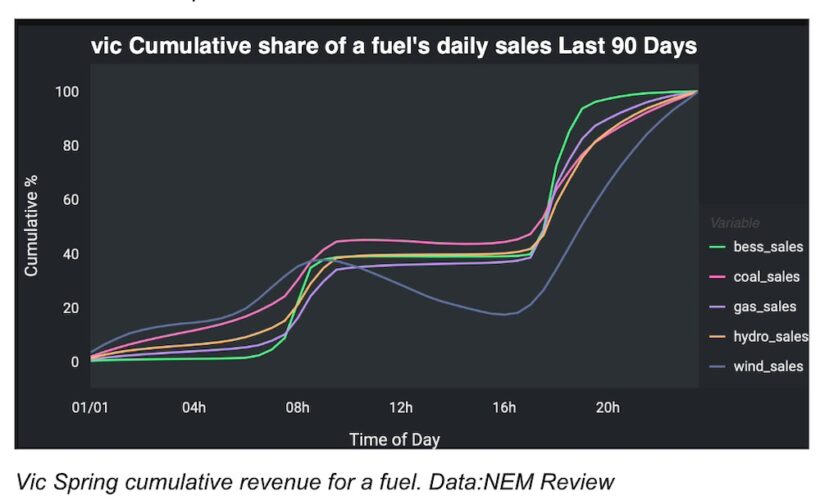

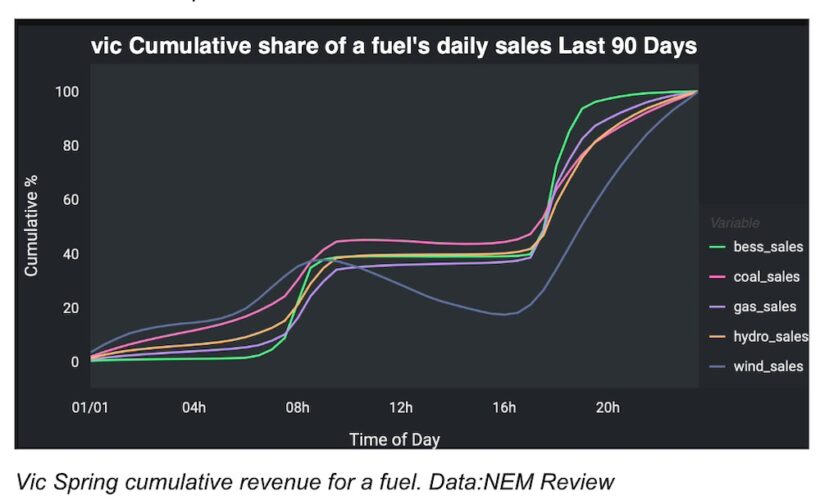

And if we want to look forward a bit we can use say Victoria for the last 90 days. Although Victoria doesn’t have that much solar, it might as well because the Victorian price is strongly impacted by solar in NSW and South Australia. For these fuels it takes from midnight to 5:30 in the afternoon to earn 50% of revenue and wind chasing RECs loses sees a sharp decline in revenue between 8 AM to 5 PM.

Screenshot

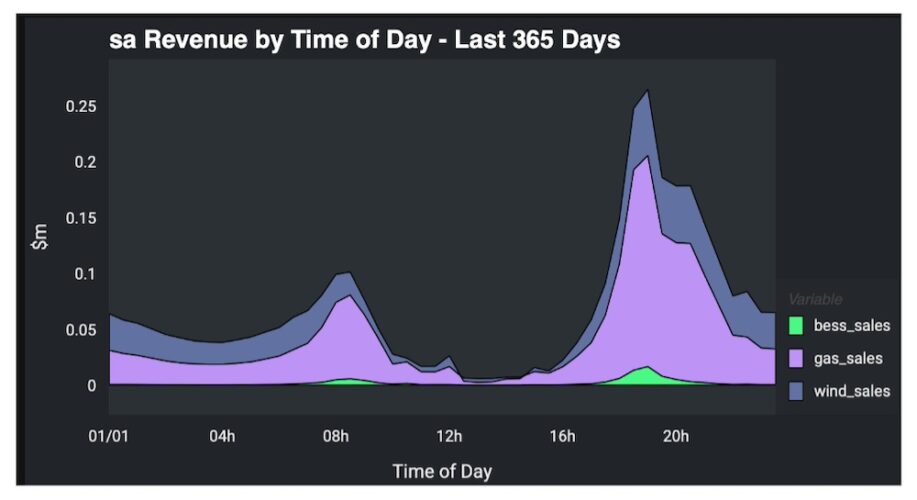

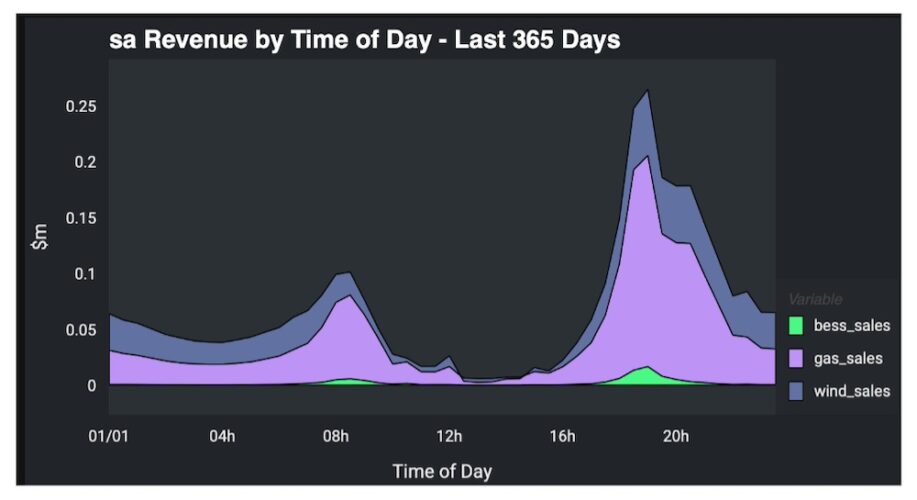

Batteries will soon be able to run 40% of NEM demand for 2 hours a day Even in South Australia where utility BESS (battery) penetration is currently highest, batteries still have a minimal share of daily pool revenue.

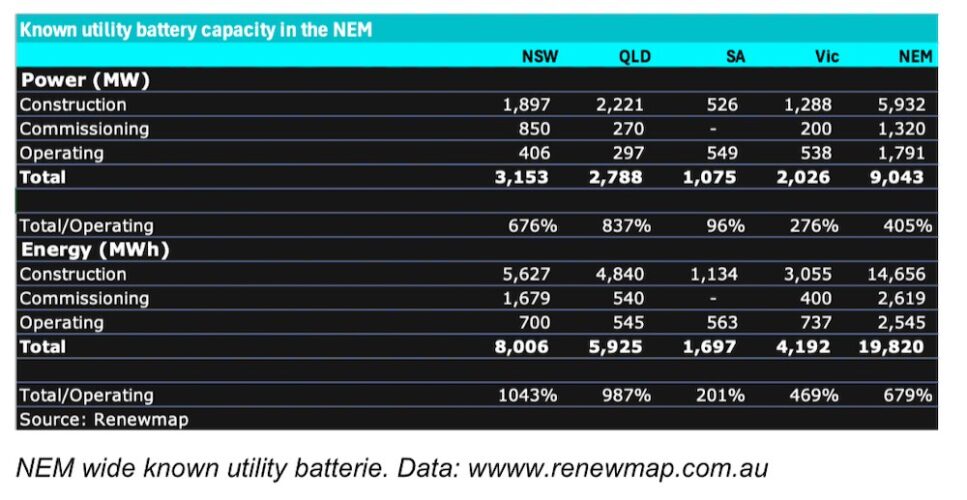

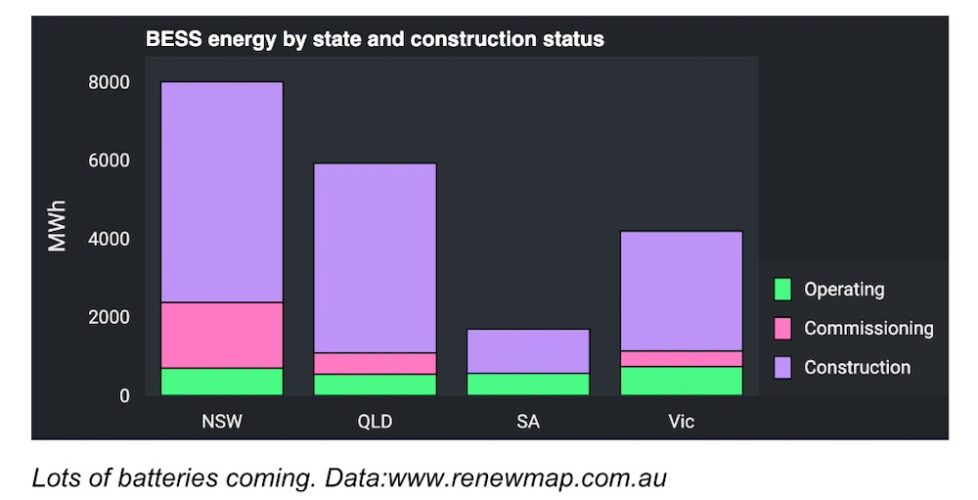

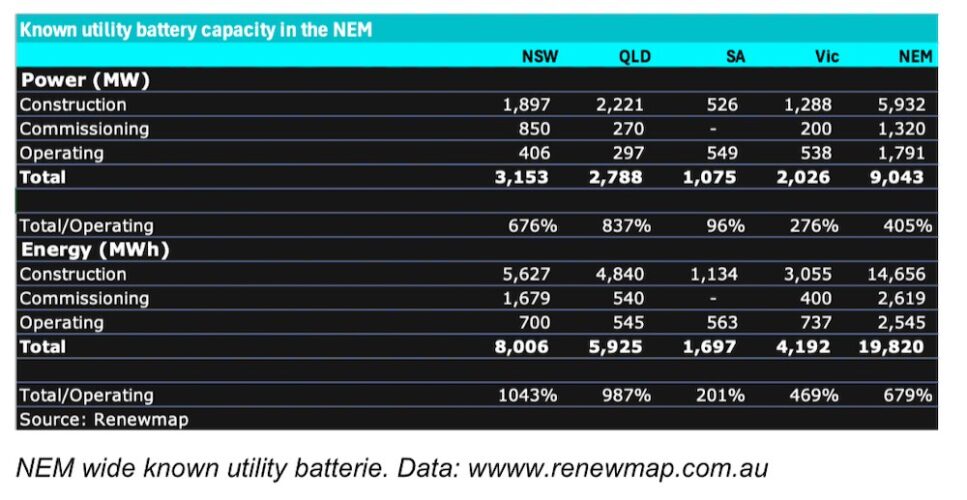

However that’s going to change as the current BESS buildout starts to come to fruition. Using Renewmap’s data battery power is going to grow about 4X and battery energy about 6.5X.

Batteries will be able to produce 9 GW of power for around 2 hours a day

Average demand in the NEM is about 24.5 GW in the NEM in 2024, and that includes rooftop solar averaging 24/7 of 2.7GW. So average operational demand is about 22 GW and batteries can supply 9 GW for a couple of hours.

Of course not all batteries are going to be used just for trading in the NEM. Plenty of capacity will be used for transmission support and other supporting roles. Even so it’s capacity that is available in an emergency

Overall, ITK models about 6 GW of battery power to be able to trade morning and evening peaks representing around 25% of demand at that time. Certainly enough to put pressure on prices and therefore sales, partly offset from a coal generator’s point of view by increased charging demand.

Increased solar supply compared to battery charging demand

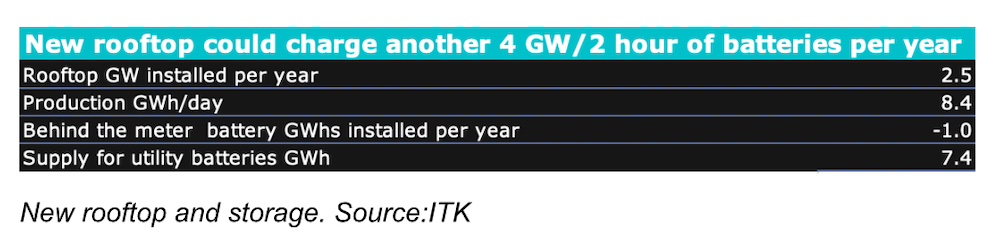

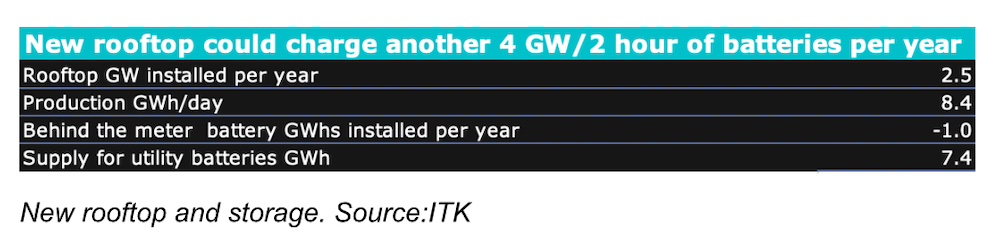

Each year there are around 2.5 GW of rooftop solar installed. That represents about 300,000 installations at a bit over 9 KW each.

Of those 300,000 probably there are about 60,000 that install a battery of say 10 KWh average size, representing say 600 MWh, plus there is a significant commercial behind the meter battery market that the Australian Energy Council stated was 405 MWh in 2023 (source: Sunwizz).

So new rooftop solar right now will make prices go down unless there is about 4 GW of 2 hour utility battery storage installed.

Of course, more focus on EVs could also absorb lunch time capacity conceptually but in practice it seems to me there are many barriers.

There aren’t enough EVs (and the average car in Australia is 12 years old so the fleet takes a while to turnover even if 100% of new cars are electric), many cars are driven to work and its very hard to imagine having enough car chargers to charge say 0.5 million vehicles at lunch time at work places or at home. Anyhow…

Equally, in the middle of the day we could replace a coal station with new rooftop solar. It’s just the other 16 hours a day that need thinking about.

As far as the middle of the day goes there is still 10 GW of unwanted coal generation. If it didn’t have to run and every unit operated as the test unit at Bayswater does, shutting down at 9 am and restarting at 2 pm there wouldn’t be any spilled solar and we could accomodate another 8 GW of behind the meter.

Wind doesn’t need as many batteries and will put pressure on peak prices

As Table 1 shows the only fuel to gain a material share of the evening peak market in recent years has been wind. Yes we expect batteries to start eating into the coal and gas share and thereby hastening the demise of coal, but coal has something like 9-10 GW operating every evening peak.

That’s a lot of capacity to replace when the system also needs to put pressure on gas and hydro at that time. You could do it with batteries but I argue that we need more wind more than we need more batteries, even if wind is hard to do and requires transmission.

On that front its worth noting that there is still 6 GW of utility wind and solar either under construction or commissioning.

Of that the biggest projects MacIntyre and Golden Plains continue to ramp up very slowly, with Macintyre recently hitting 18 MW of output.

reneweconomy.com.au |